Support CleanTechnica’s work through a Substack subscription or on Stripe.

New York Climate Week has come and gone, but the renewable energy news keeps rolling along, even here in the US where federal energy policy has taken an abrupt U-turn under President Donald Trump. One way or another, renewable energy stakeholders are keeping themselves busy until January 20, 2029, when President Trump is scheduled to leave office — peacefully one hopes, this time. Some particularly interesting areas of activity have been percolating under the media radar, so let’s catch up.

1. The Renewable Energy Winds Keep Blowing

To be clear, the next US president to occupy the Oval Office may not necessarily embrace the renewable energy transition with open arms, but that’s up to the US electorate. Fingers crossed!

Meanwhile, the US wind industry has suffered a series of setbacks under the current President’s new “American Energy Dominance” policy but some projects continue to slip through the barricades. One area to watch is the wind farm repowering field, where existing wind turbines are replaced or upgraded. In come cases a repowering project can provide the same (or more) generating capacity with fewer turbines.

New onshore wind farms are few and far between these days, but signs of a sea change in state energy policy are brewing in Wisconsin. The state was an epicenter of pushback against wind energy during the Obama administration and its Public Service Commission stopped approving new wind farms in 2011, so it was big news last week when the Wisconsin PSC approved the proposed 118-megawatt Badger Hollow Wind Energy Center, a project of the leading US firm Invenergy.

The offshore wind industry is particularly vulnerable to federal policy-making because it depends almost exclusively on offshore leases issued by the Interior Department’s Bureau of Ocean Energy Management. Under Trump’s orders, BOEM has halted new leases and attempted to stop work on projects already deep into the construction phase. However, work still carries on at two threatened projects, Empire Wind in New York and Revolution Wind in Massachusetts. Work is also continuing at the CVOW project Virginia in Virginia, which has somehow mysteriously (or not so mysteriously) avoided interference from the Trump administration so far.

2. Texas Still Attracts Renewable Energy Innovators, Now RNG In Play

Despite the red-hot rhetoric blowing out of the halls of the state legislature, Texas established itself as a renewable energy leader in the US since the early 2000’s, first with wind energy and more recently with solar.

Texas is also looking to add renewable natural gas to its renewables roster. Among other areas of RNG activity around the state, the University of Texas at Austin is hosting the new Hydrogen ProtoHub demonstration and research facility at its J.J. Pickle Research Campus. The program is designed to help clean energy innovators fine tune their systems and scale up for commercial application.

Extracting hydrogen from landfill gas is one of the projects under way at the facility, along with a new all-in-one system that produces hydrogen from a reaction between sunlight and water. Collaborators in the ProtoHub facility include the not-for-profit corporation GTI Energy, which has been assessing how natural gas infrastructure in the Gulf Coast can be repurposed for RNG as well as green hydrogen and synthetic natural gas.

3. Hydropower Taps Self Back In

The US hydropower industry has been all but mothballed for decades, relying on an aging fleet of existing hydropower dams and a handful of pumped storage projects. Still, those pumped storage projects represent one of the few long duration systems in widespread use today. The need for long duration energy storage is rising alongside the renewable energy transition and new demands on the nation’s electricity grid, which means that the pumped storage industry is primed for expansion.

The fresh burst of activity this year includes two pumped storage proposals in Nevada and Wyoming from the firm rPlus Hydro, which first surfaced on the CleanTechnica radar in 2023. As of September those two projects are still working their way through the approval process, along with about a dozen others in the rPlus pumped storage portfolio.

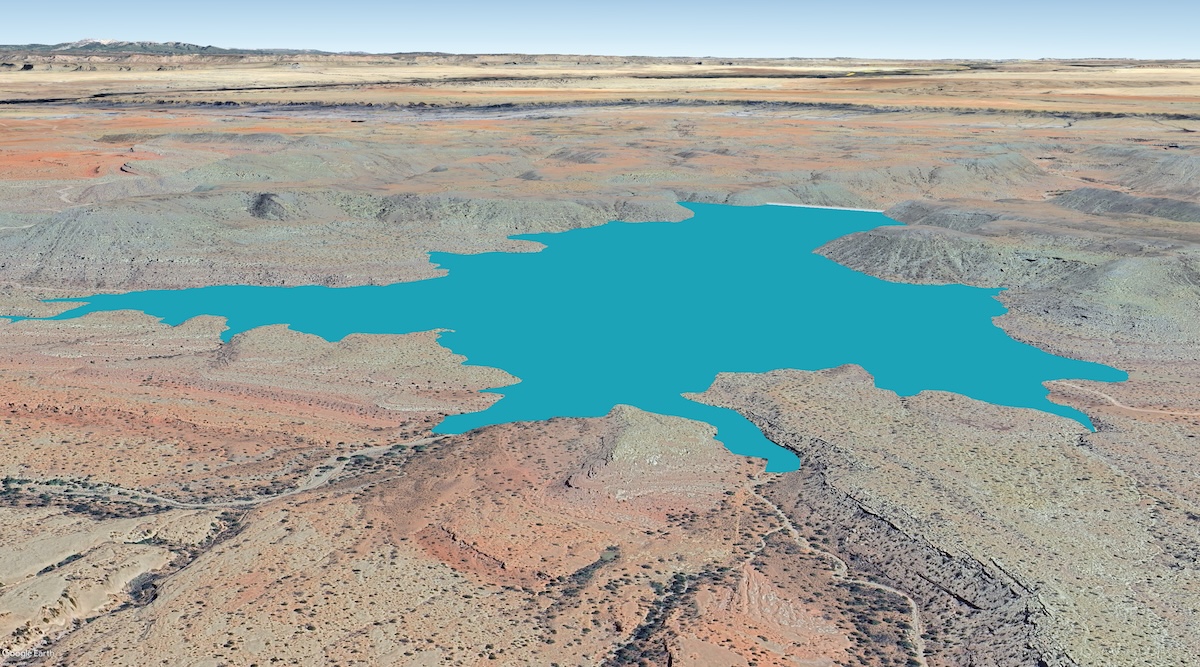

Meanwhile, in New Mexico a multi-partner collaboration aims to fast-track the proposed 1.5-gigawatt Carrizo Four Corners Pumped Storage Hydropower Center Project, which is designed as a model for similar projects elsewhere in the region.

4. Follow The Money: Corporate Renewable Energy Buyers Continue To Step Up

Corporate America has a mixed record on renewable energy, to put it mildly. However, some corporate citizens can give themselves a pat on the back for deploying their purchasing power to push the market for wind and solar energy. Their advocacy was particularly change-making in the early 2000’s, when the cost of wind and solar energy was relatively high.

In 2016 the Renewable Energy Buyers Association launched with the aim of connecting leading corporate energy consumers with more renewables. A shift in focus and a change of name to Clean Energy Buyers Association occurred in 2021 and the organization continues to make the case for corporate action.

Earlier today CEBA released a new report describing how corporate support has smoothed the way for 251 wind and solar projects spanning Texas and two other leading power markets. “Corporate clean energy buyers often enter into long-term contracts with clean energy projects to purchase the future electricity produced for a fixed price,” CEBA noted. “It’s only possible to finance a project if the loan provider knows who will buy the electricity and at what price, so without these contracts, projects won’t get the necessary loans to finance development.”

5. What About All Those Other Renewable Energies?

Of course, wind and solar are not the only renewable energy resources at hand in the US. In fact, the President’s “American Energy Dominance” policy explicitly supports three other forms of renewable energy: biomass, hydropower, and geothermal energy. The Energy Department has also slipped marine energy into the mix, referring to devices that harvest kinetic energy from ocean waves, tides, and currents.

Abundant as they are, none of these renewable energy resources pose a particular threat to fossil energy stakeholders in the power generation field, at least not at the present time. Unlike the wind and solar industries, the biomass, hydro, geothermal, and marine energy industries all face structural roadblocks of one sort or another.

Still, workarounds are emerging. In particular, the pace of technology development is picking up in the geothermal industry, so keep an eye out for new signs of commercial activity in that area.

Image (cropped): As demonstrated by a proposed pumped storage hydropower project in New Mexico, significant new renewable energy projects keeps surfacing in the US despite the abrupt U-turn in federal energy policy this year (courtesy of New Mexico State University).

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Advertisement

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.