Inflation is a significant obstacle in long-term financial planning, as it steadily erodes the purchasing power of money. Over time, the same savings will buy fewer goods and services, and the effect magnifies as the investment horizon increases.

At an average inflation rate of 5%, prices double in roughly 14-15 years, while at 6% they double in about 12 years. For example, if current annual expenses are Rs.3 lakh and one plans to accumulate Rs.45 lakh over the next 15 years to cover similar spending, the corpus will retain only about half its intended purchasing power at maturity if inflation averages 5% per year.

Beyond everyday living costs, specific categories of expenses—such as education and healthcare—tend to rise even faster than general inflation. These factors make it even more critical to incorporate inflation into investment planning to ensure savings maintain their real value and do not erode purchasing power.

Retirement is often the longest—and most inflation-sensitive—financial goal. Inflation risk in retirement planning also has a strong behavioural dimension. Many individuals base future needs on today’s costs, underestimating how inflation compounds over decades. This creates a false sense of adequacy in retirement preparedness: a corpus that appears sufficient in nominal terms may fall short in real terms (adjusted for inflation) as rising costs erode purchasing power.

A sound retirement corpus calculation must therefore account for inflation twice—first, when projecting current expenses to the retirement age, and second, when estimating expenses across the post-retirement years.

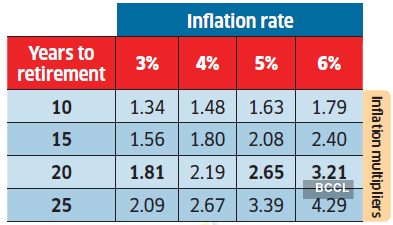

Table 1

How inflation will impact annual expenses

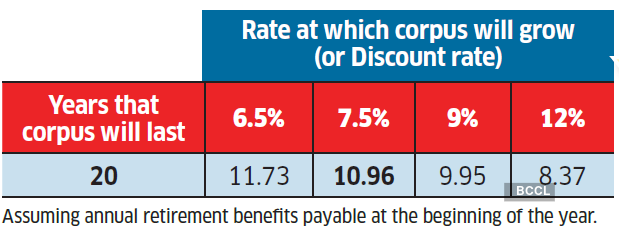

Estimating retirement corpusTable 2: Corpus multipliers without inflation.

Income required is steady

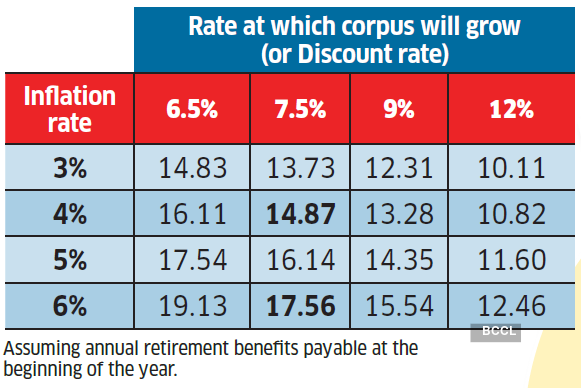

Table 3: Corpus multipliers with inflation.Income required is growing

In the pre-retirement phase, daily living costs, healthcare and discretionary spending are projected using an assumed inflation rate to estimate expense requirements at the retirement age.

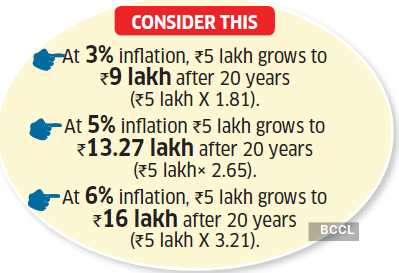

Table 1 provides multipliers for annual expenditures across different time horizons, based on retirement age and inflation assumptions. By multiplying current yearly expenses by the relevant factor, one can arrive at inflation-adjusted spending.

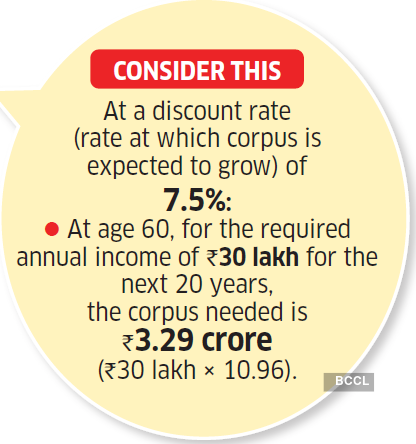

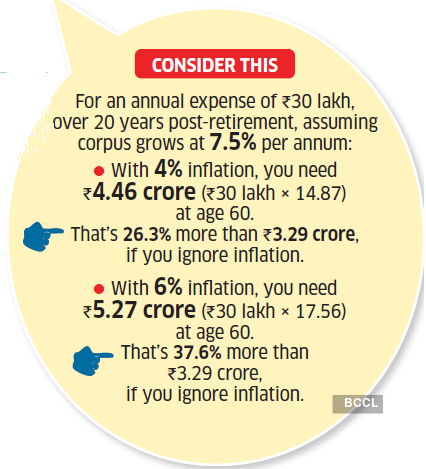

Think of your retirement corpus as a fund that must last 20-25 years after you stop working. The calculation accounts for the fact that your money will continue to earn returns even as you withdraw from it annually. Table 2 helps you determine the corpus needed, based on your expected monetary requirement and lifespan post-retirement.Table 2 figures assume constant annual expenses (or income requirement) postretirement and exclude inflation.

Ignoring inflation leads to an underestimated corpus and potential shortfall.

Table 3 shows the estimated corpus needed for 20 years post-retirement.

The corpus is calculated using the inflation-adjusted rate.

Based on the annual income requirement, the factors in the tables can be used to estimate the retirement corpus at specified discount and inflation rates.

From Table 2 and Table 3, it is clear that at 7.5% rate the estimated corpus without incorporating inflation is Rs.3.29 crore, which is 37.6% lower (Rs. 5.3 crore) when inflation rate of 6% is assumed.

Asset allocation, inflation riskFrom a portfolio construction perspective, managing inflation risk requires a dynamic approach. While fixed-income instruments offer stability and predictable cash flows, they are more vulnerable to inflation erosion over long horizons. Equity-oriented assets, despite higher short-term volatility, have historically provided better protection against inflation by participating in economic growth and earnings expansion. A calibrated mix of equity and debt—adjusted periodically as retirement approaches and progresses—can help balance growth, income stability, and inflation protection.

This means investors who prefer to invest their retirement corpus in debt securities will need to plan for a larger retirement corpus than those who prefer a mix of equity and debt, preferably in a balanced fund, which usually delivers higher returns than debt funds or debt securities.

Incorporating realistic inflation assumptions and stress-testing retirement plans under different scenarios are essential to ensuring that retirement savings deliver the intended standard of living throughout one’s post-working years.