Although the November canola contract lost $4.30 during the week ended Sept. 25, the Canadian oilseed came away better than expected on the Intercontinental Exchange. The November contract closed out the week at $619.60 per tonne, staying sufficiently above the $600 mark.

That’s pretty good given the hurdles canola is facing.

The first factor is the Prairie harvest, which has yet to really put a lot of pressure on canola. Things have been going slower than normal, and that surge of canola coming into the commercial pipeline hasn’t arrived. That doesn’t mean it isn’t coming. It is, big time.

Read Also

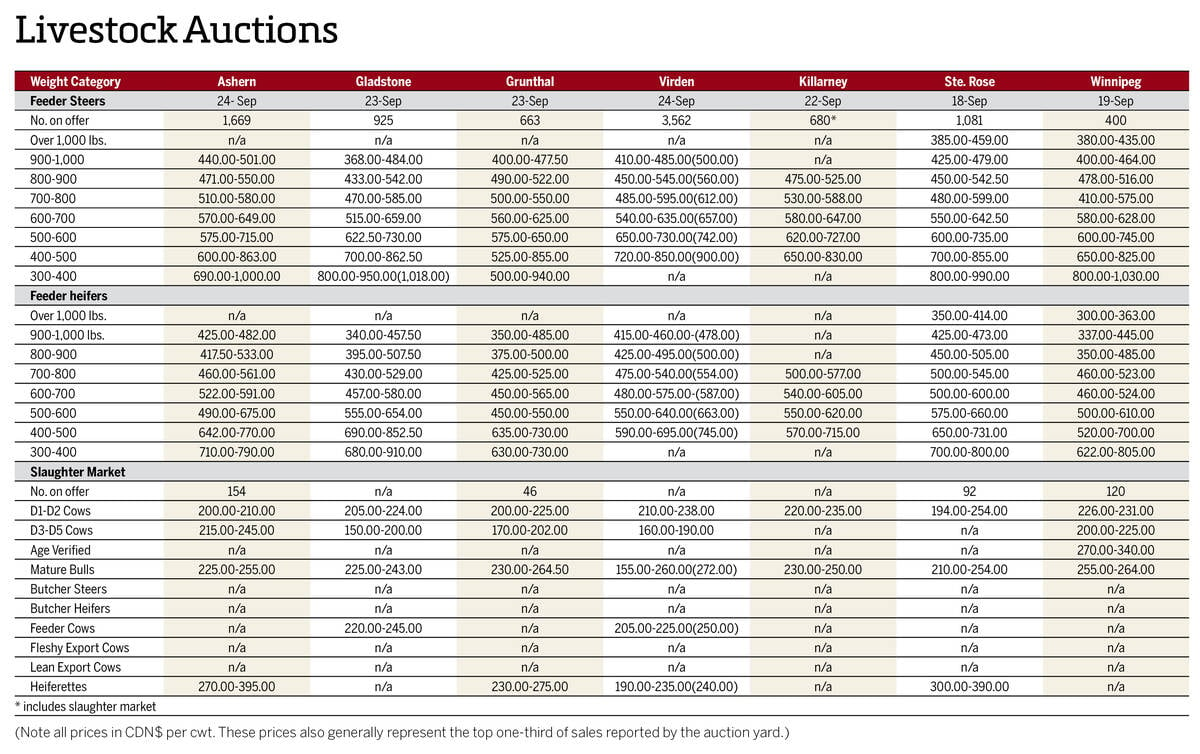

Manitoba cattle prices – Sept. 26

All major Manitoba livestock auctions posted cattle sales during the week Sept. 22-26

There’s been talk of a canola harvest larger than the 20.03 million tonnes Statistics Canada estimated in its September production update. Speculation in the trade has canola coming in at more than 21 million tonnes based on very good yields so far.

Then there’s the China problem. Those stiff tariffs on canola seed, oil and meal won’t be going away anytime soon. There’s also the failure of the United States to making any headway with China in a phone conversation between Presidents Donald Trump and Xi Jinping. Hopes of decent progress on trade issues simply didn’t happen on the call and, in the end, China has yet to buy any 2025/26 U.S. soybeans.

Without those bean sales, there’s little to inspire canola export sales to China. Cumulative year-to-date canola export sales were at 627,400 tonnes seven weeks into the marketing year, far below the 1.68 million that had been sold the same time last year.

However, some ‘hallway diplomacy’ at the United Nations in New York may have helped Canada’s canola plight. After Prime Minister Mark Carney delivered his address to the General Assembly, he discussed trade issues, including canola, with Chinese Premier Li Qiang. There’s some progress expected, with Carney eventually to meet with President Xi Jinping.

The downside to that is nothing is really going to change until after the New Year. Unfortunately, China’s levies on canola and meal are very likely to remain at 100 per cent, while the seed is to stay at 75.8 per cent.

Chinese authorities are pressing ahead with its investigation into canola dumping by Canada, which could result in further repercussions for canola. And until Ottawa punts its 100 per cent levy on imports of Chinese-made electric vehicles, forget about any changes for the oil and meal along with other Canadian goods.

Presently, canola remains above $600/tonne, but as we slide into winter, that price could slip below that psychological level. It may push under last year’s low of $580, and that could spell a bleak Christmas for Canadian canola growers.