Ever since the end of World War 2, the United States has enjoyed incredible economic advantages: The dollar has been the reserve currency for economic transactions, the US has been seen as a beacon of democracy and freedom attracting the best and the brightest from around the world (half of Silicon Valley C suites are recent immigrants); The U.S. has engaged in the sort of geopolitical and mutual defense leadership that has allowed us to very much influence the course of events.

Some of this has been problematic: we hollowed out our manufacturing base replacing it with services but failed to train those workers who were on the losing end of that deal.

But overall, the U.S. has gained mightily in terms of wealth and stature from the post-war global order.

~~~

I try to avoid the shrieking, binary warnings. The more useful approach is to recognize the range of potential outcomes and assess the probability of each. Yes, something untoward might happen; I am not yet in the camp of those who believe Pax Americana has ended. But we must recognize that this worst-case scenario is certainly a realistic possibility.

However, the economy has been robust, corporate profits continue to grow, and markets are making new all-time highs. That combination has been historically very bullish. It is why I have not yet succumbed to the negativity rising all around us.

The recent actions from this administration are raising a variety of risks. I first mentioned the increasing probability of significant policy error back in February. Then again, after April 2nd (“Liberation day”).

My question for readers today is: “Where is the tipping point?” At what point do the chosen economic and political policies put into place by the government become an avoidable error, a self-goal, accidentally pushing the United States into a recession?

I don’t know. But I am closely watching three elements that could lead me to problems:

1) Data Opacity: The softening labor market has led to a series of weak NFP reports. Last month, the President fired the head of BLS; last week, the BLS announced “the annual release of consumer expenditures data — initially set for Tuesday — would be “rescheduled to a later date.” This comes on top of a website snafu that delayed a normal jobs data report.

2) Confidence Faltering: One of the elements that allowed the Great Depression to run so out of control was a lack of uniform measures of the state of the economy. A major fix: building national economic indicators. We created a series of uniform nationwide measures that tracked Gross Domestic Product (GDP), the Unemployment Rate, and Consumer Price Index (CPI). These became a gold standard among developed economies, creating consistent (if imperfect) measures. Anything undercutting data transparency is a rising market risk factor.

3) Overreach: The more the government moves from its traditional role as a regulator to an active participant, the greater the risk of error is. There is an increasing sense of broad and aberrational transactional governmental actions in several policy areas. The Intel deal, the (ignored) TikTok legislation, the FCC regulation of content (Colbert & Kimmel). None of these transactions can be thought of as traditional or normal in the U.S. system of capitalism.

After decades of robust growth, China’s command economy has slowed from double-digit GDP gains to less than half of that growth. Some of that was normal deceleration, but a lot was due to policy errors: China expensively created massive ghost cities; they burdened provinces with huge infrastructure debt. They also ignore the demand side of the economic equation.1

~~~

One of the many possibilities is that the noisy headlines are, in fact, just noise. The economy continues to move along briskly, and we skirt a recession, with economic activity accelerating in 2026 due to rate cuts and deficit spending. But a mild recession now seems to be about as likely as an escape. There are also increasing risks of something worse.

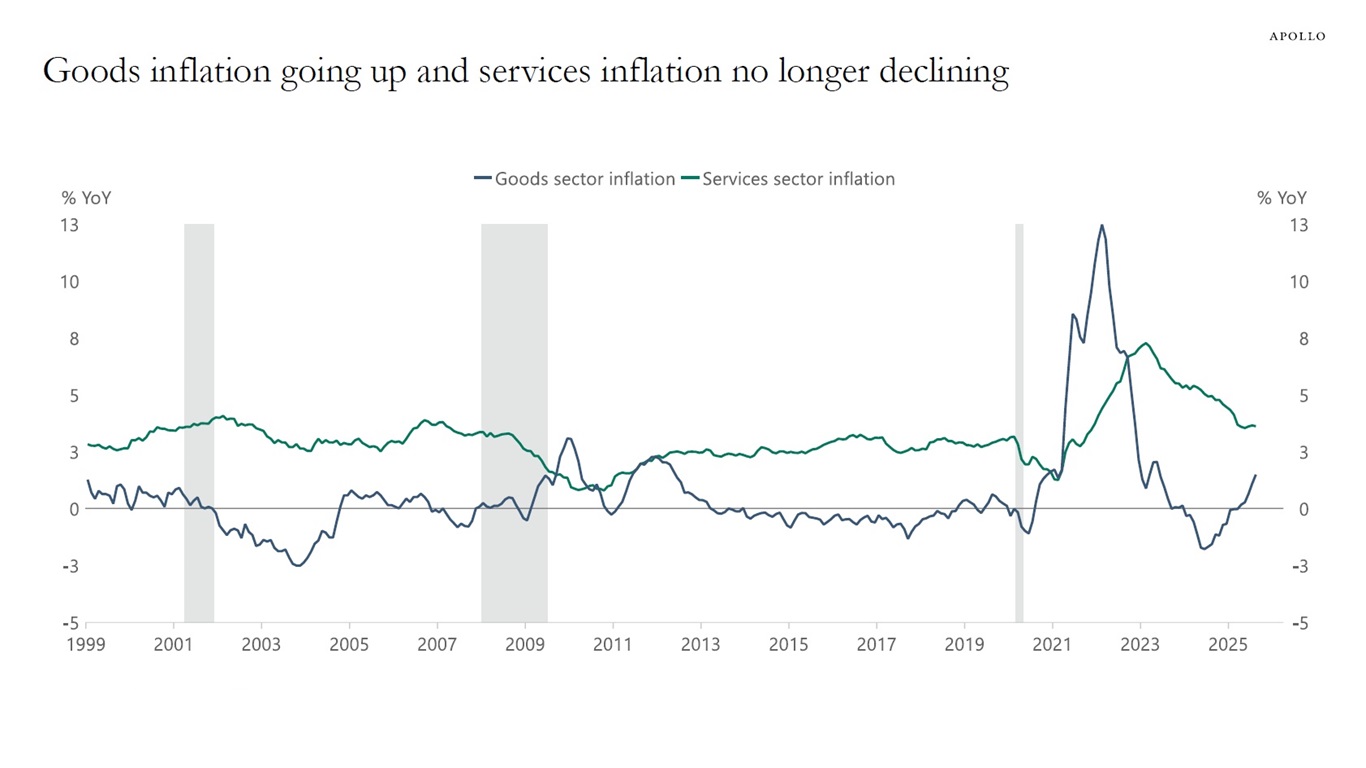

This administration inherited a robust economy. There were, below the water level, some fractures – residual inflation (see chart at top), softening labor market, terrible housing affordability, and increased public and private debt. But Presidential administrations are not judged by the cards they are dealt, but rather, how they play their hands. This administration has been doubling down on aggressive, high-risk plays.

I am hopeful that we skate, avoiding a recession. But we must acknowledge the reality of rising risks, including the possibility of recession, stagflation, or worse…

See also:

Bureau of Labor Statistics postpones key data report (Axios, September 19, 2025 )

Previously:

Risks & Opportunities of the New Administration (February 3, 2025)

7 Increasing Probabilities of Error (February 24, 2025)

The Consequences of Chaos (April 7, 2025)

Crosscurrents (August 25, 2025)

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

__________

1. See Dan Wang’s book “Breakneck: China’s Quest to Engineer the Future” for more details…