This article first appeared in The Edge Malaysia Weekly on October 6, 2025 – October 12, 2025

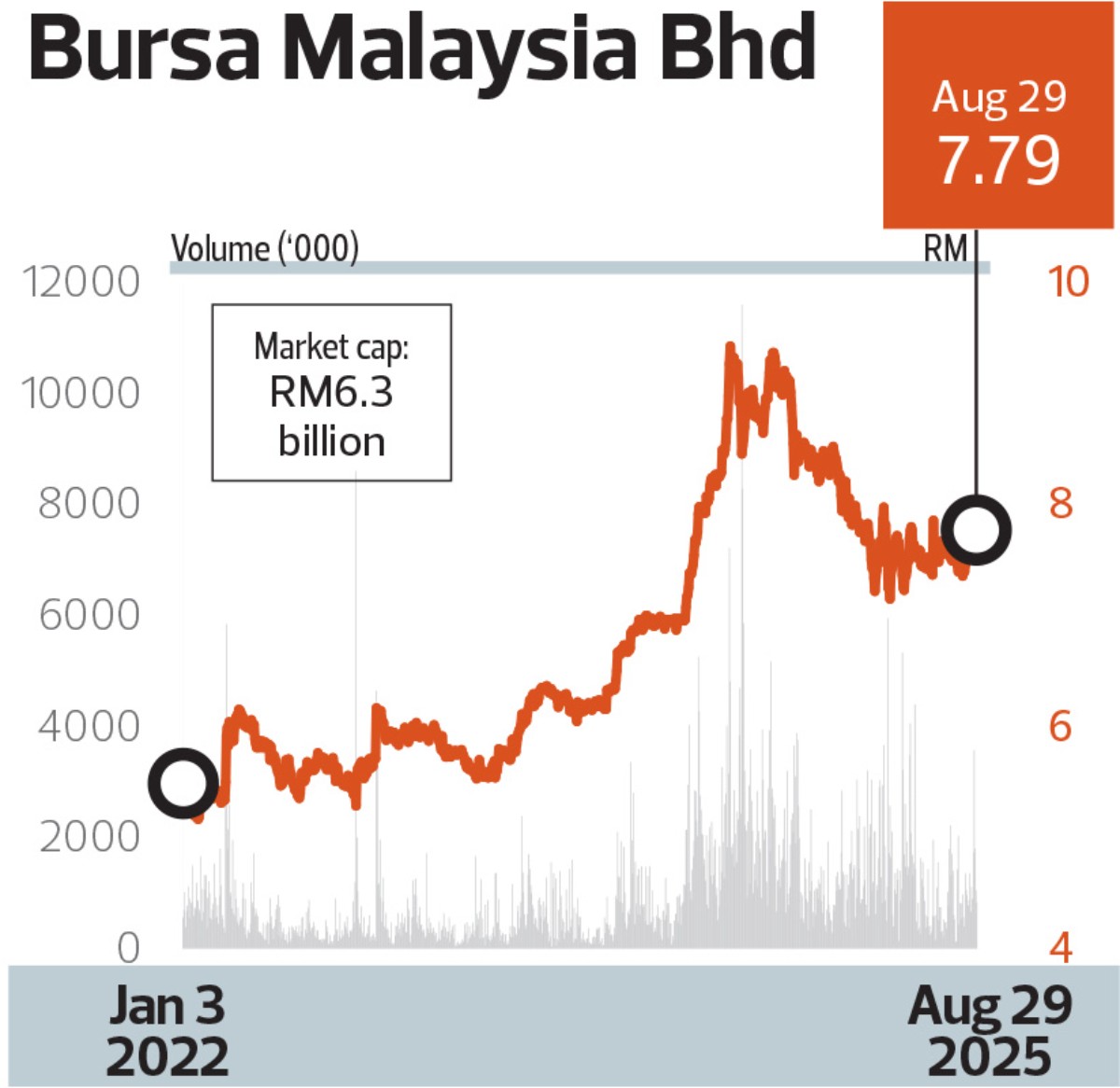

Over the last three years, a slew of market challenges saw the earnings of Bursa Malaysia Bhd (KL:BURSA) decline for the second straight year in 2022 before turning around to grow commendably in the following two years.

In the financial year ended Dec 31, 2022 (FY2022), the net profit of the stock market operator and regulator fell 36.2% year on year to RM226.57 million as revenue declined 21.4% to RM603.24 million.

This was mainly because trading in the securities market that year had softened as a result of rising interest rates, inflationary pressure and concerns about economic growth, which dampened investor sentiment. Trading revenue makes up a large proportion of Bursa Malaysia’s revenue. That year, the average daily trading value (ADV) in the securities market (for on-market trades) declined 41.7% y-o-y to RM2.07 billion, from RM3.54 billion previously.

However, in FY2023, Bursa Malaysia managed to grow its net profit by 11.4% to RM252.38 million despite ADV falling marginally to RM2.06 billion. The increase in earnings was a result of lower operating expenses, following a reversal of provision made for the sales and service tax (SST) for the period of Jan 1, 2020, to June 30, 2023. Revenue that year grew 2.2% to RM616.49 million.

Then, in FY2024, net profit grew by a solid 22.9% to RM310.12 million on the back of a 27.2% increase in revenue to RM784.30 million. ADV that year increased to RM3.15 billion.

Its return on equity came in at 28.3% in FY2022, 31.4% in FY2023 and 36.55% in FY2024, giving it an adjusted weighted ROE over three years of 33.36%. The solid performance helped Bursa Malaysia clinch The Edge Billion Ringgit Club (BRC) corporate award for highest ROE over three years in the financial services sector in the category of companies with a market capitalisation below RM10 billion. Impressively, this is the fifth straight year that it has won that award.

A regular payer of dividends, Bursa Malaysia rewarded shareholders with a dividend per share of 44 sen in FY2024 — which included a special dividend of 8 sen — compared with 29 sen in FY2023 and 26.5 sen in FY2022.

Last year marked a couple of notable firsts for the bourse. On May 7, 2024, the equities market capitalisation surpassed RM2 trillion for the first time, ending the year at RM2.08 trillion, up 15.8% y-o-y. The derivatives market, meanwhile, achieved a new high in annual trading volume for all products.

Bursa Malaysia underwent key leadership changes this year. On March 1, Datuk Fad’l Mohamed came on board as its new CEO, replacing Datuk Muhamad Umar Swift who retired after six years at the helm. Fad’l, 57, was previously managing director of group wholesale banking at RHB Bank Bhd (KL:RHBBANK) for about a year and, prior to that, CEO of Maybank Investment Bank Bhd.

Then, on May 1, Tan Sri Abdul Farid Alias became the new chairman of Bursa Malaysia, succeeding Tan Sri Abdul Wahid Omar who retired after a five-year tenure. Abdul Farid, who had served on the exchange’s board since July 2022, was president and group CEO of Malayan Banking Bhd (KL:MAYBANK) from 2013 to 2022.

In 1HFY2025, Bursa Malaysia saw a 19.3% decline in net profit to RM125.48 million even as revenue fell 7.8% to RM356.96 million, owing to a decline in trading revenue. The US tariff talks at the time and geopolitical tensions had impacted market sentiment and weighed on equities.

“A rebound is anticipated in 2HFY2025, with ADV forecast to recover as market uncertainty fades and greater clarity emerges post-US tariff negotiations. Overall, we project a 14.5% y-o-y decline in earnings per share for FY2025, followed by y-o-y growth of 0.5% in FY2026 and 0.8% in FY2027,” CIMB Securities says in a July 30 report.

Going forward, Bursa Malaysia aims to increase the earnings contribution of its non-trading businesses.

“We are committed to advancing Bursa Malaysia as a multi-asset exchange under our strategic roadmap 2024-2026. Our key focus areas include being the fundraising platform of choice for businesses, improving market vibrancy and liquidity, as well as exploring fresh ways to propel the data business,” says Fad’l.

There were 55 new listings on the bourse last year — the highest since 2005 — compared with 32 in 2023 and 34 in 2022. This year, as at end-August, there were 39 new listings (seven on the Main Market, 29 on the ACE Market and three on the LEAP Market), and the exchange is aiming to take it up to 60 by year end.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.