EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

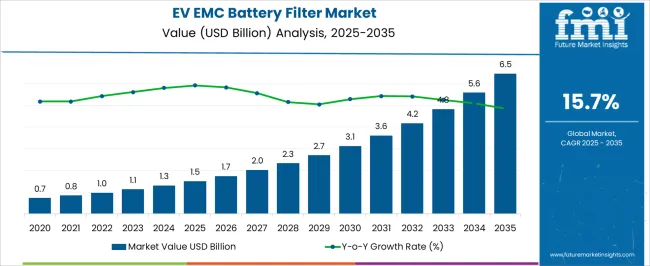

The EV EMC battery filter market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.7% over the forecast period.

From 2025 to 2030, the market will rise from USD 1.5 billion to USD 3.1 billion, marking a sharp upward slope in the early half of the forecast. The growth rate volatility index for this phase indicates aggressive acceleration, as demand for electromagnetic compatibility (EMC) filters is reinforced by the rapid scale-up of electric vehicle (EV) production. Year-on-year increases such as from USD 1.7 billion in 2026 to USD 2.7 billion in 2029 demonstrate a consistent momentum, showing that EMC filters are becoming indispensable in stabilizing power electronics, reducing interference, and ensuring system reliability. Between 2030 and 2035, the market is projected to grow further from USD 3.1 billion to USD 6.5 billion, showing a steeper trajectory compared to the first block.

The volatility index for this phase remains strong, indicating that demand patterns will be influenced by rapid technological adoption, stricter regulatory frameworks on EMC compliance, and wider penetration of high-voltage EV architectures. Values rising from USD 3.6 billion in 2031 to USD 5.6 billion in 2034 highlight accelerated adoption driven by growing EV fleets and the need for more advanced filtering solutions. The curve suggests a market moving from early adoption to widespread integration, with consistent opportunities for component manufacturers, automotive OEMs, and system integrators. This growth pattern signals a market with high momentum and a clearly upward trajectory, offering significant potential for long-term gains.

Quick Stats for EV EMC Battery Filter Market

EV EMC Battery Filter Market Value (2025): USD 1.5 billion

EV EMC Battery Filter Market Forecast Value (2035): USD 6.5 billion

EV EMC Battery Filter Market Forecast CAGR: 15.7%

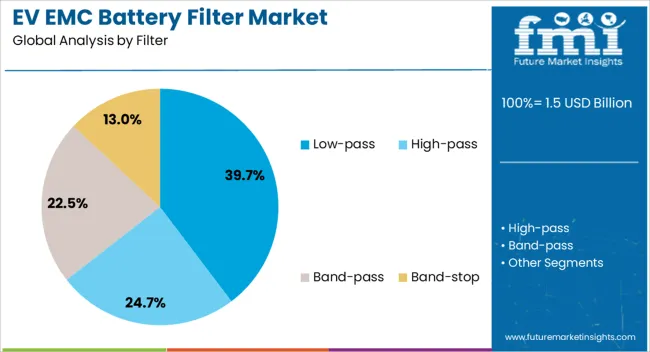

Leading Segment in EV EMC Battery Filter Market in 2025: Low-pass (39.7%)

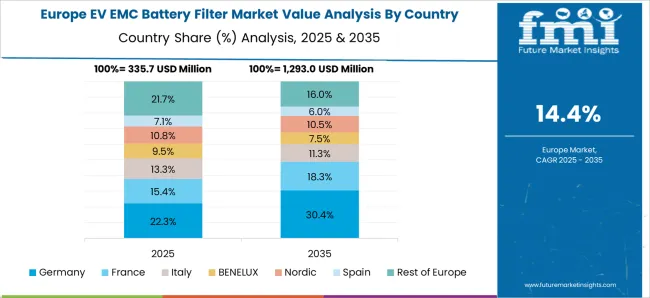

Key Growth Regions in EV EMC Battery Filter Market: North America, Asia-Pacific, Europe

Key Players in EV EMC Battery Filter Market: TDK, AstrodyneTDI, Delta, InTiCa, Littelfuse, MAHLE, Murata, STMicroelectronics, TE Connectivity, Wurth Elektronik

EV EMC Battery Filter Market Key Takeaways

Metric

Value

EV EMC Battery Filter Market Estimated Value in (2025 E)

USD 1.5 billion

EV EMC Battery Filter Market Forecast Value in (2035 F)

USD 6.5 billion

Forecast CAGR (2025 to 2035)

15.7%

The EV EMC battery filter market secures a specialized yet increasingly vital share within broader automotive and electronics segments, with its presence shaped by the rising demand for interference-free EV performance. Within the electric vehicle components market, EMC battery filters account for about 5%, reflecting their role as a niche but important element alongside batteries, inverters, and motors. In the electromagnetic compatibility solutions market, their contribution is stronger at nearly 12%, since filters directly address electromagnetic interference challenges in high-voltage EV systems. Within the automotive power electronics market, EV EMC battery filters represent around 7%, supporting efficient current flow and protecting circuits from instability. In the EV battery systems market, their share stands at close to 6%, as filters are integrated into battery packs to ensure reliability and safety under varying operating conditions.

Finally, in the automotive electrical and electronics market, their presence is about 4%, given the wide range of competing subsystems such as infotainment, sensors, and lighting. Collectively, these percentages demonstrate that EV EMC battery filters hold their strongest positioning in EMC solutions and automotive power electronics, while maintaining smaller but essential shares in broader EV component and electronics categories. Their importance lies not in scale but in functionality, ensuring safety, compliance, and efficiency, which positions them as indispensable within the advancing ecosystem of electric mobility.

Why is the EV EMC Battery Filter Market Growing?

The EV EMC battery filter market is witnessing significant expansion driven by the surge in electric vehicle adoption, increasingly stringent electromagnetic compliance (EMC) standards, and the growing integration of sensitive electronic components within battery systems. Automakers and component manufacturers are prioritizing robust EMC strategies to avoid interference with vehicle safety, infotainment, and control systems.

Additionally, innovations in battery architecture and modular designs are pushing demand for filters that can provide reliable shielding while maintaining power efficiency. Market participants are focusing on miniaturized, high-temperature-resistant filter solutions to meet space and performance constraints.

Regulatory pressures across North America, Europe, and Asia-Pacific are further bolstering demand for advanced EMC filtering solutions tailored to next-gen EV platforms.

Segmental Analysis

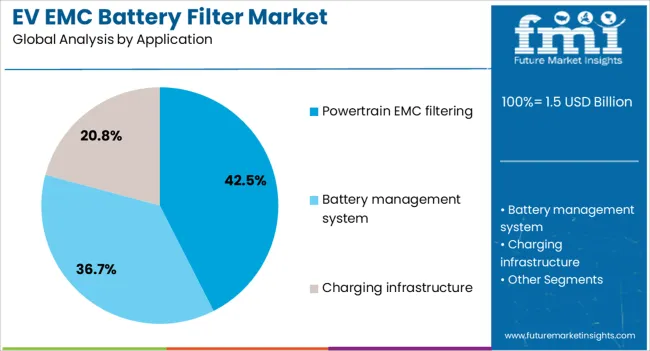

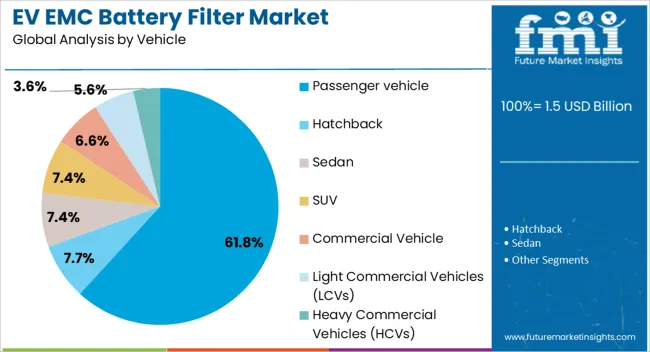

The EV EMC battery filter market is segmented by filter, application, vehicle, end-use, and geographic regions. By filter, EV EMC battery filter market is divided into low-pass, high-pass, band-pass, and band-stop. In terms of application, EV EMC battery filter market is classified into powertrain EMC filtering, battery management system, and charging infrastructure. Based on vehicle, EV EMC battery filter market is segmented into passenger vehicle, hatchback, sedan, SUV, commercial vehicle, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). By end-use, EV EMC battery filter market is segmented into lithium-ion battery, lead acid battery, nickel metal hydride battery, and solid-state battery. Regionally, the EV EMC battery filter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Low-pass Filter Segment:

Low-pass filters are expected to dominate the EV EMC battery filter market with a 39.70% share by 2025. This dominance stems from their efficiency in attenuating high-frequency noise while preserving the integrity of low-frequency power signals critical to EV battery operation. Low-pass filters are increasingly embedded in power modules to suppress electromagnetic emissions that could disrupt on-board systems. Their simplicity, cost-effectiveness, and compatibility with evolving EV architectures make them a preferred choice across OEMs and Tier 1 suppliers. As the number of power electronics in EVs rises, low-pass filter adoption is expected to scale further due to their essential role in achieving compliance with international EMC norms.

Insights into the Powertrain EMC Filtering Application Segment:

The powertrain EMC filtering segment is projected to lead the market with a 42.50% share in 2025, underscoring its critical role in safeguarding core propulsion electronics. As EV powertrains become more sophisticated integrating inverters, converters, and fast-charging modules the potential for electromagnetic interference (EMI) has increased substantially. Powertrain-specific filters ensure stable performance, reduce emissions, and help meet the demanding signal integrity requirements of modern EV propulsion systems. OEMs are investing in high-performance filtering solutions to protect high-voltage and communication circuits that co-exist within compact powertrain environments. This has positioned the segment as a central pillar in the overall EMC management strategy in electric vehicles.

Insights into the Passenger Vehicle Segment:

Passenger vehicles are expected to account for 61.80% of total demand in the EV EMC battery filter market by 2025, making it the top vehicle segment. This is largely attributed to the explosive growth in battery-electric and plug-in hybrid passenger vehicle adoption worldwide. With increasing electrification, these vehicles require more complex EMC solutions to handle rising circuit density and multifunctional battery systems. Filters are being integrated not only for regulatory compliance but also to enhance the performance and safety of in-cabin electronics, advanced driver-assistance systems (ADAS), and battery management systems. As premium and mid-range EVs scale, passenger segment demand for compact, reliable EMC filters will continue to outpace other categories.

What are the Drivers, Restraints, and Key Trends of the EV EMC Battery Filter Market?

The EV EMC battery filter market is advancing as rising EV adoption intensifies the need for electromagnetic compliance, safety, and performance reliability. Opportunities are expanding in high-voltage platforms, commercial fleets, and energy storage, while trends highlight compact, integrated, and modular filter designs. Challenges remain in high costs, regulatory complexity, and supply chain vulnerabilities. In my opinion, manufacturers that innovate in cost-effective, high-performance designs and strengthen compliance expertise will gain competitive advantage, positioning EMC battery filters as indispensable components in next-generation electric vehicle powertrains.

Rising Demand for EMC Compliance in Electric Vehicles

Demand for EV EMC battery filters has been driven by the need to reduce electromagnetic interference (EMI) in electric vehicles, ensuring safety and compliance with regulatory standards. These filters are vital for maintaining stable battery performance, protecting sensitive electronic components, and ensuring smooth communication between power systems. As EV adoption grows, manufacturers are prioritizing EMC solutions to meet increasingly strict certification requirements. In my opinion, demand will continue to rise as automakers rely on EMC filters to enhance reliability and meet global regulatory expectations.

Expanding Opportunities in High-Voltage EV Architectures

Opportunities are strengthening in high-voltage battery systems, where EMC filters play a critical role in reducing interference during fast charging and high-power operation. With premium EVs and commercial electric fleets adopting 800V platforms, demand for advanced filter technologies is rising. Energy storage applications and hybrid vehicles further expand opportunities. Companies offering compact, high-performance filters tailored to diverse voltage ranges will capture substantial opportunities, particularly as automakers scale production of next-generation electric vehicles across global markets.

Key Trends toward Compact and Integrated Filter Designs

Trends in the EV EMC battery filter market highlight miniaturization, modularity, and integration. Automakers are increasingly seeking compact designs that reduce weight and space while maintaining high filtering efficiency. Integration of EMC filters directly within battery packs and inverter systems is becoming common, simplifying design and assembly. In my opinion, this trend marks a shift toward holistic power electronics solutions, where filters are no longer standalone components but integral parts of the EV powertrain, supporting efficiency and reducing system complexity.

Persistent Challenges in Cost and Technical Complexity

Challenges include high costs associated with designing filters that meet stringent automotive standards while remaining compact and durable. Variations in global EMC regulations create complexities for manufacturers supplying to multiple regions. Supply chain constraints for specialty materials and electronic components also hinder production scalability. In my assessment, success will favor companies that develop cost-optimized designs, ensure compliance with diverse standards, and secure resilient sourcing strategies to address these barriers, enabling broader adoption of EMC battery filters in the expanding EV market.

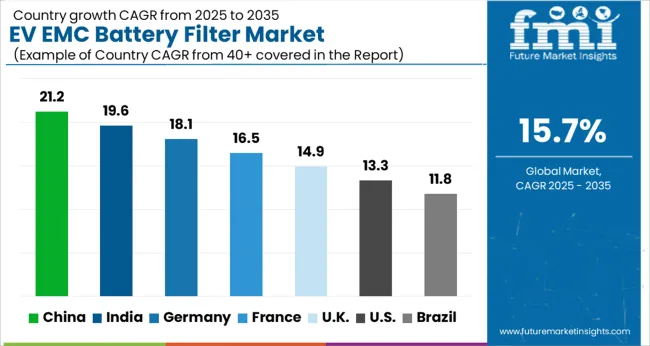

Analysis of EV EMC Battery Filter Market By Key Countries

Country

CAGR

China

21.2%

India

19.6%

Germany

18.1%

France

16.5%

UK

14.9%

USA

13.3%

Brazil

11.8%

The global EV EMC (Electromagnetic Compatibility) battery filter market is projected to grow at a CAGR of 15.7% from 2025 to 2035. China leads with a growth rate of 21.2%, followed by India at 19.6%, and Germany at 18.1%. The United Kingdom records a growth rate of 14.9%, while the United States shows the slowest growth at 13.3%. Growth is driven by rising EV adoption, stricter EMC regulations, and the need for stable battery performance in high-voltage environments. Emerging markets such as China and India are witnessing faster growth due to large EV production volumes and favorable policies, while developed economies like the USA, UK, and Germany emphasize advanced semiconductor technologies, noise suppression, and integration of high-efficiency EMC filters. This report includes insights on 40+ countries; the top markets are shown here for reference.

Sales Outlook on EV EMC Battery Filter Market in China

The EV EMC battery filter market in China is projected to grow at a CAGR of 21.2%. China’s leadership in EV production and exports is fueling strong demand for EMC battery filters. Government-backed policies requiring EMC compliance in EV systems are accelerating adoption. Manufacturers are focusing on high-capacity filters that reduce electromagnetic interference in high-voltage batteries. Collaborations between domestic automakers and semiconductor firms are ensuring innovation and cost efficiency. With rapid EV adoption across passenger and commercial fleets, China is establishing itself as the largest global hub for EMC battery filter manufacturing.

High EV production and exports drive EMC filter demand in China.

Government EMC compliance regulations accelerate adoption.

Collaborations with semiconductor firms strengthen innovation capacity.

Demand Analysis for EV EMC Battery Filter Market in India

The EV EMC battery filter market in India is expected to grow at a CAGR of 19.6%. Government initiatives such as FAME II and state-level subsidies are fueling growth in EV production and sales, driving demand for EMC-compliant battery systems. Local manufacturers are partnering with global suppliers to integrate advanced filter technologies into domestic EV platforms. The growing two-wheeler and three-wheeler EV segments, where cost efficiency is critical, are emerging as major drivers. India’s increasing investment in battery cell and module manufacturing is further supporting demand for EMC battery filters across the EV supply chain.

FAME II and state-level subsidies accelerate EV adoption in India.

Two- and three-wheeler EV segments drive EMC filter demand.

Domestic battery manufacturing expansion boosts long-term opportunities.

Growth Outlook on EV EMC Battery Filter Market in Germany

The EV EMC battery filter market in Germany is projected to grow at a CAGR of 18.1%. Germany’s strong automotive manufacturing base and strict EU regulations for EMC compliance are major growth drivers. Demand is being shaped by premium automakers integrating advanced SiC- and GaN-based inverters, requiring high-efficiency EMC filters. German manufacturers are focusing on high-performance solutions for luxury EVs, buses, and heavy-duty vehicles. Research collaborations between automakers and semiconductor firms are further enhancing product innovation, ensuring Germany’s strong role in the European EV supply chain.

Strict EU regulations drive widespread EMC compliance in EV systems.

Premium automakers adopt high-performance EMC filters for luxury EVs.

Collaborations enhance Germany’s leadership in advanced EV technologies.

Future Analysis for EV EMC Battery Filter Market in the United Kingdom

The EV EMC battery filter market in the UK is projected to grow at a CAGR of 14.9%. Growth is supported by government targets for EV adoption and stricter regulatory frameworks around electromagnetic compatibility. UK automakers and R&D centers are investing in compact and lightweight EMC filters suitable for passenger EVs and commercial fleets. The development of battery gigafactories and expansion of charging infrastructure further support adoption. With growing interest in premium EVs and collaborations with European semiconductor firms, the UK is gradually strengthening its position in the EMC battery filter market.

Government EV targets and regulations drive EMC filter demand.

Investments in lightweight and compact EMC filters fuel growth.

Battery gigafactories and infrastructure expansion boost adoption.

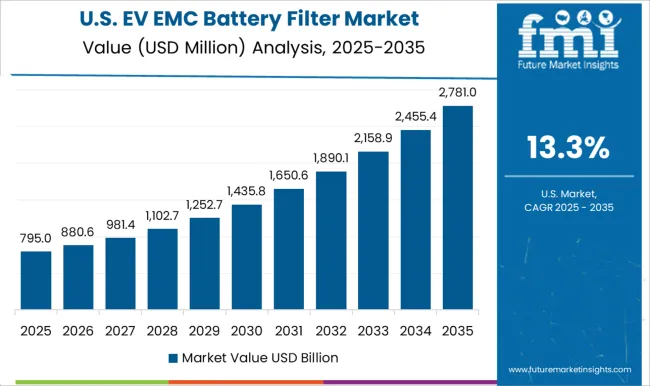

Opportunity Analysis for EV EMC Battery Filter Market in the United States

The EV EMC battery filter market in the USA is projected to grow at a CAGR of 13.3%. Growth is supported by federal and state policies promoting EV adoption, as well as EMC compliance standards from regulatory agencies. USA automakers are focusing on integrating advanced EMC filters into high-voltage EV platforms, particularly SUVs, trucks, and commercial vehicles. Leading semiconductor and electronics companies are innovating in high-frequency suppression and thermal management solutions to improve reliability. Although slower than Asia, steady demand is ensured by the USA focus on premium EV performance and strong domestic semiconductor expertise.

Federal and state EV policies sustain EMC filter adoption.

High-voltage EV platforms drive demand for advanced EMC filters.

Domestic semiconductor innovation enhances product performance.

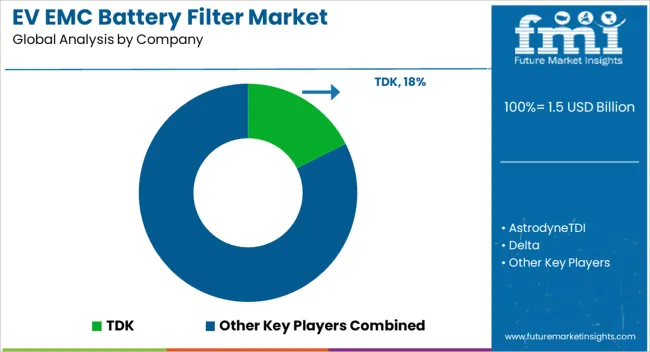

Competitive Landscape of EV EMC Battery Filter Market

Competition in the EV EMC battery filter space is driven by expertise in electromagnetic compatibility, power conditioning, and compact design for high-voltage battery systems. TDK, Murata, and Wurth Elektronik dominate through wide portfolios of inductors, capacitors, and EMI suppression components tailored for EV applications. Littelfuse and TE Connectivity emphasize circuit protection and connector integration, making EMC filters part of larger safety-critical architectures. Delta and AstrodyneTDI focus on high-efficiency power management modules for OEMs and Tier-1s, while InTiCa positions itself as a niche supplier of coil-based filter assemblies. MAHLE differentiates by leveraging its automotive pedigree to deliver integrated filters with thermal management capabilities, while STMicroelectronics drives silicon-based solutions that pair filtering with advanced power electronics. This competitive mix blends electronics leaders, automotive specialists, and niche innovators, each staking ground through component reliability and integration flexibility. Strategies emphasize miniaturization, higher current handling, and compliance with automotive EMC regulations.

TDK and Murata highlight multilayer ceramic and film capacitor technologies with strong suppression at high frequencies, while Wurth and InTiCa focus on coil and choke innovations. Littelfuse and TE Connectivity promote filter assemblies tested for voltage surges and fault resilience, ensuring alignment with ISO and UNECE standards. Delta and AstrodyneTDI emphasize OEM partnerships, marketing customized modules for fast-charging compatibility. MAHLE markets thermally optimized filter housings, while STMicroelectronics stresses silicon integration to shrink form factors and boost efficiency. Product brochures showcase insertion loss graphs, rated voltage and current specs, and visual layouts of compact filter assemblies. Messaging underscores reduced electromagnetic interference, improved driving range through efficient power conditioning, and compliance assurance for OEM certification. By combining technical clarity with application-specific benefits, brochures act as both engineering guides and persuasive materials, positioning EMC battery filters as indispensable elements for safe and reliable EV adoption.

Key Players in the EV EMC Battery Filter Market

TDK

AstrodyneTDI

Delta

InTiCa

Littelfuse

MAHLE

Murata

STMicroelectronics

TE Connectivity

Wurth Elektronik

Scope of the Report

Item

Value

Quantitative Units

USD 1.5 billion

Filter

Low-pass, High-pass, Band-pass, and Band-stop

Application

Powertrain EMC filtering, Battery management system, and Charging infrastructure

Vehicle

Passenger vehicle, Hatchback, Sedan, SUV, Commercial Vehicle, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs)

End-use

Lithium-ion battery, Lead acid battery, Nickel metal hydride battery, and Solid-state battery

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

TDK, AstrodyneTDI, Delta, InTiCa, Littelfuse, MAHLE, Murata, STMicroelectronics, TE Connectivity, and Wurth Elektronik

Additional Attributes

Dollar sales by product type (capacitive, inductive, hybrid filters), Dollar sales by vehicle type (battery electric, plug-in hybrid, fuel cell), Trends in electromagnetic compatibility compliance and noise suppression, Use in high-voltage battery systems and inverters, Growth of EV safety regulations and fast-charging adoption, Regional production clusters across Asia-Pacific, Europe, and North America.