Executive Summary and Key Takeaways

As a Silicon Valley corporate lawyer advising high-growth companies and their boards, I have seen firsthand how capital strategy, disclosure, governance, and litigation risk all intersect. In today’s market, emerging growth companies, whether focused on the technology, clean energy, or life sciences sectors, must work within multiple, complex financing structures, each with its own legal frameworks, financial reporting obligations, and reputational implications.

The U.S. capital markets have undergone a significant transformation from 2019 to 2025, experiencing extreme volatility, regulatory uncertainty, and the emergence of innovative financing structures. Following the unprecedented boom of 2021, when IPO proceeds reached $155.8 billion, and the subsequent contraction in 2022-2023, the market has been in a period of selective recovery and structural adaptation.

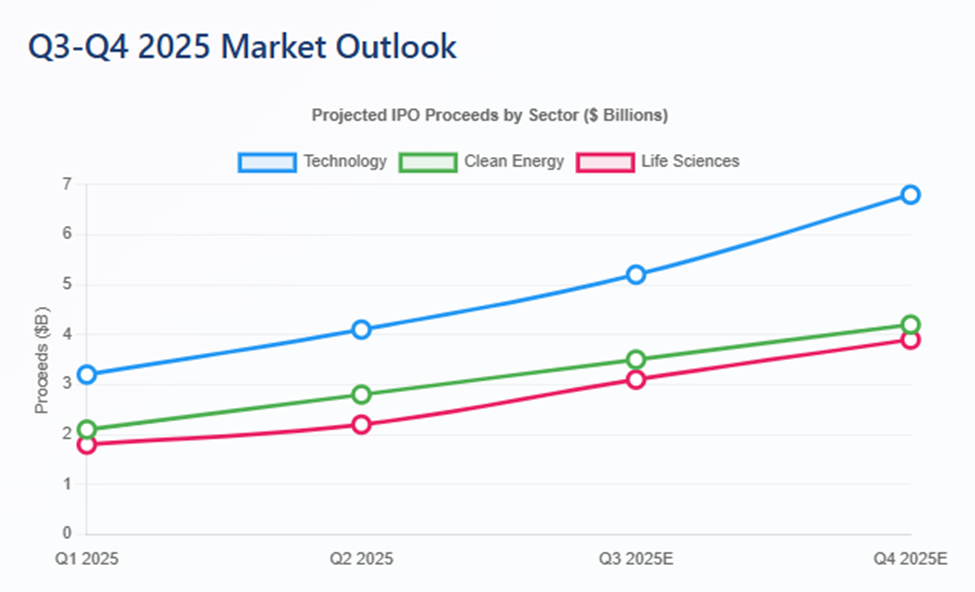

As of mid-2025, technology, clean energy, and life sciences companies are experiencing an increasingly complex landscape of financing options. Traditional IPOs have raised more than $30.8 billion through September 30, 2025.

What 2025 presents, in my albeit opinionated view, is a market of selective access. The capital is there, but only for the prepared, the credible, and those who choose the right instrument for the right moment. In this environment, optionality beats perfection, liquidity beats price, and readiness beats hope.

The capital markets landscape of 2025 represents both continuity and change from historical norms. While traditional IPOs remain important for establishing public currency and achieving liquidity, the proliferation of alternative financing mechanisms provides companies with unprecedented flexibility in accessing capital.

The technology, clean energy, and life sciences sectors each face distinct challenges and opportunities. Technology companies must demonstrate sustainable business models and paths to profitability. Clean energy firms benefit from policy support but require patient capital for long development cycles. Life sciences companies must carefully consider the timing of capital raises around clinical and regulatory milestones.

Looking forward, successful navigation of capital markets will require sophisticated understanding of products, careful preparation across multiple workstreams, and strategic timing of market entry. Companies that invest in readiness, maintain flexibility in structure selection, and execute with experienced advisors will be best positioned to capitalize on improving market conditions.

The remainder of 2025 and into 2026 promises to be a period of continued recovery and innovation in capital markets. While unlikely to reach the exuberant heights of 2021, the market is establishing a new equilibrium that balances investor protection with capital formation efficiency. Companies that understand these dynamics and prepare accordingly will find receptive markets for well-structured transactions at appropriate valuations.

As we progress through this transitional period, the convergence of traditional and alternative financing methods will continue, creating hybrid structures that combine the best features of multiple products. This evolution, combined with regulatory modernization and technological advancement, suggests that despite recent challenges, the U.S. capital markets will maintain their position as the premier destination for growth company financing.

The path forward requires careful navigation but offers substantial opportunity for prepared companies with compelling value propositions. By understanding the comprehensive landscape of financing alternatives, regulatory requirements, and market dynamics outlined in this survey, companies can make informed decisions that optimize their capital structure while positioning for long-term success in the public markets.

In 2025, public capital markets can still be your ally, but only if you respect their pace, their rules, and their cycles. My counsel after 25 years in these trenches: be ready, be flexible, and never assume the window will still be open tomorrow.

The following comprehensive, multi-part report examines the current state of capital markets products, regulatory requirements, cost structures, and provides strategic guidance for companies considering public market transactions in the remainder of 2025 and beyond so boards can make informed, compliant, and strategic decisions.

Before We Get Started – Making Sense of the Jargon

Before we dive deep into the subject, to put us all on the same page, let us put some definition around the jargon.

Primary Offering: a public offering of securities directly by a company, sometimes referred to as “the issuer.” The company or issuer receives the proceeds.

Secondary Offering: a public resale offering by stockholders of the company or issuer; the proceeds of the offering are received by the stockholders, rather than the company.

Follow-on Offering: a public offering after an IPO, which could be a primary offering with proceeds to the company or a secondary offering with proceeds received by the stockholders, or some combination of both. Most follow-on offerings are typically registered with the SEC on either Form S-1 or Form S-3. In rare instances, there can be a private follow-on offering, which is typically exempt from registration in reliance on Rule 506(b).

Form S-1: refers to the long-form registration statement used for initial public offerings and other transactions for which a short-form registration statement is not available. Issuers cannot affect an at-the-market primary offering on Form S-1 (but secondary offerings can be effected on Form S-1).

Form S-3: refers to the short-form registration statement that incorporates much information by reference to longer periodic reports filed by public companies. A Form S-3 can be a shelf-registration statement for a delayed, at-the-market primary offering of various securities, sometimes referred to as a “universal shelf.” It can only be used by issuers that have been reporting companies for one year or more with a non-affiliated market cap of at least $75 million. Baby shelf rules permit smaller issuers to issue up to one-third of non-affiliate market cap per year. These limitations do not apply to secondary offerings by listed companies.

PIPE: refers to a private investment in public equity, usually coupled with an obligation of the issuing company to file a “resale registration statement” to enable the PIPE investors to sell into the market at a later time. PIPEs are generally considered an expensive way to raise capital. Issuers are usually companies that could not raise capital through a traditional public offering or “shelf takedown.” Investors are typically institutional or accredited investors. PIPE investors enter into private purchase agreements to acquire securities at a fixed price. Securities cannot be immediately resold because they are “restricted securities.” PIPEs are often made through a placement agent. The investor is granted registration rights that require the issuer to file, soon after closing the offering, a resale registration statement and have it declared effective. The security sold in the PIPE can be common stock, convertible preferred stock, convertible notes, warrants, or other securities. Transaction counterparties sometimes structure IPEs to involve some combination of the foregoing, with warrants being regular, contingent, funded, or unfunded. Notes can be amortizing or not. Structured PIPEs may involve terms, restrictions, consent rights, anti-dilution provisions, optional and mandatory conversion and redemption features, and preemptive and board designation rights. Definitive documents usually consist of a common stock purchase agreement (or securities purchase agreement), registration rights agreement, and maybe a form of convertible note and/or warrant. To market a PIPE, a private placement agent or underwriter will need to “cross the wall” and comply with Regulation FD. Transactions must be immediately announced on Form 8-K so the investor does not have material non-public information.

Benefits of a PIPE include:

Alternative source of capital which can be obtained quickly notwithstanding the public market environment

Confidential marketing process

Typically, lower transaction expenses than registered offerings

Relatively limited offering documentation that has become fairly standardized

Continued control over shareholder base (assuming friendly investor)

Downsides of PIPEs include:

More expensive capital than a traditional public offering because of resale restrictions (e.g., an illiquidity discount is priced in). Investors in a PIPE traditionally get a discount on the market price of the stock, which could be in a range of 20% or more.

Failing to timely file or obtain effectiveness of the resale registration statement can result in monetary penalties.

Investor-specific covenants and control over company actions in certain types of structured transactions.

Restrictions on implementing PIPEs can include:

The ubiquitous “20% rule,” a stock exchange rule which requires the company to solicit stockholder approval before the issuance of securities in a private placement if the amount of common stock issued (or the amount issuable as a result of the conversion) exceeds 20% of the issuer’s outstanding stock (not fully diluted), unless the stock is issued at a price that equals or exceeds the minimum price (e.g., the market price) of the stock, subject to some exceptions.

SEC Rule 415, a rule by which the SEC can challenge a secondary offering as essentially being a primary offering disguised as a secondary offering.

Individual ownership limits. PIPE investors seek to avoid beneficial ownership limits that could trigger a Schedule 13D or 13G filing, so parties use “conversion blockers” and “prefunded warrants” to address ownership issues.

Convertible Notes: are different in the public company context than in the start-up world or in Rule 144A offerings and can be used by either private or public companies. Potential terms include:

Principal

Interest

Maturity date

Events of default

Amortization, pay-in-kind or PIK features, and PIK interest

Secured or unsecured

Conversion price and conversion price adjustments

Registration rights

Affirmative and negative covenants

Minority holder rights

RDO: refers to a “registered direct offering,” which is a public offering sold by a placement agent on a best-efforts basis, rather than on a firm commitment basis. An RDO is marketed and sold much like a PIPE, but issuing shares by the issuer is registered so that subsequent registration of the securities issued in the offering is not required. The securities issued in an RDO are usually registered on a Form S-3 universal shelf registration statement, but they can also be done on a Form S-1 (known as a “bullet registration statement”).

CMPO: refers to a “confidentially marketed public offering.” A CMPO is an underwritten registered public offering made under an S-3 shelf registration statement under which the underwriter confidentially markets the offering to a select group of wall-crossed institutional investors, often on an overnight basis. Sometimes, the CMPO is marketed to the public for a short period following the confidential marketing effort.

ATM: refers to an “At-the-Market Offering,” where a listed company sells newly issued shares into an existing trading market through a designated sales agent at market prices. The sales agent may act on an agency basis or a principal (firm commitment) basis, but in recent times, more typically on an agency basis. Sales are consummated as ordinary brokers’ transactions. No special selling efforts are needed (e.g., no roadshows or other active solicitation). There is no advance commitment to size, price, or timing. ATMs are used when companies frequently need capital in small amounts. REITs and healthcare companies are frequent users of this product. To establish an ATM, a company would file a Form S-3 registration statement, whereby the full ATM program would count against the one-third limitation under the “baby-shelf” rules. The transaction is often documented through an equity distribution agreement with one or more sales agents, including standard indemnification, reps and warranties, legal opinions, certificates, and a cold comfort letter from the audit firm. There would be a base prospectus, a prospectus supplement describing the specific ATM program (if a takedown from a universal shelf), and a Form 8-K would be filed with the signature of the equity distribution agreement, and sales would be reported in quarterly reports on Form 10-Q and 10-K. As sales agents have Section 11 liability, they will perform the same due diligence as an underwriter, with diligence updated quarterly.

Equity Lines: refer to the entry by a registered public company into a purchase agreement with an investor that gives the issuer the right to “put” its securities to the investor at a price based on a discount to the market-price of the issuer’s stock at the time of the put. The shares are deemed issued in a private placement that is deemed to be completed once the purchase agreement is signed. The issuer agrees to file a registration statement for the resale of the shares sold under the purchase agreement. Effectiveness of the registration is one of many conditions on the ability of the issuer to sell the shares. The SEC has imposed narrow limitations on the use of equity lines, where an investor cannot decide not to purchase the shares. They are highly dilutive, often used by companies unable to access the ATM market (because they cannot use a Form S-3). They can contribute to stock price volatility, as the market views them as a financing of last resort.

Rule 144A Offering: refers to a private placement to an “initial purchaser” or “underwriter,” who then reoffers and sells the restricted securities to qualified institutional buyers. Rule 144A provides investors with a way to resell securities in efficient, secondary market transactions, as long as they sell only to “qualified institutional buyers” or “QIBs.” QIBs do not need the protection of registration under the Securities Act and can fend for themselves. This can be similar to a registered transaction without the time delay imposed by registration with the SEC. The buyers typically will have registration rights, or the issuer will conduct a registered exchange offer to exchange new securities registered with identical terms for the Rule 144A securities.

Rule 144A/Reg S Offering: refers to a private placement to QIBs (Rule 144A) and non-U.S. persons offshore (under Regulation S under the 1933 Act).

Part I: Market Evolution and Current Landscape

Historical Context: The 2019-2025 Journey

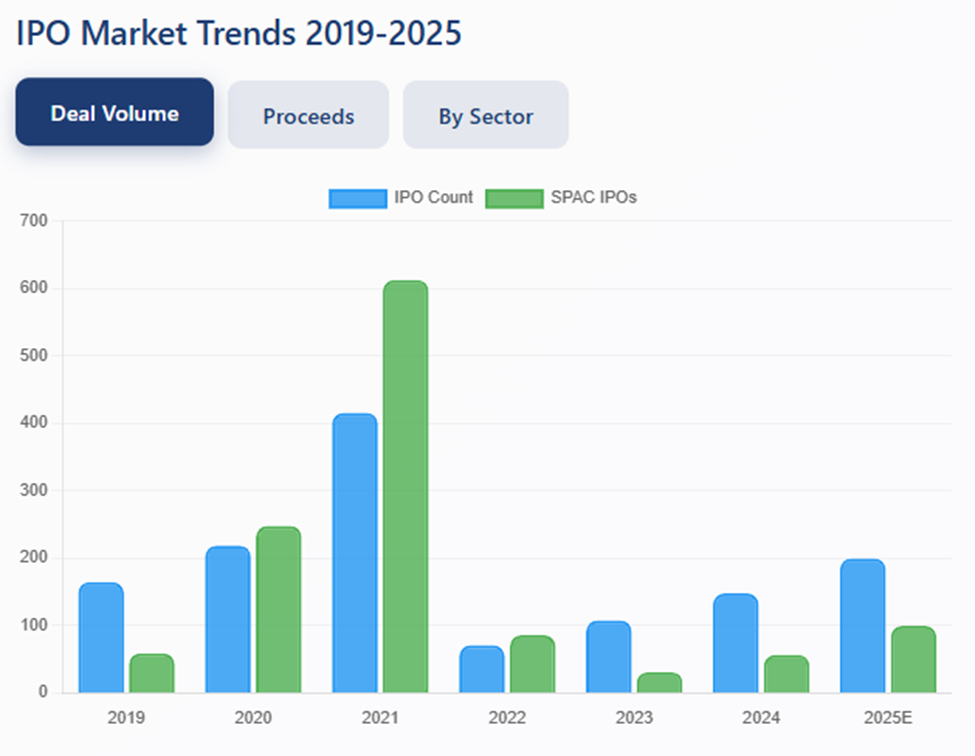

From 2019 to 2025, we have experienced one of the most dynamic eras in U.S. capital markets history. The steady growth in 2019, when 235 IPOs raised $65.4 billion, established a baseline for what would become an extraordinary boom-bust cycle.

From 2020 to 2021 we saw record-breaking activity, driven by pandemic-era monetary stimulus, retail investor participation, and the SPAC phenomenon. The market peaked in 2021 with 416 traditional IPOs raising $155.8 billion, while SPAC IPOs exploded to 613 transactions raising $162.5 billion.

The key characteristics of this period included:

Valuation exuberance with companies achieving unicorn status at accelerated rates

Democratization of investing with retail participation through commission-free platforms

SPAC proliferation that included celebrity sponsors and compressed timelines

Sector rotation from pandemic beneficiaries to reopening plays

Then a correction came swiftly in 2022, as rising interest rates, inflation concerns, and geopolitical tensions drove the most severe contraction since 2008. IPO activity drastically fell to just 71 deals raising $7.7 billion, while SPAC activity virtually ceased amid regulatory scrutiny and poor de-SPAC performance.

However, a recovery began in 2024, with IPO proceeds increasing 45% to $41.4 billion across 231 transactions. The first nine months of 2025 have shown continued momentum, though with notably different characteristics than the boom years. Investors now prioritize profitability over growth, proven business models over speculation, and sustainable unit economics over total addressable market narratives.

Current Market Dynamics

In 2025 we are seeing several key themes that define capital markets:

Selective Appetite: Investors are demonstrating strong interest in quality companies while maintaining strict valuation discipline. Multiples of forward earnings are more attractive for investors in 2025, and they are responding with demand.

Sector Concentration: Companies in the technology, clean energy, and life sciences sectors account for a substantial portion of IPO activity, with artificial intelligence, renewable energy infrastructure, and cell/gene therapy companies attracting premium valuations.

Alternative Prominence: Non-traditional financing methods now represent a larger share of total capital formation than IPOs, with companies increasingly turning to hybrid structures and staged capital-raising strategies.

Regulatory Clarity: The SEC’s comprehensive SPAC rules, effective July 2024, have created a more standardized framework, while enhanced disclosure requirements have improved transparency across all transaction types.

Geographic and Cross-Border Trends

The U.S. markets continue to attract international issuers, with cross-border IPOs making up two-thirds of total offerings in Q2 2025. Chinese companies are selectively returning to the IPO market, focusing on consumer sectors rather than technology to manage regulatory sensitivities. European technology companies are increasingly choosing U.S. listings for deeper capital pools and higher valuations, while Latin American growth companies are utilizing dual-listing structures.

Key Performance Indicators for Emerging Growth Companies Looking to Go Public

When is the right time for an emerging growth company to seek to go public? Achievement of key performance indicators over the past eight quarters, with visibility to achievement over the next eight quarters, with some indication of a new product or new market that could enable the company to outperform, are often the criteria separating success from failure. KPIs are wildly different by sector, and in this summary, we will explore them for each.

Technology Sector

Tech companies, especially in software, AI, and SaaS, are often evaluated on growth velocity and scalability:

Tech companies are expected to show strong unit economics and scalability before IPO. Investors tolerate losses if growth is exponential and efficient.

Clean Energy Sector

Clean energy companies are capital-intensive and often evaluated on project pipeline and regulatory alignment:

Clean energy IPOs often hinge on regulatory tailwinds and infrastructure readiness. Profitability may be deferred in favor of long-term impact.

Life Sciences Sector

Life sciences companies are judged on clinical progress and IP portfolio strength:

Life sciences IPOs are often pre-revenue, functioning as a continuation of the venture capital financing cycle. Investors focus on scientific validation, regulatory strategy, and IP defensibility.

Comparative Summary

My Take

If you are the CEO, CFO, or a board member of a publicly listed company in technology, clean energy, or life sciences, here is your reality:

Your funding runway is your true balance sheet. If you are within six months’ liquidity from breaching covenants or slowing strategic programs, you are already negotiating from a position of weakness.

Regulatory burden is real and growing. The SEC’s 2023–24 rulemakings on climate disclosure, cybersecurity, and SPACs have not simplified your life.

The window is fickle. Equity and debt issuance capacity is opening and shutting with macro data, Fed whispers, and sector momentum. You must be “file ready” 365 days a year.

Smaller publics are disadvantaged. Exchange rules, float thresholds, and analyst coverage desertion have left sub-$2 billion market cap stocks in structural financing purgatory.

Part II: The Current State of Play and Recommendations for Reform

Structural and Regulatory Reforms Needed

Despite a historic backlog of exceptionally strong emerging growth companies in the technology, clean energy, and life sciences sectors, initial public offerings have suffered a significant decline over the past 25 years. On average, the past 25 years have seen just 135 IPOs per year, a third of the activity witnessed in the 1990s. Additionally, the number of publicly listed U.S. companies has halved since 1996 due to the increasing costs of maintaining a public listing and the broader economic environment.

Reinstate 500 Holder Threshold for Going Public: The JOBS Act of 2012 removed a key impetus for companies to go public by increasing the stockholder threshold that triggers public registration. Rather than stimulate the IPO market, the JOBS Act enabled many companies to stay private longer, or indeed, indefinitely. The change certainly boosted private capital formation, but indefinitely delayed the process of going public. With fewer companies choosing to go public, the pool of investable U.S. equity focuses on larger cap stocks, reducing liquidity and removing price signals that reflect public-market scrutiny. Earlier public listings would bring broader transparency, improve governance, shareholder rights, and corporate accountability. A larger, more diverse roster of public companies would support a healthier IPO window. It would also enable earlier access to a fungible equity path to help employees monetize holdings, improve retention, and align with growth objectives.

Decimalization of Trading:The shift to penny-based commissions reduced brokers’ margins, leading them to focus on larger public companies at the expense of smaller ones. Should the rules on commissions be reframed to enable larger commissions for emerging growth companies that have gone public, or has the train left the station?

Global Analyst Research Settlements: These 2003 agreements between Wall Street banks and regulators made research coverage for smaller public companies prohibitively expensive. Should new rulemaking foster and encourage analyst research on emerging growth companies that go public?

Brokerage Concentration: The consolidation of brokerage activities in large banking corporations has marginalized smaller public companies. Should FINRA make it easier for broker dealers to become licensed or to make a market in emerging growth companies that have gone public?

Regulatory Burdens: Laws like the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010 have significantly increased compliance costs, making the IPO process more expensive and burdensome, particularly for smaller companies. Should some of the expensive regulatory compliance burdens be rolled back?

Rise of Private Capital: The growth of private equity and other private capital sources has reduced the incentive for companies to go public. Should there be a forcing function for emerging private companies with a billion dollars or more of valuation or capital raised to be forced to publish their financial statements, for example?

Shift to Passive Investing: The move from active to passive investment strategies has favored large-cap companies, further marginalizing smaller firms. How can we level the playing field for emerging growth companies that go public to compete for capital allocation?

These factors have led to a U.S. equity market dominated by the largest companies, often called the “seven sisters” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). Without structural reforms, these trends are likely to continue, posing challenges for the broader market and the U.S. economy’s capacity for innovation and job creation.

From my vantage point, as a Silicon Valley lawyer trying to stimulate the innovation economy, the following are additional recommendations for regulatory reform of the U.S. capital markets:

Reinstate the 500-stockholder registration trigger. There needs to be an on-ramp to the IPO market.

Extend EGC scaled disclosure to 10 years because cost savings matter.

Lower the S-3 float threshold to $50 million. Keep shelves alive for small/mid-caps.

Rationalize the 20% Rule so that well covered issuers have flexibility without a three to four month shareholder vote.

Incentivize small cap liquidity and allow exchange tiered rebates for market maker participation.

Expand 144A access and allow more sophisticated capital pools that expand depth.

Expand the Private Securities Litigation Reform Act to protect against frivolous lawsuits.

Harmonize ESG/climate disclosure and cut duplicative state/federal/EU costs.

If implemented, we would see more IPOs, more resilient small cap publics, and innovation capital flowing more efficiently.

Part III: Comprehensive Product Analysis

Traditional Equity Offerings

Initial Public Offerings (IPOs)

The traditional IPO remains the gold standard for companies seeking public market access, despite its complexity and cost. The process typically spans six to twelve months and involves extensive preparation across multiple workstreams:

Financial preparation: Three years of audited financials (two for EGCs), implementation of SOX-compliant controls, establishment of public company reporting infrastructure

Corporate governance: Independent board recruitment, committee formation, executive compensation restructuring

Legal and regulatory: S-1 drafting and SEC review process, state blue sky compliance, exchange listing applications

Marketing and distribution: Roadshow presentation development, institutional investor targeting, retail allocation strategies

Cost structures for traditional IPOs have evolved significantly. Underwriting fees, while still representing the largest component at four to seven percent of proceeds, have compressed for large, high-quality issuers. However, fixed costs have increased due to enhanced regulatory requirements and the need for sophisticated investor relations capabilities.

Follow-On Offerings

Secondary offerings by already-public companies provide growth capital and liquidity for existing shareholders. The market has seen increased activity in 2025, with companies taking advantage of recovered valuations to strengthen balance sheets. Key considerations include:

Timing relative to earnings announcements and lock-up expirations

Impact on existing shareholder base and index inclusion

Use of proceeds messaging and growth narrative reinforcement

Alternative Public Offerings

Once a public listing is achieved, companies have access to a variety of capital markets products, each with distinct characteristics:

PIPEs (Private Investment in Public Equity) offer quick access to capital but may involve discounts and warrants.

RDOs (Registered Direct Offerings) are similar but registered with the SEC, providing more transparency.

CMPOs (Confidentially Marketed Public Offerings) allow issuers to gauge investor interest before filing. Rule 144A offerings target qualified institutional buyers and are exempt from SEC registration.

De-SPAC transactions involve merging with a special purpose acquisition company, while RTOs are reverse mergers with public shells.

ATM offerings and equity lines provide flexible capital raising options. Debt products include investment grade (low risk), high yield (higher returns), and crossover debt (between investment grade and high yield).

We examine these in greater detail below.

Private Investment in Public Equity (PIPE)

PIPE transactions have become increasingly sophisticated, with structures ranging from traditional common stock purchases to complex convertible instruments with price adjustment mechanisms. The 2022-2023 period saw approximately 1,200 PIPE transactions raising $74 billion, with activity continuing robustly into 2025.

Key advantages include:

Execution speed (two to eight weeks vs. six to twelve months for IPOs)

Certainty of pricing and proceeds

Ability to select strategic investors

Reduced market risk during volatile periods

Common structures now include:

Traditional PIPE: Direct purchase at a fixed price

Structured PIPE: Convertible securities with price protection

Strategic PIPE: Includes commercial agreements or board representation

PIPE with warrants: Provides upside participation for investors

In 2025, PIPEs remain a go to for speed and discretion. They work when you have a friendly institutional base or strategic investor. They are less ideal when you need broad market validation. Discounts are unavoidable; in a flat or rising tape, they can be palatable; in a falling tape, they punish the remaining holders. My advice: Use PIPEs to bridge catalysts, not as recurring lifelines.

Registered Direct Offerings (RDO)

RDOs combine the speed of PIPE transactions with the liquidity benefits of registered securities. Institutional investors receive freely tradeable shares, eliminating the discount typically required for restricted securities. Execution is as fast as a PIPE if you have an effective shelf and a ready buyer. But you must manage Reg FD and avoid selective disclosure landmines.

The structure has gained popularity among small and mid-cap companies, particularly in the life sciences sector, where capital needs are ongoing but unpredictable. The optics are cleaner than a PIPE, and pricing can be firmer.

Confidentially Marketed Public Offerings (CMPO)

CMPOs represent an evolution in public offering technology, allowing companies to gauge institutional demand before public announcement. The structure has become popular for companies with volatile trading or those seeking to minimize market disruption. The two-phase process involves:

Confidential marketing phase: Wall-crossed institutions provide feedback and soft commitments

Public offering phase: Compressed public marketing period with pre-built book

The Confidentially Marketed Public Offering is a surgeon’s scalpel: fast, precise, and unforgiving if wielded poorly. It is my top choice for a shelf-eligible issuer with upcoming good news that can be floated with select investors before going public.

Success factors for CMPOs include strong institutional relationships, compelling equity stories, and favorable market windows. Failed CMPOs that never reach public announcement avoid the negative signaling of withdrawn traditional offerings.

Warning: Do not use this tool in a rumor laden environment. Leaks kill CMPOs.

Special Purpose Acquisition Companies (SPACs)

The party is over for speculative SPACs. The deals that now work are those that look like traditional IPOs in diligence and disclosure, but involve a SPAC shell. Yes, SEC review is intense. Yes, redemptions can gut your trust proceeds. But for the right cross border or complex story issuer, it’s still viable. See my piece on “SPAC 4.0” here.

SPAC IPOs and Market Evolution

The SPAC market has stabilized at sustainable levels following the 2021 bubble and subsequent correction. Current market dynamics include:

Quality sponsors: experienced operators with sector expertise replacing celebrity sponsors

Improved structures: enhanced investor protections, including overfunding and forward purchase agreements

Realistic valuations: de-SPAC transactions at reasonable multiples with achievable projections

Sector focus: concentration in capital-intensive industries benefiting from patient capital

The SEC’s January 2024 final rules fundamentally altered the SPAC landscape by:

Requiring target companies to assume co-registrant liability

Mandating enhanced sponsor compensation disclosure

Implementing 20-day minimum dissemination periods

Aligning financial statement requirements with traditional IPOs

De-SPAC Transactions

De-SPAC execution has become increasingly complex, with successful transactions requiring:

Comprehensive investor education on target company fundamentals

Significant PIPE commitments to offset redemptions

Realistic projections with achievable milestones

Strong post-merger integration planning

At-The-Market (ATM) Programs

ATM offerings have emerged as a critical tool for public companies requiring financing flexibility. This structure allows companies to sell shares directly into the market through designated broker-dealers, providing several advantages:

Market timing: ability to raise capital during favorable windows

Price optimization: sales at prevailing market prices without discounts

Minimal disclosure: no deal-specific disclosure requirements

Cost efficiency: lower fees than traditional offerings

Life sciences companies have been particularly active users. The ability to raise capital incrementally as clinical milestones are achieved aligns funding with value creation.

ATMs are my favorite back pocket instrument for mid cap tech and life sciences. It is patient capital — you draw as the market allows. But beware: over reliance signals desperation. My counsel: pair an ATM with an announced strategic milestone so draws are masked by liquidity spikes.

Equity Line Financing

Equity lines provide committed capital that companies can draw upon over time, typically 12-24 months. Unlike ATMs, equity lines involve firm commitments from institutional investors, providing certainty of capital. Key structural features include:

Commitment amounts: typically, $10-100 million for small/mid-cap companies

Pricing mechanisms: usually based on VWAP with small discounts (three to five percent)

Draw limitations: daily volume restrictions and minimum price thresholds

Registration requirements: requires effective resale registration statement

These are misunderstood. The stigma of “toxic” structures was real in the 2000s. Modern equity lines with credible, repeat counterparties can be efficient — but only if disclosed and managed with discipline. Boards must demand transparency into draw triggers.

Rule 144A Private Placements

The ability to privately place to QIBs without SEC review is a high-speed lane — but remember, you will often need to file an 8-K for material terms, and you must manage information flow to avoid leaks.

Quietly, convertibles have become a lifeline for sectors like clean energy and SaaS. 144A allows you to tap deep pools of debt equity crossover funds without a full SEC filing at offer. Remember — in 18–36 months, you may face a wall of maturities if equity markets aren’t hospitable.

Comparative Table of Capital Markets Products

The following table sums up the key differentiating factors of these products:

What market forces are driving the utilization of these products?

PIPEs and CMPOs dominate sub-$500 million issuers due to speed and flexibility.

RDOs remain viable for seasoned issuers with effective shelves.

Rule 144A offerings are increasingly used for structured debt and pre-IPO bridge rounds.

RTOs and de-SPACs face heightened disclosure and litigation scrutiny.

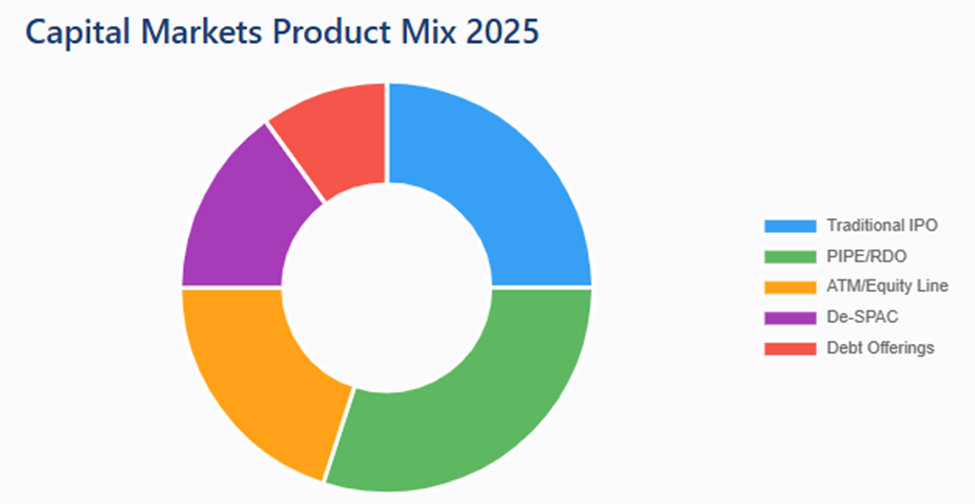

What is the total mix of these products across the capital markets by volume? This infographic divides up the pie.

Part IV: Debt Capital Markets

Equity is only part of the story. History reminded us in 2022 that a zero interest rate policy was not to be forever. In response to a surge (some say a scourge) of inflation, beginning in January 2022, the Federal Reserve tightened the cost of money faster and steeper than at any other point in history, both increasing the interbank cost of lending and concurrently decreasing the size of its balance sheet. The result was the return of debt capital markets as investors sought to take advantage of the increase in yield. Let us look at the debt capital markets products for public companies.

Investment Grade Debt

Investment-grade issuers have benefited from continued investor demand despite rate volatility. Current market characteristics include:

Spreads: trading near historical tights at 90-120 basis points over Treasuries

Duration: average 6.79 years, creating interest rate sensitivity

Covenant packages: increasingly borrower-friendly with limited restrictions

ESG integration: green and sustainability-linked bonds gaining market share

Technology companies with strong cash flows and clean energy companies with contracted revenues have achieved investment-grade ratings, accessing lower-cost capital than equity alternatives.

But these are relegated to highly profitable companies that long since graduated out of the “emerging growth” category.

High Yield Markets

High yield debt products have not historically been used by emerging growth companies due to the lack of a history of profitability, nor a clear path to get there. High yield debt has largely been relegated to the acquisition finance category for established public companies. For example, when a financial sponsor buys out a public tech company, it may use high yield debt to finance the transaction. Or a large tech company seeking to finance an acquisition or a product buildout on terms better than the cost of equity capital may seek to raise high yield debt.

Crossover Credit

The crossover market, spanning BBB to BB ratings, has expanded significantly as companies navigate rating transitions. This segment offers:

Flexible structures: ability to access both investment-grade and high-yield investors

Transition financing: bridge funding during credit improvement journeys

Hybrid instruments: convertible bonds and preferred securities

Strategic alternatives: private credit competition driving improved terms

Once again, crossover credit products have not historically been used by emerging growth companies due to the lack of history of profitability, and are a better option for established public tech companies that are achieving deleveraging after a buyout.

Part V: Regulatory Framework and Compliance

SEC rules applicable to capital markets transactions include Regulation D (private placements), Regulation S (offshore offerings), Rule 144A (resales to QIBs), and Form S-1/S-3 registration requirements. Disclosure obligations are governed by Regulation S-K and Regulation S-X. Stock exchange rules (NYSE, NASDAQ) require shareholder approval for certain transactions, minimum listing standards, and corporate governance compliance. For example, NASDAQ Rule 5635 requires shareholder approval for issuances exceeding 20% of outstanding shares.

SEC Registration Requirements

The regulatory landscape has become increasingly complex, with different transaction types requiring specific forms and disclosures.

Form S-1 and S-3 Requirements

The SEC filing process varies by product. PIPEs often use Form 8-K to disclose material agreements. RDOs and CMPOs use Form S-3 for shelf registration. Rule 144A offerings do not require SEC filings but must comply with antifraud provisions. De-SPAC transactions use Form S-4 and undergo full SEC review. RTOs require Form 8-K with detailed disclosures. ATM offerings use Form S-3 and update prospectus supplements. Equity lines may use Form S-1 or S-3 depending on eligibility. Debt offerings use Form S-1 or S-3 based on issuer status.

S-1 eligibility: available to all issuers but requires comprehensive disclosure

S-3 eligibility: requires 12-month reporting history and $75 million public float

Baby shelf limitations: restricts primary offerings to one-third of public float for smaller companies

Incorporation by reference: S-3 allows streamlined disclosure through periodic report incorporation

Warning: if your public float drops below $75 million, your ability to do quick shelf takedowns vanishes. For a mid-cap caught out of cycle, this can be lethal. I have had boards opt to do insider rounds to prop up float and preserve S-3 status.

Financial Statement Requirements

The SEC’s Article 15 implementation has standardized requirements across transaction types:

Age requirements: 135 days for annual, 45 days for interim periods

Audit standards: PCAOB audits required for all public offerings

Segment reporting: enhanced disclosure for multi-business companies

Pro forma requirements: significant acquisition and disposition presentations

Exchange Listing Standards

NYSE and NASDAQ have implemented stricter compliance mechanisms in 2025:

Minimum Price Compliance

Immediate delisting for non-compliance after a 360-day cure period

Restrictions on reverse splits that trigger other listing violations

Enhanced notification requirements (10 days for NASDAQ, up from five)

Market Value Requirements (Effective April 11, 2025)

NASDAQ Global Market: $8 million MVUPHS from IPO proceeds only

NASDAQ Capital Market: $5 million MVUPHS from IPO proceeds only

Elimination of previously issued share inclusion in calculations

Corporate Governance Standards

Independent director requirements (majority of board)

Committee composition rules (100% independence for audit)

Shareholder approval thresholds (20% rule for dilutive issuances)

Related party transaction oversight

Warning: NYSE/Nasdaq require shareholder approval if you issue >20% of outstanding shares below market price. Timing a vote takes three to four months. If liquidity needs are urgent, your best paths are debt or a registered offering at market.

Disclosure and Liability Considerations

Enhanced disclosure requirements have increased preparation complexity:

Material Contract Filing: expanded interpretation requiring more commercial agreement disclosure

Cybersecurity Reporting: four-day disclosure for material incidents

Human Capital Disclosure: enhanced workforce and diversity metrics

Climate Risk Reporting: pending requirements for emissions and physical risk disclosure

Part VI: Cost Analysis and Timeline Consideration

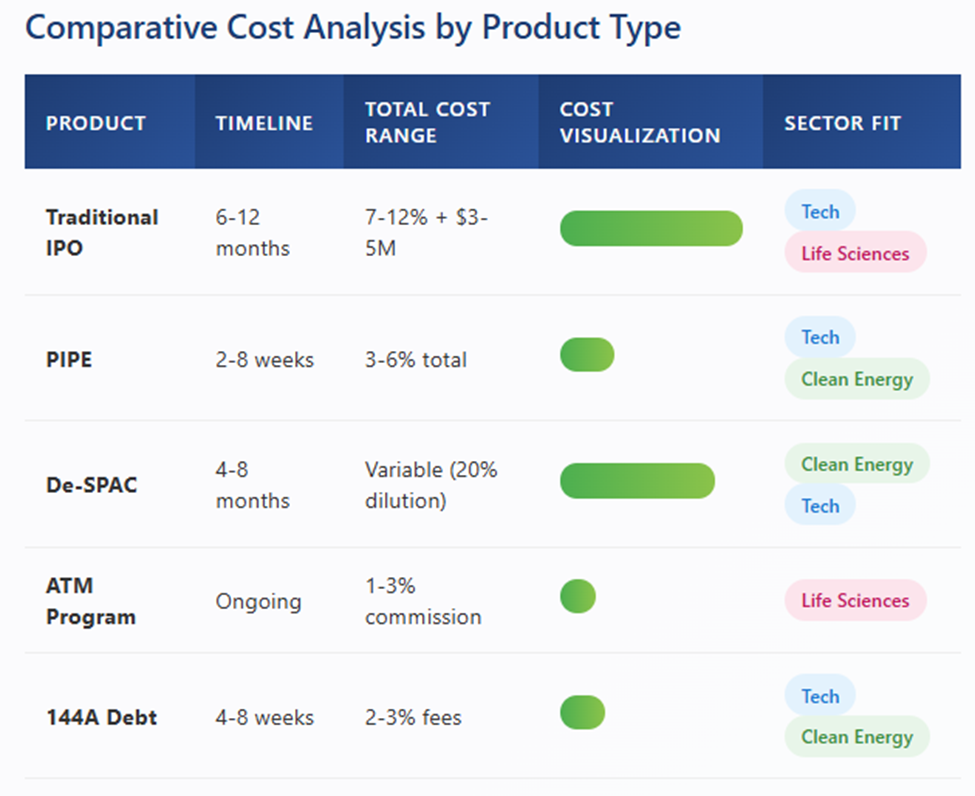

Costs and timelines vary significantly across products. PIPEs and Rule 144A offerings are relatively quick and inexpensive. RDOs and CMPOs require more preparation and SEC review, increasing costs. De-SPAC and RTO transactions are complex and costly due to due diligence and regulatory scrutiny. ATM and equity line products offer flexibility but require ongoing compliance. Debt offerings depend on credit rating and investor appetite.

Detailed Cost Breakdowns

IPO Cost Components

Direct costs for a $100 million IPO typically include:

Underwriting Fees (4-7% of proceeds): $4-7 million

Lead underwriter typically gets at least 20% of the gross spread

Syndicate members typically get a 60% selling concession

Expenses are typically 20% for roadshow and support

Professional Services: $2-4 million combined

Legal counsel (company): >$1.5 million

Legal counsel (underwriters): >$1 million

Accounting and audit: >$1 million

Financial printer: $300-$600,000

Regulatory and Listing: $500,000-$1 million

SEC registration: $153.10 per $1 million in proceeds

FINRA filing: $1.125 million as of July 2025

Exchange listing: $150-500,000 initial plus annual fees

Blue sky filing: $50-$100,000

Marketing and IR: $500,000-$1 million

Roadshow logistics: $200-$400,000

IR firm retainer: $250-$500,000 annually

Market research: $50-$150,000

Alternative Financing Costs

Comparative cost analysis reveals significant variations:

PIPE Transactions: 3-8% all-in cost

Placement fee: 2-3%

Discount to market: 5-15% (situation dependent)

Legal and administrative: $200-$500,000

ATM Programs: 1-3% of proceeds

Sales commission: 1-3%

Setup costs: $100-$250,000

Ongoing compliance: $50,000 annually

De-SPAC Transactions: Variable but substantial

Sponsor promote: 20% dilution typical

PIPE commitment fees: 2-5%

Advisory and legal: $2-$5 million

Redemption impact: Potential 50%+ dilution

Timeline Analysis

Transaction timelines vary significantly based on complexity and market conditions:

Traditional IPO Timeline (6-12 months):

Months 1-2: organizational meeting, due diligence commences

Months 3-4: S-1 drafting and financial statement preparation

Month 5: initial SEC filing (often confidential)

Months 6-7: SEC review and comment process

Month 8: testing-the-waters meetings

Month 9: public filing and roadshow

Month 10: pricing and trading commencement

SPAC Timeline Considerations:

SPAC IPO: 3-4 months

Target search: 12-18 months (per SEC guidance)

De-SPAC execution: 4-6 months

Total timeline: 18-24 months to public listing

The Wrap on Timelines and Cost

Boards often underestimate execution timelines. Here’s my blended real-world counsel:

Fast lane (<2 weeks) – ATM draws, CMPOs, RDOs, PIPEs with lined up investors

Mid lane (4–8 weeks) – 144A converts, HY debt, marketed follow-ons

Slow lane (3–6 months) – IPOs, de-SPACs, shareholder approval requiring PIPEs

Costs:

Legal: 0.2–0.5% for shelf takedown; 1%+ for IPO/de SPAC

Bankers: 1–3% for debt, 3–7% for equity (negotiable on size)

Accounting: Flat + incremental for comfort letters

Part VII: Sector-Specific Considerations

Technology Sector Dynamics

Technology companies face unique considerations in accessing capital markets:

Valuation Methodologies: Shift from revenue multiples to profitability metrics

SaaS companies are trading in a range of 4-8x ARR (down from 15-20x in 2021)

Marketplace businesses focus on contribution margin and take rate

AI companies achieve premium valuations but are getting higher scrutiny on differentiation

Key Success Factors:

Demonstrated path to profitability within 12-18 months

Strong unit economics with improving margins

Diversified customer base with low concentration

Clear competitive moats and differentiation

Preferred Structures: Technology companies increasingly utilize convertible debt and structured equity to minimize dilution while maintaining flexibility for future rounds.

Clean Energy and Climate Technology

The clean energy sector has experienced renewed interest driven by federal policy support and institutional ESG mandates:

Market Drivers:

Infrastructure Investment and Jobs Act funding

Inflation Reduction Act tax incentives

Corporate renewable energy commitments

Grid modernization requirements

Capital Requirements: Clean energy projects require substantial upfront investment with long payback periods, making them ideal for patient capital structures like SPACs or infrastructure funds.

Financing Structures:

Project finance for utility-scale developments

YieldCos for operating assets

SPACs for pre-revenue technology companies

Green bonds for investment-grade issuers

Life Sciences and Biotechnology

Life sciences companies navigate unique challenges requiring specialized financing approaches:

Development Stage Considerations:

Pre-clinical: limited to private funding or reverse mergers

Phase I/II: PIPE transactions and ATM programs predominant

Phase III: IPO window opens with significant data packages

Commercial: full access to capital markets

Regulatory Milestones: FDA approval timelines and clinical trial results create binary events requiring careful capital planning.

Preferred Instruments:

ATM programs for incremental funding needs

Royalty financing for commercial-stage companies

Strategic partnerships with upfront payments

Convertible debt to bridge value inflection points

Part VII: Strategic Recommendations and Outlook

Decision Framework for Capital Access

Companies should evaluate financing alternatives across multiple dimensions:

Timing Flexibility: can the company wait for optimal market conditions?

Capital Requirements: is the need immediate or can it be staged?

Valuation Sensitivity: how important is minimizing dilution?

Investor Base: institutional, retail, or strategic focus?

Ongoing Obligations: capacity for public company compliance?

Several factors suggest continued improvement in capital markets conditions:

Positive Catalysts:

Federal Reserve pivot toward accommodative policy

Resolution of regional banking concerns

Strong corporate earnings in key sectors

Accumulated private equity portfolio requiring exits

Risk Factors:

Geopolitical tensions and trade policy uncertainty

Inflation persistence requiring policy reversal

Market concentration in mega-cap technology

Credit stress from refinancing wave

Sector-Specific Projections:

Technology: expected to lead IPO activity with 35-40% of total volume, focusing on enterprise software and AI applications.

Clean Energy: continued SPAC activity and project finance, with an emerging focus on grid storage and hydrogen.

Life Sciences: selective IPOs for late-stage companies, continued reliance on alternative financing for earlier stages.

Best Practices for Market Preparation

Regardless of the chosen financing path, companies should focus on:

Financial Readiness:

Implement robust financial reporting systems

Achieve clean audit opinions for required periods

Develop sophisticated forecasting capabilities

Establish strong internal controls

Governance Excellence:

Recruit independent directors with public company experience

Establish proper committee structures

Implement public company-ready compensation programs

Develop comprehensive insider trading policies

Strategic Positioning:

Articulate a clear and differentiated equity story

Build relationships with research analysts

Develop a comprehensive investor relations strategy

Maintain consistent financial communication

Risk Management:

Address regulatory compliance gaps

Implement enterprise risk management framework

Develop crisis communication protocols

Establish cybersecurity and data governance programs

My Takeaways for Board Directors

If you are a board director reading this piece, to maintain a strong public listing with access to the capital markets whenever a window opens, look to ensure that management:

Maintains clean, timely 34 Act filings. Form S-3 eligibility is strategic gold.

Builds a multi-path capital plan (equity + hybrid + debt) and socializes it with its bankers quarterly.

Pre-clears with the stock exchange on any >15% issuance to manage 20% Rule risk.

Uses ATMs/CMPOs to “top-up” outside major events and avoid desperate appearances.

Keeps investor communications clear, avoiding execution risk that rises with rumor driven volatility

[View source.]