He says the inquiry is part of regular internal work

TBS Report

22 September, 2025, 10:05 pm

Last modified: 23 September, 2025, 12:08 am

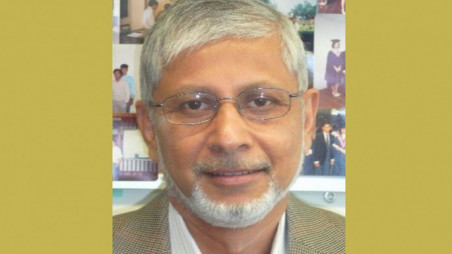

Chief Adviser’s Special Assistant Anisuzzaman Chowdhury. Photo: Collected

“>

Chief Adviser’s Special Assistant Anisuzzaman Chowdhury. Photo: Collected

The market is overreacting to the recent letter from the National Board of Revenue (NBR) seeking information on capital gains exceeding Tk50 lakh, Chief Adviser’s Special Assistant Anisuzzaman Chowdhury has said.

“The issue was a routine government task that should not have triggered such panic,” he said at a seminar organised by the Bangladesh Securities and Exchange Commission and the Dhaka Stock Exchange in Dhaka today.

“Regarding a simple NBR letter on Tk50 lakh capital gains, the market has blown it out of proportion. This is part of regular internal work. The NBR has a deadline of 31 October to compile updated tax income data. Such a reaction is not acceptable,” he said.

Keep updated, follow The Business Standard’s Google news channel

He added that there should be no problem in providing the information. “No allegations of irregularities have been raised. Then why is there so much fear? People in our market need to behave more responsibly.”

Financial Adviser Salehuddin Ahmed, also speaking at the event on “Unlocking Bangladesh’s Bond and Sukuk Markets: Fiscal Space, Infrastructure Delivery and Islamic Money Market Development”, said many small investors mistakenly expect permanent income from the stock market.

“If a company doesn’t perform well, investors must share the loss. The DSE must educate investors that shares or bonds are not guarantees of permanent profit,” he said.

The Dhaka Stock Exchange extended its losing streak for a fourth consecutive day, with DSEX losing 172 points over the past week. Market capitalisation dropped by around Tk8,000 crore, while daily turnover fell to Tk500 crore from nearly Tk1,000 crore earlier this month.

Market insiders blamed the panic selling on confusion over the NBR’s letter, which was hastily forwarded by the BSEC to stock exchanges without thorough review.