Muscat: The Sultanate of Oman is experiencing an explosive rise, driven by mobile and instant payment solutions, which also underscores the need for robust cybersecurity and regulatory safeguards to maintain the integrity of its financial system.

According to the Financial Stability Report 2025, the Mobile Payments Clearing and Switching System (MPCSS) experienced the strongest growth among all systems, with volume surging by 318.6% and value increasing by 223.5%.

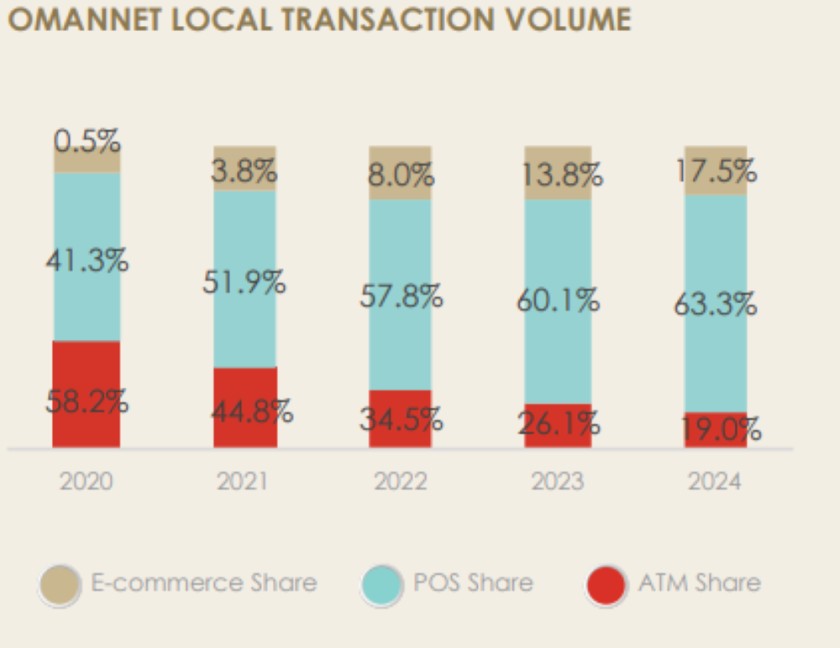

The report said that the rapid expansion of OmanNet and MPCSS indicates a significant transition to cashless payments. This shift supports financial stability by reducing dependency on physical cash and promoting efficient digital ecosystems. Along with ACH, both systems are key enablers of digital transformation, supporting Oman’s strategic push toward digital financial services.

Moreover, E-commerce transactions increased modestly by 1.5 percent, indicating steady digital shopping activity. The total e-commerce transaction value reached RO1.4 billion, reinforcing its continued importance in the digital economy. While growth in this area was moderate, it reflects stability in online purchasing trends and supports ongoing digital transformation efforts.

Decline in ATM transactions

ATM transactions experienced a decline in both usage and value. The total ATM transaction value in 2024 was OMR 4.1 billion, with transaction volume decreasing by 8.6 percent. This trend also reflects a move away from cash withdrawals toward digital and contactless payment methods. The contraction in ATM usage is consistent with efficiency for banks.

This is also confirmed by the surge in Point of Sale (POS) transactions, which rose by 44.8percent, demonstrating strong consumer adoption of card-based and contactless payments at physical retail locations. The total POS transaction value reached RO 3.4 billion in 2024, signaling rising digital readiness among retailers and increased confidence of users in secure, traceable payment systems.

Across all transaction types, the total number of transactions rose by 32.1 percent, with an overall transaction value of RO8.9 billion. This substantial increase reflects expanding usage of digital payment systems, improved financial access, and greater economic participation. It also aligns with national objectives to enhance financial stability through digital innovation, reduce cash reliance, and improve oversight through traceable transactions.

To sustain these gains, financial authorities should continue monitoring risks related to fraud, cybersecurity, and digital inclusion while supporting fintech innovation and regulatory improvements, the report said.