Report Overview

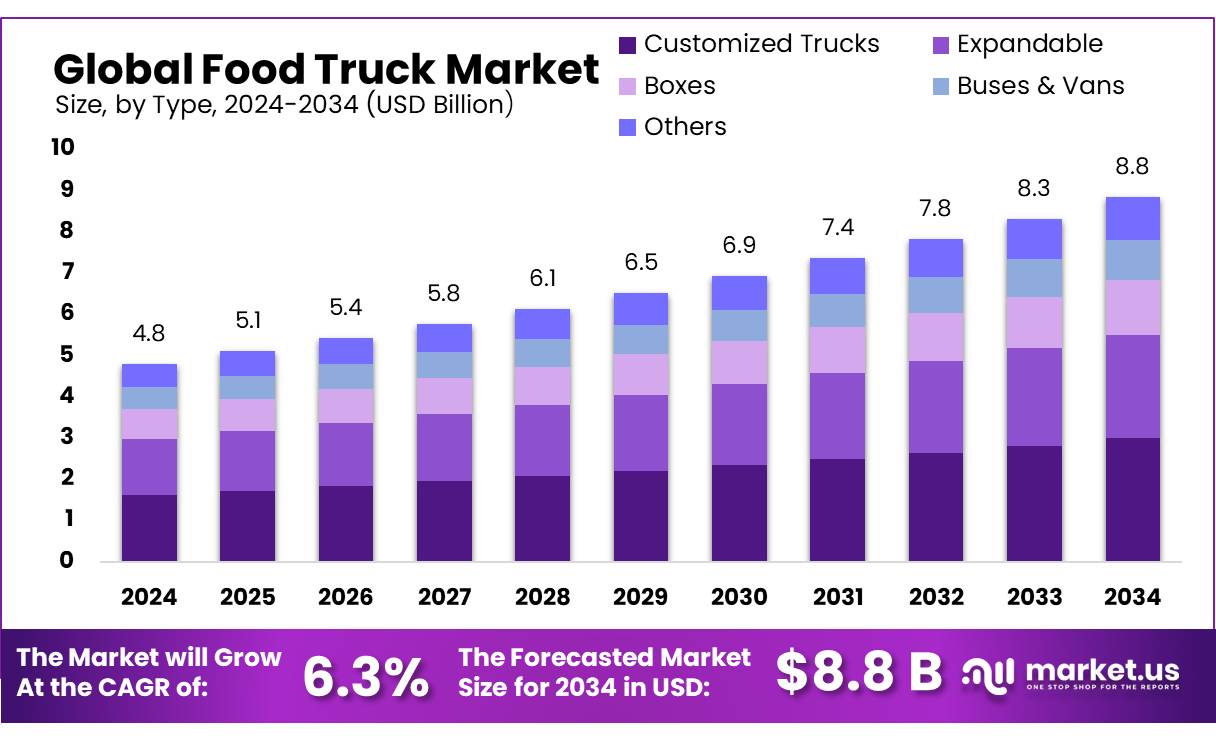

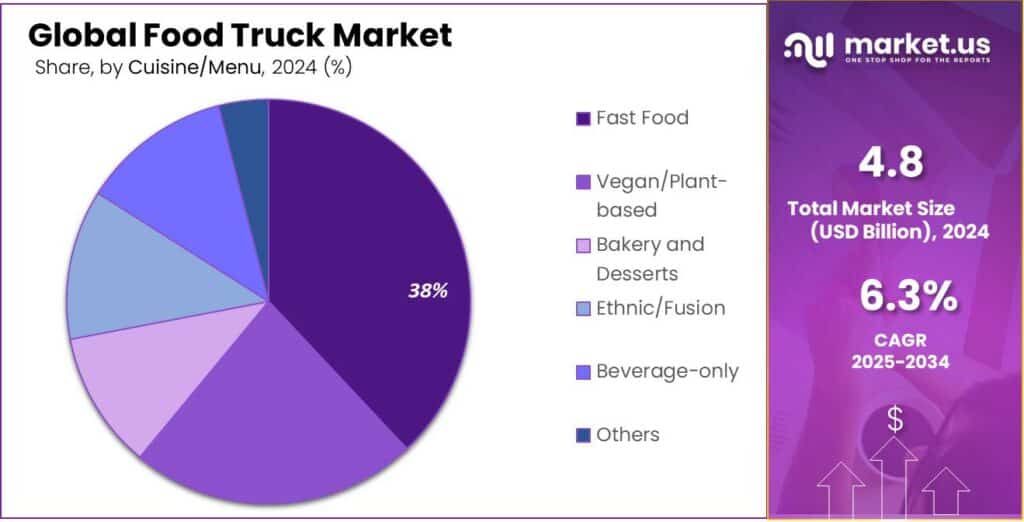

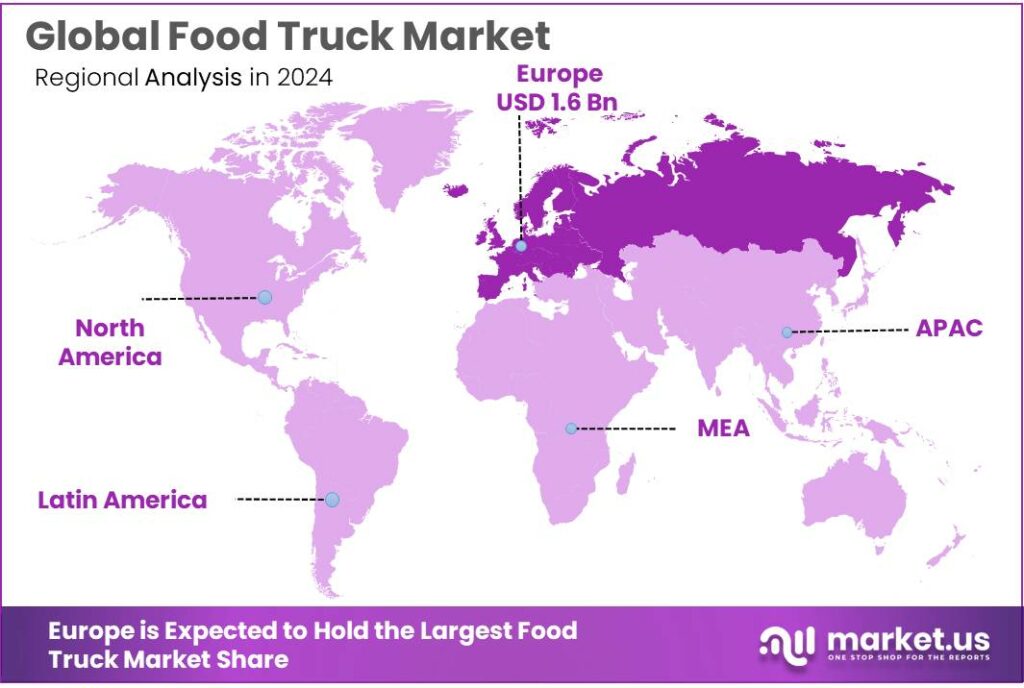

The Global Food Truck Market size is expected to be worth around USD 8.8 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 33.70% share, holding USD 1.6 Million in revenue.

The food truck concept—mobile culinary services serving urban and public settings—has gained traction globally and is emerging as a vibrant segment within India’s informal food service landscape. Though currently more prominent in countries like the United States, India is witnessing gradual uptake, especially in metropolitan and tier‑1 cities, blending street vending traditions with modern consumer demand for convenience and diverse cuisine.

In India, urbanization and evolving consumer lifestyles have catalyzed the development of this mobile dining format. While precise official numbers on food trucks are limited in the public domain, the broader street food sector is governed by the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. This legislation provides formal recognition and regulatory protection to street vendors—approximately 10 million individuals nationwide, including in major urban centers like Mumbai (250,000), Delhi (450,000), Kolkata (>150,000), and Ahmedabad (100,000)—and allocates designated vending zones with procedural safeguards.

A noteworthy government initiative is the launch of Akka Cafe Trucks by Dakshina Kannada Zilla Panchayat under the National Rural Livelihoods Mission (NRLM). Aimed at women’s self‑help groups, the program provides up to ₹15 lakh per SHG, including ₹7 lakh for the truck and operating costs. The Ujire Akka Cafe registers ₹9,000–12,000 in daily transactions, while Munnoor does ₹5,000–7,000—showcasing viable revenue models under supported, women‑led mobile food services.

The regulatory environment is further supported by the Food Safety and Standards Authority of India (FSSAI), the statutory authority under the Ministry of Health and Family Welfare established by the Food Safety and Standards Act, 2006. FSSAI mandates licensing—registration for businesses with turnover below ₹12 lakh, state licenses for ₹12 lakh–₹20 crore, and central licenses above ₹20 crore—and oversees food safety through a network of laboratories: 22 referral labs, 72 state/UT labs, and 112 NABL‑accredited private labs.

Key Takeaways

Food Truck Market size is expected to be worth around USD 8.8 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 6.3%.

Customized Trucks held a dominant market position, capturing more than a 33.8% share of the food truck market.

14 to 22 ft food trucks held a dominant market position, capturing more than a 49.5% share of the total market.

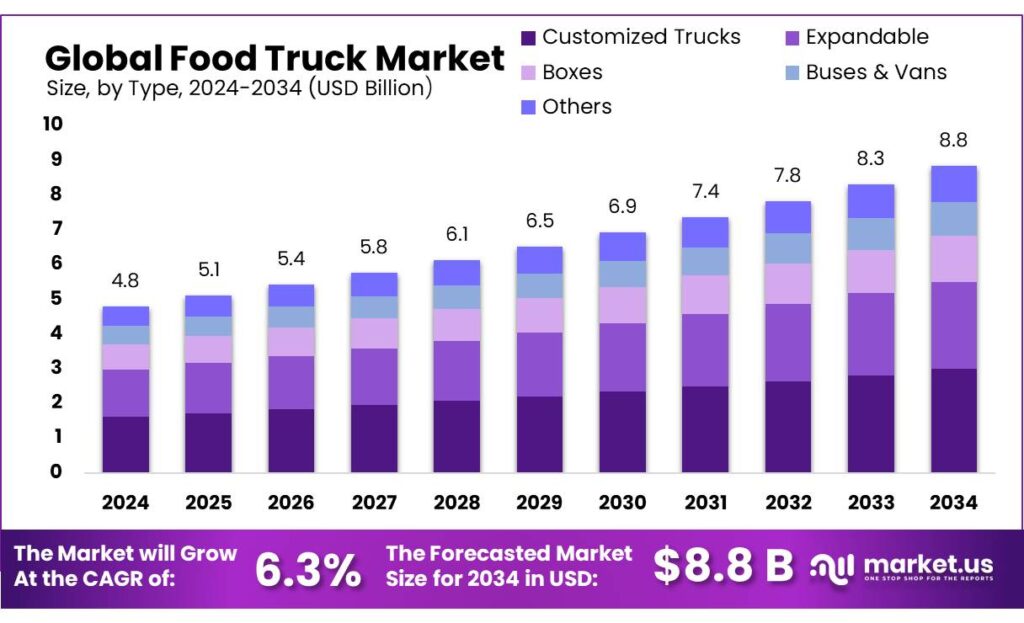

Fast Food held a dominant market position, capturing more than a 38.9% share in the food truck market.

Independent Operators held a dominant market position, capturing more than a 56.5% share in the food truck market.

Europe holds a dominant position in the global food truck market, accounting for approximately 33.70% of the market share, valued at USD 1.6 billion.

By Type Analysis

Customized Trucks dominate with 33.8% due to flexibility and high customer appeal.

In 2024, Customized Trucks held a dominant market position, capturing more than a 33.8% share of the food truck market. These trucks gained popularity due to their ability to be tailored to specific business needs—whether it’s cuisine-focused interiors, modern kitchen layouts, or attractive branding on the exterior. Entrepreneurs in cities like Mumbai, Delhi, and Bengaluru are increasingly choosing customized models as they offer a better dining and cooking experience, leading to higher footfall and repeat customers. Compared to standard or rented trucks, customized options provide better utility, longer life, and a unique identity in a competitive market. In 2025, the segment is expected to see steady momentum as more first-time food truck operators opt for tailored designs to suit niche offerings like gourmet burgers, vegan menus, and global street food styles. This growing trend reflects a strong demand for individuality and innovation in mobile food services across India.

By Length Analysis

14 to 22 ft Food Trucks dominate with 49.5% for their ideal balance of space and mobility.

In 2024, 14 to 22 ft food trucks held a dominant market position, capturing more than a 49.5% share of the total market. This size range has become the most preferred option among food truck operators across India due to its practicality—it offers enough space for full kitchen setups while remaining easy to maneuver in urban and semi-urban areas. Cities like Bengaluru, Pune, and Hyderabad have seen a rise in medium-length trucks operating in tech parks, festivals, and college zones, where space is limited but customer demand is high. These trucks allow efficient workflows for staff, better storage, and the ability to cater to a wider menu without sacrificing speed. In 2025, this segment is likely to remain the top choice as it balances operational efficiency, fuel economy, and customer reach, making it a smart investment for both new and experienced food truck entrepreneurs.

By Cuisine/Menu Analysis

Fast Food dominates with 38.9% as quick bites win over busy urban crowds.

In 2024, Fast Food held a dominant market position, capturing more than a 38.9% share in the food truck market. The popularity of burgers, fries, wraps, and sandwiches continues to rise, especially in metro cities where working professionals and students look for affordable and quick meal options. Food trucks offering fast food are often seen outside office complexes, colleges, and crowded marketplaces, drawing in large footfalls due to their short prep times and familiar taste. These menus also allow for easy customization and high profit margins, making them a favorite among vendors. Looking ahead to 2025, the fast food segment is expected to maintain its stronghold as demand grows in tier-2 cities and digital ordering makes quick meals even more accessible. The fast food format’s speed, affordability, and mass appeal make it a dependable choice for food truck businesses across India.

By Ownership Model Analysis

Independent Operators dominate with 56.5% thanks to low entry barriers and creative freedom.

In 2024, Independent Operators held a dominant market position, capturing more than a 56.5% share in the food truck market. This ownership model has become the top choice for first-time entrepreneurs and culinary enthusiasts who want to start small with limited capital and full creative control. Without the need to follow franchise rules or corporate branding, these independent operators can experiment with unique menus, fusion dishes, and localized offerings that resonate well with their target audiences. From solo-run taco trucks in Pune to family-owned momo vans in Guwahati, the diversity is vast. In 2025, this segment is expected to grow further as more individuals, especially from the younger generation, view food trucks as a viable path to business ownership, offering both flexibility and personal expression in the competitive food industry.

Key Market Segments

By Type

Customized Trucks

Expandable

Boxes

Buses & Vans

Others

By Length

Up to 14 ft

14 to 22 ft

Above 22 ft

By Cuisine/Menu

Fast Food

Vegan/Plant-based

Bakery and Desserts

Ethnic/Fusion

Beverage-only

Others

By Ownership Model

Independent Operators

Franchise Chains

Corporate / Institutional Fleets

Emerging Trends

Embracing Technology and Digital Platforms

The food truck industry in India is experiencing a transformative shift, driven by the integration of technology and digital platforms. Entrepreneurs are increasingly adopting online ordering systems, cashless payment methods, and social media marketing to enhance customer engagement and streamline operations. This digitalization not only improves service efficiency but also helps food trucks reach a broader audience, including tech-savvy consumers seeking convenience and variety in their dining experiences.

A notable example of this trend is the collaboration between food truck operators and the Open Network for Digital Commerce (ONDC). Launched by the Government of India, ONDC aims to democratize digital commerce by enabling small businesses, including food vendors, to access digital platforms without relying on major e-commerce giants.

As of early 2024, ONDC had facilitated over 7.1 million transactions across various sectors, with a significant portion attributed to food and beverage vendors. This initiative provides food truck operators with an opportunity to expand their customer base and improve operational efficiency through digital means.

Moreover, the government’s Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme offers financial support to micro food processing units, including food trucks. Under this scheme, entrepreneurs can avail themselves of a 35% capital subsidy for project costs up to ₹10 lakh, along with additional benefits for branding and marketing. This financial assistance enables food truck operators to invest in technology, enhance their digital presence, and improve service delivery.

Drivers

Government Support and Policy Initiatives

The Indian government has introduced several initiatives to promote the growth of the food truck industry, recognizing its potential to boost local economies and create employment opportunities. One significant policy is the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, which provides financial assistance to micro food processing units.

Under this scheme, individual units can receive a credit-linked subsidy of 35% of the project cost, up to a maximum of ₹10 lakh. Group units, such as Farmer Producer Organisations (FPOs), self-help groups (SHGs), and cooperative societies, are also eligible for similar subsidies.

Additionally, Common Facility Centres can receive up to ₹3 crore for infrastructure development. This initiative aims to formalize the unorganized food processing sector, enhancing its competitiveness and value realization.

Furthermore, the Ministry of Food Processing Industries (MoFPI) has been actively involved in supporting the food processing sector through various schemes and initiatives. The ministry aims to make food processing a national initiative by facilitating quality investments from both domestic and international sources. Its key objectives include improving infrastructure, promoting value addition, and enhancing the competitiveness of food processing units.

Restraints

Regulatory Challenges and Licensing Complexities

One of the most significant hurdles faced by food truck entrepreneurs in India is navigating the complex and often fragmented regulatory landscape. Unlike traditional restaurants, food trucks are subject to a myriad of licenses and permits that vary across states and municipalities, leading to confusion and delays in operations.

In cities like Bengaluru, food truck owners have reported being “stuck in license limbo,” with no clear guidelines or support from local authorities to legalize and regulate their trade. Despite repeated appeals to the Bruhat Bengaluru Mahanagara Palike (BBMP) and the state government, there has been little progress in establishing a formal framework for food trucks.

Similarly, in Indore, the Regional Transport Office (RTO) issued license cancellation notices to 17 modified food vehicles for obstructing traffic and operating without proper documentation. These vehicles, often registered in other states like Gujarat and Maharashtra, were found to be illegally modified and parked on sidewalks, causing significant traffic disruptions.

Moreover, the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014, intended to protect the rights of street vendors, has not been uniformly implemented across the country. While the Act mandates the establishment of Town Vending Committees and the issuance of vending certificates, many states have yet to fully operationalize these provisions, leaving vendors, including food truck operators, vulnerable to harassment and eviction

Opportunity

Government Schemes and Support for Food Truck Entrepreneurs

The Indian government’s initiatives have significantly bolstered the food truck industry, offering financial assistance, infrastructure support, and skill development opportunities. These measures have empowered entrepreneurs to establish and expand their businesses, contributing to the sector’s growth.

One of the key programs is the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, launched in June 2020. This scheme provides a 35% capital subsidy for project costs up to ₹10 lakh, ₹40,000 seed capital for each Self-Help Group (SHG) member, and 50% support for branding and marketing. For instance, Gujarat has onboarded 675 beneficiaries under the PMFME scheme, the highest in the country, enabling micro food processing units to modernize production, expand operations, and access new markets.

Additionally, the Delhi government has approved a food truck policy to establish food hubs across the city, aiming to generate business and empower the food industry. The policy’s implementation across 16 locations in Delhi is expected to promote entrepreneurship, uplift food culture, and enhance the city’s gastronomic landscape.

Furthermore, the establishment of incubation centers and laboratories, such as those at World Class Skill Centres in Jhandewalan and Wazirpur, and IoT and fabrication labs at Netaji Subhas University of Technology, is enhancing product development, testing, and skill-building for startups, students, and faculty. These initiatives aim to make Delhi a hub for innovation, MSMEs, and skilled youth-driven enterprises.

Regional Insights

Europe holds a dominant position in the global food truck market, accounting for approximately 33.70% of the market share, valued at USD 1.6 billion in 2025. This leadership is attributed to a rich culinary heritage, robust tourism industry, and a growing preference for diverse and convenient dining experiences.

The region’s deep-rooted street food culture, coupled with the increasing popularity of food festivals and events, has significantly contributed to the rise of food trucks. For instance, in 2019, food festivals and street food events more than doubled, leading to heightened demand for mobile food vendors. Countries like Italy and France are at the forefront, with cities such as Rome, Milan, and Paris serving as hubs for gourmet food trucks offering a variety of cuisines, from traditional Italian to international flavors.

Technological advancements have further propelled the growth of the food truck industry in Europe. The integration of digital platforms for ordering and payment, along with the use of social media for marketing, has enhanced customer engagement and operational efficiency. These innovations have enabled food truck operators to reach a broader audience and adapt to changing consumer preferences.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Prestige Food Trucks, based in Orlando, Florida, is widely regarded as one of the top custom food truck manufacturers. Operating from a 30,000 sq ft facility in Elkhart, Indiana, they offer turnkey solutions—design, engineering, fabrication—with competitive pricing, strong customer support, and industry-leading warranties. Certified to build across all 50 U.S. states, they tailor trucks for a wide range of clients: restaurateurs, universities, corporate institutions and more, ensuring compliance with health and fire codes.

Founded in Miami in 2015, United Food Truck has built over 600 mobile kitchen projects by blending lean manufacturing methods with innovative design. Their streamlined production allows them to complete builds in about 11 days, delivering custom food trucks, trailers, and container kitchens throughout the U.S., Caribbean, and Latin America. Their portfolio includes renowned clients like Wendy’s, Pollo Tropical, Wing Stop, and Hyatt Hotels, and they maintain a 4.7 Google rating for customer satisfaction.

Operating from Macclenny, Florida, M&R Specialty Trailers and Trucks brings over 50 years of combined fabrication experience to custom food truck and concession builds. Since 2007, they’ve focused on quality craftsmanship, offering free design blueprints and after-sales support. Their product range includes BBQ smokers, pizza trailers, coffee trucks, and mobile medical units, all built to meet health and building codes. They serve clients across the U.S. and internationally.

Top Key Players Outlook

Prestige Food Trucks

United Food Truck

M&R SPECIALTY TRAILERS AND TRUCKS

Veicoli Speciali

Futuristo trailers

MSM CATERING TRUCKS MFG. INC.

The Fud Trailer

Cruising Kitchens

VS Veicoli Speciali

Food Truck Company BV

Recent Industry Developments

In 2024, United Food Truck—a custom mobile kitchen builder based in Miami—continued its steady rise in the food truck market. Since launching in 2015, the company had completed over 600 food truck and trailer builds by the start of 2024, spreading its mobile culinary solutions across the U.S. and even beyond.

In 2024, Prestige Food Trucks continued to lead as a respected builder of custom food trucks and trailers. With roots going back to 2012, they’ve steadily built their reputation—and figures underline that. By the middle of this decade, they had constructed nearly 50 custom food trucks, shipping them across more than 20 U.S. states and even overseas.

Report Scope