The busy IPO cycle of 2025 is handing out some of the biggest returns that venture and growth investors have seen in India’s startup ecosystem.

The half a dozen new-age companies — Urban Company, Lenskart, Groww, Ather Energy, Bluestone and Pine Labs — that have listed so far this year have collectively unlocked more than Rs 15,000 crore ($1.6 billion) in cash liquidity for their early- and late-stage shareholders, as per ET’s calculations. Beyond the realised gains, investors are also sitting on over $8 billion in mark-to-market value on the shares they continue to hold, buoyed by strong post-listing performance by some of these companies.

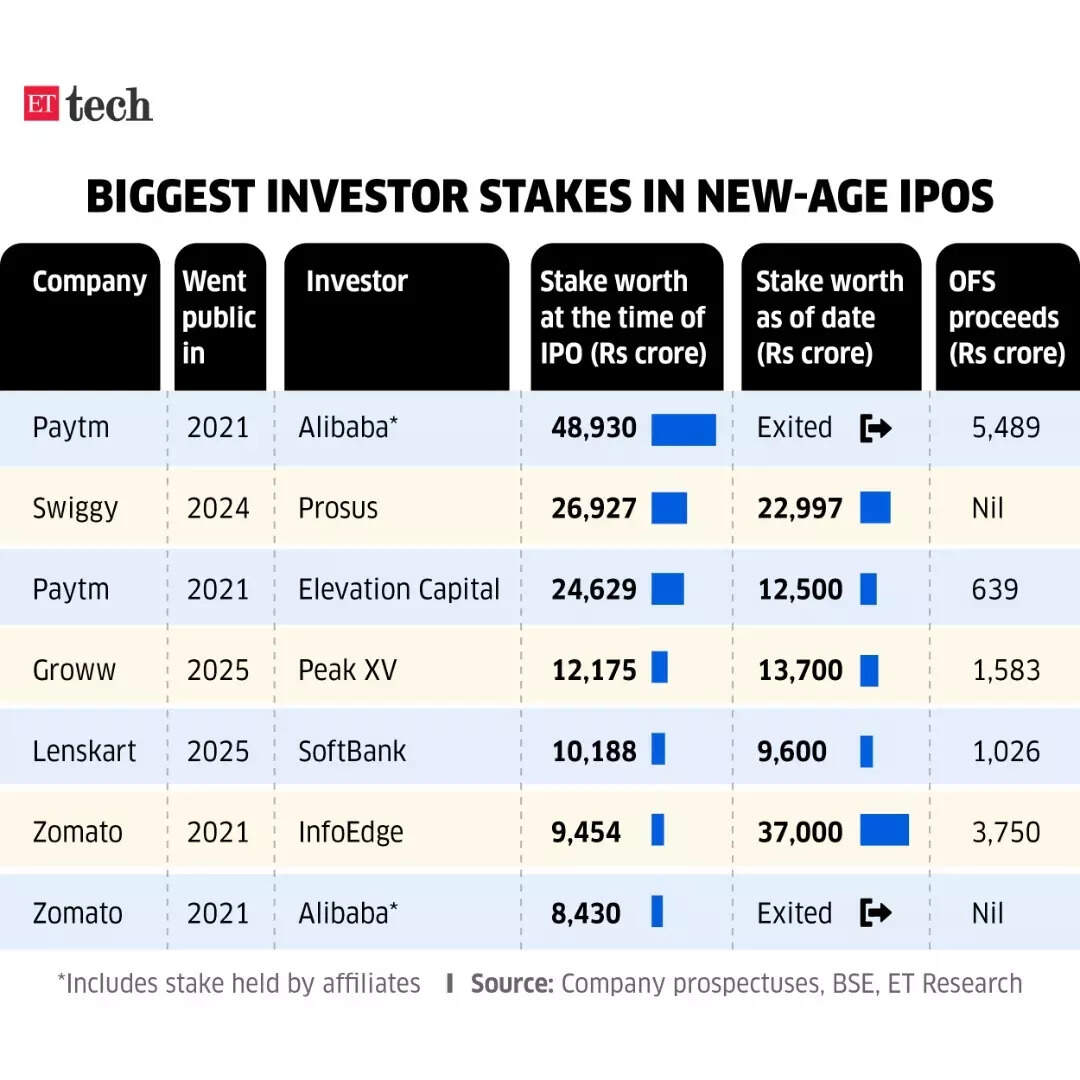

The largest paper gains have come for Peak XV’s (formerly Sequoia Capital India) residual stake in wealth-tech platform Groww, now valued at around $1.7 billion. SoftBank with its $1.1 billion position in Lenskart is next.

Silicon Valley’s famed startup accelerator Y Combinator has also raked in multi-fold returns on Groww. It sold around a 2% stake in the firm through the offer-for-sale (OFS) portion of the IPO and is still holding on to around 10% in the firm, which crossed Rs 1 lakh crore in market capitalisation on Friday.

New York-based Tiger Global and Palo Alto-headquartered Ribbit Capital have both sold a small part of their shareholding in Groww during the IPO and as per the current market cap of the fintech firm, their stakes are worth Rs 4,726 crore and Rs 11,511 crore, respectively.

“These IPOs have given a clear message to global investors that Indian startups can facilitate sizeable exits,” said an early-stage investor who has backed fintech and consumer tech startups. “If there ever was any doubt or question in the minds of large global venture funds, the successful IPOs of startups like Groww have given a larger statement on behalf of the sector.”

ETtech

ETtech

Peak XV’s big IPO season

Peak XV Partners has taken home the largest cash exits from Groww and Pine Labs, two of its very large bets. Accel, Elevation Capital and SoftBank also liquidated parts of their holdings across Lenskart, Ather, BlueStone and Urban Company at a premium.

Between wealth-tech startup Groww and digital payments platform Pine Labs, Peak XV Partners sold shares worth more than Rs 2,000 crore through the OFS process, which lets existing investors sell shares during an IPO. Their remaining stake in the two companies is worth more than Rs 20,000 crore as per closing stock prices on Friday.

“Peak XV’s investment in Pine Labs was a unique case of long-term patient capital which is typically unlikely for venture investors, but the returns have been huge as well,” said a senior fintech industry executive and an active angel investor. Peak XV had invested around $35 million in Pine Labs over two or three rounds since first backing it in 2009. It is today sitting on likely gains of over $1 billion, with $575 million already coming in.

For Peak XV, the series of cash-outs come at a time when it is in the midst of raising its first independent fund at over $1 billion, after the split from Sequoia Capital in 2023, as reported first by ET in April.

The Pine Labs IPO gave partial exit opportunities to two large corporate investors as well: PayPal and Mastercard. However, some of the late-stage backers like Vitruvian Partners and Nordmann Investment are in the red having come in at a $5 billion valuation. Pine Labs took a 40% cut on its private valuation when it fixed the IPO price.

SoftBank snagged a multimillion-dollar exit from the eyewear retailer Lenskart. The fund had invested $280 million in the company and its current stake in the firm is valued at more than $1 billion. The Masayoshi Son-led group sold shares of around $200 million through secondary transactions and the OFS component in the IPO. SoftBank’s remaining stake in Lenskart is worth over $1 billion.

“We’re in the business of making money, so if incremental IRR (internal rate of return) isn’t attractive, we redeploy, but there’s no mandate to liquidate. We don’t report performance by region, but it’s safe to say India is one of the strongest-performing geographies in the Vision Fund,” Sumer Juneja, managing partner and head of EMEA and India at SoftBank Investment Advisers, told ET in an interview earlier this month.

Strong gains for early backers

In the case of Urban Company and BlueStone, early investors including Accel and Elevation Capital generated strong returns.

Accel first backed jewellery retailer BlueStone in 2012 and participated in multiple funding rounds for the company since then. The venture capital firm invested a total of Rs 200-215 crore in BlueStone and is sitting on paper gains of six times its investment, including realised and unrealised returns.

With Urban Company, where Accel was the earliest institutional backer along with Elevation Capital, the VC fund made paper gains of 29 times its investment of Rs 70-75 crore. Elevation Capital, which ploughed Rs 95-100 crore across various stages in the at-home services platform, meanwhile saw a multiple of 19x on its investment.

In the Groww IPO, YC took out Rs 1,054 crore, thereby marking the first such instance of a public market exit for the venture firm in India.

Another YC alumnus, ecommerce firm Meesho, is slated for a December IPO at a valuation of $6-7 billion, which could change depending on market conditions. The IPO will see investors including Elevation Capital, Peak XV Partners and Y Combinator sell stakes.

Ribbit Capital, an active investor in Indian fintech startups, sold shares worth Rs 1,181 crore in the Groww IPO and has a shareholding worth of Rs 11,511 crore currently.

Tiger Global, which was an investor in electric scooter manufacturer Ather, sold shares worth Rs 12.8 crore in the IPO and exited the company fully by selling shares worth Rs 1,204 crore through post-IPO block deals.