The launch of Guinea’s US$20 billion Simandou iron ore project marks a globally significant milestone.

The event on Tuesday at Guinea’s Morebaya port, attended by Chinese and regional African leaders, saw the departure of the first shipment of ore from the Simandou project – a major feat after nearly three decades of development.

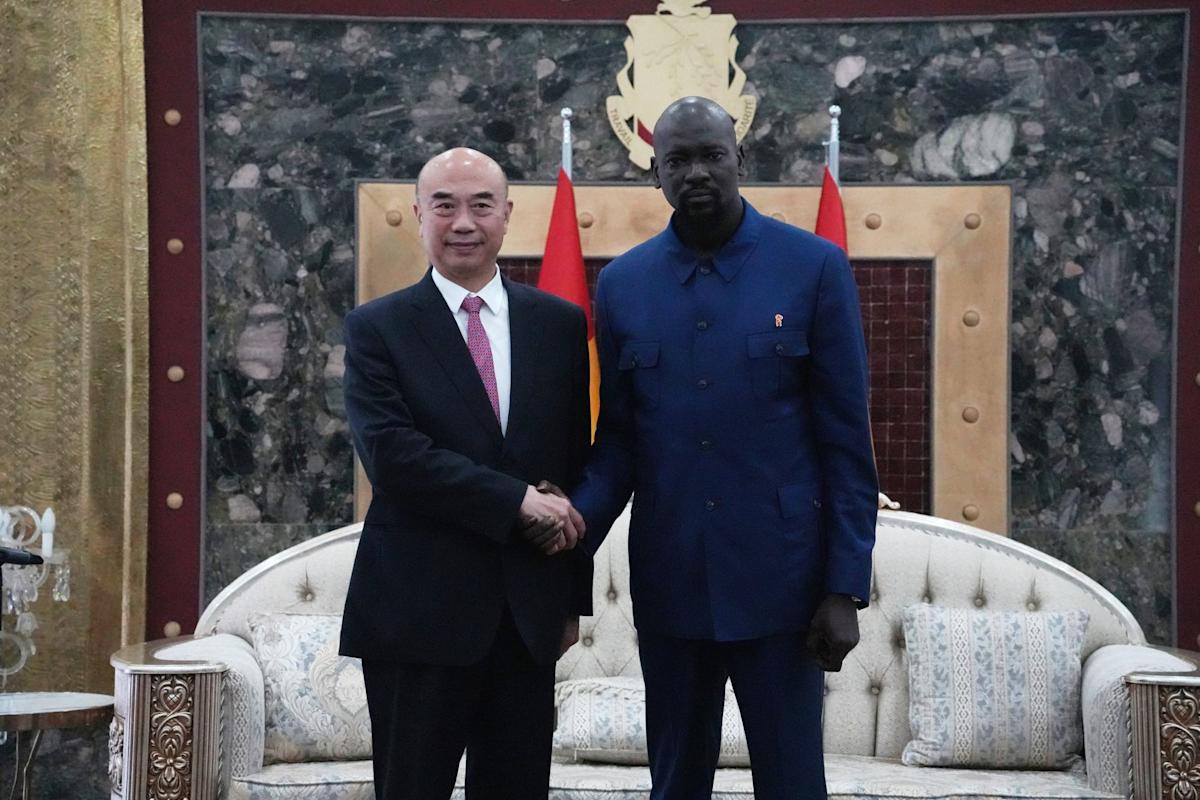

The Chinese delegation was led by Vice-Premier Liu Guozhong, who underscored the importance Beijing has attached to securing high-grade ore for decarbonising the national steel industry and diversifying away from Australian supplies.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Guinea’s Simandou 2040 plan aims to use mining revenues to develop infrastructure, agriculture and education in the West African country, while also signalling the mine’s immediate global importance.

Most extracts from Simandou – the world’s largest known untapped deposit of high-grade iron ore – are expected to be shipped to China, given the heavy investments by Chinese firms in the project. But the majority Chinese stake is a key concern for both the Guinea government and British-Australian mining giant Rio Tinto regarding future market stability, which has created an unusual alliance.

Guinean officials are aware of the possibility that Chinese firms would use the massive influx of high-grade ore to suppress global iron ore prices, but have pledged to actively collaborate with Rio Tinto to leverage the mine’s premium product and Rio Tinto’s market expertise to maintain stable high prices for the ore.

The Guinean minister of mines and geology, Bouna Sylla, said the country was monitoring the formation of China Mineral Resources Group (CMRG), which aims to centralise Chinese iron ore imports.

“We are closely following that development because it tells how we must engage in informal discussions with Rio Tinto about how we can work together to maintain a high iron ore price,” said Sylla, who is also a member of the Simandou Strategic Committee that monitors the project for the government.

Chinese Vice-Premier Liu Guozhong with Guinean President Mamadi Doumbouya in Conakry on Tuesday. Liu attended the inauguration of the Simandou mine project during his three-day trip to Guinea. Photo: Xinhua alt=Chinese Vice-Premier Liu Guozhong with Guinean President Mamadi Doumbouya in Conakry on Tuesday. Liu attended the inauguration of the Simandou mine project during his three-day trip to Guinea. Photo: Xinhua>

As Rio Tinto is a pure miner, Guinea is “often closer to Rio Tinto in the desire to maintain a high iron ore price”, he added, referencing the diverse interests of the Chinese stakeholders, which also include processing and steelmaking.

The project is expected to ramp up production over 30 months to reach its full commercial capacity of 120 million tonnes annually, a volume that will position Guinea among the top global iron ore exporters.

A Rio Tinto executive who requested anonymity due to the sensitivity of the matter acknowledged the market reality that most global ore went to China, and said that since China Baowu Steel Group was a major partner for Simandou, “a lot of this ore will go to China, there is no doubt”.

However, the executive said that Rio Tinto maintained market flexibility, saying: “Rio is not beholden to that and has the ability to sell to any market anywhere, so we will continue to explore those other markets.”

Rio Tinto and the Aluminium Corporation of China (Chinalco) own blocks 3 and 4 of Simandou under a consortium called Rio Tinto Simfer, while blocks 1 and 2 are owned by the Winning Consortium Simandou (WCS), whose key partners include Singapore’s Winning International Group, as well as China’s Weiqiao Aluminium and Baowu Resources. The Guinean government holds a 15 per cent stake in both, with an 18 million tonne share per year.

Guinean, Chinese and other African officials attend the Simandou commissioning ceremony at the port of Morebaya. Photo: X/presi_doumbouya alt=Guinean, Chinese and other African officials attend the Simandou commissioning ceremony at the port of Morebaya. Photo: X/presi_doumbouya>

Crucially, to overcome delays caused by a lack of infrastructure, Simfer and WCS jointly funded and built the shared 650km (404-mile) railway and port of Morebaya infrastructure.

Sylla described the Simandou situation as “extremely complex”, noting that Guinea’s interests sometimes aligned with Rio Tinto, sometimes with Baowu, and other times with WCS because “WCS is a logistics specialist”.

Sylla also highlighted a complementarity between Simandou and Australian Pilbara ore. Simandou’s high-grade deposit targets the premium 65 per cent iron content blend market, making it comparable only to Brazil’s Vale, especially the Carajas deposits.

He said this gave Rio Tinto the unique opportunity to offer both products and sell the premium ore not only to China but also to European and Middle Eastern steel mills.

But the Simandou project is widely dubbed a potential Pilbara killer, a reference to its long-term threat to Western Australia’s market dominance.

According to Sylla, this superior quality is critical to China’s “green steel” industry and gives Rio Tinto the “unique opportunity to offer both products” globally, as most of Australian Pilbara ore typically focuses on the larger 62 per cent blend market.

Hu Wangming, the chairman of China Baowu, described Simandou as “a significant milestone” in the history of the global mining industry.

In a statement on Tuesday, Hu said that “the stable supply of Simandou’s premium iron ore resources will provide a solid foundation of low-carbon raw materials for the development of China’s steel industry and the global steel sector”.

Similarly, Chris Aitchison, general director of Rio Tinto Simfer, said that emerging steelmaking technologies required high-grade ore and Simandou’s quality allowed for reduced energy input in the process, thereby lowering carbon dioxide emissions.

“So, there is a direct correlation between the benefits of sourcing Simandou ore and people being able to use that ore in their new steelmaking technology processes.” So, it is a direct enabler; it is very important for China to achieve their goals,” Aitchison said.

A worker holds a walkie-talkie as she stands near a pile of iron ore at blocks 3 and 4 of the Simandou mine. Photo: Reuters alt=A worker holds a walkie-talkie as she stands near a pile of iron ore at blocks 3 and 4 of the Simandou mine. Photo: Reuters>

Beijing-based lawyer Kai Xue noted that China’s shift from infrastructure to a hi-tech economy was reducing its demand for steel and iron ore. As China produced 54 per cent of the world’s steel in 2023, this transition signals a long-term contraction for the global iron ore market.

“With supply rising and demand falling, someone will inevitably be pushed out and that someone is likely to be the Pilbara region of Western Australia. The reason is geopolitical,” he said of Simandou’s entry.

Xue argued that Australia’s Pilbara region was likely to be displaced due to geopolitical factors, specifically Australia’s 2021 entry into the Aukus security pact with the United States and United Kingdom, focused on acquiring nuclear-powered submarines to boost its military standing in the Indo-Pacific.

This move prompted China to diversify its supply chains, unblocking the long-stalled Simandou project in Guinea.

Initiated by Rio Tinto in 1997, the project experienced many delays due to legal and political challenges before advancing with the partnerships involving Rio Tinto, Chinese firms and the Guinean government. Final construction started in 2022.

“The first shipment marks the moment Australia’s strategic choices began to undermine its own resource economy,” Xue said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2025 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.