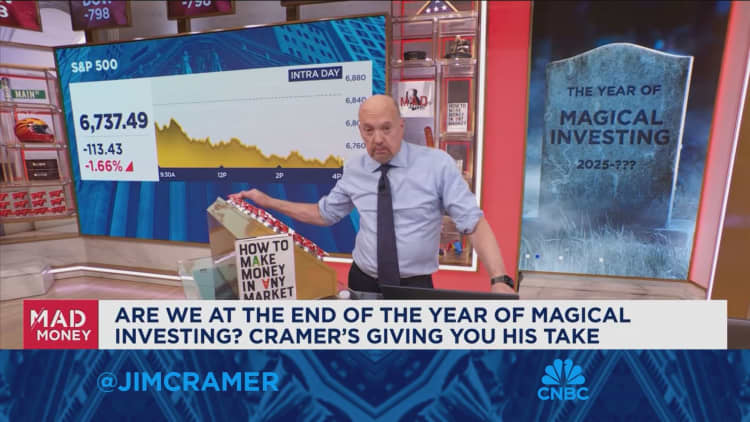

CNBC’s Jim Cramer unpacked Thursday’s market action and worried about declines in the broader tech sector, suggesting insider selling in certain companies is reminiscent of the dotcom era.

“Today was a hideous day, but particularly for tech, most especially the data center and AI stocks. See, the money’s headed to the sidelines or headed to high growth away from tech,” he said. “I don’t want to abandon the truly profitable companies involved in AI — and [the CNBC Investing Club’s Charitable Trust] hasn’t – but I know a mania when I see one, and this one feels like it’s starting to unwind.”

Cramer said he’s become more cautious about speculative stocks connected to artificial intelligence and the data center over the past few months, indicating that investors can no longer make easy money in many of these companies. He expressed trepidation about some “peripheral companies” in the data center space, especially those related to quantum computing and alternative power that have a history of losing money. OpenAI’s massive spending on AI infrastructure is also worrisome, he continued.

Cramer said he’s concerned about insider selling and secondary offerings from executives in many of these companies, especially in AI-related cryptocurrency outfits. He recalled the market environment 25 years ago, when tons of dotcoms were coming public and trying to raise more money while insiders were selling their own stock.

However, he stressed that the comparison to the dotcom era isn’t ironclad, suggesting there are a number of profitable tech megacaps making bets on AI that could protect the sector as a whole.

“In 2000, these kinds of companies ended up bringing down the whole darned edifice,” he said. “Now, I don’t think it’s going to repeat like that. Why? Because the big hyperscalers that we talk about all have more money than they know what to do with.”

Jim Cramer’s Guide to Investing

Jim Cramer’s Guide to Investing