Alibaba Group Holding captured more than a third of China’s artificial intelligence cloud services market in the first half of this year, surpassing the combined share of its three closest rivals and solidifying its lead over competitors, according to a report from research firm Omdia.

With a 35.8 per cent market share, Alibaba Cloud significantly outperformed ByteDance’s Volcano Engine, which ranked second at 14.8 per cent. Huawei Cloud followed with 13.1 per cent, while Tencent Cloud held 7 per cent. Baidu Cloud placed fourth, with a 6.1 per cent share, according to the report published on Monday.

Omdia forecast that the Chinese market for AI cloud services, comprising computing infrastructure optimised for generative AI tasks, would more than double in 2025 to 51.8 billion yuan (US$7.3 billion), up from 20.83 billion yuan in 2024. From 2025 to 2030, the sector was expected to grow at an annual rate of 26.8 per cent.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Alibaba, owner of the Post, is investing heavily in AI and cloud infrastructure, developing what it calls “full-stack AI capabilities”. That includes its Qwen family of large language models, as well as a range of cloud servers, cloud container services, databases and developer tools.

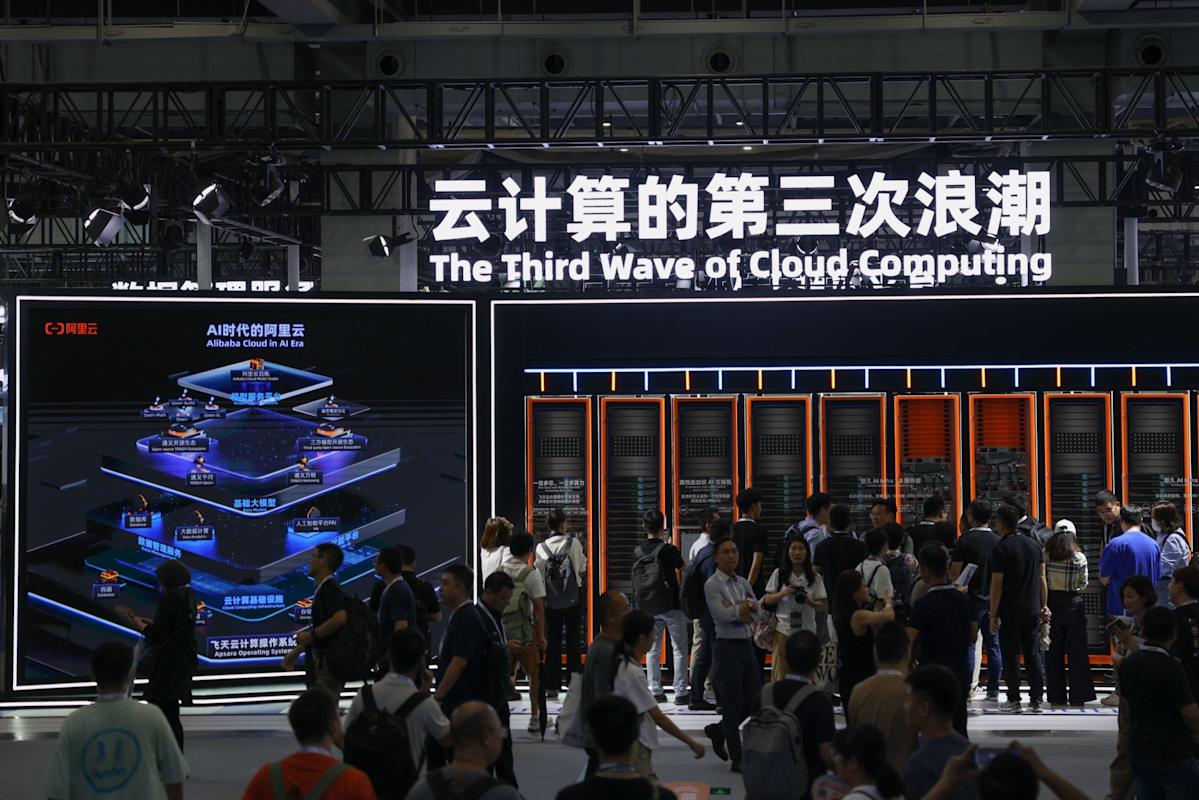

Alibaba Cloud’s Apsara conference in Hangzhou, China, in September 2024. Photo: Xinhua alt=Alibaba Cloud’s Apsara conference in Hangzhou, China, in September 2024. Photo: Xinhua>

Alibaba Cloud, a key driver of the company’s ambitious US$52 billion capital-expenditure commitment unveiled earlier this year, operates 89 availability zones across 29 regions worldwide.

For the June quarter, the division reported revenue of 33.4 billion yuan, a 26 per cent increase from a year earlier, outpacing the 18 per cent growth seen in the March quarter. That made Alibaba Cloud the group’s fastest-growing unit, surpassing the international e-commerce arm.

Capital investment in AI and cloud infrastructure reached 38.6 billion yuan in the three months to June, and totalled more than 100 billion yuan across the past four quarters, CEO Eddie Wu Yongming said during an earnings call with analysts last month.

He emphasised the role of the open-source Qwen models in driving adoption of Alibaba Cloud, noting booming demand throughout China for both training and inference.

Story continues

As AI technologies grow, developers require an increasingly comprehensive stack of tools to build applications, Wu said. “Customers tend to favour vendors with extensive product portfolios, particularly those leading in multiple categories,” he added.

In the first half of this year, daily token consumption by enterprise-grade large models in China jumped more than fourfold from the previous six months, according to a recent report from consultancy Frost & Sullivan. Tokens are the fundamental units of text or code processed by AI models.

Alibaba’s Qwen series accounted for 17.7 per cent of usage, followed by ByteDance’s Doubao at 14.1 per cent and DeepSeek at 10.3 per cent.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2025 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.