This article first appeared on GuruFocus.

Bill Ackman (Trades, Portfolio) recently submitted the 13F filing for the third quarter of 2025, providing insights into his investment moves during this period. William Ackman, co-investment manager for hedge-fund group Gotham Partners LP, formed Pershing Square in November 2003 with $54 million raised from three investors. Ackman got his start in the real estate business, where he worked for his father prior to starting Gotham. Bill Ackman (Trades, Portfolio) is an activist investor. He buys the common stocks of public companies, and pushes for changes so that the market can realize the values of the companies. Ackman buys stocks trading at a discount, and sells when the companies reach their appraised value.

Bill Ackman Reduces Stake in Alphabet Inc, Impacting Portfolio by -0.67%

Bill Ackman (Trades, Portfolio) also reduced position in 4 stocks. The most significant changes include:

Reduced Alphabet Inc(NASDAQ:GOOGL) by 519,007 shares, resulting in a -9.68% decrease in shares and a -0.67% impact on the portfolio. The stock traded at an average price of $209.46 during the quarter and has returned 36.32% over the past 3 months and 46.49% year-to-date.

Reduced Brookfield Corp(NYSE:BN) by 140,166 shares, resulting in a -0.34% reduction in shares and a -0.06% impact on the portfolio. The stock traded at an average price of $44.31 during the quarter and has returned 0.86% over the past 3 months and 15.55% year-to-date.

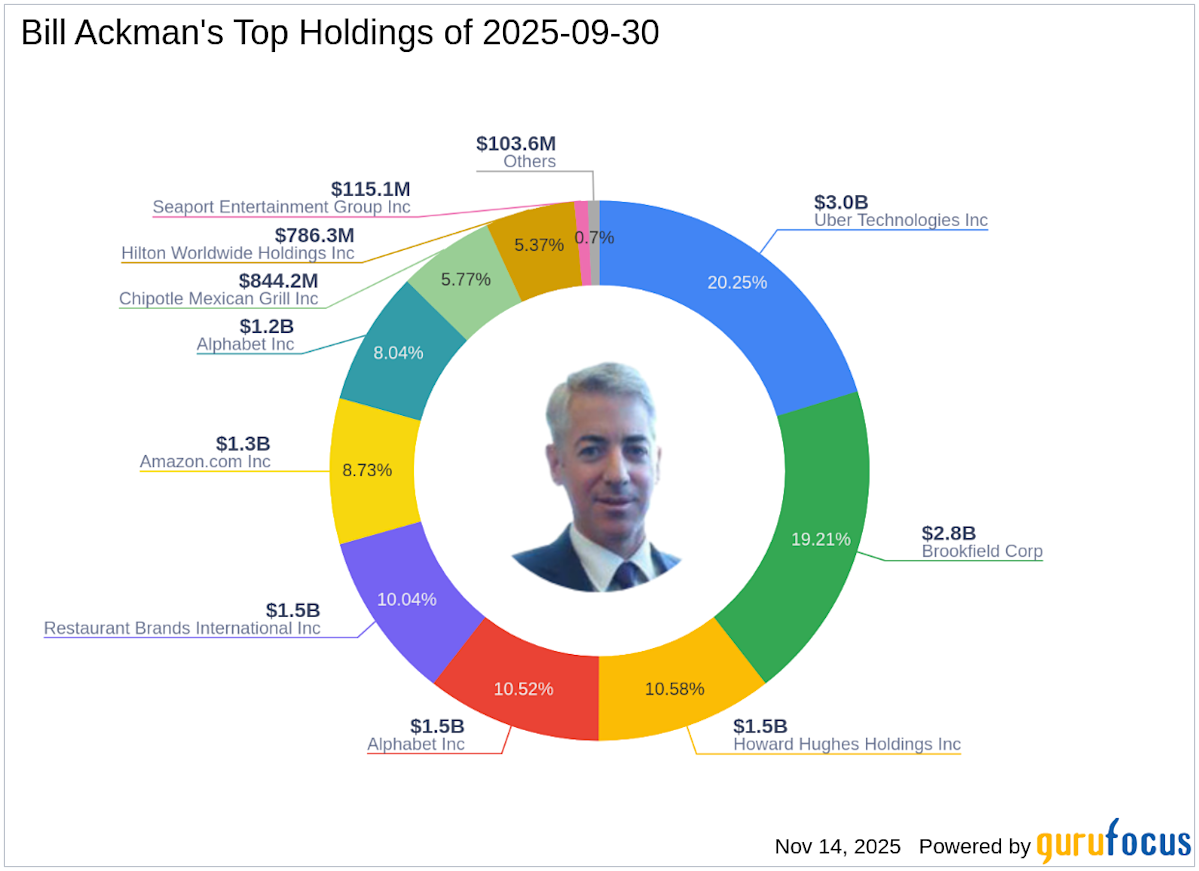

At the third quarter of 2025, Bill Ackman (Trades, Portfolio)’s portfolio included 11 stocks, the top holdings included 20.25% in Uber Technologies Inc(NYSE:UBER), 19.21% in Brookfield Corp(NYSE:BN), 10.58% in Howard Hughes Holdings Inc(NYSE:HHH), 10.52% in Alphabet Inc(NASDAQ:GOOG), 10.04% in Restaurant Brands International Inc(NYSE:QSR).

Bill Ackman Reduces Stake in Alphabet Inc, Impacting Portfolio by -0.67%

The holdings are mainly concentrated in 6 of all the 11 industries: Consumer Cyclical, Technology, Financial Services, Communication Services, Real Estate, Industrials.

Bill Ackman Reduces Stake in Alphabet Inc, Impacting Portfolio by -0.67%