Over the past few years, a friend has undergone Ayurvedic treatment for fluctuating blood pressure at a hospital in Kerala. Each year, the insurer pays the cost of a week’s hospitalization, but this time it demurred and rejected the claim, saying that the annual treatment seemed more for rest than a medical necessity. It is harder to get Ayurvedic claims through insurers.

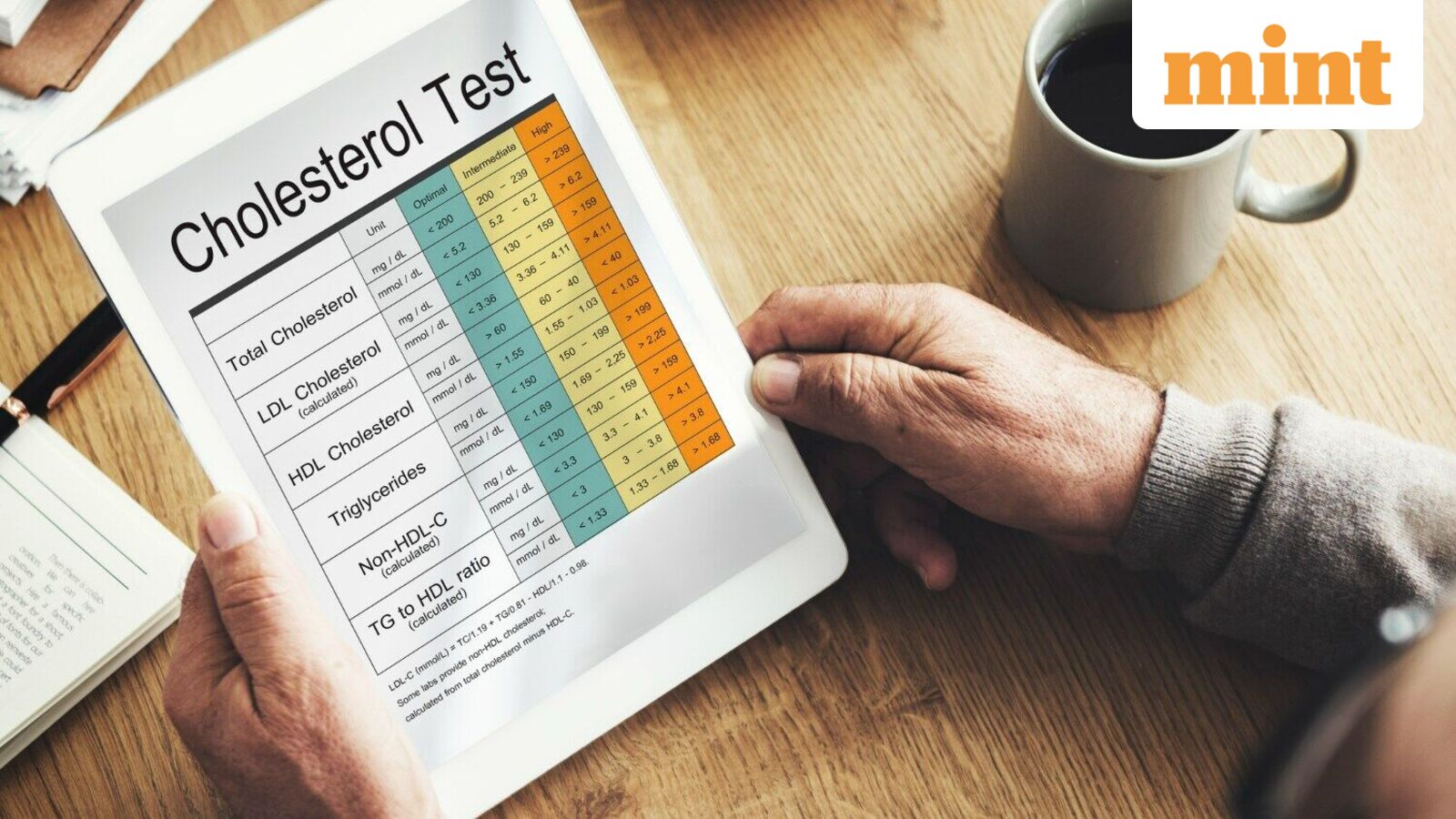

There is no denying the popularity of Ayurveda. Ayurveda is mostly accepted for chronic, low-severity medical conditions such as hypertension, high cholesterol or arthritis. The severity of the health condition is important in deciding the treatment protocol. Someone with mildly-elevated creatinine levels will look to Ayurveda standalone or as a supplement to allopathic medicines. However, at higher creatinine levels, dialysis of the kidney may be needed.

The growing use of Ayurveda, especially for chronic low-severity illnesses, creates a unique challenge for insurers. Allopathic treatment for such conditions usually happens on an outpatient (OPD) basis, so insurers don’t pay for it. But Ayurvedic treatment for the same conditions often requires hospitalization — and insurers do pay for that. Such hospitalization may be repeated annually for long-term benefits. So, from an insurer’s perspective, Ayurvedic hospitalization results in additional cost that they would not otherwise have borne.

This cost increase for insurers results in four aspects of an Ayurvedic claim being questioned. First, was hospitalization required? Second, was this a rest-and-wellness treatment rather than something that was medically necessary? Third, what length of hospital stay was medically necessary, and finally, was the patient treated in a recognized and reliable Ayurvedic hospital? These questions are also relevant for allopathic treatments, but get asked more often for Ayurveda. So, if you are filing an Ayurvedic claim, expect and prepare for a higher degree of scrutiny. Here is what you can do:

Explain the need for hospitalization right away. One effective approach is to provide diagnostic reports to substantiate the health condition for which you are to be treated. Blood reports, X-rays, and ultrasounds help. Even more effective are diagnostic reports over an extended period if they show that yours is a long-term chronic issue not getting readily treated by conventional means. A diagnosis from an allopathic doctor is also a useful input for the insurer.

Another strong piece of evidence that hospitalization is necessary could be that the regimen requires equipment and conditions that are not available at home. These could be the oils, room conditions or equipment used.

List out the daily treatment routine and link the interventions to your specific medical issue. Good Ayurvedic hospitals will do this in a detailed manner, making it simpler for claim handlers to assess the relevance of a treatment. Quite often, policyholders disguise a wellness-and-rest programme as a medically-necessary treatment. To prevent misuse, insurers will ask more questions and sometimes deny cashless settlement. Instead, they may ask the claimant to file for reimbursement as that allows a more detailed investigation.

Minimize your hospital stay. This is less of an issue in allopathic hospitals, because most of us want to make a quick getaway from stressful hospitalization. But in Ayurvedic hospitals, there is a tendency to stay longer because the treatment and conditions are so relaxing and stress-relieving. If you have a shorter hospital stay, it is easier for the insurer to conclude that you are opting only for the medically-necessary treatments, and your claim is more likely to be approved.

Pick an accredited hospital on the insurer’s panel. Insurers are extra careful about the Ayurvedic hospitals they accredit. This is one reason why the Ayurvedic hospitals on insurer panels are so few. Many insurers have over 10,000 allopathic hospitals, but fewer than 100 Ayurvedic hospitals on their panels. As the insurer’s selection of Ayurvedic hospitals is so measured, you know that these hospitals are likely to have authentic Ayurvedic care.

Apply for cashless approval. Since most Ayurvedic interventions are planned well in advance, you must apply for cashless approval. Cashless settlement of claims is so much easier than reimbursement. Even if a cashless request is rejected, the feedback that you receive from the insurer on rejection is useful to prepare your reimbursement claim.

To sum up, the best way for you to get your Ayurvedic claim paid is to share your diagnostic reports with the insurer, have a detailed treatment plan linked to the medical issues diagnosed, minimise your hospital stay to what is necessary, get treated in a hospital empanelled by the insurer, and apply for cashless payment well in advance.

Returning to my friend whose claim was rejected, he refiled with evidence showing that each previous Ayurvedic treatment had slightly improved his medical parameters. The logic was that a few more years of treatment would help him get back to normal. Faced with strong medical logic, the insurer approved the claim.

Kapil Mehta is the co-founder of SecureNow Insurance Broker.