The Kerala High Court has recently held that a court can attach a father’s retirement benefits for maintaining his child. It further clarified that the exemption under Section 60(1)(g) of the Code of Civil Procedure, which provides that stipends and gratuities of pensioners are not liable to attachment and sale in execution of a decree, would not apply in such cases.

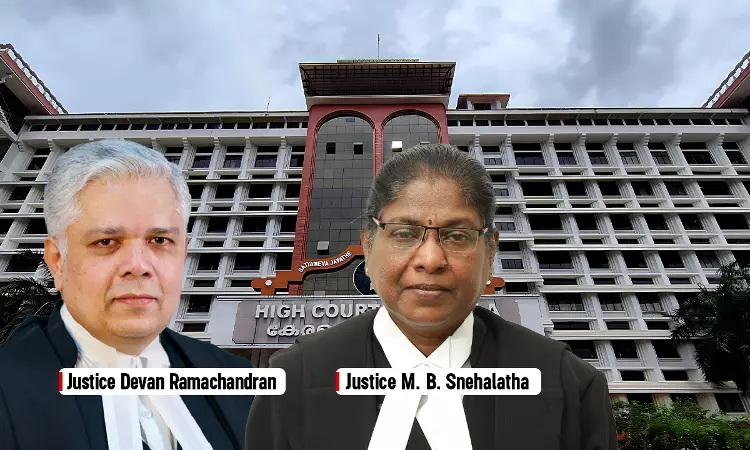

Distinguishing the Supreme Court decision in Radhey Shyam Gupta v. Punjab National Bank (2009), the Division Bench comprising Justice Devan Ramachandran and Justice M.B. Snehalatha observed that a minor daughter claiming maintenance cannot be equated with a creditor.

The Bench opined: “A person’s obligation to maintain his minor children is a fundamental, legal and constitutional duty. The object of payment of maintenance is to prevent vagrancy and destitution. The right of a wife or a minor child to maintenance supersedes the employee’s right to claim exemption under Section 60(1)(g) CPC. Articles 15(3) and 39 of the Constitution of India direct the state to ensure the protection and welfare of children and women. Maintenance laws act as instruments to give life to these constitutional directives.”

The petitioner in the case had filed a plea before the Family Court seeking past and future maintenance and educational expenses. Therein, she filed interim application seeking to attach her father’s retirement benefits stating that he was taking steps to withdraw and divert the same.

The father claimed that she did not have the means to pay the amount and that he was suffering from various illnesses and taking care of his aged parents. The Family Court dismissed the petition relying on Section 60(1)(g) CPC and the finding of the Supreme Court in Radhey Shyam Gupta’s case. Aggrieved, the minor daughter challenged the same before the High Court.

With respect to the provision under Section 60(1)(g) CPC, the Court opined that the object of the provision is to protect retired employees but cannot be used to resist their obligation to family.

It further opined: “The object and purpose behind Section 60(1)(g) of the CPC is to protect the said amount for utilizing the same for the benefits of the employee and family and to prevent vagrancy and destitution of the family members of the employee… However, this protection cannot be used as a shield against fulfilling a statutory and moral obligation towards dependents… in the case at hand, the claim is made by his own minor daughter seeking maintenance and educational expenses, both past and future. She cannot be equated with a creditor who is attaching the retirement benefits of an employee for a debt due from the employee. She is undoubtedly the part of family of the 1st resppondent; and therefore, the argument advanced by the learned counsel for the 1st respondent that the retirement benefits of R1 is not attachable towards her plea for maintenance, in view of the exemption under Section 60(1)(g) CPC, is untenable.”

Thus, it allowed the petition and directed the Family Court to reconsider the petitioner’s interim application for attachment.

Case No: OP (FC) No. 503 of 2025

Case Title: Rifa Fathima v. Salim and Ors.

Citation: 2025 LiveLaw (Ker) 724

Counsel for the petitioner: P.Rahul, Rajesh V. Prasad, Abhina L., Namitha Neethu Balachandran, Shyama S

Counsel for the respondents: B. Mohanlal, P.S. Preetha, Motty Jiby, Abijith M., Avani Nair, Jayaprabha Arjun, Praveena T.