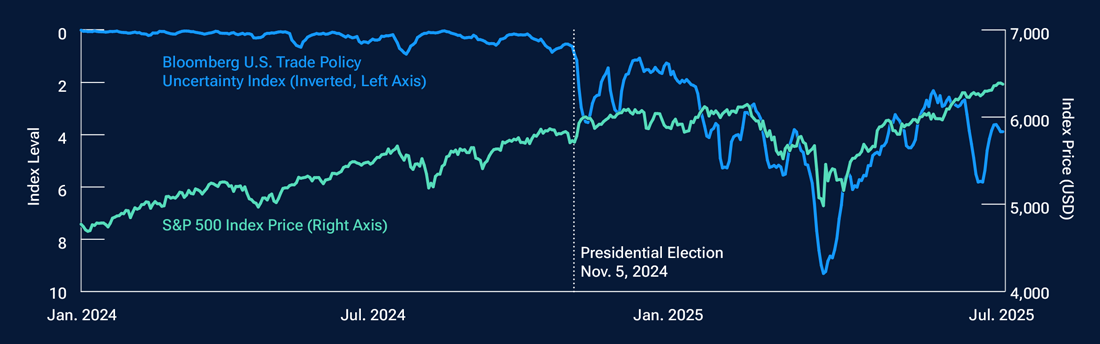

Markets in 2025 have been dominated by a series of disruptive and unpredictable policy implementation. Tariffs have been hastily announced, causing considerable market disruption, only to be raised, suspended, renegotiated, or halted by legal challenges. The confusion has created a murky landscape for investors.

“…the safest course is to remove as much guesswork as possible from asset allocation….”

In an environment such as this, the safest course is to remove as much guesswork as possible from asset allocation by focusing on parts of the market where visibility is still strong. And while much of the investment landscape is clouded by uncertainty, there remain clear areas of opportunity in which we have high conviction. At present, we believe there are three such areas, two of which are policy‑driven and the third more idiosyncratic.

Deregulation and a steeper curve have brightened banks’ prospects

The first theme relates to the marked improvement in the outlook for financials amid a more favorable regulatory environment and a steepening yield curve. On the regulatory side, President Donald Trump appears determined to roll back some of the most significant measures introduced following the 2008 global financial crisis. Federal regulators have scaled back bank supervisory exams and enforcement measures, while the Federal Reserve has since delayed the implementation of the “Basel III Endgame” reforms and intends to reduce the capital requirements proposed under the previous administration.

“Lower capital requirements would free up hundreds of billions of dollars for banks….”

Lower capital requirements would free up hundreds of billions of dollars for banks to use for other purposes such as lending, stock buybacks, dividends, or acquisitions. Less stringent compliance rules would lower costs and enable greater flexibility in balance sheet management. As a result, banks would likely take on more lending and trading activity, boosting returns.

In addition to the deregulation tailwind, the steepening of the yield curve has also been supportive for financials. A steeper yield curve is favorable for banks because they borrow at the short end of the curve and lend at the long end, and a wider spread between these rates (known as net interest margin) increases their profitability. The combination of deregulation and large fiscal deficit spending is expected to place upward pressure on the long end of the yield curve, while the Fed is expected to cut rates on the short end, providing visibility into a sustained steepening of the curve for the foreseeable future—an environment in which banks should thrive.

Trade policy has been a key driver of stock prices

(Fig. 1) Tariff-related uncertainty hit equities hard

As of July 31, 2025.

Past performance is not a guarantee or a reliable indicator of future results.

Sources: Bloomberg Finance L.P. and Standard & Poor’s (see Additional Disclosures).

close

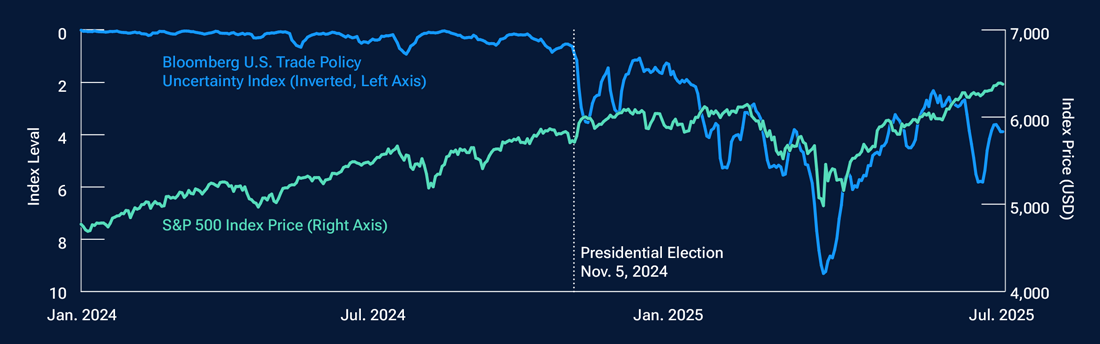

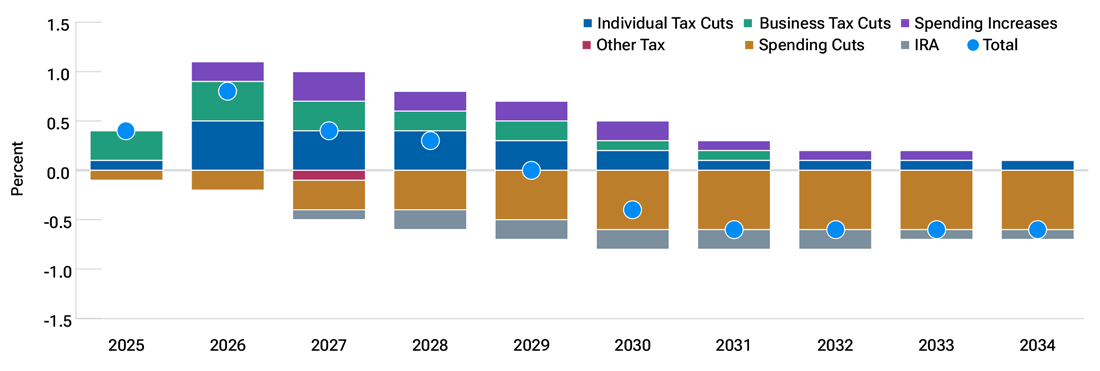

Fiscal impulse and lack of austerity likely to fan the flames of inflation

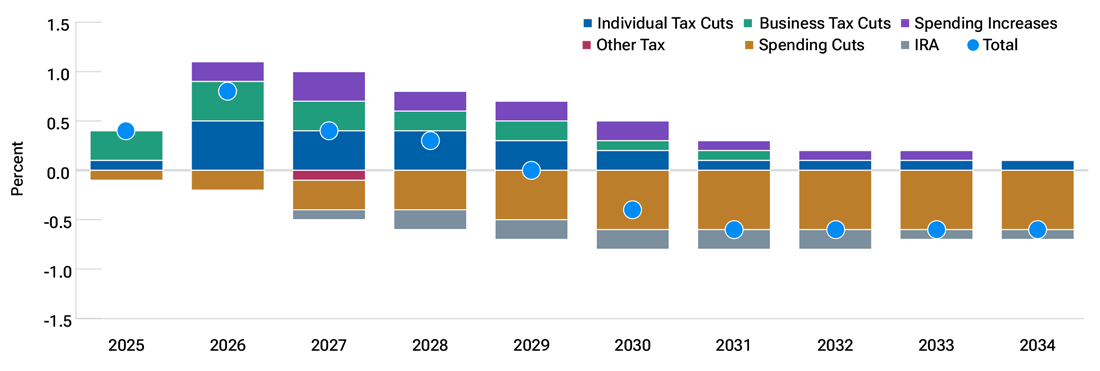

The second theme relates to federal deficit spending. President Trump’s “Big Beautiful Bill,” which outlined the tax and spending policies at the heart of his second-term agenda, is likely to add something in the region of USD 3 trillion to the federal deficit over the next 10 years. This spending is likely to have stimulative effects, keeping upward pressure on inflation.

When prices rise due to inflation, consumers spend more on goods and services. This benefits credit card companies because charges are a percentage of purchases—as the dollar volume of transactions increases, card issuers receive more in interchange fees.

Higher inflation can also be beneficial for leading insurance companies. Inflation increases the cost of claims, enabling insurers to raise premiums on new or renewed policies to reflect higher replacement costs. This is especially true of insurance firms that specialize in types of insurance that allow for flexible pricing, such as commercial insurance and specialty insurance (which cover complex risks that fall outside of traditional insurance policies).

Favorable “sandboxes” reduce the need for guesswork

This strategic area of opportunity is not focused on a specific aspect of policy, but rather on something we call the “sandbox” concept. The key question at the heart of the sandbox concept is: “Is this an investment that you will feel just as positively about, if not more so, in three to five years’ time?” If the answer to this question is yes, then you have identified a favorable sandbox to play in.

Sandboxes can take many different forms, but one of the more common profiles is a business with a durable, open-ended growth outlook with sufficient visibility. While insulation from negative downstream policy impacts is a desirable trait in this situation, the dynamics of a sandbox are subject to change, particularly in a changing political environment. The key to finding a good sandbox is to take a step back and identify potential long-term changes before they occur and decide how those changes are likely to affect that industry, for better or worse.

“Good sandbox” firms will always be sought after, but they become invaluable at times like the present, when large chunks of the market have become too risky to invest in due to policy uncertainty. In an environment in which some of the rules are constantly changing, it pays to reexamine first principles. And one principle that we believe still holds true is that if you own companies that you are very confident that you will still feel good about five years from now, and you have an overweight position in such companies, you will have a higher chance of outperforming.

Estimated impact of U.S. budget reconciliation

(Fig. 2) U.S. budget deficit expansion as a percent of gross domestic product relative to current policy

As of June 30, 2025.

IRA = Inflation Reduction Act.

All data represents estimates and actual future outcomes may differ materially.

Sources: Piper Sandler, Congressional Budget Office, and Joint Committee on Taxation. Data reflect fiscal years 2025 to 2034.

close

Strong over the long run, but near-term visibility in AI is slightly more opaque

Looking ahead, the rise of artificial intelligence (AI) shows little sign of abating and could arguably be considered another “knowable” area of the market, with a few caveats. While there is little doubt over AI’s long-term potential, questions remain over the durability of the current cycle. In the near term, the major chip manufacturers are likely to remain highly profitable, with AI capex expected to continue at a robust pace. But in order for this current trajectory of spend to continue, purchasers of these chips will need to be able to demonstrate improved return on investment in the form of proliferating use cases that include the deployment of AI agents and other incremental revenue streams.

While we are strong believers in AI being a transformative, multi-decade secular growth story, what we need to guard against in the near term is the market entering a frenzy of “irrational exuberance” at a time when future chip demand is approaching a crossroads. We believe the best way to navigate this situation is a disciplined adherence to a time-tested stock‑picking framework that is adept at identifying attractive opportunities in this theme, while also detecting signs of froth that could indicate an asymmetric risk/return relationship.