The number of ISAs adults paid into has topped 15 million for the first time in 13 years. The latest data from HMRC shows that in 2023/24, the nation paid into 9.9 million Cash ISAs and more than 4 million Stocks and shares ISAs, as well as almost one million Lifetime ISAs.

Cash is king, as the nation funnelled almost £70 billion into their Cash ISAs in the 2023/24 tax year to protect it from the taxman’s clutches. The amount paid in grew by 67% compared to the previous year, equivalent to an extra £28 billion over the year. The rise in Cash ISA use has been huge, with more than double the amount paid in compared to just two years earlier.

Stocks and shares ISAs also saw a chunky rise in inflows, as people found themselves facing bigger tax bills and made moves to protect their investments. The amount paid into Stocks and shares ISAs jumped 11% compared to the previous tax year, bringing the total to just over £31 billion for the 2023/24 tax year.

How much are people holding on average?

An ISA holder with income between £20,000 and £29,999 holds an average £31,536 across their ISAs, according to data from HMRC*. The average is relatively similar for those that earn up to £49,999, but then starts to increase, with those earning between £100,000 and £150,000 at closer to £60,000 in savings.

ISA balances tend to go up with age, with those between 35 to 44 holding an average of £13,527, while those 65 and older hold an average £63,365.

Average ISA balance by age group

Source: HMRC, AJ Bell

Investment Junior ISA subscriptions surpass £1 billion for first time

More parents are opening ISA accounts for their kids, and they are also stashing more money in the accounts, with nearly 1.4 million Junior ISAs subscribed to in 2023/24, up from 1.25 million in 2022/23.

Parents have also ditched some of their conservatism and embraced investing for their children. For years cash has dominated the Junior ISA landscape, with parents plumping for the safety of cash for their children’s savings, rather than the higher risk and higher potential returns of investing. But this year the amount subscribed to the Stocks and shares versions of Junior ISAs has surpassed £1 billion for the first time. It means that almost two-thirds of the money paid into Junior ISAs is going into investments now.

The nation’s kids will presumably be thankful for this shift, as holding the money in cash for many years, particularly for younger children, leaves it vulnerable to inflation, which can erode both returns and the eventual spending power of the pot at age 18. Whereas a long-term timeframe lends itself to investing and allowing more risk to ride out market fluctuations.

Lifetime ISAs see record inflows but exit penalties also jump

The Lifetime ISA continues to be a popular way for younger savers to get a foot on the property ladder or save for retirement, with the number of accounts paid into jumping by 28% in 2023/24 to almost one billion. A record £2.3 billion was paid in during 2023/24, as more people took advantage of the government bonus to boost their savings.

However, the figures also highlight the ongoing flaws with the product. The punitive government withdrawal penalty is hitting savers hard, with over £100 million lost to exit charges last year alone. On top of that, more than £400 million was pulled out in unauthorised withdrawals, showing how many people either don’t fully understand the rules or are forced to raid their savings in an emergency.

The average withdrawal remains modest at around £3,000, underlining that many people are cashing in relatively small amounts and being disproportionately penalised for doing so.

When it comes to using a Lifetime ISA to buy a home, the average withdrawal was around £15,000 for the 2024/25 tax year.

The gender ISA gap

Although 51.6% of all ISA holders are women, they are more likely to opt for cash than the investment version. It means that women make up 56% of Cash ISA holders, while they represent just 42% of Stocks and shares ISA holders*.

We know that over time investing has generated higher returns than cash, so it’s unsurprising that men have bigger ISAs overall – as they are benefitting more from investment growth and compounding over time. It means that the average man’s ISA is worth £35,652 versus £32,533 for women – giving a gender ISA gap upwards of £3,000.

When you compare the gender ISA gap at different ages, it highlights just how much investment returns are boosting men’s average ISA values over time. While the difference between men and women’s ISA values is just £80 when they are under 25, it peaks at a whopping £6,040 when we reach the 55 to 64 age group. The fact that it drops again for the oldest age groups likely reflects people drawing down on their ISA pots, moving to cash to de-risk and spouses inheriting their partner’s ISAs on death.

One bright spot is that if we look at the biggest ISA accounts there is a 50:50 split between men and women – as 49.6% of ISA holders of accounts worth £50,000 or more are women.

AgeGender ISA gapUnder 25£8025-34£1,33035-44£2,65845-54£4,07355-64£6,04065 and over£4,544Total£3,119

Source: HMRC, AJ Bell

How pensioners are accessing their savings

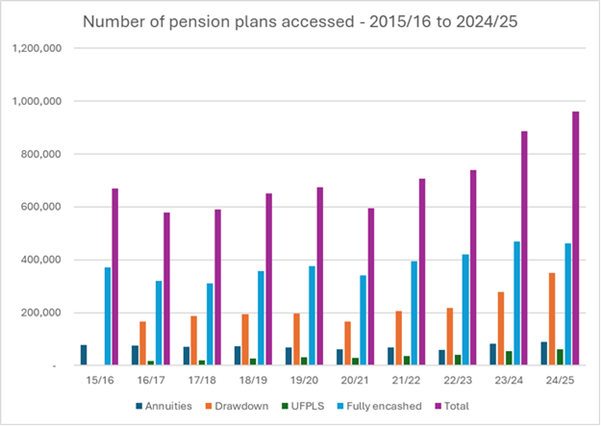

Switching from savings to withdrawals, money accessed from pensions surpassed £70 billion for the first time in the 2024/25 tax year, a 36% increase on the previous year, according to new data from the Financial Conduct Authority. Thanks to pension freedoms, people can take as much as they like from their pensions, but the concern is many aren’t making decisions based on what’s best for them, instead changing their behaviour because they are worried about possible changes to pensions tax incentives from the government.

Speculation surrounding the fate of pensions tax-free cash ahead of Chancellor Rachel Reeves’ inaugural Budget last October led to an increase in people accessing their cash out of fear they may lose some of it to a change in policy, potentially causing untold damage to their long-term retirement plans. Alongside this, the announcement that unused pensions would be subject to inheritance tax from April 2027 has led many to review their overall estate planning, possibly withdrawing pension money faster to spend or gift to loved ones.

Source: AJ Bell analysis of FCA figures between 2015/16 and 2024/25.

Appeal of drawdown for pensioners

The number of people choosing drawdown as their income option increased by a staggering 26% last year, perhaps reflecting that more wanted to bank their tax-free cash under the current rules before any possible tax regime changes were introduced. This is borne out by 60% of people entering drawdown choosing to take their cash but no further income withdrawals, suggesting most had no immediate need for an income. Equally, many could be looking for the flexibility to take the right amount of money to suit their needs, finding drawdown the perfect balance between access and investment.

*Based on the latest HMRC data from 2022/23 tax year