This article first appeared in The Edge Malaysia Weekly on December 22, 2025 – December 28, 2025

BURSA Malaysia is expected to start the new year with a bang, thanks to the imminent listing of Sunway Healthcare Holdings Bhd.

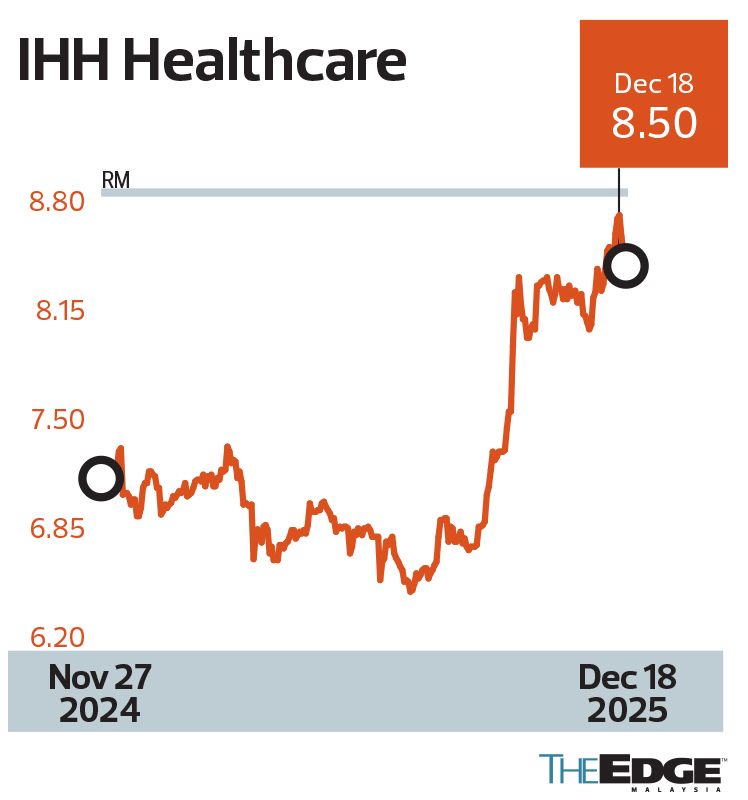

As the year comes to an end, the buzz in the market is that Sunway Healthcare’s listing is likely to set a new benchmark for valuations in the healthcare sector, surpassing the previous high set in 2012 during the listing of IHH Healthcare Bhd (KL:IHH).

“The final valuation is still being determined. But institutional funds are lining up, wanting a slice of the action,” says a fund manager.

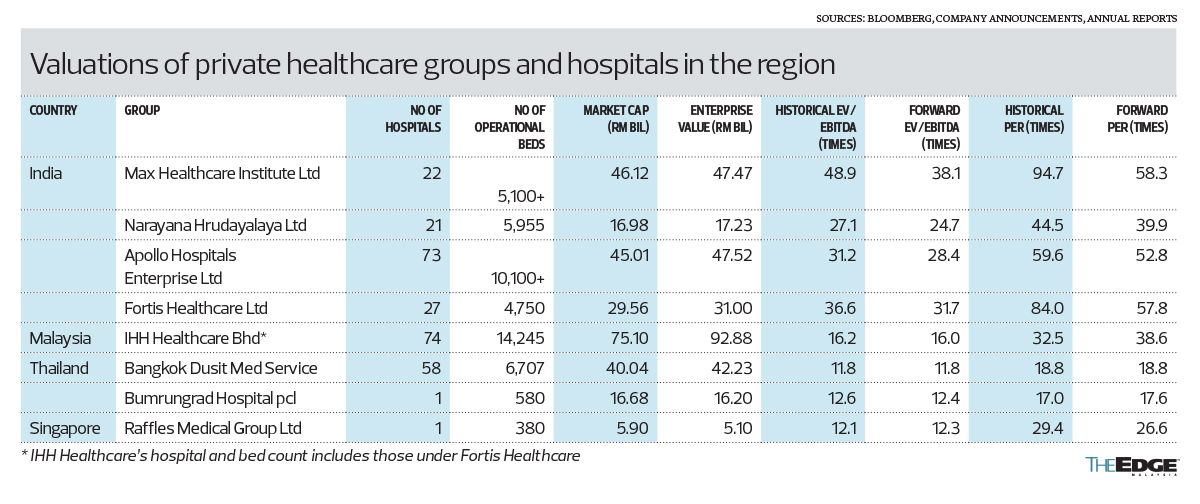

Due to the nature of the business that requires heavy capital expenditure up front, the usual valuation benchmark for healthcare groups is the enterprise value over earnings before interest, tax, depreciation and amortisation (EV/Ebitda).

It is said that Sunway Healthcare is being pitched to investors at an EV/Ebitda of more than 27 times its forward earnings for 2026. If it materialises, Sunway Healthcare, in which Singapore’s GIC Pte Ltd is a shareholder, will set a new record for the healthcare sector.

The previous record in the healthcare sector was set by IHH, which was listed in July 2012 at a historical EV/Ebitda of 24 times and forward EV/Ebitda of less than 18 times. At the time, funds viewed IHH’s valuation as undemanding due to the high growth of the sector and the group being a regional play.

Sunway Healthcare is primarily a local chain comprising five hospitals and more than 1,300 beds. Nevertheless, the fact that there is anticipation of it being accorded a higher valuation than IHH underscores the general rising tide in the healthcare sector.

Recent transactions suggest that valuations for the healthcare sector are going north. For instance, IHH acquired Island Hospital Sdn Bhd for RM3.9 billion cash. The deal, which comes with land for expansion, valued the 500-bed hospital at a historical EV/Ebitda of 24.6 times.

The IHH-Island Hospital deal is lower than what GIC paid for a 16% stake in Sunway Healthcare Sdn Bhd in 2021. According to analysts, the GIC deal was done at an EV/Ebitda of 31 times, valuing Sunway Healthcare at RM4.7 billion.

In November 2023, Columbia Asia Healthcare Sdn Bhd, which is controlled by the Hong Leong Group and TPG Asia, purchased Ramsey Sime Darby Healthcare Sdn Bhd (RSDH) in a RM5.68 billion transaction. The deal was valued at an estimated EV/Ebitda of 20 times. RSDH has three hospitals in Malaysia and four in Indonesia, offering 1,577 beds.

As a whole, the healthcare sector is enjoying an exuberance in valuations because of a “scarcity premium” and strong Ebitda growth.

For instance, Sunway Healthcare’s Ebitda margin over revenue was a high of 30% in 2022. In the last two years the margin has come down to about 25%, which industry executives deem more sustainable.

“An Ebitda margin of 25% is sustainable. It would translate into a return on equity of about 15%, which is palatable,” says Ahmad Shahizam Mohd Shariff, a director at the Malaysia Healthcare Travel Council (MHTC).

His views are echoed by other industry executives, who say the market average is an Ebitda margin of about 25%, and anything more than that would be unsustainable.

Can valuations be sustained?

As for the “scarcity premium”, there are not that many listed hospital chains, which is why there is demand, especially from private equity funds.

Other than IHH, the other listed hospital group on Bursa Malaysia is KPJ Healthcare Bhd (KL:KPJ). The largest unlisted healthcare group in Malaysia is Asia OneHealthcare Group, which owns the Columbia Hospital chain.

There are smaller healthcare companies — Metro Healthcare Bhd (KL:METRO) and TMC Life Sciences Bhd (KL:TMCLIFE) — listed on Bursa. But the companies do not have the scale to capture the imagination of institutional investors.

“Although Sunway Healthcare is largely a local franchise, it is seen as the closest to rival IHH, which has a regional presence,” says a fund manager.

While Sunway Healthcare is going for a listing when the exuberance in the healthcare sector is rising, the question that arises is whether the valuation can be sustained.

Only in countries such as India is it common for healthcare stocks to trade at an EV/Ebitda of more than 30 times. That is because of the size of the domestic economy and poor services at public hospitals, causing many to seek treatment at private hospitals. The “out of pocket” spending, meaning medical expenses paid out of the pockets of individuals, is high.

In Malaysia, the total healthcare expenditure (THE) growth is about 2.7% per annum, which is lower than in other countries in the region. But Malaysia’s THE per capita, which is medical bills paid out of pocket and claims from insurance companies, is the second-highest in the region, behind Singapore.

According to a report, Malaysia’s THE per capita is US$527 and grew at a rate of 4.5% between 2019 and 2024. In the next few years, the growth is expected to moderate to 3.1%.

A reduction in Malaysia’s THE is only to be expected, considering the increasing regulatory oversight by Bank Negara Malaysia, which spoke about curbing medical inflation last year. Following complaints of high premiums on medical insurance, the central bank capped the increase in premiums to 10% and paused the increase for those above 60 years old.

This has resulted in insurers being more cautious in approving medical claims. For instance, it is common for insurers to tell their customers to pay first and claim later. Guarantee letters (GLs) are not a certainty.

Underlying cost on the rise

But is the cost of healthcare expensive in Malaysia relative to other countries?

Ahmad Shahizam says it is not. “If the cost of healthcare is high, why are foreigners coming to Malaysia to seek treatment,” he tells The Edge.

A seasoned hand in the healthcare industry and one of the pioneers involved in building up IHH’s regional presence, Ahmad Shahizam says one of the problems private hospitals are facing is determining the price of the services they offer.

“For instance, the total bill for a similar procedure at two hospitals will be about the same. But the charges for each component that makes up the total bill can be different,” he adds.

On that score, Ahmad Shahizam points out that the underlying cost of healthcare is going up. He says staff costs, especially for nurses, make up about 30% of the total cost.

“Hospitals need to run 24 hours, which adds up to cost. And if nurses are not well paid, they leave. I don’t think hospitals make extraordinary profits,” says Ahmad Shahizam.

If hospitals are not making extraordinary profits, while cost is only going up amid an environment of higher regulatory scrutiny on medical insurers, the next question that arises is: Can the current trend in valuations be sustained?

An executive at a large conglomerate with two hospitals feels that the current valuations in the healthcare sector cannot be sustained.

“The oversight on insurers providing medical insurance will only continue to increase. If medical insurance is beyond the reach of the masses, it becomes a political issue, which is why Bank Negara had to step in to ensure the premiums on medical coverage are moderate,” says the executive.

The executive feels that the valuations of healthcare service providers are high and will only come down in an environment of stricter policies adopted by insurance companies.

“Increasingly, insurance companies are slower in accepting new hospitals as part of their panels. Previously, it was three months. Now, it can go on for more than a year. If this trend continues, hospitals will only make less money because out-of-pocket patients will not pay much,” says the executive.

Ahmad Shahizam, on the other hand, says the healthcare industry can deliver reasonable returns provided that the hospitals are of a certain size and the shareholders have deep pockets.

“Generally, it has to be about 400 to 500 beds and about four hospitals or more. Then, the management can get some economies of scale,” he explains.

After the listing of Sunway Healthcare, all eyes will be on the listing of Asia OneHealthcare, which has TPG Asia as a shareholder.

If Asia OneHealthcare decides to go for a listing, the indication is that valuations are still rising. However, if TPG exits through a trade sale, it means that reality is finally catching up with valuations in the sector.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.