Pricing in the catastrophe bond secondary market already implies a lighter hurricane season impact and actual losses are running below expected levels, which leads Lane Financial to estimate expected returns for the cat bond market of around 10.5% in 2025, giving the potential for this to be a third year of double-digit returns in a row.

Back in July, specialist consultancy Lane Financial LLC had said that catastrophe bond pricing remained firmly in the “neutral zone” and it predicted that the market remained on-track for an expected 8.5% total return in 2025.

Fast-forward to the end of the third-quarter and Lane Financial has analysed the state of catastrophe bond market pricing and what that implies, based on secondary market pricing sheet data.

“At the end of the third quarter of 2025, the secondary market for ILS indicates that investors (underwriters) in ILS risk believe that the major hazard of landfalling hurricanes in the US is past,” the analysis states.

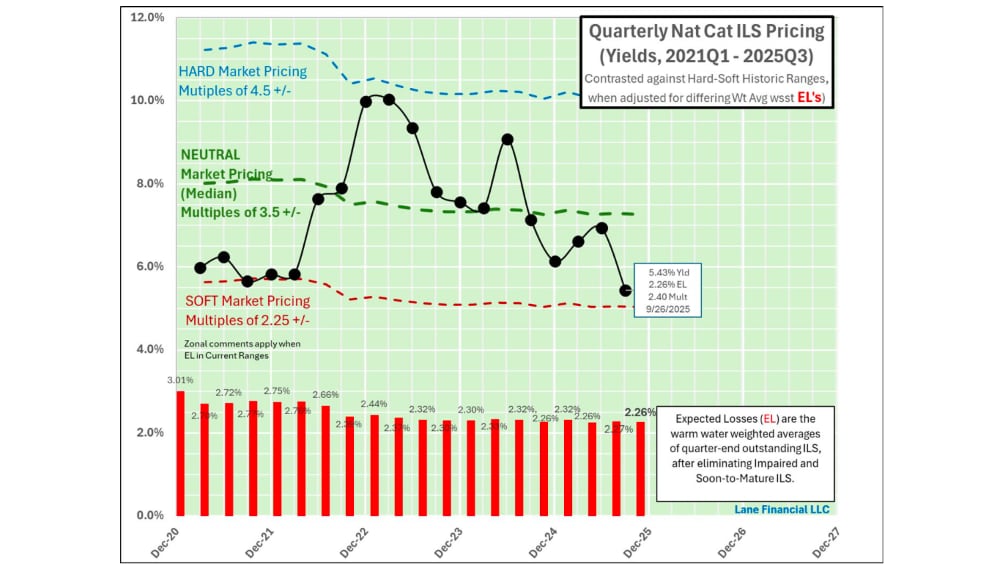

With no impacts from the hurricane season so far this year, Lane Financial notes that ILS prices have risen and yields fallen, with data now suggesting “quarter-end rates-on-line are at their historic soft market lows.”

Clearly the softening of pricing has persisted and this is also evident in the first cat bond to come to market in the fourth-quarter, as we reported in relation to USAA’s latest Residential Re deal yesterday.

Rightly, Lane Financial notes that this is good news for two market constituents, with the softer pricing indicating that catastrophe bond sponsors “will have to pay less for risk protection if the current situation holds.”

You can see Lane Financial’s latest pricing-based view of the market in the chart below, which shows the index hovering just above the soft market level at the end of Q3 2025.

But it’s also good for existing investors, as it implies stronger performance than predicted earlier in the year is now possible, in expected total returns for 2025.

At the end of Q1 and Q2 2025, Lane Financial forecast the 8.5% expected total return was a likely level of performance the catastrophe bond market could anticipate for this year.

But now, “In the light of experience, that has to be raised,” the consultancy has explained.

Cat bond prices have risen by around three-quarters to a full percentage point, “So, returns from mark-to-market increases push expected return to 9.5%.”

But added to that needs to be the current expectations on loss experience. While there are still weeks to go in the hurricane season and no guarantees a different major peril loss event could occur, at this stage Lane Financial believes another point of performance is now possible.

Expected losses at the start of 2025 were around 2.27%, but actual losses have been much less so far.

“Taking all of this into account and assuming that actual 2025 losses will be closer to 1% rather than 2.27% means that existing investors can now expect returns at 10.5%,” Lane Financial explained, adding that “More honestly stated – low double digits rather than high single digits.”

While events could occur in the final-quarter of the year and Q4 has not always been light for losses, the chances of this occurring are rising with each day.

Lane Financial said, “If however reality turns out as expected, this will mean that ILS investors will have their third double digit total return year in a row – quite a record.”

But added, “On the downside, if 2026 starts out from the prices currently in the market, it will imply that 2026 will be much leaner.”

There are a number of reasons for expected returns to be lower next year, such as the expectation of a declining floating rate of return on collateral, as well as the compressed underwriting yield spreads in the market.

Lane Financial points out that yield spreads currently don’t, “leave much room for unpleasant surprises.”

But adds that, “We doubt that further compression will occur. In the fourth quarter of the year there will be new supply of ILS and this will perhaps put a floor on falling yields. The January renewals will also do the same.”

The consultancy concludes, “While we do not expect the full effects of supply until the beginning of next year, we expect the bounce then will be modest. An early forecast of 2026 returns would therefore be for the mid-single digits.”

This new paper is not yet available on the Lane Financial website, but reach out to them and ask if you would like a copy.