In a market environment where major indexes have recently hit record highs despite a week of losses, investors are keenly observing small-cap stocks for potential opportunities. With inflation pressures and tariff impacts shaping the economic landscape, identifying promising stocks that can navigate these challenges is crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In The United StatesNameDebt To EquityRevenue GrowthEarnings GrowthHealth RatingSouthern Michigan Bancorp117.38%8.87%4.89%★★★★★★Oakworth Capital87.50%15.82%9.79%★★★★★★Metalpha Technology HoldingNA75.66%28.60%★★★★★★FineMark Holdings115.37%2.22%-28.34%★★★★★★Valhi44.30%1.10%-1.40%★★★★★☆FRMO0.10%42.87%47.51%★★★★★☆Pure Cycle5.02%4.35%-2.25%★★★★★☆Linkhome Holdings7.03%215.05%239.56%★★★★★☆Rich Sparkle Holdings26.73%-6.13%1.75%★★★★★☆Solesence91.26%23.30%4.70%★★★★☆☆

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Value Rating: ★★★★★★

Overview: Etoiles Capital Group Co., Ltd operates through its subsidiaries to offer integrated investor relations services across Hong Kong, China, and the United States, with a market cap of $299.84 million.

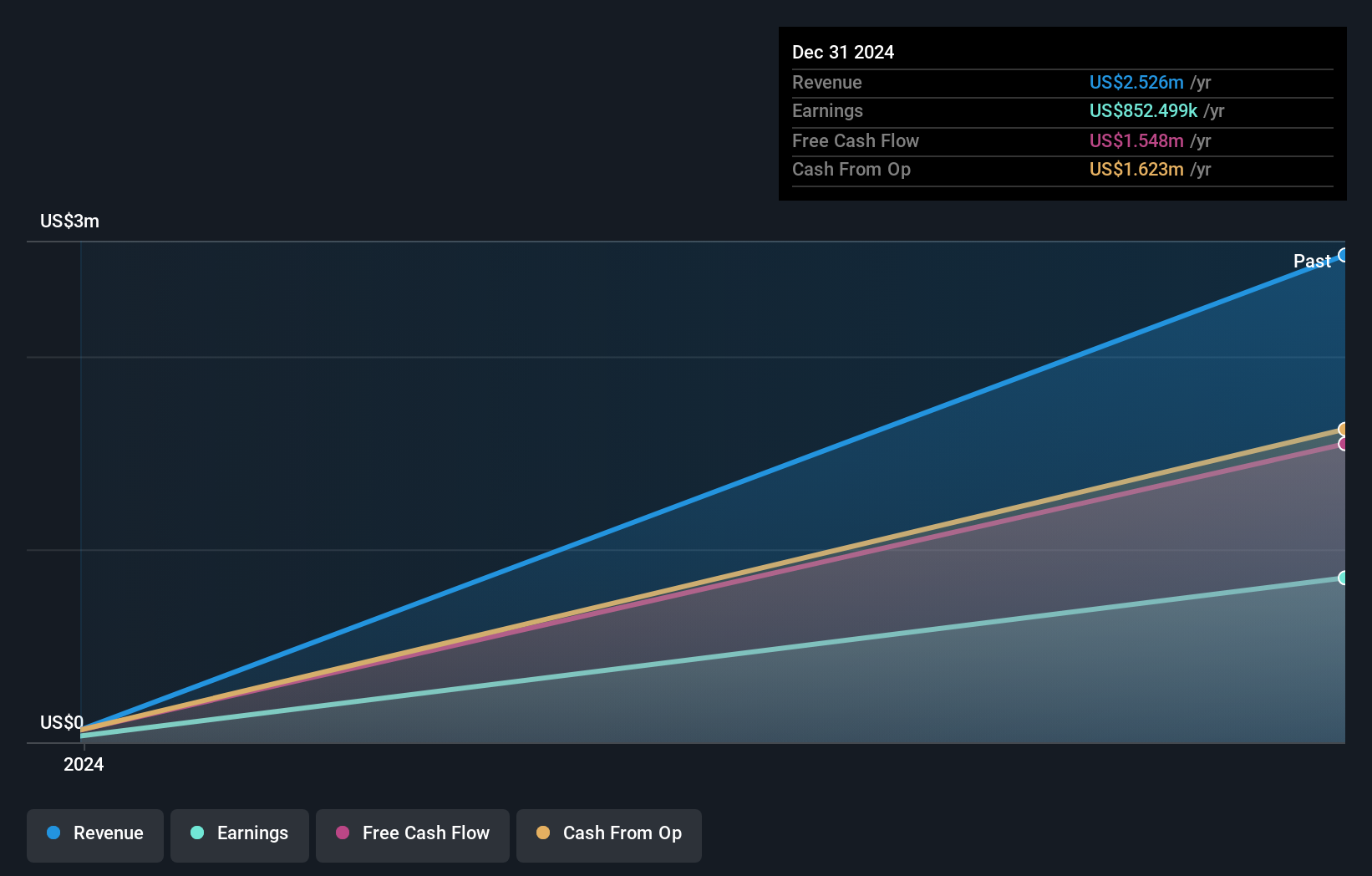

Operations: Etoiles Capital Group generates revenue primarily from its advertising segment, which contributed $2.53 million.

Etoiles Capital Group, a small player in the financial sector, has experienced significant earnings growth of 2507% over the past year, outpacing the media industry’s 16%. Despite this impressive growth, its net profit margin has dropped from 51.2% to 33.8%, indicating some profitability challenges. The company is trading at a substantial discount of 51% below its estimated fair value and remains debt-free for five years. Recent activities include completing an IPO raising US$5.6 million and filing a shelf registration for US$29.88 million, suggesting strategic moves to bolster financial flexibility and market presence.

EFTY Earnings and Revenue Growth as at Sep 2025

EFTY Earnings and Revenue Growth as at Sep 2025

Simply Wall St Value Rating: ★★★★★☆

Overview: Hang Feng Technology Innovation Co., Ltd. operates in the technology sector with a focus on management consulting services and has a market capitalization of $309.21 million.

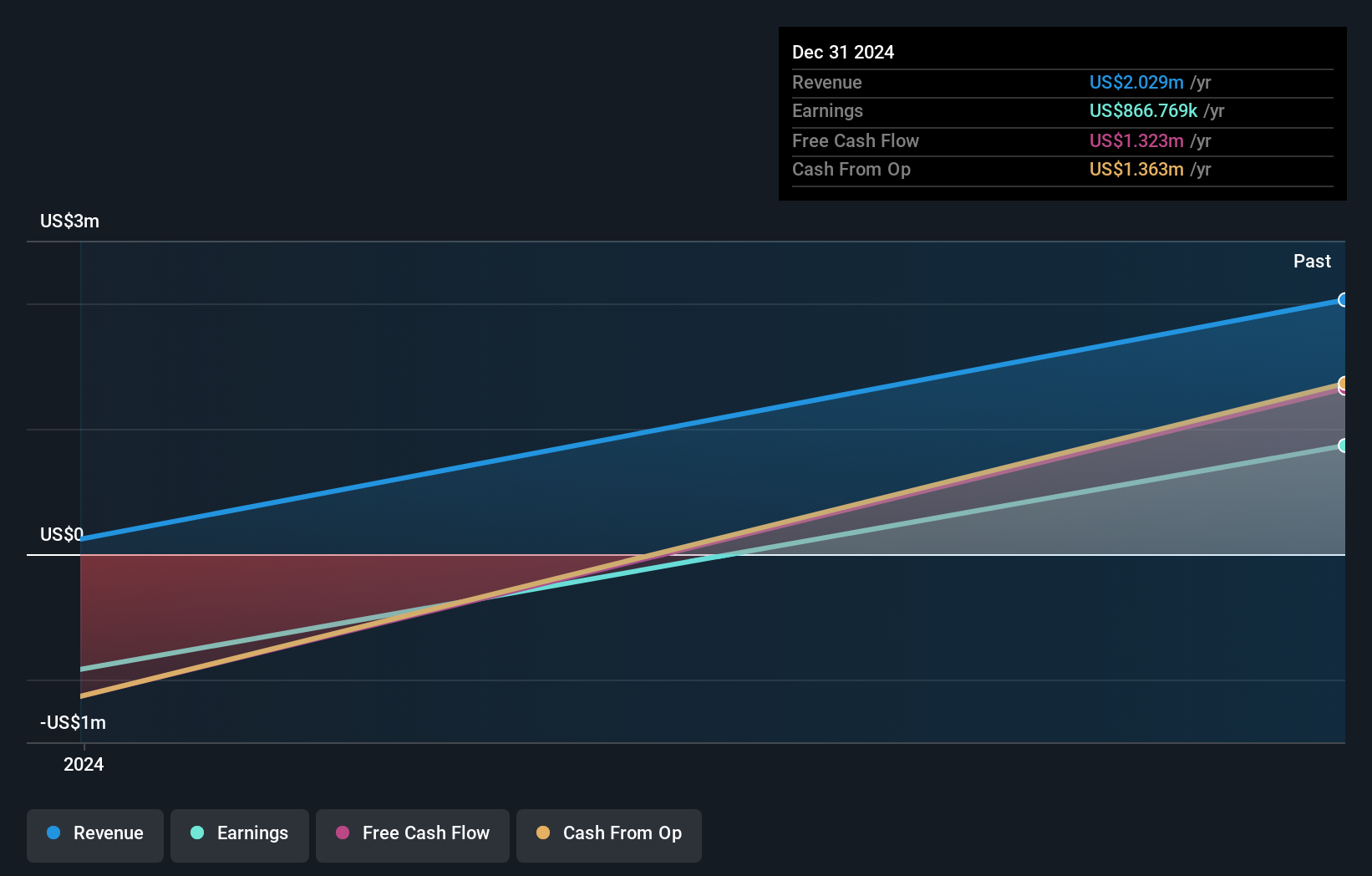

Operations: FOFO generates revenue primarily from management consulting services, amounting to $2.03 million.

Hang Feng Technology Innovation, a small player in the tech space, recently completed a $5.5 million IPO, offering 1.38 million shares at $4 each with a slight discount of $0.32 per share. It was added to the NASDAQ Composite Index earlier this month, marking its growing presence despite having only $2 million in revenue and highly illiquid shares. The company has become profitable this year and trades at 46% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in the tech sector. Its cash position exceeds total debt, indicating robust financial health amidst limited revenue growth.

FOFO Earnings and Revenue Growth as at Sep 2025

FOFO Earnings and Revenue Growth as at Sep 2025

Simply Wall St Value Rating: ★★★★★★

Overview: Radiant Logistics, Inc. is a third-party logistics company offering technology-enabled global transportation and value-added logistics services across the United States and Canada, with a market cap of $280.45 million.

Operations: Radiant Logistics generates revenue primarily from its transportation segment, specifically air freight services, amounting to $902.70 million.

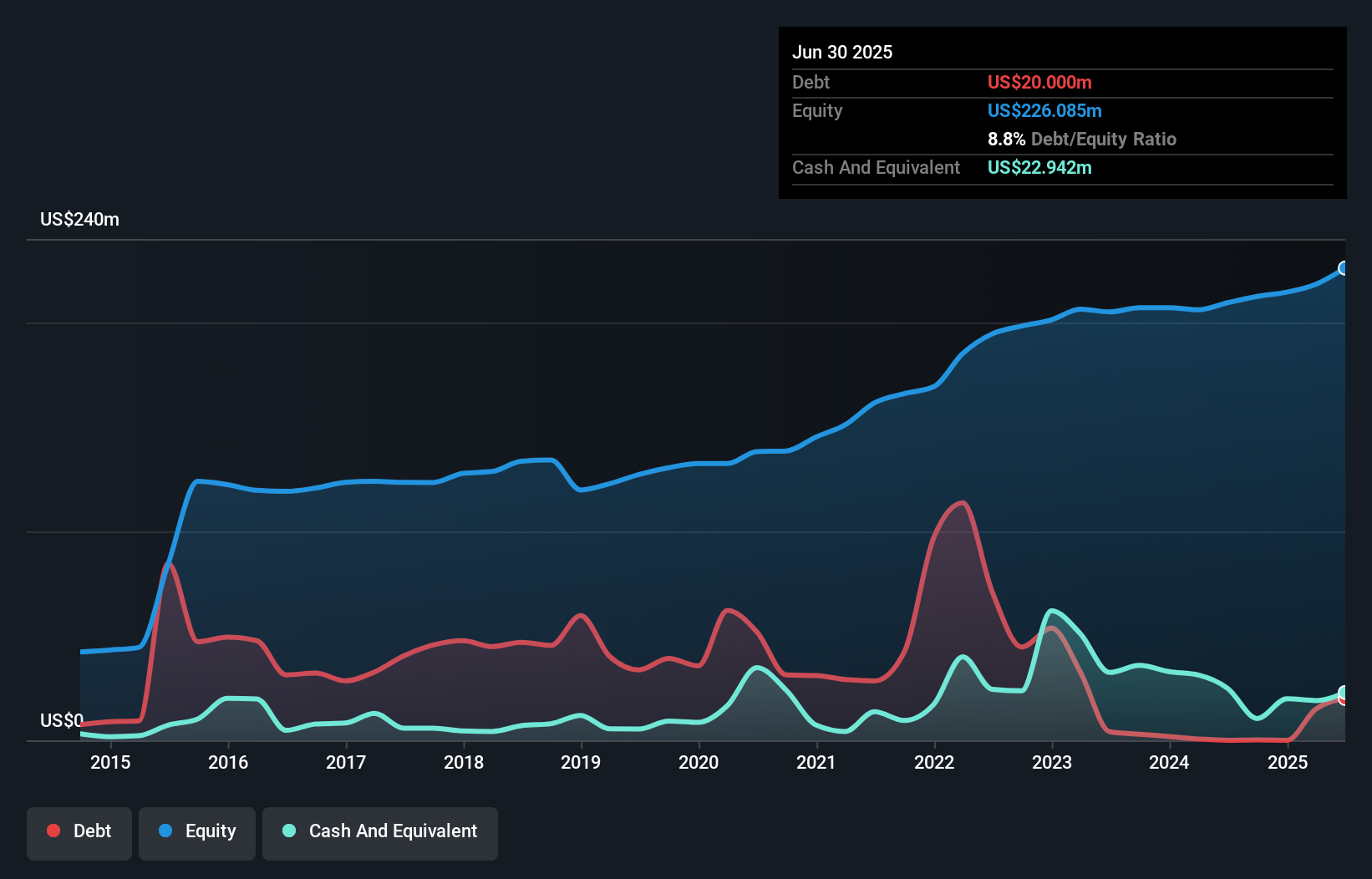

Radiant Logistics, a nimble player in the logistics sector, has shown robust financial health with its debt to equity ratio dropping from 37.6% to 8.8% over five years. The company reported annual sales of US$902.7 million, up from US$802.47 million the previous year, while net income surged to US$17.29 million from US$7.69 million, reflecting its high-quality earnings and effective cost management strategies. Notably trading at a significant discount of 52.8% below estimated fair value, Radiant’s strategic acquisitions and efficient capital allocation position it well for future growth despite industry challenges like tariffs and competitive pricing pressures.

RLGT Debt to Equity as at Sep 2025Key TakeawaysSearching for a Fresh Perspective?

RLGT Debt to Equity as at Sep 2025Key TakeawaysSearching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Etoiles Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com