On Christmas Day, 1492, Columbus’s flagship ran aground and sank off the coast of present-day Haiti.

Losing their largest vessel was a major blow to the expedition.

The remaining two ships were too small to carry the entire crew back to Spain.

Faced with no alternative, Columbus left 39 men behind on the island.

Those men were tasked with finding gold, trading peaceably with the Taíno, and building a fortified tower from the timbers of the wrecked flagship.

The Taíno, an indigenous people who had lived in the area for centuries, were the first to encounter the Spanish.

The Spanish described them as “timid, tractable, docile, and harmless,” framing the shipwreck as what they called a “great good fortune.”

This accidental run-in with the Taíno ended up netting more gold than any other leg of the voyage.

Amidst panic LIES opportunity

That same reflex—panic on the surprise of potential shipwreck—lit up markets Friday when Trump’s tweet about China “becoming hostile” sent the $VIX ripping from under 17 to over 22.

But our process kept investors calm, focused, and level-headed when consensus was panicking.

The huge spike in volatility appears to have been “timid, tractable, docile, and harmless.”

Here’s three things we have on our radar as we navigate the week ahead.

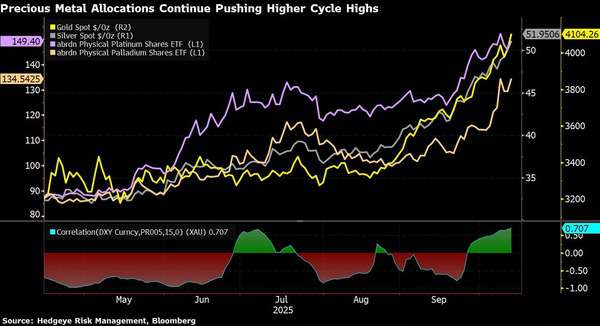

1. Precious metals

Gold loves collapsing yields—surging +2.2% to fresh all-time highs above $4,100/oz as its immediate-term TRADE correlation to the USD flips positive at +0.71—while Silver rips +4.1% further past its 1980s highs, and Platinum (+2.1%) and Palladium (+3.9%) ride the same inflation wave.

2. Fixed Income

The big short-term risk to U.S. equities would’ve been a rates breakout.

Instead, the opposite happened — UST yields moved lower into the weekend, pressing toward new cycle lows:

That gave us the greenlight to reload on High Yield and stay long Core Precious Metals exposure.

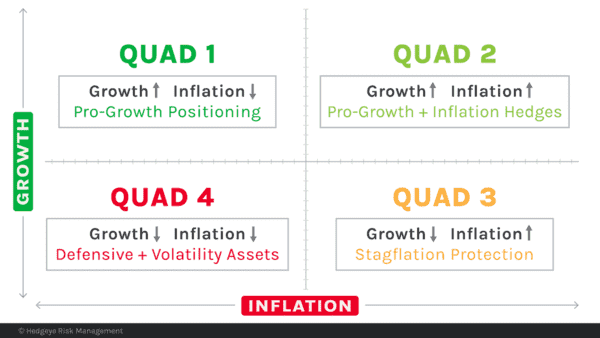

This aligns with the Quad Countdown: the U.S. is currently in a 3-2-1 progression — moving from Quad 3 (slowing growth, sticky inflation) through Quad 2 in Q4 (accelerating growth + inflation), and eventually into Quad 1.

3. Volatility

One day of the VIX being in what we call the “Chop Bucket” (between 20-29) does not equate to a change in TREND.

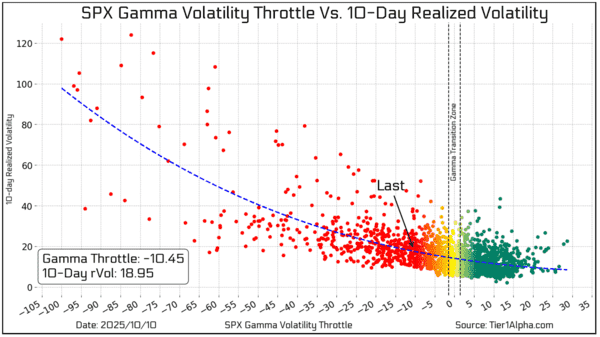

However, with market makers now skewed toward negative gamma as indicated by Tier 1 Alpha‘s Gamma Volatility Throttle (GVT), hedging logic flips from trading against the trend to trading with it.

With the GVT now at -10.45, this level historically amplifies directional moves, and drives volatility higher.

THIS IS THE PROCESS IN ACTION

Process over panic. That’s how Columbus turned wreckage into a fort full of Gold.

Markets reward discipline, not erratic and emotionally driven reactions.

To go deeper into our Global Macro process and positioning into the end of 2025, join us for the 15th Hedgeye Investing Summit—LIVE and on-demand.

Claim your free virtual seat today.