Report Overview

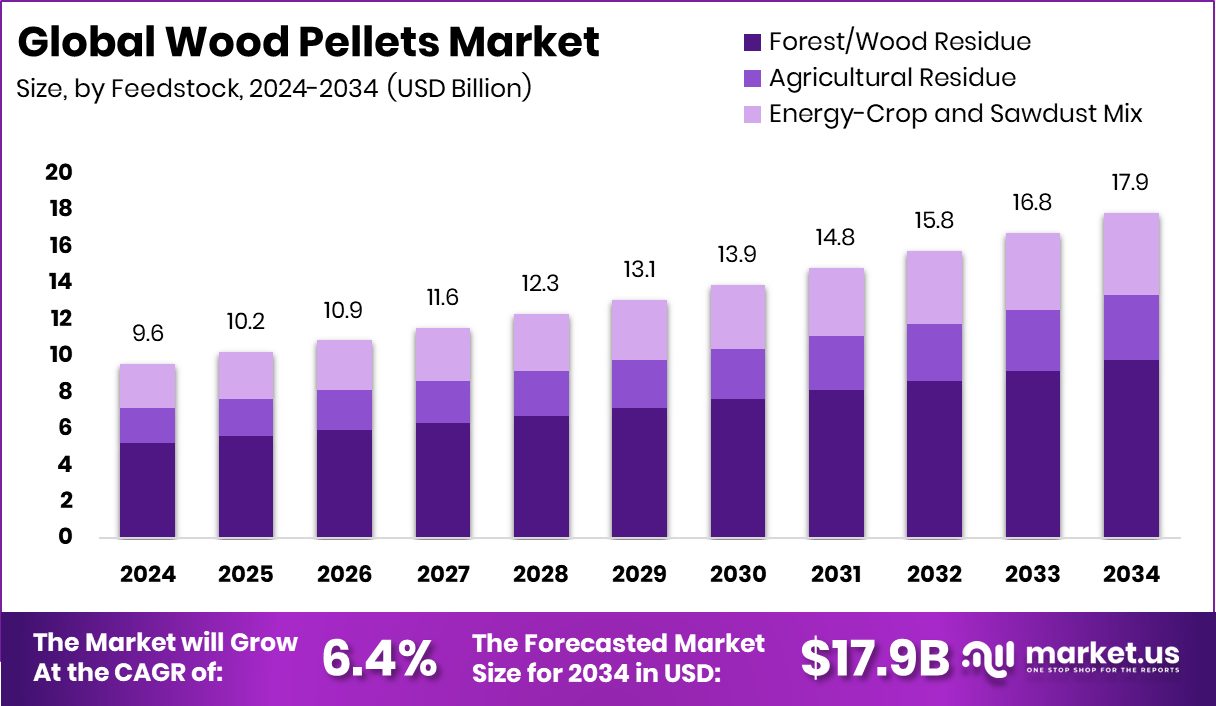

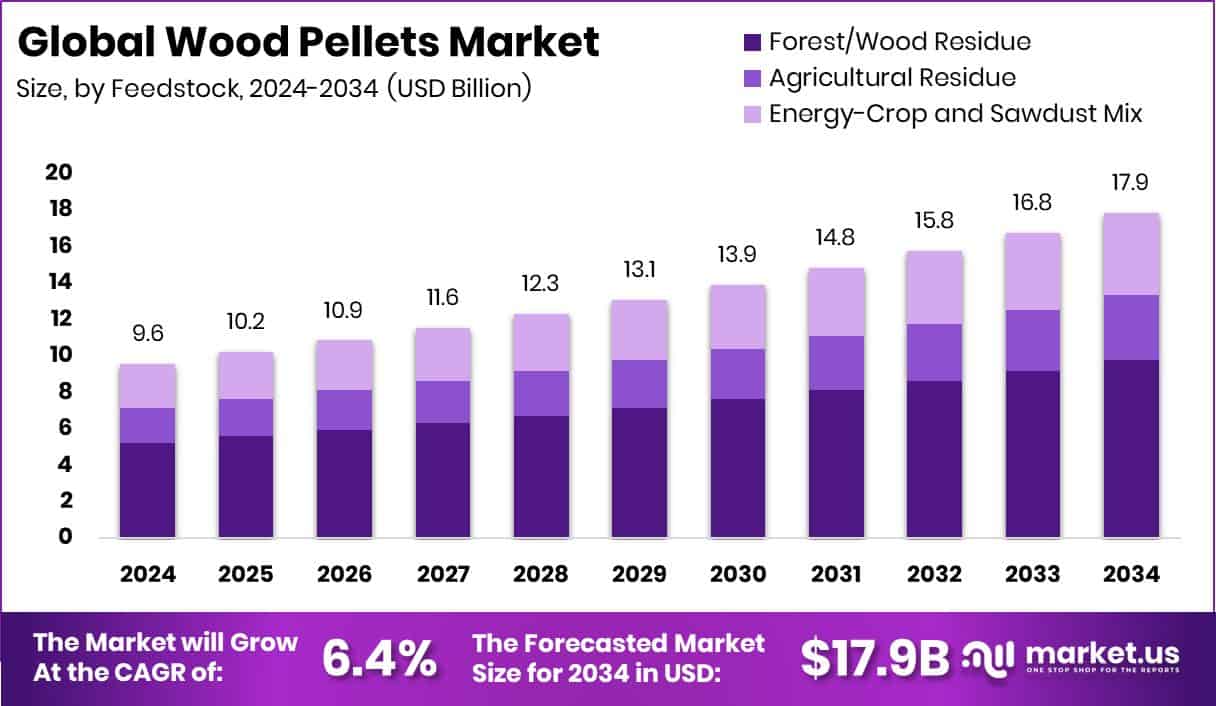

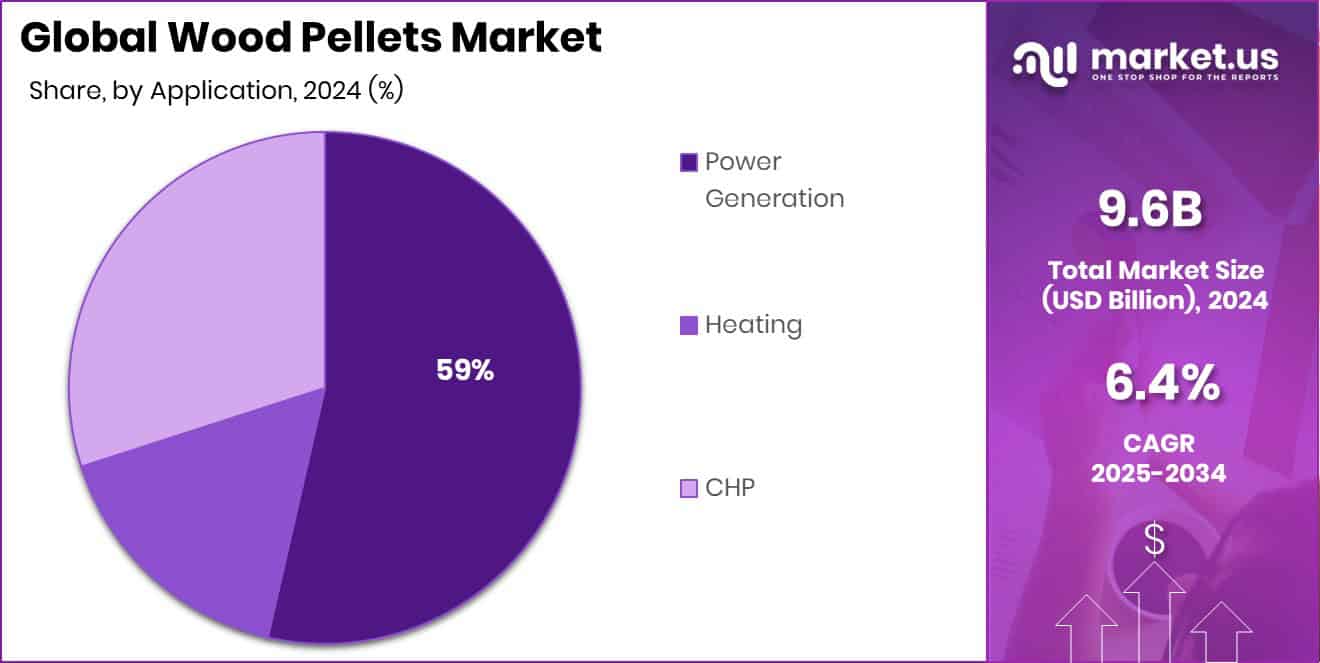

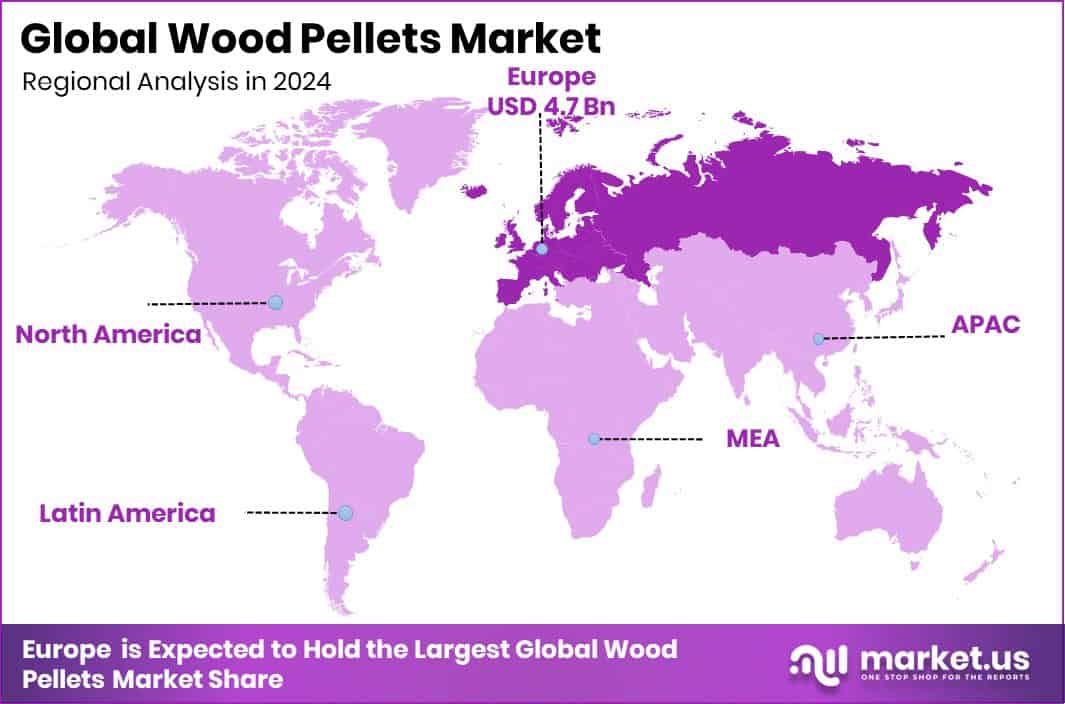

The Global Wood Pellets Market is expected to be worth around USD 17.9 billion by 2034, up from USD 9.6 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Europe’s USD 4.7 billion leadership reflects its commitment to sustainable energy and biomass-based heating solutions.

Wood pellets are small, cylindrical biofuels made from compressed sawdust, wood shavings, and other forestry by-products. They are widely used as an alternative energy source because they burn cleanly and are considered carbon-neutral when sourced sustainably. Their uniform size and high energy density make them easy to transport, store, and use in heating systems, industrial boilers, and power generation plants.

The wood pellets market is gaining momentum as nations transition toward cleaner energy options to reduce reliance on coal and fossil fuels. Demand is driven by policies supporting renewable energy and the increasing focus on sustainable heating and electricity generation. For example, state-backed programs and large-scale energy funds, such as Texas’s $7.2 billion loan program for gas power plants and Poland’s $14.7 billion approval for its first nuclear plant, are shaping the broader energy mix, creating space for wood pellets to complement other renewables.

One major growth factor is rising government support for renewable energy infrastructure. For instance, India recently approved Rs 5,400 crore in viability gap funding for 30 GWh battery storage projects, highlighting global interest in clean energy ecosystems. Such initiatives indirectly boost the wood pellet sector by encouraging alternative, sustainable fuels.

Demand for wood pellets is also increasing as industries and households seek affordable and reliable alternatives to coal and heating oil. In regions like Texas, where a $562 million energy fund loan was approved for new power projects near Baytown, the urgency to balance conventional and renewable sources highlights opportunities for wood pellet integration in energy supply.

The market holds strong opportunities through global climate-driven initiatives. The creation of funds such as the US$500 million DRE Nigeria Fund and Nuveen’s $1.3 billion sustainable infrastructure credit fund shows capital flowing into greener energy pathways. Although the U.S. canceled $13 billion in green energy funds, ongoing global commitments ensure that biomass solutions like wood pellets remain part of a diversified, low-carbon future.

Key Takeaways

The Global Wood Pellets Market is expected to be worth around USD 17.9 billion by 2034, up from USD 9.6 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

The Wood Pellets Market relies heavily on forest and wood residues, accounting for 54.8% feedstock.

Utility-grade white pellets dominate the Wood Pellets Market, holding a significant 48.4% market share.

Power generation drives the Wood Pellets Market, representing 59.9% of total application consumption globally.

Industrial usage leads the Wood Pellets Market, contributing 67.3% of overall end-use demand worldwide.

The European market value reached USD 4.7 billion, showing strong renewable adoption.

By Feedstock Analysis

Wood Pellets Market relies heavily on forest and wood residue, contributing 54.8%.

In 2024, Forest/Wood Residue held a dominant market position in the By Feedstock segment of the Wood Pellets Market, with a 54.8% share. This leadership highlights the significant role of forestry by-products such as sawdust, shavings, and logging residues in pellet production. The availability of these raw materials at scale, coupled with their cost-effectiveness and consistent quality, has strengthened their use as the preferred feedstock.

Growing emphasis on sustainable resource utilization further supports this trend, as wood residues reduce waste while contributing to the renewable energy supply. The strong reliance on forest and wood residues underlines their importance in maintaining the balance between energy security, affordability, and environmental responsibility within the wood pellet industry.

By Grade Analysis

Utility-grade white pellets dominate the Wood Pellets Market, holding a 48.4% share.

In 2024, Utility-Grade (White) held a dominant market position in the By Grade segment of the Wood Pellets Market, with a 48.4% share. This dominance reflects the widespread use of white pellets in large-scale power generation due to their uniform composition, lower ash content, and efficient combustion properties.

Utility-grade pellets are particularly suited for co-firing in power plants, offering a reliable and consistent alternative to coal while supporting renewable energy targets. Their cost-effectiveness and ease of handling in bulk volumes have further cemented their position as the preferred choice in industrial energy applications. The strong market share of utility-grade pellets highlights their critical role in global energy transition strategies.

By Application Analysis

Power generation drives the Wood Pellets Market growth, accounting for 59.9% of consumption.

In 2024, Power Generation held a dominant market position in the By Application segment of the Wood Pellets Market, with a 59.9% share. This strong presence underscores the growing adoption of wood pellets as a reliable renewable fuel in utility-scale energy production.

Power plants increasingly favor pellets for their high energy density, standardized quality, and compatibility with existing coal-fired infrastructure, enabling a smoother transition toward cleaner energy sources. The use of wood pellets in power generation also aligns with global policies aimed at reducing carbon emissions and diversifying the energy mix. Their significant share highlights the critical role of biomass in meeting rising electricity demand while advancing sustainability goals.

By End-use Analysis

Industrial end-use leads the Wood Pellets Market demand, capturing 67.3% global share.

In 2024, Industrial held a dominant market position in the end-use segment of the Wood Pellets Market, with a 67.3% share. This dominance reflects the extensive utilization of wood pellets in large-scale industrial operations, particularly for energy generation and heat supply.

Industries prefer wood pellets for their consistent quality, high calorific value, and ability to reduce reliance on conventional fossil fuels. Their bulk handling efficiency and suitability for continuous operations make them an ideal choice for industrial applications. The substantial market share highlights the importance of industrial demand in driving the overall growth of the wood pellets market, reinforcing their role as a dependable renewable energy source in industrial energy strategies.

Key Market Segments

By Feedstock

Forest/Wood Residue

Agricultural Residue

Energy-Crop and Sawdust Mix

By Grade

Utility-Grade (White)

Premium-Grade

Standard-Grade

Torrefied Black Pellets

By Application

Power Generation

Heating

CHP

By End-use

Industrial

Residential

Commercial

Driving Factors

Rising Global Shift Toward Cleaner Energy Alternatives

One of the main driving factors for the wood pellets market is the growing shift from coal and oil toward cleaner and renewable energy sources. Governments and industries are pushing for energy options that cut carbon emissions while keeping power reliable and affordable. Wood pellets fit into this demand as they are renewable, cost-effective, and can be used in existing power plants with minimal changes. This move is reinforced by heavy global energy investments.

For instance, ACWA Power finalized $3.4 billion in financing for two gas-fired plants in Saudi Arabia, and Fervo Energy secured $206 million to build a large geothermal power plant. Such large-scale clean energy investments indirectly support the adoption of biomass solutions like wood pellets.

Restraining Factors

High Reliance on Conventional Power Plant Investments

A key restraining factor for the wood pellets market is the continued reliance on conventional energy sources, especially natural gas. While wood pellets are promoted as a clean and renewable alternative, heavy funding and policy backing often go toward fossil fuel-based plants, which slows the shift to biomass solutions.

For example, NRG Energy recently brought a new gas power plant to Houston with a $216 million loan from the Texas Energy Fund. Such investments make it harder for renewable options like wood pellets to compete on cost and scale. This reliance on conventional power generation creates challenges for wider adoption of biomass, delaying the market’s potential to contribute more strongly to clean energy transitions.

Growth Opportunity

Expanding Role in Hybrid Renewable Energy Projects

A major growth opportunity for the wood pellets market lies in their integration within hybrid renewable energy projects. As countries focus on building diverse and resilient energy systems, combining solar, battery storage, gas, and biomass offers a balanced approach to ensure both reliability and sustainability. Wood pellets can serve as a steady backup fuel to complement intermittent solar or wind, making them attractive for large-scale energy mixes.

Recent funding highlights this shift—Texas finalized $1.8 billion to build solar, battery, and gas-powered microgrids, while Zambia received $8 million from the African Development Bank’s Sustainable Energy Fund for Africa to develop a 25 MW solar plant. Such initiatives open pathways for wood pellets to play a stronger supporting role.

Latest Trends

Growing Interest in Pairing Biomass with Geothermal Energy

One of the latest trends in the wood pellets market is the growing interest in pairing biomass with geothermal power to create more stable, carbon-free energy systems. While wood pellets provide a reliable fuel source, geothermal plants deliver continuous clean power, and together they can balance energy demand more effectively. This trend is gaining attention as new investments flow into geothermal energy.

For example, Fervo Energy secured $255 million to deploy carbon-free geothermal power, while Dominica received $34 million in financing for a 10-MW geothermal power project. These developments show how renewable energy sectors are aligning, creating opportunities for wood pellets to be integrated into innovative, mixed renewable strategies.

Regional Analysis

In 2024, Europe dominated the Wood Pellets Market with a 49.90% share.

The Wood Pellets Market shows varied regional dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, reflecting differences in energy policy, renewable adoption, and biomass availability.

In 2024, Europe emerged as the dominant region, accounting for 49.90% of the market share with a value of USD 4.7 billion. This strong position is supported by the region’s long-standing focus on renewable energy integration, widespread use of biomass heating systems, and stringent carbon reduction targets.

North America follows with steady growth driven by increasing demand for sustainable heating fuels and renewable power generation initiatives. Asia Pacific is witnessing rising adoption, supported by expanding energy demand and government focus on diversifying fuel sources to reduce reliance on coal.

Meanwhile, markets in the Middle East & Africa and Latin America are still at a developing stage but show potential as countries explore cost-effective renewable solutions to enhance energy security.

Overall, Europe continues to lead the global market, setting benchmarks for sustainable practices and large-scale biomass deployment, while other regions are gradually strengthening their positions through renewable energy programs and supportive policies that encourage biomass utilization.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Drax Group Plc has positioned itself as a leading utility player that integrates biomass power generation into large-scale electricity systems. By converting coal-fired units to run on wood pellets, the company demonstrates how legacy infrastructure can be repurposed for sustainable energy, reflecting a wider industry shift toward carbon neutrality.

Enviva LP, recognized for its extensive pellet production capacity, continues to strengthen the supply chain by sourcing residues and forestry by-products for pellet manufacturing. Its approach ensures consistency in global supply while maintaining sustainability standards, making it a key player in bridging the gap between raw material availability and growing international demand. The company’s role in long-term supply agreements also adds stability to the market.

ANDRITZ plays a different yet equally crucial role by providing technology and equipment for pellet production. Its expertise in designing efficient pellet mills and processing systems supports scalability, enabling producers to meet rising demand with optimized operations. This technical contribution ensures the industry maintains quality and efficiency as production expands.

Top Key Players in the Market

Drax Group Plc

Enviva LP

ANDRITZ

The Westervelt Company, Inc.

Energex

Wood Pellet Energy (UK) Ltd.

United Company

Groupe Savoie Inc.

Vermont Wood Pellet Co.

Premium Pellet Ltd.

Recent Developments

In September 2024, Drax announced plans to potentially invest up to USD 12.5 billion in biomass power plants with carbon capture (BECCS) in the U.S., via its new “Elimini” business arm.

In March 2024, ANDRITZ secured an order to supply a pressurized refining system to Lignatherm AG’s new insulation board plant in Switzerland, supporting wood-based product manufacturing.

Report Scope