For the first time in years, the global helium market is experiencing excess supply, with Russian volumes flooding into Asia and softening demand for new container builds in the US.

The shift has already forced at least one US manufacturer to scale back output at a Pennsylvania facility, highlighting the knock-on effects of changing trade flows.

The shift has already forced at least one US manufacturer to scale back output at a Pennsylvania facility.

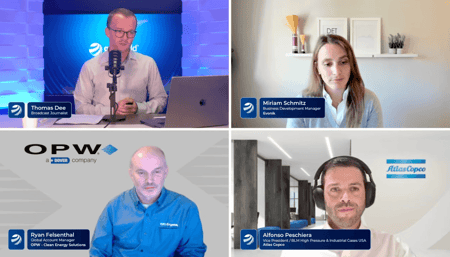

Ryan Felsenthal, Global Account Manager at OPW Clean Energy Solutions – shortened to CES – told a gasworld webinar that supply volatility remains the biggest challenge for helium, but said that the current surplus was also creating opportunities for equipment suppliers to diversify.

“Right now, the Asian market is being flooded with Russian [helium] molecules, which has softened the demand for new equipment builds, particularly in the US,” he said.

“In fact, this is the first time we’re seeing an excess supply of helium on the market, and it’s reflected by the recent news that one of the largest manufacturers in the US announced a reduction of capacity at the Pennsylvania facility due to this.”

Here he is likely referring to the Air Products subsidiary Gardner Cryogenics, which is laying off staff at its Lehigh county operations in the state.

It was announced last month that 14 staff are to be let go from 17 November due to a downturn in orders for its large tanks, designed to transport liquid hydrogen and helium.

On top of that, supply is impacted by ongoing geopolitical tensions, trade disruptions, and embargoes.

©gasworld

“These challenges cut straight into the profitability of transporting that helium around the globe, which turns into shaping the broader market as well,” said Felsenthal.

This was backed up by Miriam Schmitz, Business Development Manager at Evonik, who said, “Helium production is concentrated in a few countries, making supply chains vulnerable to geopolitical tensions [and] to trade restrictions, which can lead to supply disruption.”

Gazprom’s Amur Gas Processing Plant in eastern Russia resumed helium shipments back in September 2023, initially dispatching around 50 ISO containers a month into Asia. Those flows have since expanded, establishing steady routes into China, South Korea, Japan, India and Malaysia.

Alongside the smaller Irkutsk project, Russia’s share of global helium supply has been rising strongly from about 2% in 2023 and is forecast to climb to 17% by 2030. Its share today could even be pushing towards 10%, experts reckon.

And industrial gas majors have felt the effect. Air Liquide reported in late 2023 that helium prices in China had softened on cheaper Russian volumes, a trend that has persisted through 2024 and into 2025.

The shift was further accelerated when the EU’s ban on Russian helium imports took effect in September 2024, forcing Gazprom to push more of its product into non-EU markets, especially Asia.

While demand for new container builds has softened, CES is adapting by channelling its expertise into emerging applications like fusion energy, big science, and data centres.

“[We are] even revisiting some of our legacy technology like helium purifiers to help offset some of the impacts.”

Despite the challenges presented by supply volatility, Felsenthal sees potential. “It is also creating some opportunities to diversify and innovate and position for the next wave of helium uses and applications,” he said.