Molecular diagnostics redefines healthcare–driving accessibility, equity, personalized care, and anchoring a smarter, inclusive, humane future.

For most of medical history, diagnosis has been guided by the visible and the tangible. Physicians relied on observable symptoms such as fever, cough, or pain, on physical signs such as a lump or organ enlargement, and on basic laboratory measures that assessed biochemical changes in blood or urine. While these methods have remained valuable, they often identify disease only after significant physiological damage has already occurred. X-rays may reveal tumors when they are large, blood tests may detect organ dysfunction once cells have been destroyed, and cultures may identify bacteria after they have multiplied into millions. The era of clinical guesswork, supported by lagging biomarkers, is slowly being replaced by something more precise, timely, and transformative.

Molecular diagnostics, or MDx, represents that transformation. By probing deeply into the DNA, RNA, proteins, and other molecular building blocks of life, MDx reveals the earliest signals of illness, often long before symptoms are apparent. Instead of waiting for a malignant growth to appear on a CT scan, molecular assays can detect tiny fragments of tumor DNA circulating in the blood. Instead of waiting several days for microbes to grow in culture, polymerase chain reaction–based techniques can identify pathogens within hours. This shift enables not only early detection but also a fundamental re-orientation of healthcare itself, from reactive treatment to a system that is predictive, preventive, and profoundly personalized.

At its core, MDx transcends boundaries between the laboratory bench and the patient’s bedside. It translates fundamental discoveries in genomics and molecular biology into actionable clinical insights. The transition from symptom-driven detection to molecularly driven care has been gradual but irreversible, paving the way for an age where therapies are matched to individual genetic profiles and public health surveillance can identify outbreaks as they emerge. Molecular diagnostics is influencing every corner of healthcare, not just high-tech cancer genomics in developed nations but also infectious disease management in resource-limited regions of Asia and Africa.

The scale of this impact is difficult to overstate. MDx is not merely an extension of existing diagnostic techniques; it is the foundational pillar underpinning precision medicine. By enabling clinicians to see the invisible, intervene earlier, and treat more effectively, molecular testing is actively reshaping human health outcomes worldwide.

Indian market dynamics

India today represents one of the most dynamic and fast-growing markets for molecular diagnostics, yet it is also one of the most challenging arenas for adoption. A complex interplay of factors influences the national healthcare landscape–the heavy burden of chronic diseases such as cancer, diabetes, and cardiovascular illness on the one hand, and the persistent prevalence of infectious diseases such as tuberculosis, dengue, malaria, and hepatitis on the other. This duality creates an unusually high demand for diagnostic tools that are not only accurate but also scalable and adaptable across very different disease categories.

One of the distinctive features of the Indian market is its decentralization. While high-end molecular diagnostics in the West may be concentrated in a network of large academic hospitals and centralized laboratories, in India, adoption has been more heterogeneous. Beyond major metropolitan hubs such as Delhi, Mumbai, and Bengaluru, there is growing traction in Tier-II and Tier-III cities, as well as in semi-urban and rural areas. Small diagnostic laboratories, regional laboratory networks, and even mobile testing initiatives are incorporating molecular techniques into their offerings. This reflects the adaptability of MDx to contexts outside tertiary care hospitals. Platforms like portable PCR assays, isothermal amplification technologies, and microfluidic-based diagnostic devices are particularly well suited for use in environments with limited infrastructure, and India’s vast semi-urban belt is an ideal testing ground for such innovations.

Leading players*

2024

Tier I

Thermo Fisher, Roche, Illumina, Molbio, and Cepheid

Tier II

Qiagen, 3B BlackBio, bioMérieux, HiMedia, and Abbott

Tier III

Bio-rad, Agappe, Snibe, Genes2me, Randox, MGI, and Genetix

Others

Transasia, BD, Oxford Nanopore, Agilent, Helini, Mylab, MedGenome, Altona, CoSara, Huwel, Trivitron, Meril, Neodx, Siemens, FlashDx, SeeGene, and Zybio

*Vendors are placed in different tiers on the basis of their sales contribution to the overall revenues of the Indian molecular diagnostics instruments & reagents market.

ADI Media Research

Government policy has been a key accelerator. National efforts for tuberculosis control, which incorporated high-throughput molecular platforms, demonstrated how rapid molecular tests could be integrated into large-scale public health programs. More recently, the pandemic catalyzed the funding and deployment of PCR testing capacity across the subcontinent, leaving behind an installed base of equipment and a more aware ecosystem of clinicians, laboratorians, and patients. Programs like the Ayushman Bharat Digital Mission provide a framework within which molecular reporting and results can be linked with electronic health records at scale, further boosting integration.

The private sector has been equally instrumental. India’s well-established diagnostic chains–such as Dr. Lal PathLabs, Metropolis, and Thyrocare–are expanding molecular offerings beyond metro cities, bringing advanced tests to Lucknow, Indore, Coimbatore, and Guwahati. Their business model relies on centralized processing but with geographically distributed collection centers, which makes it possible for even smaller towns to access oncology biomarker panels, infectious disease MDx assays, and pharmacogenetic profiling. This hybrid delivery model has proven especially effective in reducing disparities in access to advanced testing.

Still, challenges remain formidable. Costs remain a primary hurdle. Most next-generation sequencing technology and high-value oncology assays are imported, which drives up prices for Indian patients and keeps them out of reach for all but affluent households or institutions. Reimbursement policies by insurers rarely cover molecular testing, particularly for preventive or predictive purposes. As a result, patients often pay out-of-pocket, slowing uptake.

Indian market trends in molecular diagnostics instruments and reagents industry

Rhema Elizbeth Thomas

Rhema Elizbeth Thomas

Executive Director,

Agappe Diagnostics Ltd

India’s molecular diagnostics (MDx) instruments and reagents market continues its strong upward trajectory in 2025, fuelled by growing healthcare demands, increased genomic research, and significant investment in public health infrastructure. According to recent estimates, the Indian MDx market is projected to surpass USD 1.4 billion by 2026, indicating a CAGR of over 18 percent from 2022 levels.

Key growth drivers include the post-pandemic momentum, which drives the adoption of MDx tools across hospitals, diagnostics labs, and research institutions. The expansion of non-communicable disease screening–especially for oncology, diabetes, and cardiovascular diseases–is a primary catalyst. Government-backed initiatives, such as the Ayushman Bharat Digital Mission and the National Genomic Grid, have intensified the integration of molecular testing into standard care protocols.

Emerging segments and technologies are numerous.

In oncology and genetic testing, demand for liquid biopsy assays, companion diagnostics, and tumour mutation profiling is rapidly increasing. The affordability of Next-Generation Sequencing has enabled deeper penetration into Tier 2 cities.

In infectious disease diagnostics, MDx testing remains essential for TB, HIV, Hepatitis, and HPV. The emergence of antimicrobial resistance (AMR) surveillance panels is pushing further innovation. In women’s and neonatal health, non-invasive prenatal testing, newborn screening, and HPV DNA testing are experiencing accelerated adoption. Besides, I POCT, the shift towards decentralised diagnostics, especially in rural health setups, has seen portable MDx platforms being deployed for TB, dengue, STIs, and glucose monitoring.

However, the market is witnessing strategic collaborations between Indian and global players to manufacture reagents and instruments domestically. The integration of AI in diagnostic workflows, particularly in image-guided molecular analysis and real-time PCR platforms, is paving the way for precision diagnostics.

With regulatory streamlining by the CDSCO and increasing public-private partnerships, the Indian MDx landscape is evolving rapidly, making it a strategic growth hub in Asia.

Agappe is advancing MDx-based diagnostic solutions for tuberculosis and leptospirosis, aiming for commercialization after development completion. Building on its Agappe Chitra Magna RNA Extraction, Reagent, and the LumeScreen-nCoV, RT LAMP-based COVID-19 Assay, the company is committed to delivering fast, accurate, and reliable diagnostics that strengthen global healthcare and support early detection of infectious diseases.

Another barrier lies in human resources. Skilled molecular pathologists, genomics analysts, and bioinformatics specialists remain concentrated in academic hubs. While demand is increasing nationwide, training has not kept pace. Small laboratories that have invested in instruments often find themselves short of skilled manpower to run and interpret high-complexity assays.

Regulatory mechanisms are still early in development. Unlike the structured pathways offered by the United States’ FDA or the European Union’s CE-IVD route, India is still building comprehensive frameworks for approving novel MDx kits and devices. This creates uncertainty for innovators and slows down the translation of laboratory discoveries into commercial products.

Despite these constraints, India’s opportunity lies in localization and innovation. The indigenous manufacturing of reagents and kits under the Make in India initiative has begun, holding the promise of dramatically reducing input costs. Startups are experimenting with low-cost microfluidic systems, CRISPR-powered paper-strip diagnostics, and battery-operated amplification tools adapted for field use in rural clinics. Furthermore, integrating molecular oncology and infectious disease MDx testing into mainstream public health programs, from HPV screening to antimicrobial resistance monitoring, will increase volume utilization and broaden impact. If India successfully aligns cost reduction, skill building, and government-driven integration, it could emerge not only as a major MDx consumer but also as a global manufacturing hub.

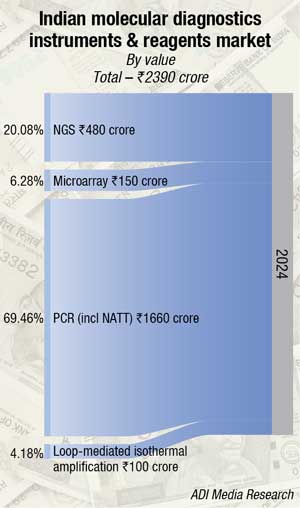

The Indian MDx instruments and reagents market was valued at ₹2,390 crore (USD 1.3 billion) in 2024, reflecting robust expansion as adoption deepens across clinical and reference laboratories. Demand for PCR testing (including NAAT) remains high–retaining a dominant 70-75 percent share of India’s MDx market following pandemic-fueled acceleration, with hospitals and labs continuing to rely on its sensitivity, speed, and versatility for infectious disease diagnostics and genetic screening. This entrenched position is expected to hold over the next decade given ongoing innovations in real-time and digital PCR platforms.

Molecular diagnostics in India – Growth and prospects

Yin Li-Head

Snibe Instrument R&D,

Shenzhen New Industries Biomedical Engineering Co., Ltd

Molecular diagnostics involve extracting and detecting RNA or DNA, analyzing their sequences to identify risk signals for specific diseases. This technology is widely used for disease diagnosis, monitoring, risk assessment, and determining individualized treatment plans. The rapid development of this technology has brought revolutionary changes to the healthcare industry, enabling doctors to formulate more precise treatment plans based on the specific genetic information of patients.

In India, the spread of infectious disease viruses such as hepatitis B and dengue, along with the increasing prevalence of chronic diseases like cancer and diabetes, has driven the rapid development of molecular diagnostics in the Indian market. Currently, PCR (Polymerase Chain Reaction) and NGS (Next-Generation Sequencing) technologies are relatively mature and widely applied due to their high sensitivity and specificity, rapid detection capabilities, and applications in personalized medicine. These technologies not only help researchers gain deeper insights into the genetic basis and variations of diseases but also assist public health authorities in more effectively controlling outbreaks.

However, complex and cumbersome operations, reliance on skilled professionals, the large space required for multi-step processes, and the high costs of instruments and reagents all hinder the development of this technology.

To address the current challenges, some companies are focusing on the research and development of fully automated instruments, aiming to achieve fully automated nucleic acid testing from sample collection to result presentation. Automated testing offers higher efficiency and safety, reduces manual operations, avoids cross-contamination, improves laboratory space utilization, and provides reliable and accurate analytical performance, thereby promoting the widespread application and development of molecular diagnostic technologies. For example, Snibe has launched the Molecision™ R8, which features fully automated detection capabilities.

With the continuous advancement of technology and the increasing market demand, molecular diagnostics in India are gradually moving towards broader applications, providing solid support for improving public health standards. In the future, with increased policy support and investment, molecular diagnostics are expected to play a role in more areas, including early screening, personalized treatment, and public health monitoring, contributing even more to health initiatives in India and globally.

Next-generation sequencing (NGS) maintains significant relevance, especially in oncology, hereditary disease diagnostics, and pharmacogenomics, but its market share in India lags due to cost and workflow complexity. Investments and infrastructure upgrades are projected to boost NGS uptake in coming years.

Microarray and loop-mediated isothermal amplification (LAMP) technologies, while commanding an estimated 5 percent share each of the Indian MDx market, are nonetheless experiencing sustained global growth, driven by advances in automation, AI-enabled data analysis, and expanded clinical and industrial applications. LAMP is rapidly gaining traction in infectious disease testing–particularly in point-of-care (POC) and resource-limited settings–thanks to its speed, affordability, and operational simplicity compared to PCR. Similarly, microarrays are propelled by rising demand for personalized medicine and cancer research, with data-driven platforms supporting more efficient gene profiling and biomarker discovery. Both segments face future competition from increasingly accessible NGS platforms, yet remain essential for applications requiring high-throughput targeted analysis.

Advancing molecular diagnostics in India

Dr Rajas V Warke

Dr Rajas V Warke

Director-Molecular Biology & Virology,

HiMedia Labs Pvt. Ltd.

The molecular diagnostics market in India is witnessing rapid expansion driven by the critical need for precise and timely disease detection. This surge is propelled by the increasing incidence of infectious and chronic conditions such as tuberculosis, hepatitis, cancer, and antimicrobial resistance (AMR). As innovative molecular technologies evolve alongside strengthened government healthcare infrastructure, adoption rates across the country continue to accelerate. Nationwide screening and surveillance programs are playing a pivotal role in integrating these advanced diagnostic tools into mainstream healthcare.

High-throughput PCR assays and automated nucleic acid extraction platforms have become essential in both public and private healthcare sectors. These affordable and scalable diagnostic solutions are progressively reaching beyond major metropolitan centers into Tier 2 and Tier 3 cities, thereby expanding access. Furthermore, these systems enhance turnaround times and diagnostic accuracy, establishing molecular diagnostics as a foundational pillar in India’s transforming healthcare landscape.

HiGenoMB® – HiMedia Laboratories stands as one of the key contributors to this transformation, serving Government institutions and leading diagnostic chains across the country. By strictly adhering to regulatory standards and investing in robust infrastructure and skilled personnel, the company addresses challenges related to cost, accessibility, and reliability. The rising demand for reliable diagnostic tools is further supported by advancements in domestic manufacturing capabilities and stringent regulatory frameworks, making molecular diagnostics both affordable and sustainable.

HiGenoMB® offers a comprehensive portfolio of diagnostic solutions customized to meet the unique healthcare needs. With sample collection devices such as cfDNA and cervical specimen collection kits, HiGenoMB® ensures accurate sample storage and transportation. Automated extraction instruments such as Insta NX® Mag16 Plus (1 to 16 samples) and Mag24 (1 to 24 samples) combined with HiPurA® Pre-filled kits featuring cartridges and plates, help streamline workflows, delivering cost-effective, high-quality testing solutions suited to diverse diagnostic samples. Our broad array of CE-IVD, CDSCO-approved products also include real-time detection and quantification kits for respiratory and febrile illnesses, HBV, HCV, and AMR detection.

Through its commitment to quality and affordability, HiMedia Laboratories is not only fortifying India’s diagnostics sector but also ensuring the country is well-equipped to meet the rising demand for sophisticated molecular testing.

The Global MDx market

Globally, the momentum around molecular diagnostics is unmistakable. According to Coherent Market Insights, the global molecular diagnostics (MDx) market is valued at USD 18.36 billion by 2025. It is projected to nearly double to USD 41.63 billion by 2032, growing at a compound annual growth rate (CAGR) of over 12 percent. This growth is rooted in multiple structural trends that span multiple continents.

The world is grappling with the rising incidence of non-communicable diseases, notably cancer, cardiovascular disorders, and metabolic syndromes. Cancer alone accounts for more than 20 million new cases annually, driving unprecedented demand for accurate, early, and personalized diagnostics. At the same time, infectious disease preparedness has become a global priority in the wake of Covid-19, reinforcing the role of rapid molecular tools that can be deployed swiftly in the face of pandemics. Concurrently, the proliferation of genetic testing for rare diseases and for preventive health has expanded the application set far beyond hospital wards, into wellness clinics, fertility centers, and even consumer-facing genome services.

The technology base driving this expansion is broad. Polymerase chain reaction remains the workhorse of clinical molecular testing, but next-generation sequencing and whole genome sequencing are increasingly being integrated into clinical workflows, enabling deeper insight into tumor biology, rare disease mechanisms, and resistance pathways. CRISPR-based assays, once a futuristic concept, are now entering commercial use, offering the potential for laboratory-grade accuracy in portable point-of-care formats. Integration with artificial intelligence and big data systems further strengthens these technologies, allowing raw molecular signals to be translated into actionable decision support for clinicians.

From a market perspective, reagents and kits are the backbone, accounting for more than sixty-five percent of global revenue in 2025. Unlike capital-intensive instruments, which have long replacement cycles, reagents and kits are consumed on a per-test basis, assuring recurring demand. Their availability and quality determine the accuracy of diagnostic workflows. Oncology is the single-largest driver of clinical adoption, representing more than a third of applications. Diagnostic laboratories and hospitals remain the fulcrum of end-user demand, with nearly half the global market anchored in these institutions due to their ability to scale large volumes with automation and skilled workforces.

Regionally, North America continues to lead with about forty-two percent of global share, reflecting strong innovation in genomics research, favorable regulatory conditions, and the concentration of global diagnostic players headquartered there. Europe remains a critical market, though its new In Vitro Diagnostic Regulation has slowed the entry of novel kits with more stringent approval conditions. Asia-Pacific is the fastest-growing region, where large patient populations, government healthcare investments, and cost efficiencies in China and India combine to accelerate expansion.

The barriers are nonetheless significant. The high cost of instruments and consumables creates accessibility gaps in emerging economies, where public sector budgets remain constrained. Reimbursement limitations in many countries delay the adoption of new technologies, while lengthy regulatory timelines can inhibit innovation. Human capital shortages–lack of trained bioinformaticians, precision pathologists, and lab technologists–pose a global bottleneck. These challenges underscore that while molecular diagnostics is growing rapidly, equitable access across geographies remains a central hurdle.

Clinical impact–From oncology to infectious disease

The clinical consequences of molecular diagnostics are already visible across major domains of medicine. In oncology, molecular assays have revolutionized treatment strategies. Instead of prescribing uniform chemotherapy, clinicians today can identify actionable mutations such as EGFR, KRAS, BRAF, or HER2 and guide therapy choices accordingly. Patients with EGFR mutations in lung cancer can now receive targeted EGFR inhibitors rather than cytotoxic regimens, while women with HER2-positive breast cancer benefit from trastuzumab and related therapies. Next-generation sequencing-based tumor profiling allows the discovery of even rarer mutation subsets, providing comprehensive roadmaps for treatment decisions across immunotherapies and targeted options. Liquid biopsy complements these approaches by offering a blood-based, minimally invasive modality to monitor treatment responses and detect disease recurrence in real time. This reduces reliance on repetitive tissue biopsies and enables oncologists to modify therapy strategies proactively.

Rare genetic diseases provide another arena of dramatic impact. For decades, families with children suffering from unexplained neurological or developmental problems often endured what is called the “diagnostic odyssey”–multiple inconclusive tests over years before arriving at a definitive diagnosis. Molecular diagnostic tools, particularly exome sequencing and genomic panels, have cut down this odyssey, allowing clinicians to pinpoint single-gene mutations responsible for a disease within weeks. This not only aids in early medical intervention but also opens doors to gene therapies and experimental treatments in conditions like cystic fibrosis, Duchenne muscular dystrophy, and beta-thalassemia.

Pharmacogenomics is expanding MDx into mainstream prescribing decisions, beyond specialized disease categories. Genetic variation in cytochrome P450 (CYP450) enzymes, for example, significantly influences how patients metabolize drugs ranging from antidepressants to anticoagulants. Testing for these variants enables customized dosing or alternative drug selection, greatly reducing adverse reactions while increasing therapeutic efficacy. Similarly, BRCA gene status informs not only cancer risk but also guides preventive interventions, including prophylactic surgeries and targeted chemoprevention, illustrating how molecular testing can shift healthcare from cure to prevention.

Molecular diagnostics has shown perhaps its most immediate life-saving power in infectious diseases. During the Covid-19 pandemic, PCR tests became a household term, symbolizing the power of rapid diagnostics in curtailing an unknown global threat. Today, the portability of RT-LAMP assays, the specificity of CRISPR-based tests, and the adaptability of lab-on-a-chip systems are enabling accelerated detection of pathogens ranging from tuberculosis to dengue. These technologies have compressed detection timelines, once counted in days or weeks, to mere hours, which is essential to breaking chains of transmission and preventing outbreaks.

Core technologies at work

At the heart of MDx are core technological pillars that continue to evolve. Polymerase chain reaction remains the most widely used, with advanced variations such as real-time quantitative PCR and digital PCR now offering unparalleled sensitivity and precision. Digital PCR, in particular, enables the detection of rare mutations with quantitative accuracy, proving invaluable in oncology and minimal residual disease monitoring. Next-generation sequencing has democratized genomic analysis, allowing comprehensive profiling of tumors, pathogen genomes, and rare disease panels. CRISPR-based diagnostic tools like SHERLOCK and DETECTR exemplify a new generation of adaptable, ultrafast assays suitable for both clinical labs and point-of-care use. Liquid biopsy technology leverages the analysis of cell-free DNA, circulating tumor cells, and exosomes in the bloodstream, enabling non-invasive monitoring of cancer with remarkable utility. Meanwhile, portable benchtop NMR analysis is beginning to extend molecular diagnostics into the realm of cardiology and metabolic disorders, by enabling fast lipoprotein profiling at the clinic level. The growing convergence of multi-omics platforms is perhaps even more revolutionary, integrating genomics with transcriptomics, proteomics, and metabolomics to provide a holistic perspective on disease biology.

Digital transformation–AI, automation, and integration into healthcare systems

Molecular diagnostics is evolving into a data-intensive, digitally powered domain. Artificial intelligence and big data analytics are central to interpreting the massive volumes of molecular data generated by sequencing and multi-omics technologies. Machine learning algorithms distinguish significant signals from background noise, predict disease risks, and help classify genetic variants as benign or pathogenic with speed and reliability. Hospitals and laboratories are embedding AI-driven platforms into daily workflows, transforming once-specialized analyses into standard operating procedures.

Automation is playing a pivotal role in scaling up. Robotic liquid handling, automated nucleic acid extraction, and fully integrated sample-to-answer MDx systems reduce manual errors and increase throughput, ensuring that results are not just accurate but also timely. Integration with laboratory information systems and electronic health records connects diagnostic data seamlessly to clinical decision pathways. This ensures that test results directly inform care, whether it is oncologists adjusting regimens or infectious disease specialists tailoring antibiotics. Cloud-based molecular data platforms and trusted research environments allow for secure, large-scale analyses across institutions, enabling collaborations in biomarker discovery and epidemiological mapping.

From innovation to sustainable adoption

The next phase in MDx is not merely one of innovation but of sustainable adoption. It is not enough to pioneer increasingly advanced tools; technologies must become widely available, affordable, and aligned with healthcare system priorities. Reagents and kits, already the backbone of testing, will play a large role in sustainability by being locally produced, affordable, and compatible with both centralized and point-of-care platforms. Whole genome sequencing, steadily becoming more cost-efficient, is poised to change preventive medicine by revealing genetic predispositions to disease and guiding intervention years before illness manifests. The integration of multi-omics strategies will allow clinicians to capture the full complexity of disease, moving away from single-gene explanations to a network-based understanding of health and pathology.

Healthcare transformation, however, depends as much on policy alignment as it does on technological advancements. Equitable reimbursement frameworks, training programs to address workforce shortages, and infrastructure capable of managing vast data sets are essentials. As molecular diagnostics begin to pervade community clinics and even home settings through decentralization, sustainability will be measured in terms of not just scientific excellence but social inclusion and economic viability.

What lies ahead

The future of molecular diagnostics is being shaped by three converging dynamics–the rapid expansion of point-of-care testing beyond respiratory pathogens into broader disease categories, the evolution of more focused and cost-effective testing panels that align with clinical decision-making, and the integration of MDx into global preparedness systems for outbreak detection and rapid response.

In the post-pandemic era, molecular diagnostics is transitioning from being a laboratory specialty to becoming a public necessity, fundamental not just to healthcare delivery but to global health security. The future is one where rapid, molecular-level insights are available at community clinics, where AI translates genomic raw data into actionable care paths instantly, and where disease burden can be anticipated and intercepted earlier than ever before.

The story of molecular diagnostics is not simply about technological progress; it is about reimagining healthcare delivery. For India, the challenge lies in making it accessible and affordable across its diverse population, while for the global community, the central issue remains equitable distribution. For clinicians and researchers, it is about ensuring that tests translate into effective patient management. And for patients, it represents the hope of care that is truly personalized–care shaped not by averages but by the unique molecular blueprint of the individual.

This is why molecular diagnostics is not merely part of modern medicine; it is its cornerstone, anchoring a healthcare future that is faster, smarter, more inclusive, and ultimately, more humane.

Second opinion

Molecular diagnostics revolutionizing early detection and treatment.

Molecular diagnostics at scale – Transforming public health screening in India.