Report Overview

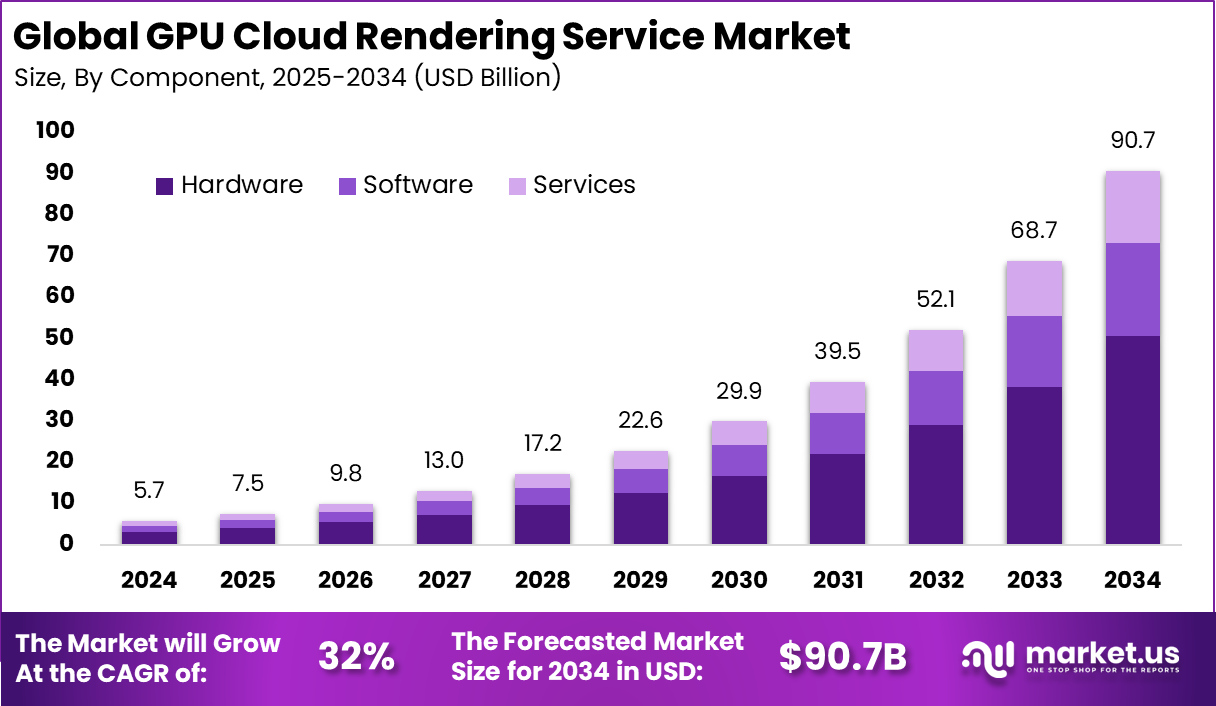

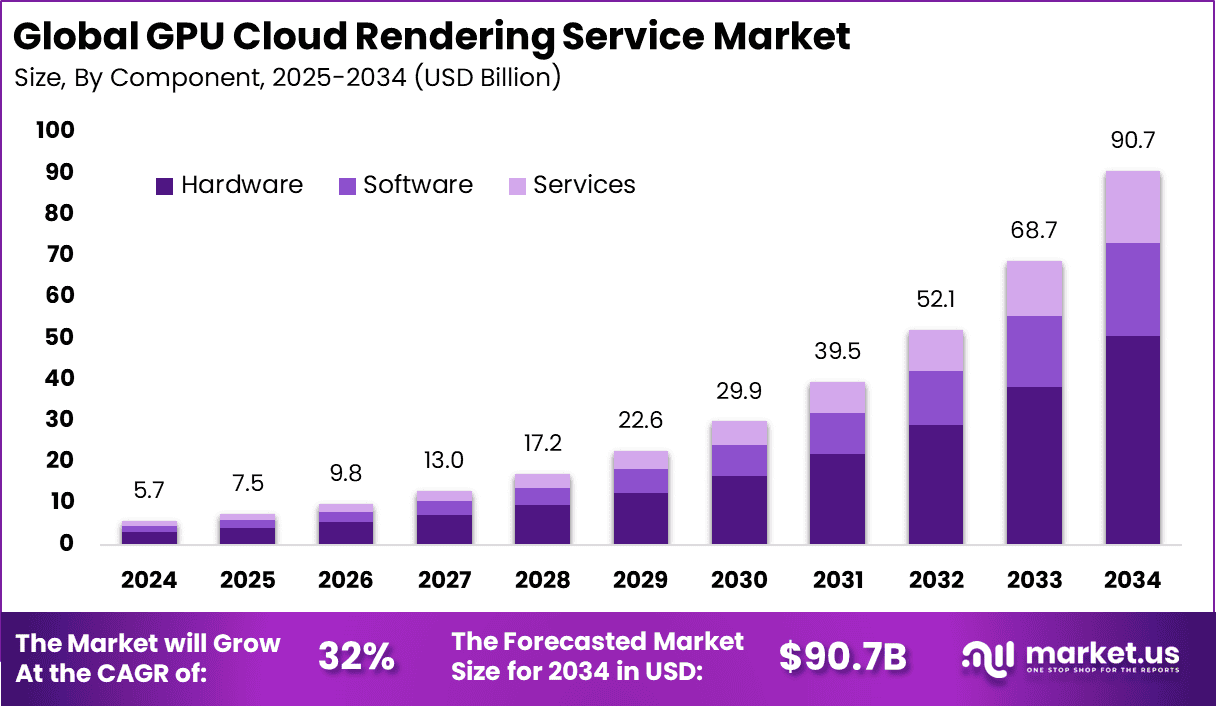

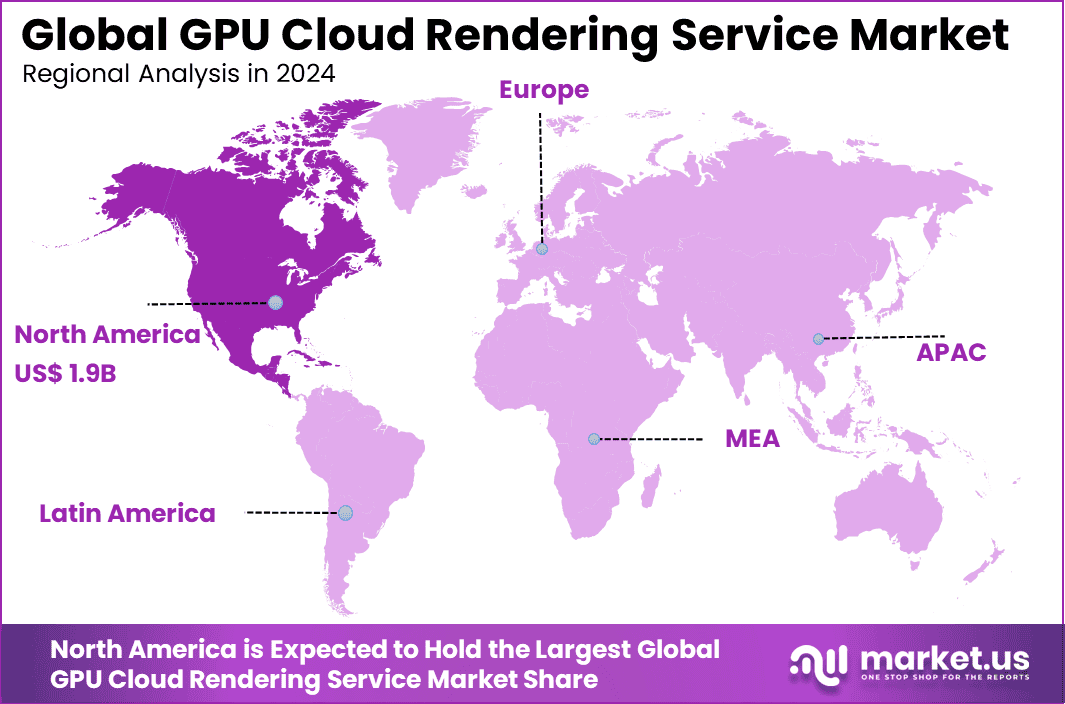

The market for GPU Cloud Rendering Service worldwide, valued at USD 5.7 billion in 2024, is estimated to grow from USD 7.5 billion in 2025 to roughly USD 90.7 billion by 2034, expanding at a CAGR of 32% across 2025-2034. In 2024, North America held a dominan market position, capturing more than a 34.4% share, holding USD 1.9 Billion revenue.

GPU cloud rendering refers to rendering graphics, animations, or visual content using remote servers equipped with powerful GPUs. Instead of relying on local machines, users send rendering jobs to cloud servers that perform the heavy computation and return rendered frames. This market includes infrastructure, software platforms, rendering engines, and managed services that provide GPU-backed rendering capabilities on demand.

Key Insight Summary

Hardware components dominate with 55.7%, highlighting the importance of GPU infrastructure in rendering workloads.

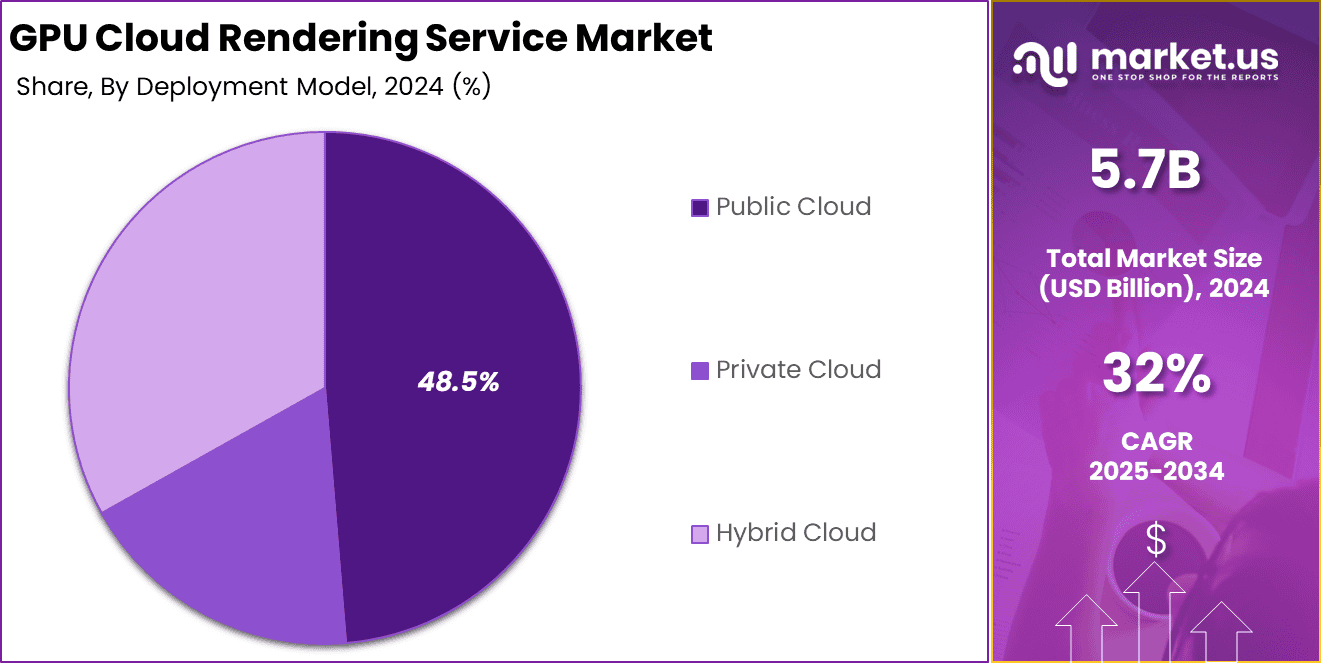

Public cloud deployment leads at 48.5%, as enterprises seek scalability and cost efficiency.

Large enterprises account for 70.5%, reflecting their investment in high-performance rendering solutions.

Media & entertainment applications hold 38.7%, driven by demand from animation, VFX, and gaming industries.

North America contributes 34.4%, supported by advanced cloud infrastructure and strong industry adoption.

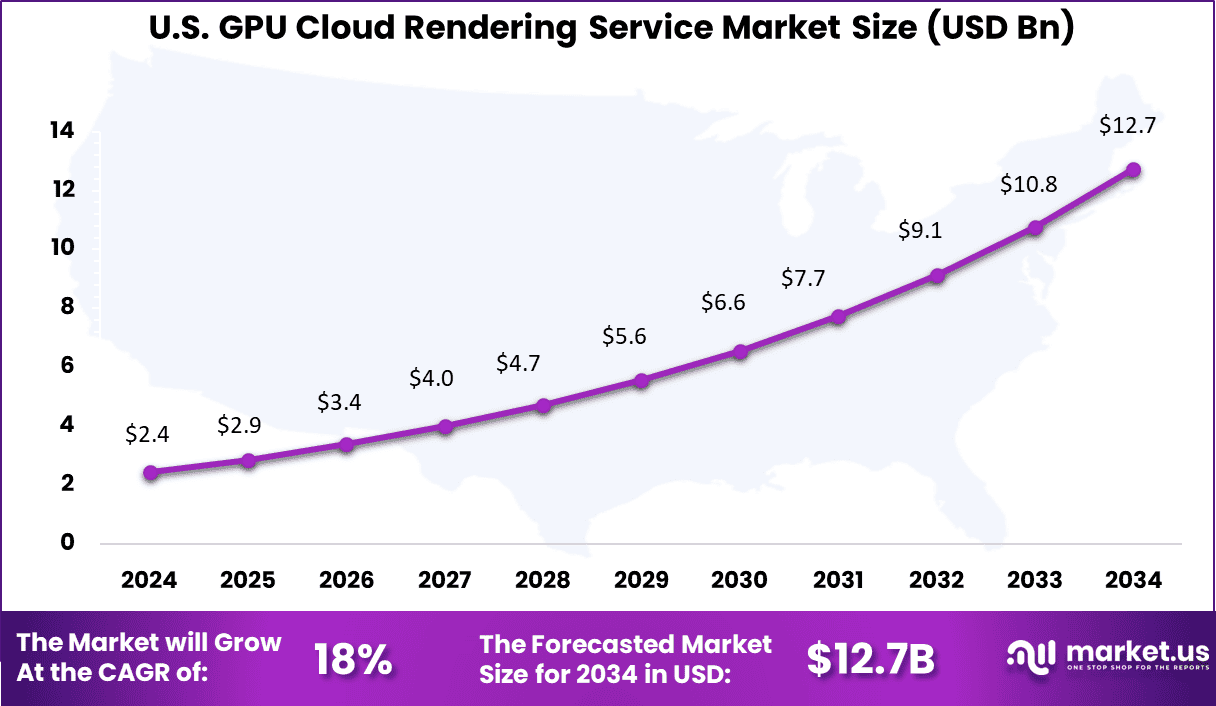

The US market reached USD 2.43 billion and is expanding at a steady CAGR of 18.0%, showcasing its leadership in GPU cloud rendering adoption.

Analysts’ Viewpoint

It supports industries such as media & entertainment, gaming, architecture, digital design, virtual production, and visualization. One of the top driving factors for GPU Cloud Rendering is the global surge in demand for AI, machine learning, and big data analytics, which require intensive computational power that GPU clouds can supply flexibly and cost-effectively.

The gaming industry alone contributes over 35% of cloud rendering demand, driven by the popularity of 4K/8K graphics and cloud gaming platforms. Additionally, innovations like real-time ray tracing and hybrid rendering solutions contribute to the enhanced visual fidelity and speed needed for immersive user experiences, accelerating adoption.

Demand analysis highlights a broad and growing user base ranging from large studios to individual artists and enterprises in sectors like film, animation, architecture, and automotive design. Businesses increasingly embrace cloud GPU services as they reduce reliance on expensive local GPUs and enable flexible scaling based on project needs. For example, cloud rendering can reduce CGI production times by up to 70%, dramatically improving efficiency for studios.

Government-led Investments

Government-led investments have also become crucial in the growth trajectory of GPU cloud rendering services. Public sector funding for cloud infrastructure and AI research has surged by 45% over the past year in many regions. Governments worldwide are investing billions annually in digital transformation projects that include support for GPU-accelerated cloud platforms.

These investments stimulate adoption in public services such as healthcare, urban planning, and education, where advanced visualization and AI capabilities are vital. The government cloud market alone is valued at over $40 billion in 2025 and growing at annual rates exceeding 17%, reinforcing the foundational support propelling GPU cloud rendering innovation.

Investment and Business Benefits

Investment opportunities in the GPU Cloud Rendering market are abundant as companies prioritize infrastructure expansion for data centers and cloud platforms. The rapid growth of AI-driven workloads and demand for high-fidelity visualization experiences encourage investments in scalable GPU farms, edge computing integration, and optimized orchestration software.

Cloud-based GPU rendering facilitates cost-efficient pay-as-you-go models, appealing to both startups and established enterprises. Additionally, there is growing interest in hybrid cloud models that balance security, performance, and costs for sensitive data and large-scale projects, offering new avenues for service providers to innovate and capture market share.

The business benefits of adopting GPU cloud rendering services include enhanced scalability, cost savings, and improved productivity. Organizations gain from reduced capital expenditure by avoiding investments in expensive on-premises hardware, instead paying for computing resources as needed. Businesses experience faster time-to-market due to quicker rendering cycles and streamlined collaboration across distributed teams.

US Market Size

The United States plays a central role in driving North America’s dominance, with a market size of 2.43 billion. The country leads in innovation within sectors such as film production, animation, gaming, and professional visualization, all of which rely heavily on GPU rendering capacities. Cloud-based solutions have become vital for U.S. enterprises as they manage larger projects, tighter delivery timelines, and rising demand for immersive content experiences.

The market is advancing rapidly with a CAGR of 18.0%, reflecting strong growth momentum. This pace points to the increasing reliance on GPU-powered cloud platforms as industries see them as both cost-efficient and performance-driven. Emerging applications like virtual reality, 3D simulations, and high-resolution visual effects will continue to fuel demand at this rate.

North America accounts for 34.4% of the GPU cloud rendering service market, making it one of the most prominent regions for adoption. The strong presence of industries such as gaming, media production, and design has created a consistent demand for high-performance rendering solutions.

Cloud-based GPU services are widely embraced in the region because they allow creative teams, studios, and enterprises to work on complex projects without investing heavily in hardware infrastructure. The region’s advanced digital ecosystem and the availability of early adopters also reinforce its leadership in this market.

By Component

In 2024, Hardware takes the lead in the GPU cloud rendering service market with 55.7% share. This dominance comes from the heavy need for processing power in rendering tasks, where GPUs are the core driver of performance. Rendering complex 3D models, visual effects, and simulations requires high-performance hardware that can deliver speed and accuracy.

As industries adopt more advanced graphics applications, the demand for powerful GPU hardware resources provided through the cloud continues to rise. Beyond raw performance, the hardware segment is also gaining from the ability of cloud providers to pool advanced GPUs and make them accessible to enterprises at scale.

Businesses that would otherwise find it difficult to purchase and maintain high-cost GPU infrastructure rely on GPU cloud hardware to reduce capital outlays while still achieving the same performance levels as on-premises systems.

By Deployment Model

In 2024, the public cloud dominates with 48.5% share due to its accessibility and flexibility. Public cloud platforms provide rendering services that are fast to deploy, cost-efficient, and suited for varied workloads from small studios to large production houses. With no need for complex setups, organizations can access rendering capacity on demand, an essential advantage in industries where project timelines are tight.

The choice of public cloud is further fueled by increasing adoption of distributed teams and collaborative workflows. Many enterprises in creative and design fields use GPU rendering services across global locations, and the public cloud model ensures easy availability of shared resources. This makes it a natural fit for studios and businesses balancing efficiency with scalability.

By Enterprise Size

In 2024, Large enterprises make up 70.5% of the market share, driven by their large-scale production needs and resource-heavy applications. These companies often work on high-end animation, virtual reality content, and large design projects where rendering workloads are massive and time-sensitive. GPU cloud rendering allows them to speed up the process, saving time and optimizing resource usage compared to relying on in-house infrastructure.

The preference for GPU rendering among large enterprises also comes from its ability to support parallel operations, ensuring multiple projects or rendering tasks can run simultaneously. Large organizations benefit from the ability to integrate GPU cloud services into existing workflows, ensuring a continuous pipeline of high-quality visuals for customers and audiences.

By Application

In 2024, The media and entertainment sector leads with 38.7% share. This segment relies on GPU rendering for tasks like visual effects, gaming, animation, and film production, where realistic graphics and smooth performance are essential. The demand comes from both traditional content production and newer fields like virtual reality and immersive media, which require fast and high-resolution rendering capabilities.

Shifts in consumer preference toward more visual and interactive content further boost this segment. Studios and entertainment companies are increasingly turning to GPU cloud rendering to accelerate production timelines and meet delivery deadlines without the limitations of in-house infrastructure. As content becomes more complex, the role of cloud GPU rendering for media and entertainment continues to expand.

Emerging Trends

Emerging trends highlight the growing integration of AI-assisted rendering techniques such as denoising, upscaling, and material synthesis, which reduce computational costs and improve rendering quality. Real-time or near-real-time rendering combined with ray tracing technologies is increasingly adopted for industries like gaming and film, which demand high fidelity and quick turnaround.

Usage-based costing models have become popular, providing businesses flexibility and cost controls. Moreover, hybrid and burst rendering approaches allow companies to maintain IP control while leveraging cloud scalability during peak workloads. These trends are supported by strong market dynamics with GPU rendering holding over 55% market share among cloud rendering services today.

Growth Factors

The growth of GPU cloud rendering is fueled by several key factors. Increasing reliance on cloud-based GPU infrastructure allows businesses to cut down upfront hardware investments and scale resources dynamically in response to workload demands. Faster internet speeds and the rise of remote collaboration tools have boosted the adoption of these services across media, gaming, architecture, and design industries.

Public cloud deployments are preferred by more than 60% of enterprises due to their cost-effectiveness and accessibility. AI integration within rendering workflows accelerates frame processing by up to 60%, leading to as much as a 70% reduction in rendering times for some firms, driving operational efficiency gains.

Key Market Segments

By Component

Hardware

Software

Services

By Deployment Model

Public Cloud

Private Cloud

Hybrid Cloud

By Enterprise Size

By Application

Media & Entertainment

Gaming

Architecture & Design

Healthcare

Automotive

Manufacturing

Others

Regional Analysis and Coverage

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherlands

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Singapore

Thailand

Vietnam

Rest of Latin America

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Driver Analysis

Rising Demand for High-Performance Rendering

The demand for high-performance rendering solutions in industries such as gaming, architecture, and visual effects is a key driver for the GPU cloud rendering service market. Companies increasingly require cloud-based GPU infrastructure to handle complex rendering tasks efficiently.

Enhanced internet speeds and scalable cloud infrastructure support real-time rendering, making it easier for studios and developers to produce high-quality visuals without investing heavily in local hardware. This rising demand is driven by the need for faster rendering times and collaborative workflows, resulting in growing adoption across sectors that require photorealistic and immersive content generation.

Restraint Analysis

High Costs and Security Concerns

Although cloud rendering offers many benefits, high service costs and data security remain significant barriers. Small and medium-sized enterprises often find it difficult to manage the unpredictable rendering expenses, especially for large projects demanding significant GPU power.

Additionally, concerns about protecting intellectual property and sensitive data when uploading assets to third-party cloud servers limit adoption. The lack of standardized pricing and vendor lock-in also add to the hesitation among potential users. These factors combine to restrain market growth despite the technological advances available.

Opportunity Analysis

Expanding Use in Gaming, AR/VR, and Digital Twins

The GPU cloud rendering service market has promising growth opportunities in emerging use cases such as gaming, augmented reality, virtual reality, and digital twins. Gaming companies benefit from cloud rendering for delivering hyper-realistic graphics and latency-sensitive multiplayer experiences.

Furthermore, AR/VR applications require scalable GPU power to build lifelike virtual environments, enhancing user immersion. Beyond entertainment, industries like automotive, architecture, and smart city planning are adopting cloud rendering to accelerate product design, visualization, and simulation efforts. This wide range of applications opens new markets and client segments for GPU cloud services.

Challenge Analysis

Supply Chain Constraints and Scalability Issues

The GPU cloud rendering market faces challenges related to supply chain bottlenecks and infrastructure scalability. The production of high-end GPUs has struggled to keep pace with soaring demand from AI, gaming, and rendering sectors, leading to shortages and elevated prices.

Additionally, infrastructure must scale efficiently to handle peak rendering workloads, which can strain cloud providers’ capacity and affect cost predictability for users. Interoperability between various rendering engines and cloud platforms adds complexity to workflows, while latency remains an issue for real-time applications in regions with weak digital infrastructure.

Competitive Analysis

The GPU Cloud Rendering Service Market is led by major cloud and semiconductor providers such as NVIDIA Corporation, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. These companies deliver high-performance GPU instances optimized for animation, VFX, gaming, AI visualization, and 3D modeling.

Enterprise technology providers including Autodesk Inc., Siemens AG, IBM Cloud, and Alibaba Cloud strengthen the market with integrated rendering solutions, CAD connectivity, and cloud-based design workflows. Their services support engineering, industrial simulation, and digital content creation. Radeon ProRender (AMD) also contributes through GPU-accelerated rendering engines that integrate into existing 3D design software.

Specialized rendering platforms such as CoreWeave, iRender, Vast.ai, Zync Render (Google), RebusFarm, GarageFarm.NET, TurboRender, SheepIt Render Farm, Fox Renderfarm, and GridMarkets cater to studios, freelancers, and creative teams. These providers offer on-demand GPU rendering with flexible pricing and multi-software support.

Top Key Players in the Market

NVIDIA Corporation

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud Platform

Autodesk Inc.

Siemens AG

Renderro

Radeon ProRender (AMD)

Alibaba Cloud

IBM Cloud

CoreWeave

iRender

Vast.ai

Zync Render (Google)

RebusFarm

GarageFarm.NET

TurboRender

SheepIt Render Farm

Fox Renderfarm

GridMarkets

Other Major Players

Recent Developments

August 2025, NVIDIA unveiled updates at Gamescom 2025 to its RTX neural rendering and generative AI technologies including DLSS 4, integrated in cloud gaming platforms such as GeForce NOW, enabling improved graphics quality and faster cloud rendering performance.

July 2025, iRender emphasized its high-speed GPU cloud rendering service supporting popular 3D design software with cloud-based scalability for rendering tasks, catering to the growing demand for flexible GPU resources in rendering workflows.

June 2025, Amazon Web Services (AWS) announced up to 45% price reduction on NVIDIA-powered GPU instances including P4 and P5 series, expanding availability in multiple regions. AWS also introduced Blackwell-powered P6-B200 instances for large-scale AI training and rendering tasks.

January 2025, Siemens integrated NVIDIA Omniverse technology into its Teamcenter platform for enhanced photorealistic digital twin rendering in the cloud. Siemens also announced a 30x speedup in aerodynamics simulations using NVIDIA Blackwell GPUs and a 25x acceleration in AI execution for industrial applications.

Report Scope