Report Overview

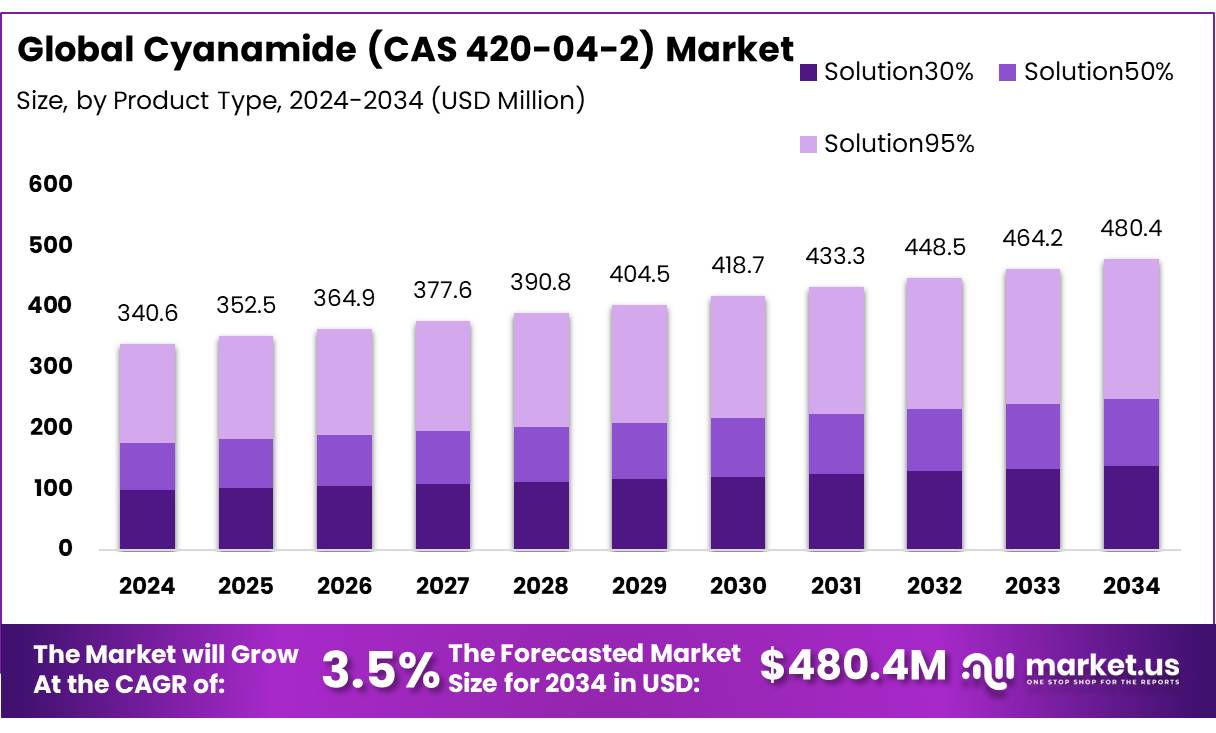

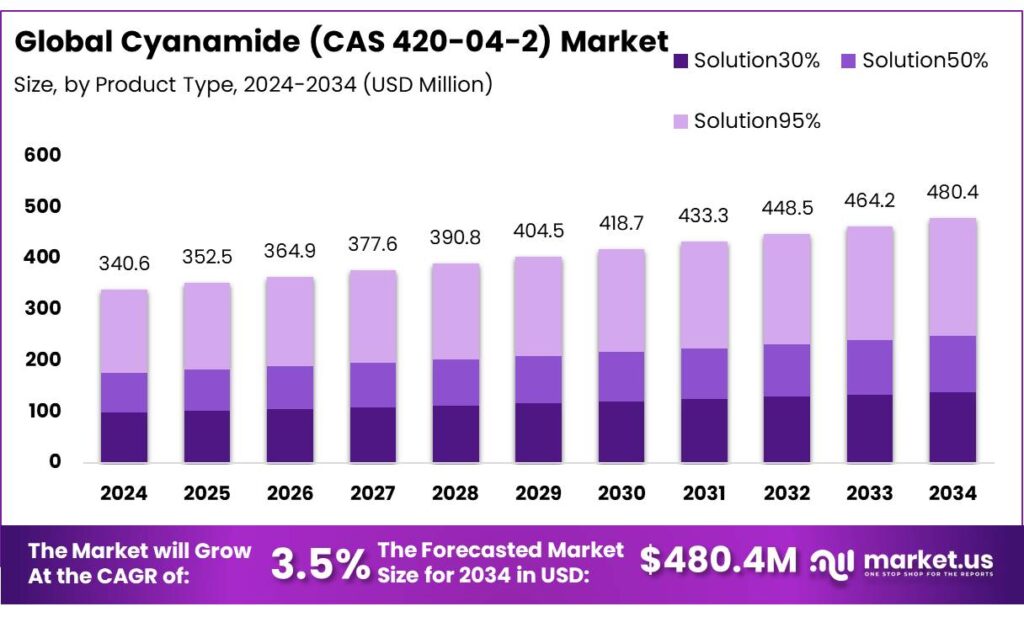

The Global Cyanamide (CAS 420-04-2) Market size is expected to be worth around USD 480.4 Million by 2034, from USD 340.6 Million in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

Cyanamide (CAS 420-04-2) is an organic intermediate (formula H₂NCN) that is principally manufactured for use as a chemical building block in agrochemicals, pharmaceuticals, and specialty chemical synthesis; it is also formulated as the plant-growth regulator product “Dormex” (50% hydrogen cyanamide) for dormancy breaking in deciduous fruit crops.

The compound is produced industrially by hydrolysis of calcium cyanamide, and the material is valued for its bifunctional reactivity that enables formation of guanidines, dicyandiamide and multiple heterocycles used in downstream active ingredients and additives. This functional role has been documented in chemical reference sources and substance databases.

The industrial scenario of cyanamide is characterized by a concentrated production base, with significant manufacturing capacities in countries like China. For instance, Rugao Zhongru Chemical Co., Ltd. in Jiangsu Province, China, has an annual production capacity of 15,000 tons of hydrogen cyanamide solutions, primarily in 30%, 50%, and 95% concentrations. This concentration in production underscores the importance of cyanamide in global supply chains.

In India, the demand for cyanamide is supported by its applications in agriculture and the chemical industry. Recent import data indicates significant quantities of cyanamide entering the country, with shipments from Germany and China.

For instance, in January 2024, a shipment of 16,000 kg of hydrogen cyanamide 50% solution was imported from Germany, valued at approximately USD 47,904. Such imports highlight the ongoing demand for cyanamide in the Indian market.

Government initiatives play a crucial role in shaping the industrial landscape for cyanamide. For example, Heranba Industries Limited, located in Gujarat, India, has proposed a project to manufacture specialty chemicals and pesticide intermediates, including cyanamide, with a proposed production capacity of 3,200 metric tons per month. The estimated cost of this project is INR 250 crore, reflecting a significant investment in expanding domestic production capabilities

Key Takeaways

Cyanamide (CAS 420-04-2) Market size is expected to be worth around USD 480.4 Million by 2034, from USD 340.6 Million in 2024, growing at a CAGR of 3.5%.

Solution95% held a dominant market position, capturing more than a 43.9% share of the global cyanamide market.

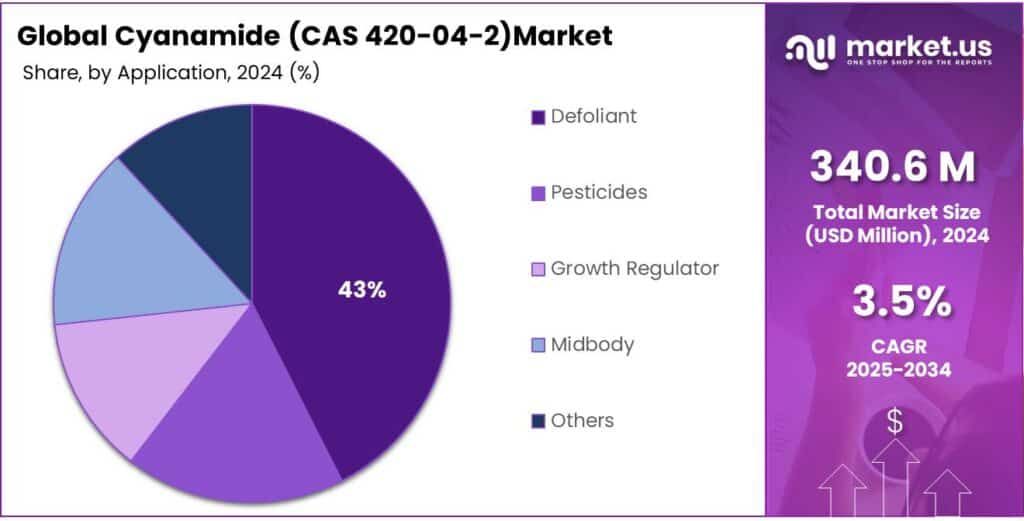

Defoliant held a dominant market position, capturing more than a 34.7% share of the global cyanamide market.

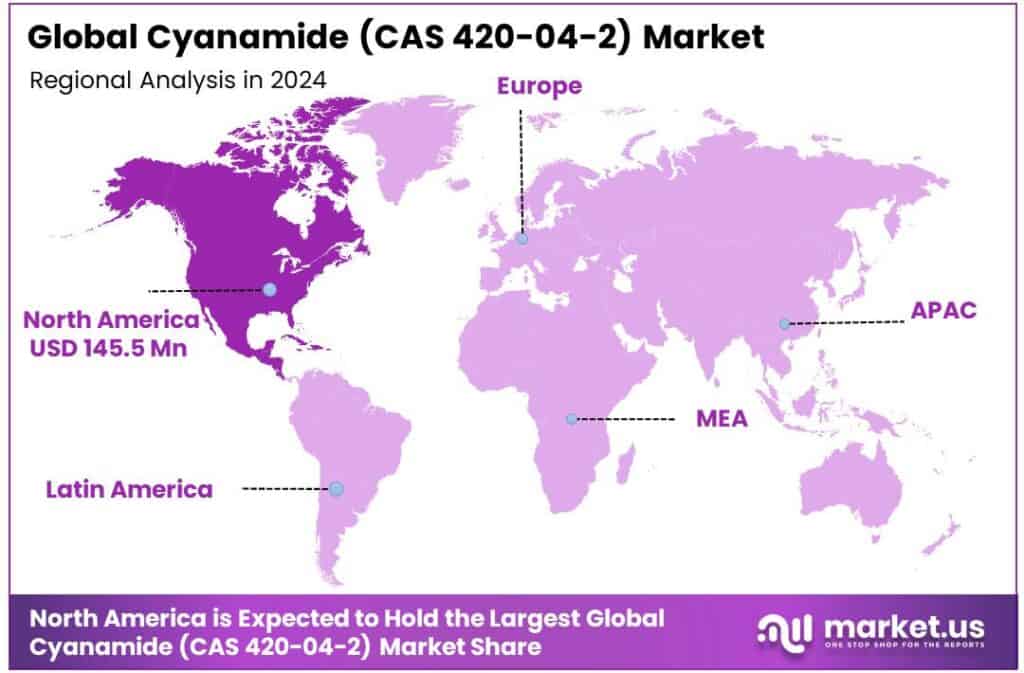

North America held a dominant position in the global cyanamide market, capturing more than 42.8% of the market share, equivalent to approximately USD 145.5 million.

By Product Type Analysis

Solution95% dominates with 43.9% share in 2024 due to widespread usage in agriculture and chemical applications

In 2024, Solution95% held a dominant market position, capturing more than a 43.9% share of the global cyanamide market. This form is highly preferred in agricultural applications as a plant growth regulator and defoliant, owing to its ease of application and consistent performance. Its adoption has been particularly strong in fruit cultivation, where uniform sprayability and precise dosage are critical for crop yield optimization.

The solution form also finds significant use as an intermediate in chemical synthesis for pharmaceuticals and agrochemicals, contributing to its substantial market presence. In 2025, demand for Solution95% is expected to maintain steady growth, supported by the ongoing need for efficient agricultural practices and chemical manufacturing processes, while regulatory frameworks continue to ensure safe and controlled usage in various industries.

By Application Analysis

Defoliant leads with 34.7% share in 2024 driven by increased agricultural efficiency needs

In 2024, Defoliant held a dominant market position, capturing more than a 34.7% share of the global cyanamide market. Its widespread use in agriculture, particularly in cotton and fruit crops, has been a key driver of this market share, as it facilitates efficient leaf removal, improves harvesting efficiency, and enhances crop quality.

The formulation allows for uniform application, ensuring consistent performance across large cultivation areas. In 2025, the demand for cyanamide as a defoliant is expected to remain strong, supported by growing agricultural productivity requirements and the ongoing adoption of mechanized harvesting practices. This segment continues to benefit from stable regulatory approvals and increased awareness of safe chemical usage practices in farming.

Key Market Segments

By Product Type

Solution30%

Solution50%

Solution95%

By Application

Defoliant

Pesticides

Growth Regulator

Midbody

Others

Emerging Trends

Adoption of Hydrogen Cyanamide in Sustainable Agriculture

Hydrogen cyanamide (CAS 420-04-2), a plant growth regulator, is witnessing a notable shift towards its use in sustainable agricultural practices. This trend is driven by the increasing demand for eco-friendly farming solutions that enhance productivity while minimizing environmental impact.

In New Zealand, hydrogen cyanamide plays a crucial role in kiwifruit production, particularly in regions with milder frosts due to climate change. The Environmental Protection Authority (EPA) has recognized its importance in ensuring consistent bud break and flowering, which are vital for high-quality yields. However, the EPA has also emphasized the need for stringent regulations to mitigate potential health and environmental risks associated with its use. This includes reassessing its approval and considering alternative substances with lower risk profiles.

Similarly, in the United States, the Environmental Protection Agency (EPA) has acknowledged the agricultural significance of hydrogen cyanamide. The EPA’s Pesticide Data Program indicates that hydrogen cyanamide is applied to various deciduous crops to promote uniform bud break, thereby enhancing yield predictability and quality. However, the EPA has also noted that the use of hydrogen cyanamide poses risks to human health, particularly to workers applying the substance, and to the environment. These risks have led to regulatory scrutiny and calls for reevaluation of its use in agriculture.

In response to these concerns, there is a growing emphasis on developing and adopting alternative substances and methods that can achieve similar agronomic benefits with reduced health and environmental risks. This includes the exploration of plant-based growth regulators and the application of precision agriculture techniques to minimize chemical usage. Such innovations align with the broader trend towards sustainable agriculture, aiming to balance productivity with environmental stewardship.

Drivers

Agricultural Demand for Uniform Bud Break in Deciduous Fruits

Cyanamide (CAS 420-04-2), commonly known as hydrogen cyanamide, plays a pivotal role in modern agriculture, particularly in enhancing the productivity of deciduous fruit crops. Its primary function is as a bud-breaker, facilitating uniform bud dormancy release, which is crucial for synchronized flowering and fruit maturation. This application is especially significant in regions with variable climatic conditions, where consistent harvests are essential for economic stability.

In New Zealand, for instance, the kiwifruit industry heavily relies on cyanamide-based products like Hi-Cane. According to the New Zealand Kiwifruit Growers Incorporated (NZKGI), Hi-Cane has been instrumental in achieving uniform bud break, leading to consistent flowering and fruiting cycles. This consistency is vital for meeting export demands and maintaining the industry’s global competitiveness.

Similarly, in the United States, the Environmental Protection Agency (EPA) has recognized the agricultural significance of hydrogen cyanamide. The EPA’s Pesticide Data Program indicates that hydrogen cyanamide is applied to various deciduous crops to promote uniform bud break, thereby enhancing yield predictability and quality.

The consistent application of cyanamide in these agricultural sectors underscores its importance in modern farming practices. Its role in ensuring uniformity in bud break directly correlates with improved crop yields and quality, which are essential for both domestic consumption and international trade.

Restraints

Restriction Due to Health and Environmental Concerns

Hydrogen cyanamide (CAS 420-04-2), commonly used as a plant growth regulator, faces significant restrictions globally due to its adverse health and environmental impacts. These concerns have led to regulatory actions that limit its use in agriculture.

In the European Union, hydrogen cyanamide has been banned since 2008. The European Chemicals Agency (ECHA) classified it as a substance of very high concern due to its potential to cause cancer and reproductive toxicity. Consequently, it was removed from the list of approved active substances for plant protection products under Regulation (EC) No 1107/2009. This ban reflects the EU’s commitment to protecting human health and the environment from hazardous chemicals.

Similarly, in the United States, the Environmental Protection Agency (EPA) has expressed concerns about the safety of hydrogen cyanamide. The EPA’s Pesticide Data Program indicates that hydrogen cyanamide is applied to various deciduous crops to promote uniform bud break, thereby enhancing yield predictability and quality. However, the EPA has also noted that the use of hydrogen cyanamide poses risks to human health, particularly to workers applying the substance, and to the environment. These risks have led to regulatory scrutiny and calls for reevaluation of its use in agriculture.

In New Zealand, hydrogen cyanamide is used in kiwifruit orchards to enhance bud break. However, the Environmental Protection Authority (EPA) has found that the risks associated with its use are above acceptable levels. As a result, the EPA has implemented strict regulations, including limiting applications to trained professionals, restricting application methods, and establishing buffer zones to protect bystanders and the environment. These measures aim to mitigate the adverse effects while allowing continued use under controlled conditions.

Opportunity

Expansion in Sustainable Agriculture Practices

Hydrogen cyanamide (CAS 420-04-2) is gaining traction in the agricultural sector, particularly in sustainable farming practices. Its role as a plant growth regulator, especially in breaking bud dormancy for deciduous fruits, aligns with the industry’s shift towards more eco-friendly and efficient agricultural solutions.

In the United States, the U.S. Department of Agriculture (USDA) has initiated the “Partnerships for Climate-Smart Commodities” program, investing over $3 billion in approximately 140 pilot projects. These projects aim to support sustainable farming practices, including the use of plant growth regulators like hydrogen cyanamide, to enhance productivity while reducing environmental impact. This initiative underscores the government’s commitment to promoting sustainable agriculture and presents a significant opportunity for the adoption of hydrogen cyanamide in climate-smart farming practices.

Similarly, in Europe, the hydrogen cyanamide market within the food and agriculture sector is projected to reach USD 750 million by 2031, expanding at a compound annual growth rate (CAGR) of 6%. This growth is driven by the increasing adoption of sustainable agricultural practices and the need for efficient crop management solutions. Hydrogen cyanamide’s ability to promote uniform bud break and flowering in fruit crops makes it a valuable tool in achieving consistent and high-quality yields, aligning with the industry’s sustainability goals.

These developments highlight the significant growth opportunities for hydrogen cyanamide in the context of sustainable agriculture. As the demand for eco-friendly farming solutions continues to rise, hydrogen cyanamide’s role in enhancing crop productivity and quality positions it as a key component in the future of sustainable agriculture.

Regional Insights

North America leads with 42.8% share in 2024, valued at USD 145.5 million, driven by robust agricultural and industrial applications

In 2024, North America held a dominant position in the global cyanamide market, capturing more than 42.8% of the market share, equivalent to approximately USD 145.5 million. This substantial share is primarily attributed to the region’s advanced agricultural practices and significant industrial demand. The United States, in particular, is a major consumer, with extensive use of cyanamide in both agriculture and industry.

The agricultural sector utilizes cyanamide as a plant growth regulator and defoliant, enhancing crop yields and facilitating efficient harvesting processes. Additionally, cyanamide serves as a vital intermediate in the production of various chemicals, including pharmaceuticals and agrochemicals, further bolstering its demand.

The industrial sector’s consumption of cyanamide is also noteworthy, with applications in the production of specialty chemicals and as a precursor in the synthesis of other compounds. This diverse range of applications underscores the critical role of cyanamide in North America’s chemical industry.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

AlzChem AG is a leading German specialty chemicals company and the sole Western producer of cyanamide (CAS 420-04-2). The company is fully integrated, managing all production stages—from raw materials to the final product—at its facilities in Germany. This integration ensures high-quality standards and consistent supply. AlzChem’s cyanamide is primarily used in agriculture as a plant growth regulator and in the synthesis of pharmaceuticals and agrochemicals. The company’s commitment to quality is reflected in its ISO-certified production sites.

Nippon Carbide Industries Co., Inc. (NCI) is a Japanese company engaged in the manufacture and sales of chemicals, plastics, resins, and electronic materials. NCI produces calcium cyanamide, a compound used as a fertilizer and agricultural chemical. The company has been manufacturing calcium cyanamide since 1936 and began sales as an agricultural chemical in 1957. Calcium cyanamide is known for its ability to release nitrogen slowly, providing a steady supply of nutrients to plants.

Richman Chemical Inc. is a U.S.-based company specializing in custom synthesis and toll manufacturing services. The company offers cyanamide as part of its product portfolio, serving industries such as pharmaceuticals, agrochemicals, and specialty chemicals. Richman Chemical provides tailored solutions to meet specific client needs, leveraging its expertise in chemical manufacturing and commitment to quality.

Top Key Players Outlook

AlzChem AG

Evonik

Nippon Carbide Industries (NCI)

Richman Chemical

Rugao Zhongru Taixing Youlian

Atamanchemicals

Sunshinefine

Recent Industry Developments

In 2024 AlzChem Group AG, reported group sales of €554.2 million and EBITDA of €105.3 million, reflecting a 29.4% increase from the previous year.

In 2024, Evonik continued its commitment to innovation and sustainability. The company reported a revenue of €15.3 billion and an EBITDA of €1.0 billion, reflecting a stable performance in its specialty chemicals segment.

Report Scope