Report Overviews

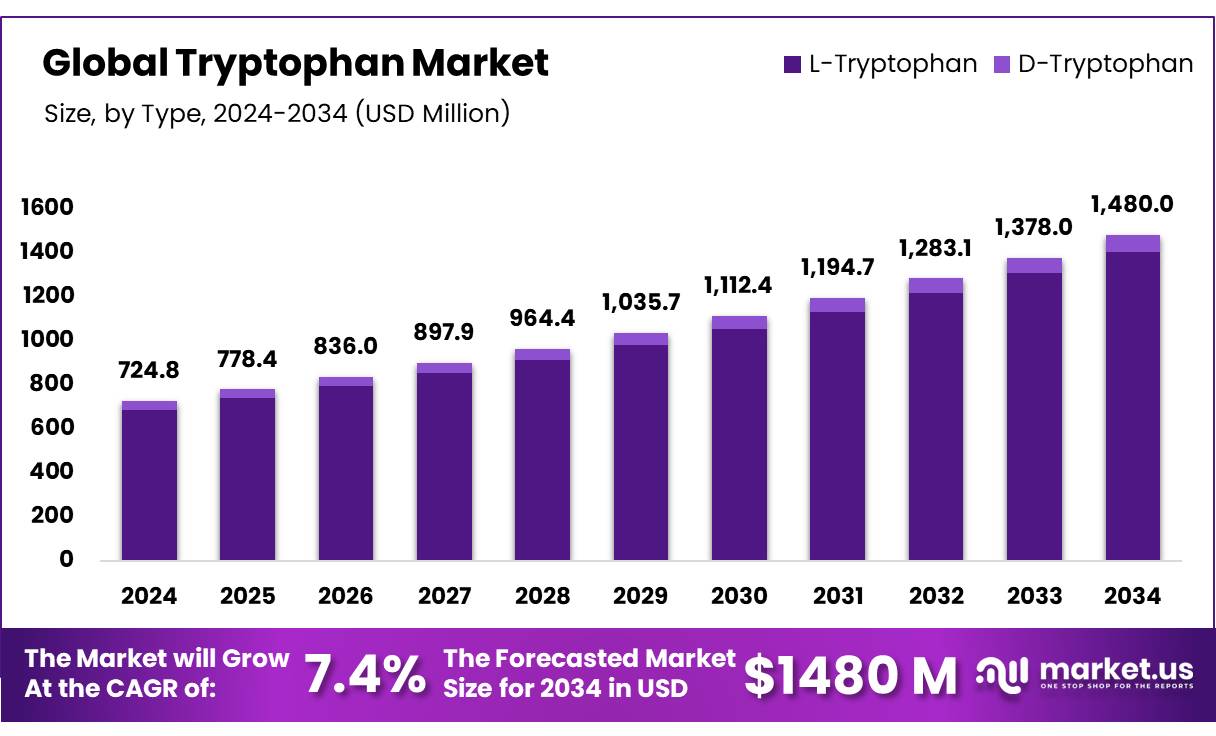

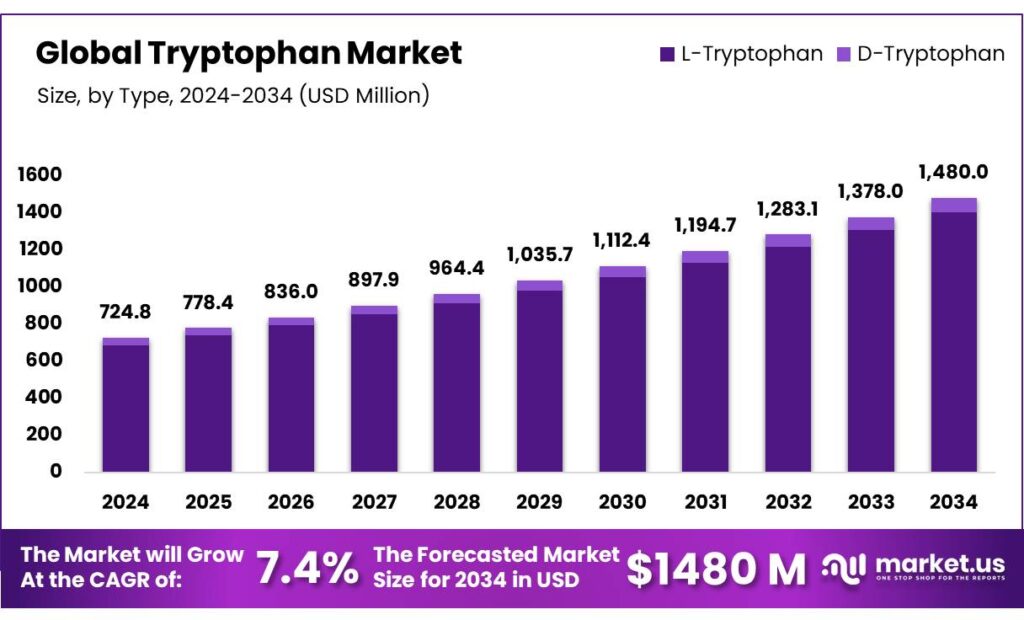

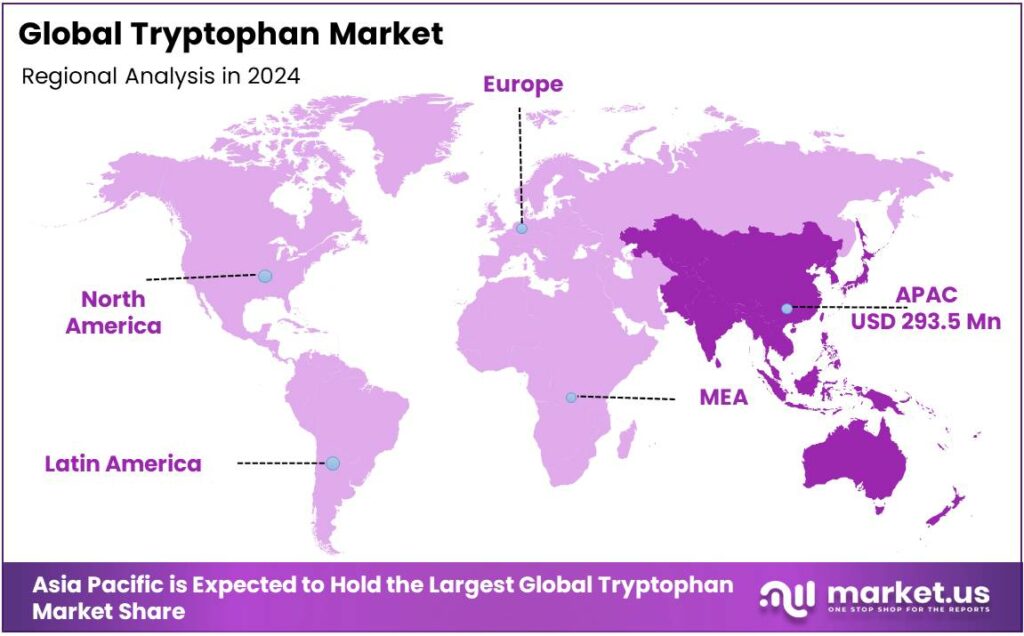

The Global Tryptophan Market size is expected to be worth around USD 1480.0 Million by 2034, from USD 724.8 Million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 40.5% share, holding USD 293.5 Million in revenue.

Tryptophan is one of the 20 standard amino acids and an essential amino acid for humans and animals. It serves as a building block for proteins and a precursor to important substances such as the neurotransmitter serotonin, the hormone melatonin, and vitamin B3 (niacin).

Tryptophan is essential for the human body; however, the body cannot synthesize it, which makes it important to obtain it from the diet. As the awareness regarding the well-being of the body increases, it creates opportunities for tryptophan to be utilized in food supplements and pharmaceuticals.

Similarly, in animals, tryptophan improves growth performance, reduces stress and regulates insulin, synthesizes protein in the muscles, and improves meat quality. The use of the amino acid in animal feed is the major driver of the market. Furthermore, the market faces challenges due to the regulatory framework and quality control. Moreover, with ongoing technological advancements, the market is expected to experience steady and sustained growth.

Annual tryptophan production is estimated at 41,000 metric tons yearly, with China leading the production.

Key Takeaways

The global tryptophan market was valued at USD 724.8 million in 2024.

The global tryptophan market is projected to grow at a CAGR of 7.4% and is estimated to reach USD 1480.0 Million by 2034.

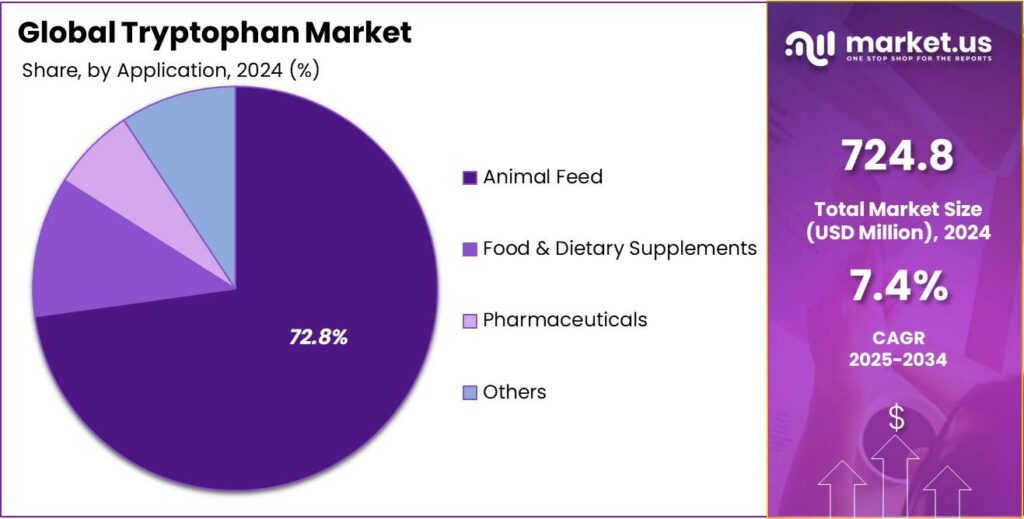

Based on grades, feed grade tryptophan dominated the market in 2024, comprising about 72.8% share of the total global market.

Based on the type of tryptophan, L-tryptophan dominated the market with approximately 94.8% of the total market share.

Among the applications of tryptophan, the animal feed industry dominated the market in 2024, accounting for around 72.8% of the market share.

Asia Pacific was the largest market for tryptophan in 2024, accounting for around 40.5% of the total global consumption.

Grade Analysis

Feed Grade Tryptophan Dominated the Market in 2024.

On the basis of grades of tryptophan, the market is segmented into feed and food grades. Feed-grade tryptophan dominated the market in 2024 with a market share of 72.8%. Feed-grade tryptophan is more widely utilized due to its cost-effectiveness and the high demand for amino acids in livestock nutrition. Animal feed formulations require tryptophan to improve growth rates, feed conversion ratios, and overall animal health, especially in poultry, swine, and aquaculture.

Feed-grade tryptophan is produced under less stringent purity standards compared to food-grade, making it more affordable for large-scale animal farming operations. Additionally, the formulation of feed-grade tryptophan typically prioritizes quantity over ultra-high purity. Conversely, food-grade tryptophan is manufactured to meet higher quality standards, often for human consumption, where higher purity and safety are crucial. As a result, the agricultural sector’s demand for affordable, high-volume ingredients makes feed-grade tryptophan more prevalent in the market.

Type Analysis

L-Tryptophan Emerged as a Leading Segment in the Market in 2024.

Based on the types of tryptophan, the market is divided into L-tryptophan and D-tryptophan. L-tryptophan dominated the market in 2024 with a market share of 94.8%. L-tryptophan is more widely utilized than D-tryptophan due to its superior bioavailability and role in biological processes. L-tryptophan is the naturally occurring isomer in both humans and animals, and it serves as a precursor to important neurotransmitters such as serotonin and melatonin, which regulate mood and sleep.

The body can readily absorb and metabolize L-tryptophan, making it highly effective in supplements aimed at improving mental health and sleep quality. In contrast, D-tryptophan is not readily incorporated into biological systems and has limited biological activity. Consequently, L-tryptophan is preferred in both dietary supplements and animal feed, as it provides the desired physiological effects and is more easily utilized by the body.

Application Analysis

In 2024, the Tryptophan Market was Primarily Driven by the Animal Feed Industry.

Among the applications of tryptophan, in 2024, the animal feed industry was at the forefront of the market, with a total global market share of 72.8%. More tryptophan is used in animal feed than in food, dietary supplements, or pharmaceuticals due to its essential role in promoting optimal growth, health, and productivity in livestock. Tryptophan is a key amino acid in animal nutrition, crucial for protein synthesis, immune function, and overall metabolism.

In the livestock and poultry industries, large quantities of tryptophan are required to ensure efficient feed conversion, improve digestive health, and enhance growth rates. The demand for high-quality, nutrient-rich animal feed is driven by the growing global consumption of meat and dairy products. While tryptophan is also used in supplements and pharmaceuticals, its application in animal feed remains dominant due to the larger scale and cost-efficiency needed to support the agriculture industry’s high-volume demands, making it a central component in animal nutrition formulations.

Key Market Segments

By Grade

By Type

L-Tryptophan

D-Tryptophan

By Application

Animal Feed

Food & Dietary Supplements

Pharmaceuticals

Others

Drivers

Growing Demand from the Animal Feed Sector Drives the Tryptophan Market.

The increasing demand from the animal feed sector has been a significant driver for the growth of the tryptophan market. Tryptophan, an essential amino acid, is crucial for the growth, development, and overall health of livestock. It plays a pivotal role in improving feed efficiency, boosting immunity, and promoting better reproductive performance in animals. With the rising global consumption of meat and dairy products, the need for high-quality animal feed has surged.

For instance, global average per capita meat consumption increased from 41.4 kg in 2012 to 44.5 kg in 2022.

Similarly, global poultry meat consumption neared 133 million metric tons in 2024. The poultry farming has seen substantial demand for tryptophan, as it helps in enhancing egg production and improving meat quality. Furthermore, the aquaculture industry has increasingly adopted tryptophan-rich feeds to optimize fish health and growth rates. The demand for tryptophan in animal nutrition continues to rise, supporting its prominent role in the feed industry.

Restraints

Regulatory Framework and Quality Control Pose a Significant Challenge in the Tryptophan Market.

The regulatory framework and quality control remain significant challenges in the tryptophan market, particularly as stricter safety and quality standards are enforced globally. Tryptophan, being a bioactive compound, is subject to rigorous regulations to ensure its safe use in dietary supplements, animal feed, and pharmaceuticals. For instance, regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) impose stringent guidelines on the manufacturing processes, labeling, and safety testing of tryptophan-based products.

Compliance with these regulations can be costly and time-consuming for producers. Additionally, ensuring consistent product quality and purity is a constant challenge, as contamination or impurities in tryptophan can lead to adverse effects, as seen in the 1989 outbreak of eosinophilia-myalgia syndrome linked to contaminated tryptophan. To mitigate such risks, companies must invest in robust quality control systems, including rigorous testing and certification processes, to maintain consumer trust and meet regulatory standards.

Opportunity

Increased Use in Dietary Supplements Boosts the Tryptophan Market.

The growing use of tryptophan in dietary supplements presents significant opportunities in the market, driven by increasing awareness of its health benefits. Tryptophan is a precursor to serotonin, a neurotransmitter that regulates mood, sleep, and appetite, making it a popular ingredient in supplements aimed at improving mental well-being. According to a study released by the World Health Organization in September 2025, more than a billion people are living with mental health disorders, with conditions such as anxiety and depression inflicting immense human and economic tolls. As mental health concerns rise globally, the demand for natural supplements to promote relaxation and alleviate symptoms of anxiety, depression, and insomnia has increased.

For instance, tryptophan is commonly found in sleep aids, with studies showing its ability to improve sleep quality. Additionally, as more consumers seek natural alternatives to pharmaceutical treatments, tryptophan’s role in supporting overall cognitive function, mood stability, and immune health has further fueled its popularity in the wellness industry. Furthermore, as consumer preferences shift, several companies are integrating tryptophan in their functional beverages. For instance, in March 2024, Nestlé launched Yiyang Wanning, a milk powder containing mulberry leaf extract, tryptophan, vitamin B, magnesium, and zinc in China.

Trends

Focus on Technological Advancements.

Technological advancements are playing a key role in the evolution of the tryptophan market, enhancing both production efficiency and product quality. For instance, innovations in biotechnology, particularly microbial fermentation, have revolutionized tryptophan manufacturing by enabling higher yields with reduced environmental impact. Companies are increasingly adopting genetically engineered microorganisms to produce tryptophan, improving the purity and consistency of the final product.

Additionally, chemical modification strategies, including photo-and electrochemical methods, are expanding tryptophan’s use in drug development, materials science, and environmental monitoring. Microbial synthesis of 5-HTP, a precursor to serotonin, is improving through enzyme evolution and the introduction of substrate pathways, providing a fast and environmentally friendly alternative to traditional extraction. Similarly, biomanufacturing methods are expanding to produce industrially relevant tryptophan derivatives such as 7-chloro-L-tryptophan and 7-bromo-L-tryptophan. Modified tryptophan derivatives are used in drug discovery and development, including potential therapeutic applications.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Tryptophan Market.

Geopolitical tensions have a notable impact on the tryptophan market, particularly due to disruptions in global supply chains, trade restrictions, and raw material availability. Countries that produce key raw materials for tryptophan, such as corn and soy, may face export bans or tariffs due to geopolitical conflicts, leading to price volatility and supply shortages.

For instance, the United States produces around 28% of the world’s soy and around 31% of the world’s corn, and China is the largest market for feed additives, including tryptophan. However, due to trade tensions between the countries have affected the global feed and supplement markets.

Additionally, the production of tryptophan is an energy-intensive process, where conflict between countries leads to a rise in prices of energy, which directly affects the price of the production of the compound, leading to a surge in the price. For instance, the conflict between Russia and Ukraine has led to a doubling of the price of oil.

Similarly, the conflicts in the Middle East and Eastern Europe have hindered the flow of key ingredients and surges in the energy prices. These disruptions force companies to seek alternative sourcing strategies, often increasing costs and lead times. Such uncertainties affect the pricing and the availability of tryptophan, leading to challenges in maintaining consistent production and meeting market demand.

Regional Analysis

Asia Pacific was the Largest Market for Tryptophan in 2024.

Asia Pacific held the major share of the global tryptophan market, valued at around US$293.5 million, commanding an estimated 40.5% of the total revenue share. Asia Pacific stands as the largest market for tryptophan, driven by its rapidly expanding animal feed and dietary supplement industries. The region, particularly countries such as China, India, and Japan, has seen a surge in the demand for tryptophan due to the growth of livestock farming and aquaculture. For instance, India has the largest livestock population, with approximately 535.78 million animals.

Additionally, China, as the world’s largest producer and consumer of animal feed, accounts for a significant portion of tryptophan usage, particularly in poultry and swine production. Similarly, China consumes approximately one-third of the world’s meat, making it the largest meat-consuming nation globally. This constant and increased consumption of meat and dairy products is further driving the need for high-quality animal feed.

Furthermore, the demand for dietary supplements in countries such as Japan and South Korea has risen as consumers seek natural solutions to improve mental health, sleep quality, and overall well-being. The combined growth in both the animal feed and supplement sectors, along with the growing trend of health consciousness, makes the Asia Pacific a key hub for tryptophan consumption.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Russia & CIS

Rest of Europe

APAC

China

Japan

South Korea

India

ASEAN

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Major global participants in the tryptophan market, including Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang Corporation, & others, are pursuing strategies centered on technological innovation, large-scale production, and vertical integration to secure market dominance. These companies invest heavily in advanced fermentation technologies to enhance yield and reduce costs, while also expanding global production facilities to meet rising demand in feed, pharmaceutical, and nutraceutical sectors. Strategic collaborations, mergers, and distribution partnerships broaden market reach, while sustainability initiatives and product quality certifications strengthen brand credibility and customer loyalty worldwide.

Ajinomoto Co. is a Japanese multinational food and biotechnology company that is known for its expertise in amino acid technologies and its comprehensive range of products, including seasonings. The company has historically expanded its global supply and production of feed-use amino acids, aiming to support regional animal nutrition needs worldwide.

CJ CheilJedang is a global South Korean company with divisions in food, food ingredients, bio, and feed, that is a leading producer of the amino acid tryptophan through its CJ BIO unit. It utilizes advanced fermentation technology to produce high-quality tryptophan, with its Bestamino brand being a leader in the global market.

Evonik is a global specialty chemicals company and a leader in animal nutrition, being the exclusive manufacturer of all four essential amino acids for animal feed, including TrypAMINO (L-tryptophan). The company’s strategy focuses on profitable growth and value creation by leveraging innovation in key areas such as health, nutrition, and resource efficiency.

The major players in the industry

Ajinomoto Co., Inc

CJ CheilJedang Corp.

Evonik Industries AG

AMINO GmbH

Kyowa Hakko Bio Ltd.

Senova Technology Co., Ltd.

Central Drug House

Glanbia plc

Daesang Corporation

Archer Daniels Midland

Others

Key Developments

In May 2023, CJ BIO, the biotechnology business unit of CJ CheilJedang Corp., announced that the 10,000-ton/year tryptophan capacity increase at its site in Piracicaba, Brazil, came online, bringing its capacity to 50,000 tons/year.

Report Scope