High-quality carbon credits are becoming more valuable than ever, with prices reaching record levels in late 2025, according to Sylvera. This finding reflects a deeper change in the voluntary carbon market. Companies are no longer buying credits only to meet pledges. They are looking for projects that prove real impact and deliver measurable results.

This shift matters because it shows how trust is shaping the carbon market. Buyers are signaling that only carbon credits backed by evidence and durability will support their net-zero goals.

Data Doesn’t Lie: Sylvera’s Market Snapshot

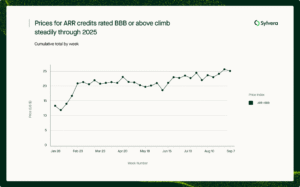

Sylvera’s Q3 2025 Carbon Data Snapshot gives a clear view of where the market is heading. Prices for afforestation, reforestation, and revegetation (ARR) credits reached $24 per tonne in September. At the start of the year, the average was closer to $14, as seen in the chart below. This jump shows how much buyers are willing to pay for quality.

Quoting Allister Furey, CEO at Sylvera:

“The growing premium for high-quality credits demonstrates that integrity is now a key driver of value. Buyers are becoming more selective and project developers are responding by meeting higher standards.”

Retirements also stayed strong. In Q3, about 31.86 million tonnes of credits were retired, almost unchanged from the 31.49 million in Q3 2024. Year-to-date retirements reached 128.15 million credits, one of the highest totals ever recorded.

Supply, however, has slowed. Issuances fell to 63.2 million credits in Q3, down from 76.9 million in Q2. This creates a tighter market where demand outpaces new supply.

Another important trend is the shift toward higher-rated credits. In the first half of 2025, 57% of retired credits reviewed by Sylvera were BB grade or higher. In 2024, that figure was 52%. Buyers are clearly moving away from lower-quality offsets and investing in verified projects that prove long-term climate value.

Real Projects Driving Change

Behind these numbers are real-world examples that show how the market is evolving. Forestry projects remain central, but the focus has shifted toward ones that demonstrate permanence and co-benefits:

Pachama works with reforestation and forest conservation across Latin America. Their credits are tied to satellite monitoring and AI verification, which improves transparency.

Verra-certified projects in Africa and Asia have begun linking biodiversity protection with carbon storage, attracting buyers willing to pay premiums.

On the technology side, Climeworks in Iceland is scaling direct air capture plants that store CO₂ underground. These credits cost far more than forestry but offer permanence, making them appealing to firms with strict climate goals.

These examples show why high-quality credits command higher value: they combine measurable climate impact with added social or environmental benefits.

Billions in Play: Carbon Market Expansion

Sylvera’s numbers fit into a much larger trend. The voluntary carbon market was valued at $4.04 billion in 2024, per Grand View Research data. Estimates suggest it could grow to between $50-$100 billion by 2030.

Nature-based and renewable energy credits remain central to this growth. In 2024, they made up a significant share of total revenues. Meanwhile, carbon removal credits are expected to expand even faster. MSCI projects removal could reach $4 to $11 billion by 2030, making it a key driver of future growth.

Prices are also spreading across a wide range. Nature-based credits typically trade between $7 and $24 per tonne. Technology-based removals, such as direct air capture, are much higher—between $170 and $500 per tonne. These differences reflect the varying durability and permanence of different credit types.

Why High-Quality Credits Cost More

The surge in premium prices for carbon credits comes from several forces working together. Companies with net-zero targets want credits they can defend publicly. That means verified, durable credits with strong evidence of climate benefit.

Supply is another issue. Many projects take years to produce verified credits, and issuances have slowed. Buyers are competing for fewer top-tier credits, which pushes prices higher.

Rating systems like Sylvera’s add more transparency. Buyers now have a clearer way to separate weak projects from strong ones. This transparency builds confidence and influences purchasing decisions.

Policy also plays a role. In Europe and elsewhere, regulators are exploring how voluntary credits may fit into compliance markets. Credits with higher integrity are more likely to qualify, which increases their value.

Finally, projects with added co-benefits—such as biodiversity protection or community development—attract more buyers. Sylvera has reported that credits offering four or more strong co-benefits command higher prices.

All of these drivers show how the market is evolving from a quantity focus to a quality-first approach.

The Great Divide: Carbon Removal vs. Avoided Emissions

A big divide exists between avoided emissions and carbon removal. Avoided emissions come from projects like preventing deforestation. Carbon removal means pulling carbon dioxide directly out of the air and storing it.

Market forecasts suggest removals will grow faster than reductions. But they are also far more expensive. Engineered removals currently trade at hundreds of dollars per tonne, while nature-based projects remain in the lower range.

As technology improves, costs for engineered removal may fall. Still, removal will likely hold a premium because of its permanence. Buyers see value in removal. For example, Microsoft has signed long-term contracts with Climeworks and other carbon removal firms. This reflects a growing recognition that permanent removal is necessary for reaching long-term climate goals.

Integrity Under Pressure: Barriers to Growth

Despite progress, several challenges remain:

Verification: Forestry credits face risks from fires, disease, or illegal logging, making permanence hard to guarantee.

Scaling technology: Engineered removals are still in pilot phases and remain costly.

Liquidity: Fewer high-quality credits means market swings are sharp when demand spikes.

Fragmentation: Multiple registries and standards create confusion, slowing investment.

These challenges underline the importance of building a system of integrity. If standards weaken, the market risks losing trust.

Future Value: Where Carbon Markets Go Next

Sylvera’s latest report makes the trend clear. Prices for high-quality credits are rising fast, and the market is demanding better integrity. Other industry data supports this, showing billions in future growth and a shift toward removal.

Challenges remain, from verifying permanence to scaling new technology. But one theme stands out: credibility now drives value. The voluntary carbon market is entering a new phase where only proven results matter.

For companies, this means buying credits is no longer just about cost. It is about quality, durability, and trust. For the market, it signals a move toward maturity. High-quality carbon credits are not just commanding record prices—they are setting the new standard for climate action.

As Furey further stated:

“This alignment between quality expectations and market demand is critical for scaling carbon markets to deliver genuine climate impact at lower economic cost.”