Webull (BULL) recently marked a significant milestone by entering the European market through its subsidiary in the Netherlands. This expansion coincided with a notable price move of 19% over the last quarter. The company’s revival of cryptocurrency trading for U.S. residents and the introduction of hourly contract trading for cryptocurrencies added to its attractiveness to investors, aligning with broader market trends where the Nasdaq hit new records and interest rate cuts are anticipated. During a time when the market showed a 1% increase, these events likely reinforced the upward movement in Webull’s share price.

Webull has 2 warning signs (and 1 which is potentially serious) we think you should know about.

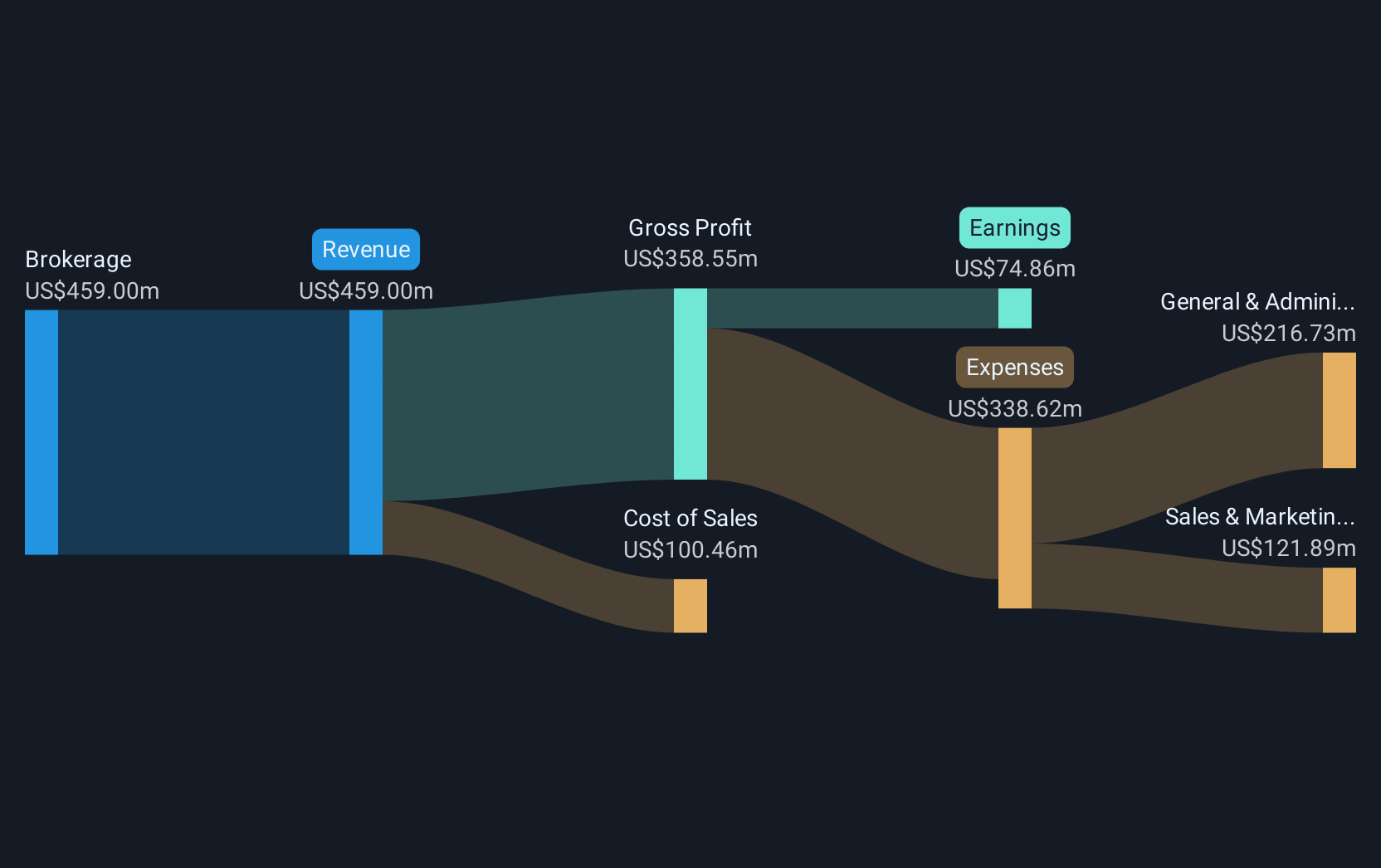

BULL Revenue & Expenses Breakdown as at Sep 2025

BULL Revenue & Expenses Breakdown as at Sep 2025

Webull’s recent expansion into the European market and the reintroduction of cryptocurrency services are expected to reinforce its growth narrative centered on global market diversification and increased user engagement. The integration of new trading options and services aligns with the company’s strategy to enhance customer growth and stabilize revenue. By entering the European market and reintroducing crypto trading for U.S. residents, Webull positions itself to potentially capture larger market shares and elevate its revenue streams, aligning with broader regulatory and market trends that are conducive to such growth.

Over the past three years, Webull’s total shareholder return, which includes both share price appreciation and dividends, has been 29.43%. This longer-term performance offers valuable context to the recent advances. Currently, Webull’s shares stand at $12.93, reflecting a significant increase yet remaining at a 28.2% discount to the consensus analyst price target of $18.0, indicating potential room for appreciation should revenue and earnings forecasts materialize as expected.

Despite a 19% rise in share price over the last quarter, Webull’s past year returns have underperformed relative to the broader U.S. market and the Capital Markets industry. Nevertheless, the expansion efforts and the anticipated improvement in digital trading options could boost future revenue growth and earnings, although profitability remains a challenge. Analysts forecast Webull’s revenue to grow at a rate of 26.1% annually over the next three years, with expectations of profit margins eventually aligning with industry averages. These developments are key to achieving the set price target and will be closely monitored in the context of execution risks and market conditions.

Our valuation report here indicates Webull may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Webull might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com