Moomoo Singapore’s chief market strategist shares how pairing options and futures with exchange-traded funds can be useful in building a more resilient portfolio

THE global investment climate in late 2025 has been marked by contradictions.

On the surface, equity markets remain buoyant. US stocks have held their ground despite lagging behind global peers, buoyed by a surging artificial intelligence (AI) sector even as trade tensions persist.

Beneath that sheen, however, lies fragility: the effects of tariffs are quietly filtering through, squeezing corporate profits, raising consumer costs, and threatening to dampen demand.

This, combined with slowing job growth and mounting signs of weakening labour markets, is pushing the Federal Reserve toward imminent interest rate cuts. Inflation, while easing from its peak, remains stubbornly elevated, and the full brunt of higher tariffs has yet to wash over households and businesses.

For investors in Singapore and across Asia, the challenge is twofold. Firstly, how do you capture the upside in global markets – especially in the US which continues to anchor risk sentiment – while still guarding against sudden drawdowns? Second, how do you construct a portfolio that is both diversified and resilient when traditional asset allocation rules are being tested?

Says Isaac Lim, chief market strategist at Moomoo Singapore: “The old model of buying and holding equities, or relying solely on local markets, no longer provides sufficient balance. Investors today need global reach and dynamic risk management tools. That’s where index derivatives, particularly those tracking the S&P 500 and Nasdaq-100, play an important role.”

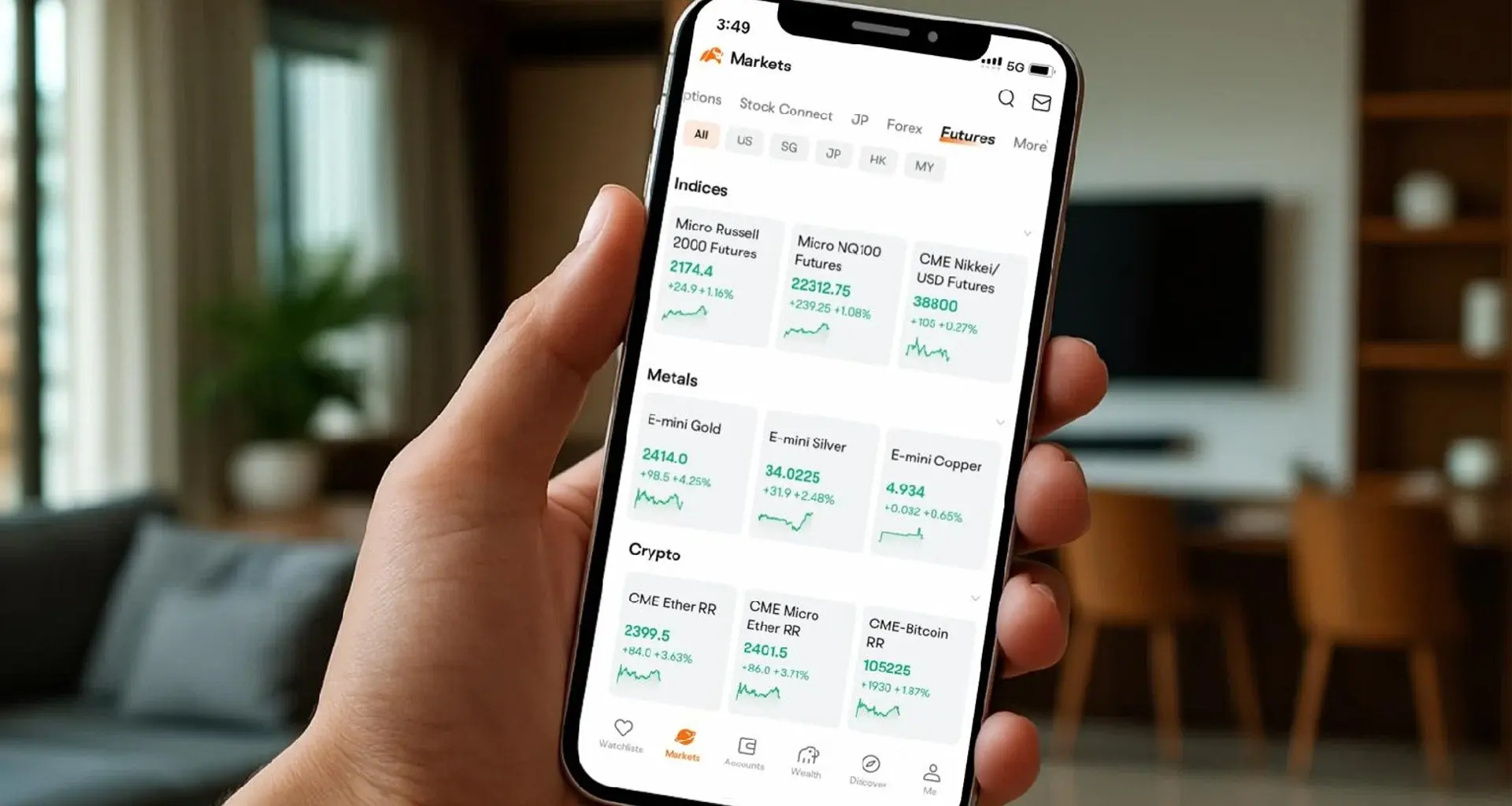

For many investors, exposure to US stocks typically comes via exchange-traded funds (ETFs). The appeal of ETFs is that they are liquid, transparent and allow for long-term participation in benchmark indices at a relatively low cost. But as Lim argues, ETFs only address one side of the equation.

“ETFs are excellent for structural exposure, but they don’t offer the same flexibility when it comes to hedging or tactical adjustments,” he says. “That’s where futures and options add another layer – not to replace ETFs, but to complement them.”

CME’s E-mini Equity Index Futures and Options: A strategic overlay

CME Group’s E-mini S&P 500 and Nasdaq-100 contracts are among the most widely traded derivatives globally. Their appeal lies not just in liquidity, but in how they enable investors to adapt portfolios to shifting market conditions.

For example, an investor with significant ETF holdings linked to the Nasdaq-100 may wish to protect against short-term volatility during earnings season. By buying put options on Nasdaq-100 futures, he can set up a cost-efficient hedge without having to force the investor to liquidate his long-term ETF positions.

Conversely, an investor expecting short-term momentum in large-cap US equities could use S&P 500 futures to act on that view quickly and with less capital outlay.

This layered approach – using ETFs for core holdings and derivatives for tactical adjustments – reflects how institutional investors have long managed portfolios. Increasingly, retail investors are adopting the same mindset.

Hedging as risk management, not speculation

A common misconception about derivatives is that they are inherently speculative. Lim counters this perception.

“At their core, index futures and options are risk-management instruments. They give investors the ability to stay invested while managing downside risk. In a volatile world, that’s not speculation – that’s prudence,” Lim says.

Lim explains that having a flexible investment strategy can be helpful in staying aligned with long-term goals while acknowledging the reality of short-term risks. Photo: Moomoo

Lim explains that having a flexible investment strategy can be helpful in staying aligned with long-term goals while acknowledging the reality of short-term risks. Photo: Moomoo

He points to recent episodes where equity markets whipsawed on policy announcements. Investors with only ETF positions were left exposed, while those using options could cushion the drawdown and reinvest more confidently once markets stabilised.

Another subtle advantage of trading derivatives is efficiency. ETFs, while accessible, require full capital deployment – buying $10,000 in an ETF means tying up $10,000 in cash. Futures, by contrast, require only margin. That capital efficiency can be significant for investors looking to balance multiple exposures at once.

Liquidity also matters. In periods of market stress, bid-ask spreads in ETFs can widen, and ETF market prices can diverge from the actual value of their holdings, creating discounts to their net asset value. Derivatives, by contrast, often retain tighter spreads because they are generally heavily traded by larger institutions.

These, however, do not diminish the importance of ETFs. Rather, as Lim explains, it underscores why each instrument has a key role to play: “ETFs are ideal for long-term, passive allocation. Futures and options are ideal for tactical, active adjustments. Together, they form a stronger portfolio than either one on its own,” according to Lim.

Take, for example, a Singaporean investor building global exposure. He might hold an S&P 500 ETF as a core position. Around that, he may layer Nasdaq-100 options to hedge against volatility in technology stocks, or use S&P 500 futures to temporarily reduce exposure to US equities if inflation data in the US looks unfavourable.

This flexibility allows the investor to stay aligned with long-term goals while acknowledging the reality of short-term risks. It also reduces the behavioural bias of panic-selling in downturns, since hedges can provide psychological as well as financial protection.

Lessons from institutional investors

Institutional investors rarely rely on a single instrument. Pension funds, endowments and hedge funds typically combine cash equities, ETFs, and derivatives. The reasoning is straightforward: each tool serves a different function.

Retail investors, empowered by better access and education, are increasingly moving in the same direction. Platforms now make it possible to monitor real-time positions, assess risk and execute hedging strategies that were once the preserve of professionals.

Lim sees this as part of a broader trend towards more sophisticated trading behaviours: “The gap between institutional and retail investing is narrowing. The key is education – helping investors understand that derivatives are not about leverage for its own sake, but about balance, protection, and adaptability.”

The need for adaptability is underscored by the pace of change. Geopolitical headlines, policy pivots, and corporate earnings now move markets at unprecedented speed. Waiting for quarterly rebalancing or annual reviews may no longer be sufficient.

CME’s E-mini Equity Index Futures and Options offer a way to respond in real time. A sudden surge in bond yields, for instance, can be hedged quickly with S&P 500 futures. A risk of concentrated tech earnings disappointment can be addressed with Nasdaq-100 puts. These are not abstract tools but practical solutions to concrete risks.

As 2026 approaches, the debate over whether central banks have truly tamed inflation, how trade tensions will evolve, and whether AI-driven growth can sustain valuations remains unresolved. What is clear is that volatility will continue to be a defining feature of markets.

For investors, that means portfolio construction cannot rest on static allocations. Core holdings like ETFs provide the foundation, but derivatives such as CME’s E-mini S&P 500 and Nasdaq-100 contracts provide the agility.

Shares Lim: “No single product has all the answers. The strength lies in combination. ETFs give you structural exposure; derivatives give you tactical flexibility. In today’s market, investors need both.”

Investments in capital market products involve risk. Full disclaimers at www.moomoo.com/sg/support/topic5_510. This advertisement has not been reviewed by the Monetary Authority of Singapore.