Report Overview

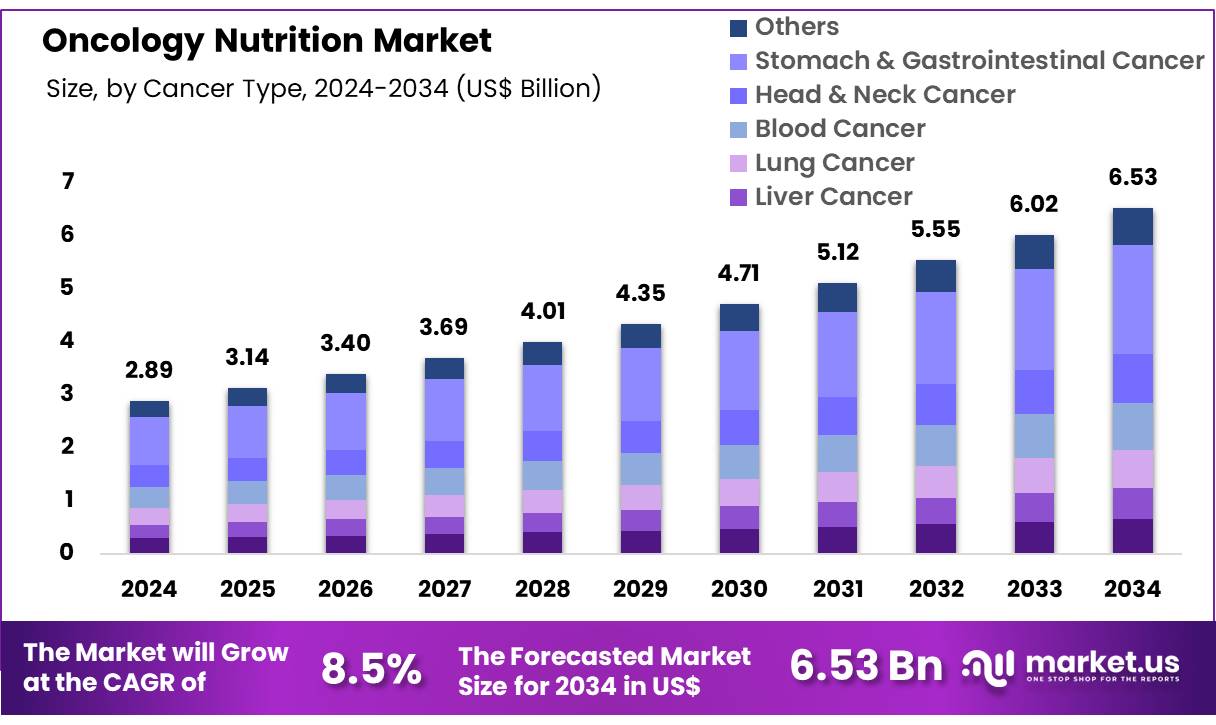

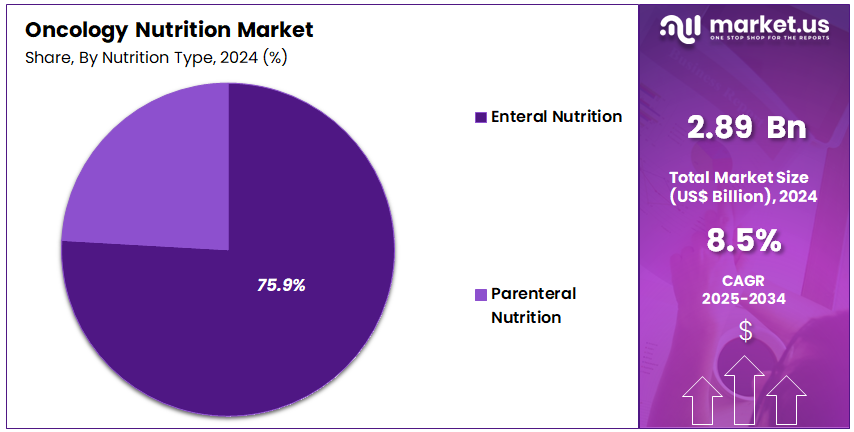

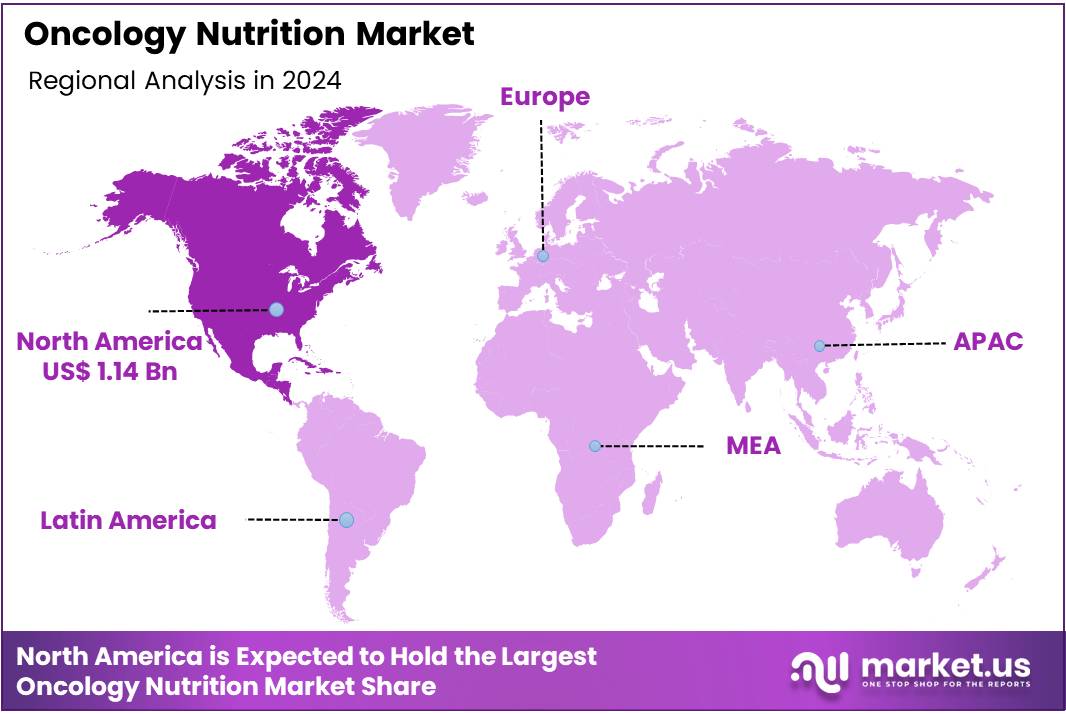

Global Oncology Nutrition Market size is expected to be worth around US$ 6.53 Billion by 2034 from US$ 2.89 Billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 1.13 Billion.

The oncology nutrition sector is growing steadily as cancer rates rise worldwide. According to the World Health Organization, new cancer cases are projected to exceed 35 million by 2050, marking a 77% increase from 2022. This increase is being linked to ageing populations, overall population growth, and risk factors such as tobacco use, alcohol, obesity, and air pollution. With more cases, hospitals and home-care services are adopting specialized nutrition programs to help patients maintain weight, muscle strength, and tolerance during treatment.

Ageing populations are also contributing to this trend. By 2030, one in six people will be aged 60 or older, and this group will reach 2.1 billion globally by 2050. Since cancer risk rises with age, more elderly individuals will require targeted nutritional care. Support such as protein-energy management and micronutrient monitoring is becoming essential for therapy and recovery.

Clinical demands remain central to growth. The U.S. National Cancer Institute highlights that many patients experience appetite loss, malnutrition, or cachexia during treatment, which can lead to infections, stronger side effects, and lower survival rates. Structured nutrition care and access to dietitians are therefore being integrated into oncology pathways to improve patient outcomes.

Cancer survivorship is further driving long-term nutrition needs. In the U.S. alone, there are over 18 million cancer survivors, many of whom require ongoing counselling, symptom-specific diets, and safe supplements to maintain quality of life.

Policy and reimbursement are also shaping the sector. Guidelines from organizations such as NICE in the UK recommend malnutrition screening and structured support, while Medicare in the U.S. covers home enteral and parenteral nutrition. Additionally, WHO and regional health authorities are promoting diet-focused public health measures.

Together, these factors rising incidence, ageing populations, clinical necessity, survivorship, supportive policies, and strong data systems are fueling sustained growth in oncology nutrition across hospitals, clinics, and home-care services.

Key Takeaways

Market Size: Global Oncology Nutrition Market size is expected to be worth around US$ 6.53 Billion by 2034 from US$ 2.89 Billion in 2024.

Market Growth: The market growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

Cancer Type Analysis: The oncology nutrition market is predominantly led by stomach and gastrointestinal cancers, which together account for 31.5% of the total market share.

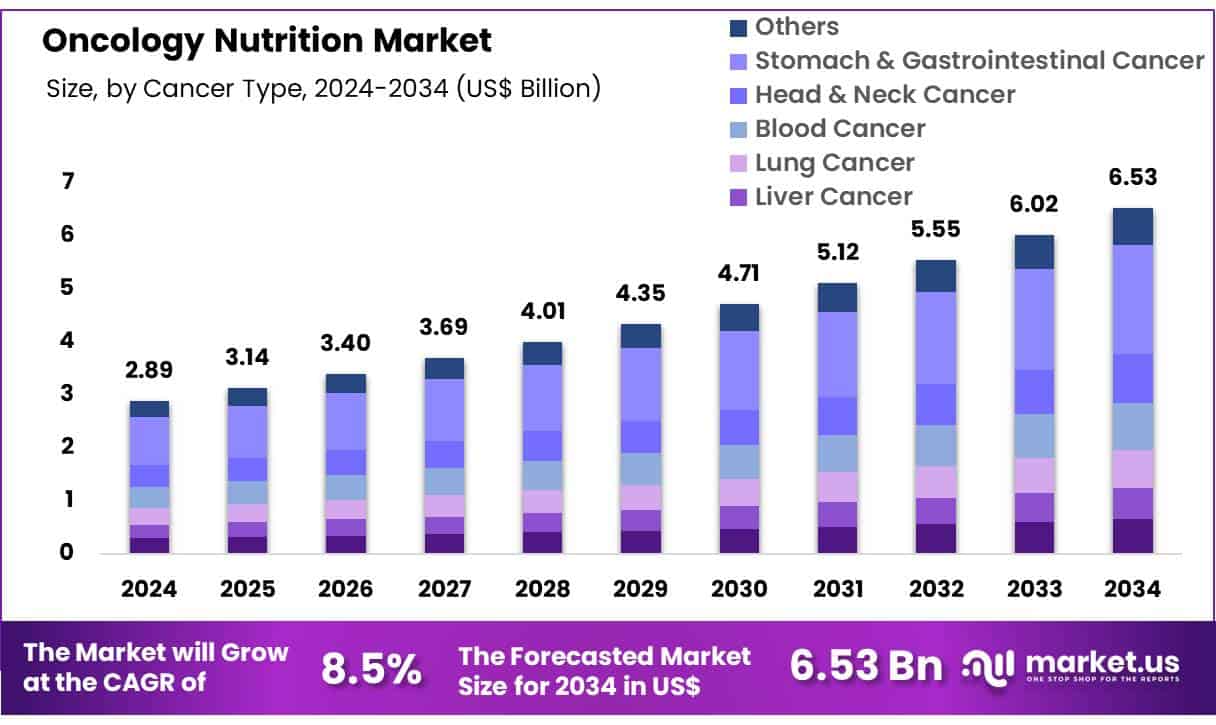

Nutrition Type Analysis: In Nutrition Type the enteral nutrition segment dominate the market, which accounts for 75.9% of the total market share.

Formula Type Analysis: Specialized formula has emerged as the dominant segment, accounting for 47.8% of the total market share in 2024.

Route of Administration Analysis: The parenteral segment accounts for 62.6% of the global market share in 2024, establishing itself as the leading mode of administration.

Distribution Channel Analysis: The distribution channel of the oncology nutrition market in 2024 is primarily dominated by hospital pharmacies, which account for 65.3% of the total market share.

Regional Analysis: In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 1.13 Billion

Cancer Type Analysis

In 2024, cancer type segmentation within the oncology nutrition market is predominantly led by stomach and gastrointestinal cancers, which together account for 31.5% of the total market share. This dominance is largely attributed to the high prevalence of gastrointestinal malignancies globally and the strong demand for nutrition support in managing treatment-related complications such as malabsorption, weight loss, and cachexia. Specialized nutritional interventions are widely adopted in these cancers to improve clinical outcomes and enhance treatment tolerance, thereby driving significant market growth.

Beyond gastrointestinal cancers, the oncology nutrition market also encompasses segments such as breast cancer, liver cancer, lung cancer, blood cancer, head & neck cancer, and others. While individually smaller in share compared to stomach and gastrointestinal cancers, these segments represent notable areas of growth.

Breast cancer patients, for instance, increasingly rely on nutritional support to manage therapy-induced side effects, while liver and lung cancer patients require targeted formulations to address metabolic imbalances and reduced appetite. Head and neck cancer further contributes to market expansion due to the critical role of enteral nutrition in managing dysphagia and maintaining adequate calorie intake.

The “Others” segment, though relatively minor, covers a diverse group of cancers where nutritional support is gaining clinical recognition. Collectively, these secondary segments demonstrate steady demand growth, driven by rising awareness of oncology-specific nutrition and the expanding adoption of personalized dietary solutions. Nonetheless, stomach and gastrointestinal cancers are expected to continue their stronghold as the principal contributors to oncology nutrition demand throughout 2024.

Nutrition Type Analysis

In Nutrition Type the enteral nutrition segment dominate the market, which accounts for 75.9% of the total market share. Enteral nutrition has emerged as the preferred mode of nutritional support for cancer patients due to its effectiveness in maintaining gut integrity, reducing infection risks, and offering cost efficiency compared to parenteral solutions.

It is extensively prescribed for patients with functional gastrointestinal tracts but with impaired oral intake, such as those affected by head and neck, gastrointestinal, or esophageal cancers. The increasing availability of disease-specific enteral formulations, improved product palatability, and advancements in tube-feeding techniques have further reinforced the segment’s leadership position in oncology nutrition.

The parenteral nutrition segment, although smaller, continues to represent a critical component of oncology care. It is primarily utilized for patients with severe gastrointestinal dysfunction, obstruction, or malabsorption, where enteral feeding is not feasible.

Despite its limited use relative to enteral nutrition, parenteral solutions are witnessing gradual adoption due to advancements in formulation safety, reduced risk of catheter-related complications, and improved clinical monitoring systems. Moreover, the rising incidence of late-stage cancers, coupled with treatment-induced gastrointestinal toxicity, is expected to sustain demand for parenteral nutrition in selected patient populations.

While parenteral nutrition holds importance in complex clinical cases, enteral nutrition is expected to retain its dominant role in 2024, supported by growing awareness, favorable clinical guidelines, and continued innovation in oncology-specific formulations.

Formula Type Analysis

The oncology nutrition market is segmented by formula type into specialized formula, standard formula, and elemental formula. Among these, specialized formula has emerged as the dominant segment, accounting for 47.8% of the total market share in 2024. The growth of this category is largely driven by the rising demand for targeted nutritional solutions tailored to address cancer-related metabolic alterations, treatment side effects, and patient-specific dietary requirements. Increased adoption of specialized formulations by healthcare providers, coupled with greater clinical evidence supporting their effectiveness, has strengthened their position as the leading formula type.

The standard formula segment represents a significant share of the market, primarily due to its widespread availability, affordability, and suitability for a broad patient base requiring general nutritional support. This segment is anticipated to maintain steady growth as it continues to be prescribed for patients with mild to moderate nutritional deficiencies, particularly in outpatient and homecare settings.

The elemental formula segment, while smaller in comparison, is projected to register noteworthy growth. These formulations are designed for patients with impaired gastrointestinal function or severe malabsorption issues, conditions often associated with advanced oncology cases. Increasing clinical acceptance and advancements in formulation technologies are expected to drive their adoption in the coming years.

Route of Administration Analysis

The parenteral segment accounts for 62.6% of the global market share in 2024, establishing itself as the leading mode of administration. The dominance of parenteral nutrition can be attributed to the high prevalence of severe cancer cases, where patients suffer from impaired gastrointestinal function, difficulty in swallowing, or poor absorption capacity. Such clinical scenarios necessitate the direct intravenous delivery of nutrients to ensure adequate caloric intake and maintenance of patient health.

Furthermore, the growing adoption of advanced parenteral formulations enriched with amino acids, lipids, and micronutrients, coupled with hospital-based nutritional support programs, continues to strengthen this segment’s position. Rising demand for tailored parenteral solutions in oncology treatment further supports its sustained growth trajectory.

The oral segment, although holding a smaller market share, is anticipated to demonstrate steady expansion. Oral nutrition is preferred in early-stage cancer and supportive care, as it enhances patient compliance and quality of life. The increasing availability of specialized oral supplements designed to manage cancer-related cachexia, weight loss, and treatment-induced side effects is expected to drive adoption. However, its growth is relatively constrained in cases where advanced disease progression necessitates parenteral administration.

Distribution Channel Analysis

The distribution channel of the oncology nutrition market in 2024 is primarily dominated by hospital pharmacies, which account for 65.3% of the total market share. This dominance can be attributed to the critical role hospital pharmacies play in ensuring immediate access to oncology nutrition products for patients undergoing cancer therapies.

Hospitals remain the first point of care for most oncology patients, and their pharmacies provide specialized nutritional formulations prescribed by oncologists and dieticians. Furthermore, the integration of oncology care with nutrition therapy within hospitals has reinforced this channel’s strong market position.

Retail pharmacies constitute another important distribution segment. These outlets provide convenient access to oncology nutrition products for patients in outpatient care or those seeking follow-up treatments after hospital discharge. While their share remains lower compared to hospital pharmacies, retail pharmacies benefit from strong geographical presence and ease of accessibility, particularly in urban and semi-urban areas.

Online pharmacies are emerging as a fast-growing channel, driven by rising digital adoption, improved logistics infrastructure, and patient preference for home delivery. This segment is expected to witness significant growth in the coming years as e-commerce penetration in healthcare continues to expand. Online platforms offer added advantages such as product comparisons, subscription models, and discreet delivery, which cater to patients’ needs for convenience and cost-effectiveness.

Key Market Segments

By Cancer Type

Breast Cancer

Liver Cancer

Lung Cancer

Blood Cancer

Head & Neck Cancer

Stomach & Gastrointestinal Cancer

Others

By Nutrition Type

Enteral Nutrition

Parenteral Nutrition

By Product type

Vitamins and minerals

Proteins

Antioxidants

Other product types

By Formula Type

Standard Formula

Elemental Formula

Specialized Formula

By Route of Administration

By Distribution Channel

Hospital Pharmacies

Online Pharmacies

Retail Pharmacies

Driving Factors

A key driver of the oncology nutrition market is the high prevalence of malnutrition among cancer patients and the evidence that nutritional support improves outcomes. Malnutrition is observed in 30 %–80 % of patients, depending on cancer type and stage, and is linked to increased treatment toxicity, postoperative complications, and reduced survival.

Clinical guidelines (ESPEN) recommend systematic nutrition screening and stepwise interventions (oral, enteral, parenteral) in cancer care. Growing recognition of nutrition as an integral component of oncology care has pushed hospitals and cancer centers to adopt specialized nutrition formulas, fueling market growth.

Trending Factors

A prevailing trend in the oncology nutrition sector is the shift from general formulas toward personalized and immunonutrition approaches. Nutritional interventions are increasingly tailored to individual patient metabolic needs, tumor type, and treatment modality.

Immunonutrition formulas enriched with arginine, omega-3 fatty acids, nucleotides—are gaining interest for their potential to modulate immunity and inflammation in cancer patients receiving surgery or chemoradiotherapy. In parallel, home-based enteral nutrition and remote nutrition monitoring are expanding, responding to outpatient cancer care models.

Restraining Factors

A significant restraint for market expansion is the lack of standardized diagnostic criteria for cancer-related malnutrition and heterogeneity in clinical practice. Despite guidelines, consensus on screening tools, thresholds, and timing remains limited, complicating adoption.

Further, limited reimbursement and coverage for specialized oncology nutrition in many health systems constrain uptake, especially in resource-limited settings. Additionally, low awareness and insufficient training among oncologists and dietitians about the value and risks of artificial nutrition impede integration of nutrition into standard care.

Opportunity

A promising opportunity lies in developing evidence-backed, tumor-specific nutritional products and integrating digital nutrition platforms. As mechanistic understanding of cancer metabolism advances, tailored formulas targeting cachexia, muscle loss, or metabolic rewiring can be devised. Use of mobile apps, tele-dietetics, and sensors to monitor dietary intake and nutritional status in real time can increase adherence and outcomes.

Moreover, public policy initiatives promoting nutrition in cancer care (e.g., mandating screening in national cancer control programs) could expand market access. For instance, India’s National Cancer Control Programme (NCCP) supports cancer services infrastructure, which could be extended to nutrition modules.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.3% share and holding US$ 1.13 billion market value for the year. The dominance can be attributed to the high cancer incidence in the region. According to the National Cancer Institute (NCI), over 2 million new cancer cases are projected in the United States in 2024. The growing burden of cancer creates strong demand for specialized nutrition support.

Government healthcare systems and cancer centers in the U.S. and Canada have integrated oncology nutrition into treatment protocols. Clinical practice guidelines from bodies such as the American Society of Clinical Oncology (ASCO) emphasize nutrition screening and intervention. In addition, favorable reimbursement structures for enteral and parenteral nutrition products have encouraged market adoption.

High awareness among oncologists and dietitians, advanced healthcare infrastructure, and strong product availability further reinforce North America’s leading position. The region is expected to maintain this advantage through continuous innovation in personalized nutrition solutions.

Key Regions and Countries

North America

Latin America

Brazil

Colombia

Chile

Argentina

Costa Rica

Rest of Latin America

Eastern Europe

Russia

Poland

The Czech Republic

Greece

Rest of Eastern Europe

Western Europe

Germany

France

The UK

Spain

Italy

Portugal

Ireland

Austria

Switzerland

Benelux

Nordic

Rest of Western Europe

APAC

China

Japan

South Korea

India

Australia & New Zealand

Indonesia

Malaysia

Philippines

Singapore

Thailand

Vietnam

Rest of APAC

Middle East & Africa

Algeria

Egypt

Israel

Kuwait

Nigeria

Saudi Arabia

South Africa

Turkey

United Arab Emirates

Rest of MEA

Key Players Analysis

The oncology nutrition market is shaped by strong competition among global and regional manufacturers that provide advanced nutritional solutions tailored for cancer care. Market participants focus on developing evidence-based enteral and parenteral formulas that address malnutrition, cachexia, and treatment-related side effects. Continuous innovation is seen in product enrichment with omega-3 fatty acids, amino acids, and immune-modulating ingredients. Strategic partnerships with hospitals, oncology centers, and academic institutions are pursued to strengthen clinical acceptance.

In addition, players invest heavily in research and clinical trials to validate product efficacy, which enhances regulatory approval prospects. Distribution strategies include hospital pharmacies, retail outlets, and increasingly direct-to-patient models with home delivery services. Growing emphasis on digital health tools for remote monitoring of nutritional intake further supports competitive differentiation.

Collectively, these approaches highlight the market’s focus on patient-centered solutions, ensuring improved treatment adherence and better clinical outcomes while sustaining long-term growth opportunities.

Market Key Players

Abbott Laboratories

Nestlé Health Science

Fresenius Kabi

Danone Nutricia

B. Braun Melsungen AG

Hormel Health Labs

Meiji Holdings Co., Ltd.

Grifols S.A.

Pfizer Inc.

Baxter International Inc.

Victus, Inc.

Ajinomoto Co., Inc.

Otsuka Holdings Co., Ltd.

Global Health Products, Inc.

Laboratoires Grand Fontaine

Recent Developments

Nestlé Health Science: In 2025, the firm expanded its parenteral nutrition capabilities through a strategic acquisition. In January 2023, Nestlé committed US$ 43 million toward expansion of its manufacturing facility in Eau Claire, Wisconsin, bolstering capacity for medical nutrition products.

Danone Nutricia: In 2024, Danone announced a partnership with a digital oncology company to integrate a nutrition support module into an oncology care platform.

Hormel Health Labs: Hormel Health Labs is referenced among key players in clinical nutrition markets in 2025 analyses, indicating growing recognition of its role in therapeutic nutrition.

Report Scope