This is AI generated summarization, which may have errors. For context, always refer to the full article.

The Philippine Stock Exchange clarifies market capitalization figures following false online claims that the local bourse lost P5 trillion from December 2024 to October

MANILA, Philippines – The Philippine Stock Exchange (PSE) set the record straight amid online claims surrounding the market capitalization (MCAP) lost since December 2024.

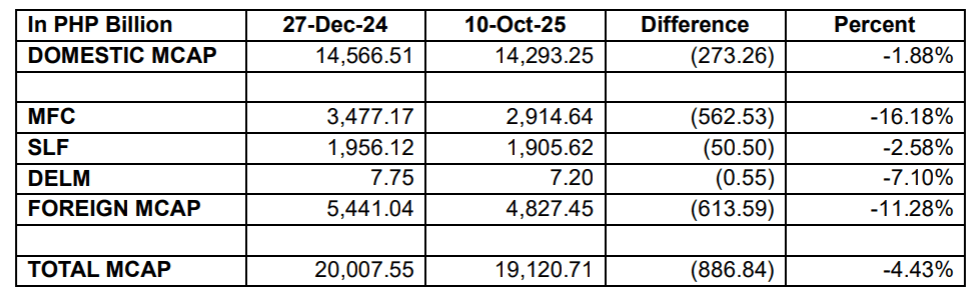

In a statement, the local bourse clarified that domestic MCAP was only down P273 billion or 1.88% from December 2024 to October 2025.

The PSE issued the clarification after what it described as a “pseudo-expert” on the stock market falsely claimed that the local bourse lost P5 trillion during that period.

“Unfortunately, this fake news was irresponsibly published on the same day and reposted the following day in an online tabloid that is known for prioritizing sensationalism that will generate clicks and engagements over providing news that have been fact-checked or verified,” the PSE said.

Market capitalization, also known as market cap, is the total value of the outstanding shares that is traded on the stock market.

The PSE explained that it tracks two types of market cap: total and domestic. Domestic MCAP includes Philippine firms that are primarily listed in the PSE. On the other hand, total market cap includes the foreign companies that are also listed with the local bourse: Sun Life Financial, Inc. (SLF), Del Monte Pacific Ltd. (DELM), and Manulife Financial Corporation (MFC).

“Since only less than 1% of the outstanding shares of MFC and SLF and less than 5% of DELM are lodged for trading in the PSE, PSE uses domestic MCAP data as the reference number since it more accurately captures the performance of the Philippine stock market,” the PSE said.

Image from Philippine Stock Exchange

Image from Philippine Stock Exchange

The local bourse further likened comparing domestic and total MCAP to comparing apples to oranges.

“Deliberately comparing apples to oranges by comparing Domestic MCAP to Total MCAP is dishonest, if not malicious, and is clearly meant to provoke investors to lose confidence in the Philippine capital market and destabilize the economy,” the PSE said.

The PSE’s clarification also comes after Securities and Exchange Commission (SEC) chief Francis Lim fell victim to a fake industry report that claimed the stock market lost P1.7 trillion in MCAP in August due to falling investor confidence amid the controversies surrounding anomalous flood control projects.

– Rappler.com

![[Vantage Point] The ghostly P1.7-trillion market plunge](https://www.newsbeep.com/il/wp-content/uploads/2025/10/1760341632_778_ghost-stock-plunge-oct-11-2025.jpg)