Auto loans grow by 58.43%, flats 38% in June as banks focus on retail banking instead of corporate loans

14 November, 2025, 07:20 am

Last modified: 14 November, 2025, 07:32 am

Illustration: TBS

“>

Illustration: TBS

Bangladesh’s banking sector saw double-digit growth in consumer lending this year, fuelled by strong demand for flats and cars, even as business loans remained subdued amid an economic slowdown.

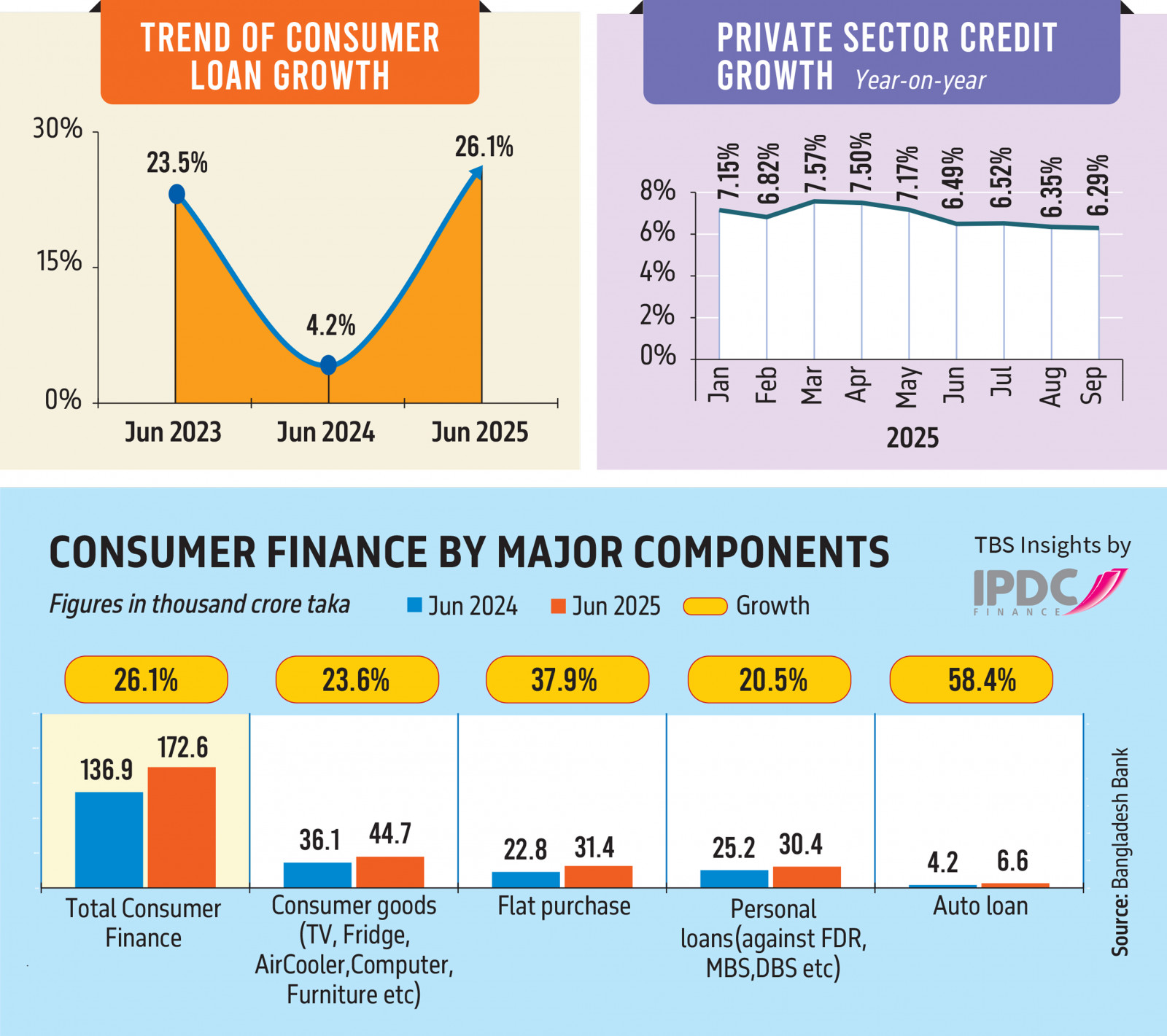

Consumer loans grew by 26% year-on-year in June 2025, compared to overall loan growth of only 8% across public and private sectors, according to the latest Bangladesh Bank data.

The sharpest increases came from auto and housing loans, which rose by 58.43% and 38%, respectively. Demand for personal loans and credit for consumer goods—including televisions, refrigerators, air conditioners, computers, and furniture—also climbed by over 20% during the period.

By the end of June 2025, total consumer loans stood at Tk1.72 lakh crore, accounting for nearly 10% of total bank lending, up from 8.57% a year earlier. Banks are currently charging a maximum rate of 11.5% on consumer loans, while non-bank financial institutions (NBFIs) charge up to 12.5%. Industry insiders expect rates to fall further in the coming months, citing weak corporate credit demand.

Keep updated, follow The Business Standard’s Google news channel

Banks shift focus to consumers

The surge in retail lending reflects a strategic shift by banks from growth-driven business loans to spending-focused consumer credit, said a senior executive at Dutch-Bangla Bank, requesting anonymity.

He said stagnant business expansion and lower default rates in retail lending encouraged banks to target individual borrowers. “Retail loans are smaller and more diversified, which reduces concentration risk compared to large corporate exposures,” he explained.

Under current regulations, individuals can borrow up to Tk20 lakh in personal loans, Tk60 lakh for auto loans, and Tk2 crore for home loans.

Dutch-Bangla Bank, which has the largest market share in housing finance, disbursed Tk100 crore in home loans in November—its highest-ever monthly volume—which has remained steady since. The figure reflects an uptick in flat purchases, the official added.

City Bank, which holds over 7% of the industry’s consumer loan portfolio, posted 20% growth in the first 10 months of 2025.

“Banks focused on consumer loans this year because corporate demand remained low,” said Md Arup Haider, deputy managing director and head of retail banking at City Bank. He noted that the bank’s monthly consumer loan disbursement rose by more than 50%, to Tk400 crore from Tk250–260 crore a year earlier.

Haider said the strongest growth came in auto loans, helped by the central bank’s decision to raise the loan ceiling from Tk40 lakh to Tk60 lakh. The bank’s nano loan partnership with bKash also contributed to the overall rise in consumer lending, he added.

Car loans in high gear

The boom in auto loans has been driven largely by the secondary car market, according to Mahjebeen Binte Rahman, head of the consumer division at IDLC Finance Ltd.

“Customers can now access financing for used cars, which was not allowed before,” she said, noting that the shift significantly expanded loan demand. While sales of high-end vehicles slowed following the recent unrest, IDLC’s overall auto loan portfolio still grew by 10% in 2025.

The depreciation of the taka, which pushed up prices of reconditioned cars, also fuelled loan demand as buyers required larger loans to cover higher costs, she added.

Sales of low-end cars have also surged, driven by middle-class consumers who increasingly view car ownership as a necessity rather than a luxury.

“Sales of reconditioned cars priced between Tk40 lakh and Tk60 lakh increased significantly this year,” said Abdul Haque, president of the Bangladesh Reconditioned Vehicles Importers and Dealers Association (BARVIDA). “Easy access to bank loans has been the main catalyst, with several banks investing surplus liquidity in the auto segment,” he said.

According to BARVIDA estimates, the auto industry expanded by at least 10% in the first 10 months of 2025 and is expected to end the year with further growth.

Why private consumption remained resilient despite subdued investment

Private consumption remained robust, growing by over 5% despite elevated inflation, supported by record remittance inflows and strong exports, according to the World Bank’s “Bangladesh Development Update” report released in October.

The report shows that private consumption growth slowed slightly to 5.2% in FY25 from 6% in FY24. Despite the deceleration, consumption remained resilient, and exports made a substantial contribution to overall growth.

This resilience was reflected in a 15.3% increase in consumer goods imports in FY25, which turned positive after two consecutive years of contraction, the report said.

Despite disruptions in industrial areas during the first half of FY25 and prevailing domestic and global uncertainties, export growth remained strong. The taka’s depreciation, sustained demand from major markets, and shifting garment orders from competitors supported this growth, the report added.

However, private investment remained weak as businesses adopted a “wait-and-see” approach amid political uncertainty, high interest rates, rising raw material costs, and energy supply concerns, the World Bank noted.

The slowdown in private investment was reflected in a decline in private sector credit growth to 6.5% year-on-year in June 2025, the lowest in 22 years. Imports of capital goods and machinery fell by 10.2% in FY25, confirming weak investment activity. Public investment also declined, with development expenditure contracting by 25.5% in FY25, reflecting the government’s cautious stance on project approvals, the report said.

The World Bank projected that real GDP growth will rise to 4.8% in FY26, supported by moderating inflation that strengthens private consumption. Investment is expected to improve relative to FY25 but remain subdued due to election-related political uncertainty and vulnerabilities in the banking sector. Export growth should remain strong despite global tariff uncertainty, the report said.