Jack SilverChannel Islands

Jack Silver/BBC

Jack Silver/BBC

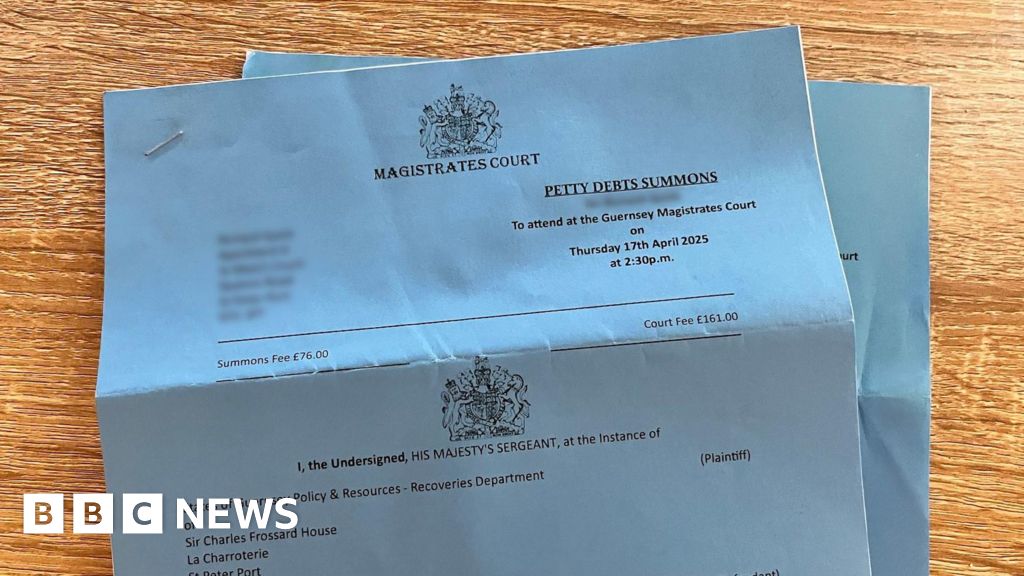

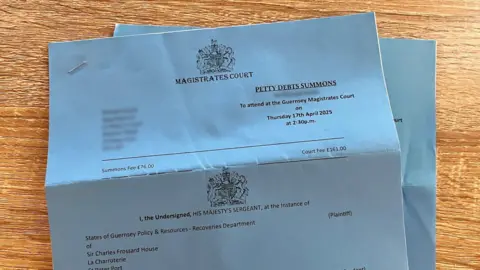

The States said 17 petty debts summons were issued on behalf of Health in 2019, which rose to 728 in 2024

Guernsey’s government is chasing hundreds of healthcare debts through the court system, a new Freedom of Information (FOI) request has revealed.

Petty debts summons rose from 17 to 728 – an increase of more than 4,000% – between 2019 and 2024.

The majority of the increase happened since 2022, when a new government-wide debt management team had targeted a “large number of historic debts”, the States said.

Darren Smith, finance business partner for the States, said there had been a “significant increase” in summons issued for unpaid health invoices, but it was a “last resort” only taken once people had received at least two reminders.

He said the new debt recovery process was there to “ensure that no debts to the taxpayer are unnecessarily written off”, with the main focus on “outstanding private patient and Emergency Department fees”.

Mr Smith said only 24 out of the 728 health summonses issued in 2024 resulted in judgements, because of payment arrangements made with debtors before going to court.

Between 2021 and 2024 the total number of summons across all departments rose from 467 to 2,289 – a 390% increase, the FOI figures reveal.

This included income tax summons which increased from 273 to 1,030 – a rise of 277%.

The government did not provide figures for income tax summons before 2021.

A previous FOI request revealed that 250 summons were issued for health debt in the first quarter of 2024.

In its latest FOI response, the States said effective debt management was “essential” to ensuring its services were “sustainably funded by those who use them”.

“The broader aim is to work collaboratively with customers to prevent debt from arising in the first place,” it said.

The States said it was “subject to the same legal process as any other party bringing a case before the Petty Debts Court” and did not get preferential treatment.

Visualisation by the BBC England Data Unit