NPLs rise by Tk1,867 crore in three months

TBS Report

18 January, 2026, 10:30 pm

Last modified: 19 January, 2026, 02:37 am

Infographic: TBS

“>

Infographic: TBS

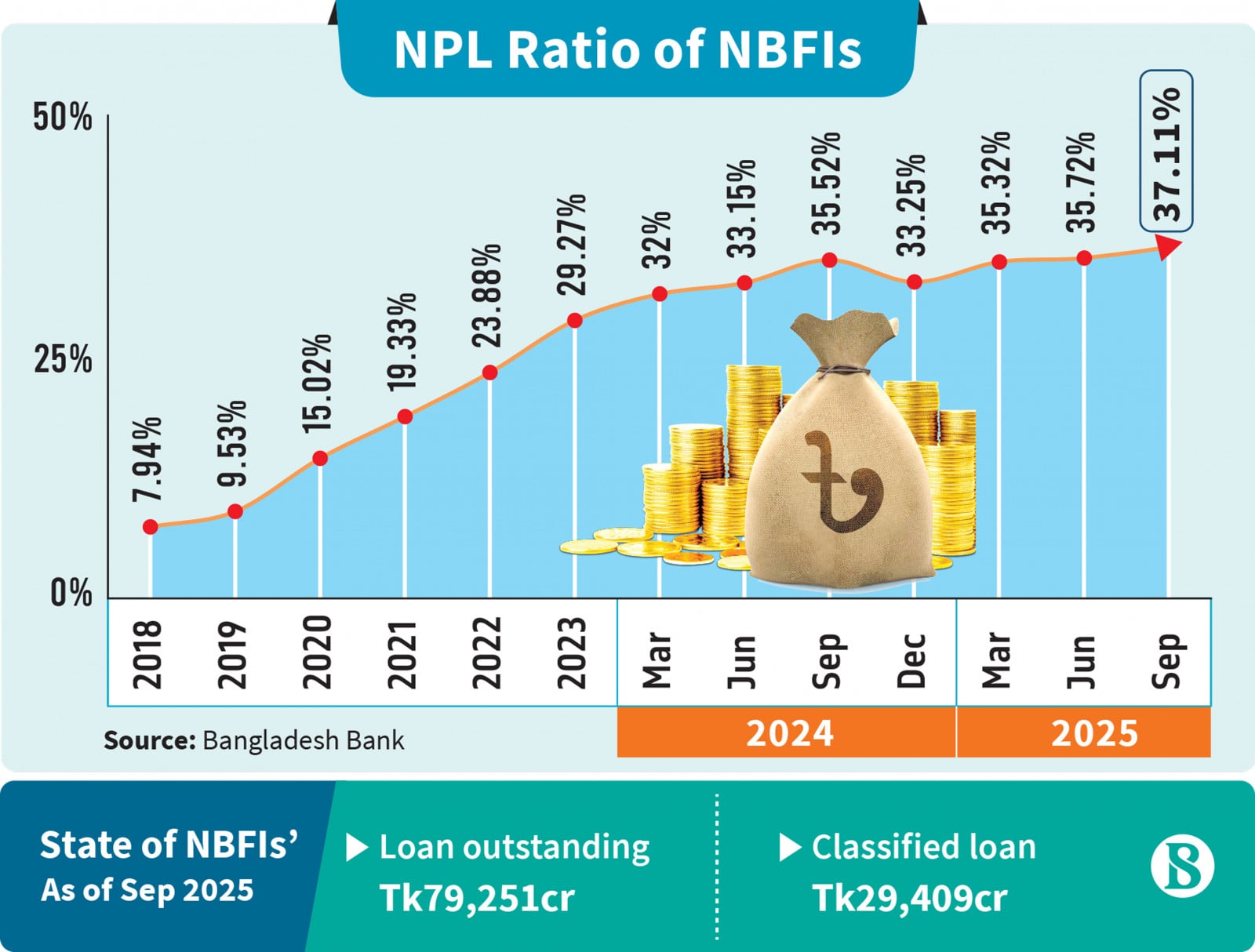

Non-performing loans (NPLs) at the country’s non-bank financial institutions (NBFIs) climbed sharply to Tk29,408 crore by the end of September 2025, accounting for more than a third of total outstanding loans, highlighting deepening stress in the sector.

According to Bangladesh Bank data, NPLs at financial institutions at the end of September 2025 account for 37.11% of total outstanding loans of Tk79,251 crore. This marks an increase of Tk1,867 crore in just three months, from Tk27,541 crore at the end of June, when classified loans accounted for 35.72% of total disbursed credit.

An analysis of the data indicates that while overall loan outstanding in the fragile NBFI sector has increased in recent months, classified loans have grown at a significantly faster pace. This suggests that not only previously disbursed loans, but also newly issued loans, are increasingly slipping into the non-performing category.

Golam Sarwar Bhuiyan, chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA), told TBS that the true extent of bad loans had long been concealed. “The amount of non-performing loans in Bangladesh’s financial companies already existed, but it was hidden,” he said. “After 5 August 2024, the central bank management began strict monitoring, forcing financial companies to disclose the actual level of NPLs.”

Keep updated, follow The Business Standard’s Google news channel

He added that following the change in regime, many borrowers who had taken loans from financial companies had left the country, leading to immediate loan classification. “Many loans were repeatedly rescheduled even though they had already defaulted,” Bhuiyan said.

Confidence in the sector has also been shaken by regulatory actions. The Bangladesh Bank has already announced plans to wind down nine financial companies, prompting depositors to withdraw funds and further straining liquidity across the sector. “Financial companies are not getting enough funds due to the lack of confidence,” Bhuiyan noted.

In December last year, the central bank’s board decided to liquidate a group of deeply distressed NBFIs after their loan portfolios collapsed under massive defaults. In the first phase, the Bangladesh Bank selected nine institutions – FAS Finance, Bangladesh Industrial Finance Company (BIFC), Premier Leasing, Fareast Finance, GSP Finance, Prime Finance, Aviva Finance, People’s Leasing and International Leasing – whose combined depositor exposure could be managed within the Tk5,000 crore fiscal limit set by the government.

A senior central bank official said the government had instructed the Bangladesh Bank to ensure that the fiscal burden of the liquidation process remains within that ceiling.

The Bangladesh Bank’s Financial Stability Assessment Report for the September 2024 quarter also paints a bleak picture for the sector. It noted a worsening trend in NBFIs’ performance due to a further deterioration in asset quality and profitability. Total assets of financial institutions declined to Tk99,493 crore, down 1.22% from the April-June 2024 quarter, alongside a broader downturn in profitability.