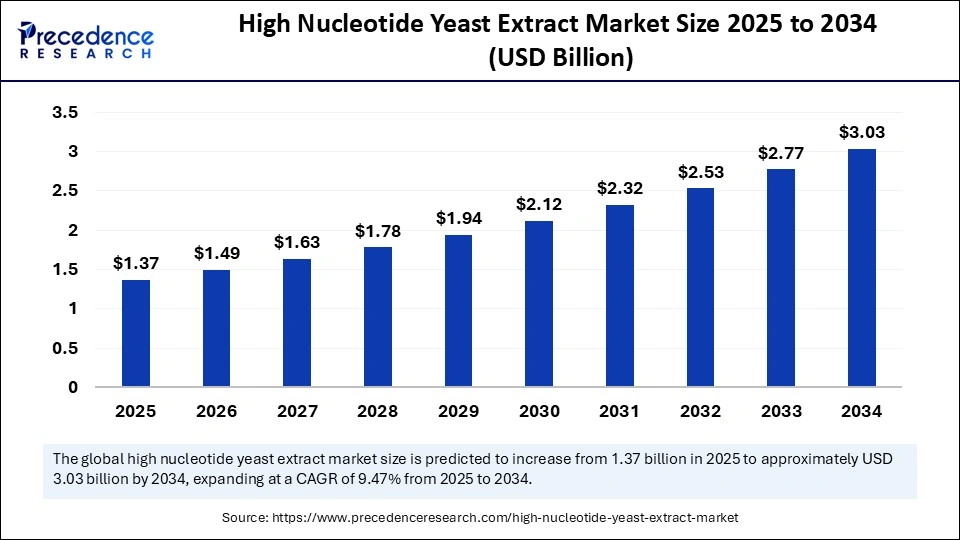

The global high nucleotide yeast extract market size was calculated at USD 1.25 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.03 billion by 2034, expanding at a CAGR of 9.24% from 2025 to 2034. The market is growing due to increasing demand for natural flavor enhancers and clean-label food ingredients in processed foods.

Market Highlights

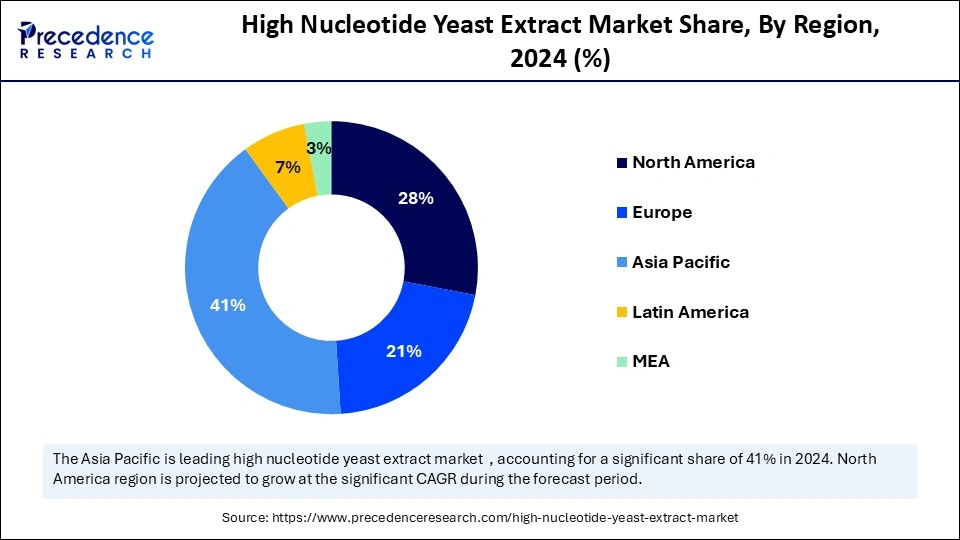

Asia Pacific dominated the high nucleotide yeast extract market with the largest share of 41% in 2024.

North America is expected to grow at a notable CAGR during the forecast period.

By form, the powder segment held the biggest market share in 2024.

By form, the liquid segment is expected to grow at the fastest rate during the forecast period.

By nucleotide content, the standard nucleotide yeast extract segment captured the highest market share in 2024.

By nucleotide content, the enriched high nucleotide extract segment is expected to grow at the fastest CAGR during the forecast period.

By source yeast, the Saccharomyces cerevisiae segment contributed the maximum market share in 2024.

By source, the brewer’s yeast segment is expected to grow at the fastest CAGR during the forecast period.

By processing method, the autolysis-derived extract segment generated the major market share in 2024.

By processing method, the enzymatic hydrolysis extract segment is observed to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

Market Size in 2024: USD 1.25 Billion

Market Size in 2025: USD 1.37 Billion

Forecasted Market Size by 2034: USD 3.03 Billion

CAGR (2025-2034): 9.24%

Largest Market in 2024: Asia Pacific

Fastest Growing Market: North America

Market Overview

The high nucleotide yeast extract market is witnessing robust growth, fueled by the growing need for clean-label ingredients, umami-rich solutions, and natural flavor enhancers in processed and plant-based foods. Yeast extracts with higher nucleotide content are being used by manufacturers in response to consumers’ growing desire for natural and healthier food products. These extracts enhance both taste and nutritional value due to its growing desire for natural and healthier food products. These extracts enhance both taste and nutritional value. Big players such as Angel Yeast Co. Ltd, Lesaffre group, Kerry group, and DSM Food Specialties are spending money on R&D product development and international growth.

In May 2025, Leiber GmbH presented at IFIA Japan 2025, showcasing the characteristics and effective use of Leiber yeast extract to approximately 120 professionals from the Japanese food industry.(Source: https://leibergmbh.de)

Artificial Intelligence is significantly influencing product innovation in the high nucleotide yeast extract market by enhancing research and development processes, optimizing production efficiency, and enabling the creation of more targeted and functional ingredients. Businesses can find new yeast strains with better functional qualities and more concentrated nucleotide content thanks to AI-driven tools that make it easier to analyze large datasets. Furthermore, AI algorithms help to ensure consistent product quality, lower production costs, and streamlined fermentation processes. This technological integration speeds up the creation of yeast extracts to satisfy the rising demand from consumers for natural, clean-label, and health-conscious food ingredients.

In July 2025, Lesaffre launched a new yeast extract product line in the Asia Pacific region, focusing on enhancing flavor and nutritional content in savory foods. This initiative aims to meet the clean-label ingredients in the food industry.(Source: https://www.lesaffre.com)

Market Scope

Report Coverage

Details

Market Size in 2024

USD 1.25 Billion

Market Size in 2025

USD 1.37 Billion

Market Size by 2034

USD 3.03 Billion

Market Growth Rate from 2025 to 2034

CAGR of 9.24%

Dominating Region

Asia Pacific

Fastest Growing Region

North America

Base Year

2024

Forecast Period

2025 to 2034

Segments Covered

Form, Nucleotide Content, Source Yeast, Processing Method, Application, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

Rising Demand for Natural Flavor Enhancers

Customers strongly favor clean labels and naturally sourced ingredients as they avoid artificial flavoring and additives. Because yeast extracts are high in nucleotides and naturally have an umami flavor, they are perfect for soups, sauces, snacks, and prepared foods. To appeal to health-conscious consumers, food manufacturers are actively reformulating their products to include these extracts without compromising flavor.

Technological Advancements in Production

Producers can now create yeast extracts with a higher nucleotide content and consistent quality thanks to advancements in fermentation extraction and AI-assisted R&D. These technologies speed up product development cycles, minimize batch-to-batch variability, and lower production costs. Businesses can now customize yeast extracts for specific uses in clean-label, savory, and functional products.

Restraints

Limited Awareness Among Consumers

Even though more people are concerned about their health, many consumers are still ignorant of the advantages of high nucleotide yeast extracts. Demand in some regional markets may be impacted by this ignorance, particularly in areas where natural or functional ingredients are not as valued to effectively convey the taste and health benefits, and marketing initiatives, and consumer education campaigns are required. Adoption might not pick up speed without broad awareness, particularly in a developing market.

Pressure from Cheaper Substitutes

Common substitutes such as hydrolyzed proteins, monosodium glutamate, and other flavor enhancers compete with high nucleotide yeast extracts. These alternatives are readily accessible, less expensive, and already widely used in the food sector. Consequently, they are frequently preferred over high-end yeast extracts by manufacturers in cost-sensitive industries. If high-nucleotide yeast extract isn’t marketed as a natural, healthier alternative, it could lose market share to these inexpensive alternatives.

Opportunities

Rising Demand for Natural Flavor Enhancers

High-nucleotide yeast extract offers a healthier substitute for artificial flavor enhancers like MSG, as consumers’ preferences for natural and clean-label ingredients continue to grow. Because it naturally enhances umami taste, the food and beverage industry finds it very appealing. Yeast extracts will become more businesses restructure their products to satisfy consumer health trends. Manufacturers are now able to market their goods as high-end natural flavoring agents.

Growth in Functional and Nutritional Foods

Nucleotides that promote immunity and gut health are among the nutritional advantages that high nucleotide yeast extract offers in addition to improving flavor. Its use is strongly encouraged by the growing popularity of dietary supplements, infant nutrition products, and functional foods. By creating fortified food and supplement products that appeal to health-conscious consumers, manufacturers can capitalize on this trend. The intersection of nutritional functionality and flavor enhancement strengthens the potential for growth in the high nucleotide yeast extract market.

Segments Insights

Form Insights

Why Did the Powder Segment Dominate the High Nucleotide Yeast Extract Market in 2024?

The powder segment dominated the high nucleotide yeast extract market in 2024, due to its greater solubility in various applications, including food processing, pharmaceuticals, and nutraceuticals, as well as its longer shelf life and ease of storage. Manufacturers favor powdered extracts because of their reliable quality, regulated dosage, and ease of transportation, all of which contribute to their widespread use in both large and small businesses. Their supremacy was further reinforced by their ability to blend easily with dry ingredients.

The liquid segment is growing rapidly as it offers higher bioavailability, faster absorption, and ease of incorporation into beverages, dietary supplements, and liquid formulations. With increasing demand for functional drinks and quick-acting nutraceutical solutions, liquid high-nucleotide yeast extracts are gaining significant traction. Moreover, food and beverage manufacturers are adopting liquid forms to achieve uniform distribution in liquid matrices, driving growth.

Nucleotide Content Insights

Why Did the Standard Nucleotide Yeast Extract Segment Dominate the High Nucleotide Yeast Extract Market in 2024?

Standard nucleotide yeast extract segment dominated the high nucleotide yeast extract market, due to its balanced nutritional qualities, broad applicability in flavor enhancement, and economical production. The food industry chooses it because of its well-established use in seasonings, soups, and sauces. Its dominance in price-sensitive markets has also been aided by its affordability when compared to enriched extracts. For large-scale production, large food chains favor it. It also has a competitive advantage in regulatory approvals due to its established safety record.

The enriched high-nucleotide extract is growing rapidly due to the increasing demand for nutraceuticals and functional food products that promote gut health, immunity, and overall wellness. Enriched extracts work better in clinical nutrition and dietary supplements because of their higher nucleotide content. Their adoption is also being accelerated by rising premium product preferences and awareness of preventive healthcare. Additionally, pharmaceutical companies are testing enriched extracts for use in therapeutic formulations. In developed economies, they are appealing due to their premium positioning.

Source Yeast Insights

Why Did Saccharomyces cerevisiae Dominate the High Nucleotide Yeast Extract Market in 2024?

Saccharomyces cerevisiae remained the dominant source of yeast in the high nucleotide yeast extract market during 2024 because of its wide availability, proven safety profile, and extensive use in both food and pharmaceutical applications. Its high nucleotide yield, coupled with cost-effective production methods, has made it the preferred choice for manufacturers. The yeast’s long history in fermentation processes also reinforces its reliability and acceptance. Consistent R&D around this yeast strain continues to improve extraction efficiency. Its regulatory acceptance across multiple regions further secures its market position.

The brewer’s yeast segment is growing because it offers a safe, nutrient-dense, and natural source of nucleotides. Brewer’s yeast by-products are being used more often as craft brewing industries grow which lowers waste and promotes circular economy principles. Its additional advantages in supplements and functional foods are further increasing demand. Innovation is being stimulated by research on turning brewery waste into extracts with added value. Additionally, the growing consumer trend of sustainability-driven purchases benefits this segment.

Processing Method Insights

Why Did the Autolysis-Derived Extract Segment Dominate the High Nucleotide Yeast Extract Market in 2024?

The autolysis-derived extracts segment dominated the high nucleotide yeast extract market in 2024 due to their cost efficiency, simple processing techniques, and ability to preserve natural flavors. This method requires fewer processing steps and ensures consistent quality, making it the preferred approach for large-scale food manufacturers. Additionally, autolysis aligns with the growing demand for clean-label products. The process minimizes chemical intervention, which appeals to health-conscious consumers. Its scalability further strengthens its industrial adoption.

Enzymatic hydrolysis extract is growing rapidly due to improved functionality, increased purity levels, and accuracy in regulating nucleotide content. Manufacturers can use this technique to customize extracts for particular uses like premium nutraceuticals, clinical nutrition, and baby formulas. A growing emphasis on specialized solutions and cutting-edge processing technologies is driving adoption. Enzymatic processes yield higher yields, which also lowers overall costs. Both the food and pharmaceutical industries find it appealing due to its versatility in applications.

Application Insights

Why Did the Food & Beverages Segment Dominate the High Nucleotide Yeast Extract Market in 2024?

The food & beverages segment dominated the high nucleotide yeast extract market in 2024, as yeast extracts are widely used for flavor enhancement, natural seasoning, and nutritional fortification. Their role as a clean-label alternative to synthetic additives further fueled demand from soup, sauce, snack, and processed food manufacturers. Rising global consumption of packaged and convenience foods have sustained its leadership. Large FMCG brands are integrating yeast extracts to replace MSG. Additionally, evolving consumer preferences for natural flavors are reinforcing dominance.

Nutraceuticals are experiencing rapid growth in the market due to increasing consumer interest in natural supplements and preventive healthcare. High-nucleotide yeast extracts are becoming more and more common in products that support immunity, healing, and gut health. Growth is being accelerated by the growing dietary supplement industry and growing awareness of functional nutrition. Clinical nutrition therapies employ nucleotides according to pharmaceutical companies. Nutraceuticals are outperforming traditional food uses thanks to their premium positioning.

Regional Insights

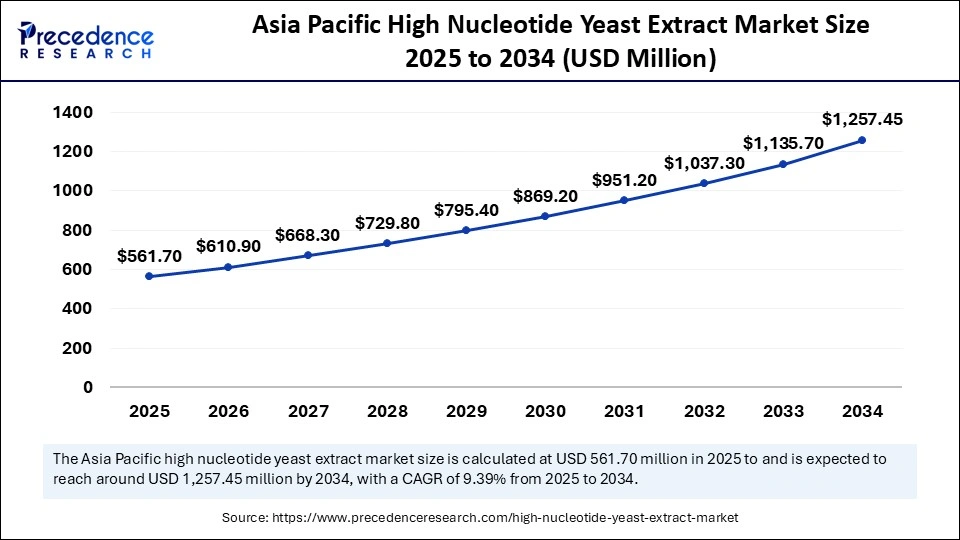

Asia Pacific High Nucleotide Yeast Extract Market Size and Growth 2025 to 2034

The Asia Pacific high nucleotide yeast extract market size was exhibited at USD 512.50 million in 2024 and is projected to be worth around USD 1,257.45 million by 2034, growing at a CAGR of 9.47% from 2025 to 2034.

What Made Asia Pacific Dominate the Market for High Nucleotide Yeast Extract in 2024?

Asia Pacific continues to dominate the high nucleotide yeast extract market with a major market share of 41% in 2024, due to the substantial food processing industry, the high demand for flavor enhancers, and the functional foods’ explosive growth. Urbanization and rising disposable incomes are driving consumption, while the region’s affordable production facilities improve supply capacities. Support from the government for regional businesses is increasing adoption even more. Additionally, regional dominance is strengthened by the expanding pharmaceutical and nutraceutical base.

North America is experiencing rapid growth due to increasing demand for natural food ingredients, clean-label products, and advanced nutraceutical solutions. The presence of robust healthcare infrastructure, increasing health awareness, and ongoing innovation in functional foods and supplements are driving the adoption of high-nucleotide yeast extracts across the region. Collaborations between ingredient suppliers and brands are driving growth. The region is also witnessing a surge in demand for enriched nucleotides in clinical settings.

Angel Yeast Co., Ltd.

Lesaffre Group

DSM-Firmenich

Ohly GmbH (Associated British Foods)

Kerry Group plc

Lallemand Inc.

Biospringer (part of Lesaffre)

Biorigin

Zhejiang Silver-Elephant Bio-Engineering Co., Ltd.

Shandong Sunkeen Biotechnology Co., Ltd.

ABF Ingredients

Synergy Flavors (yeast-based extracts)

Sensient Technologies Corporation

KOHJIN Life Sciences Co., Ltd.

Thai Foods International PCL (TFI)

Mitushi Biopharma

Thai Fermentation Industry Co., Ltd.

Aohata Corporation (specialty ingredients)

Savoury Systems International LLC

Zhuhai Txaky Biotech Co., Ltd.

Recent Developments

In May 2024, Angel Yeast announced the launch of its Ultra-Filtered Yeast Extract FM888 at the CPhI Exhibition in Spain, offering an exceptional umami flavor profile.(Source: https://en.angelyeast.com)

In January 2025, Novozymes and AgroFresh announced a partnership to develop biological solutions aimed at reducing post-harvest food waste and improving crop yields. (Source: https://www.agrofresh.com)

Segments Covered in the Report

By Form

By Nucleotide Content

Standard nucleotide yeast extract

Enriched high-nucleotide extract (>10% concentration)

Customized nucleotide blends

By Source Yeast

Saccharomyces cerevisiae (baker’s yeast)

Brewer’s yeast

Torula yeast

Other yeast strains

By Processing Method

Autolysis-derived extract

Enzymatic hydrolysis extracts

Thermal hydrolysis extracts

By Application

Food & beverages

Soups, sauces & seasonings

Processed meats & ready meals

Dairy & cheese flavoring

Snacks & savory products

Nutraceuticals & dietary supplements

Immune support products

Infant formula & pediatric nutrition

Digestive health supplements

Animal nutrition & feed additives

Aquaculture feed

Pet food

Livestock feed

Pharmaceuticals (nutrient fortification, excipients)

Others (cosmeceuticals, fermentation nutrients)

By Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa