Watson is also on the losing side of a more than decade-long legal tussle with Sir Owen Glenn – during which Watson was imprisoned for contempt in 2020 over his hiding of assets – and his New Zealand companies have been liquidated by Inland Revenue over tens of millions of dollars in unpaid tax.

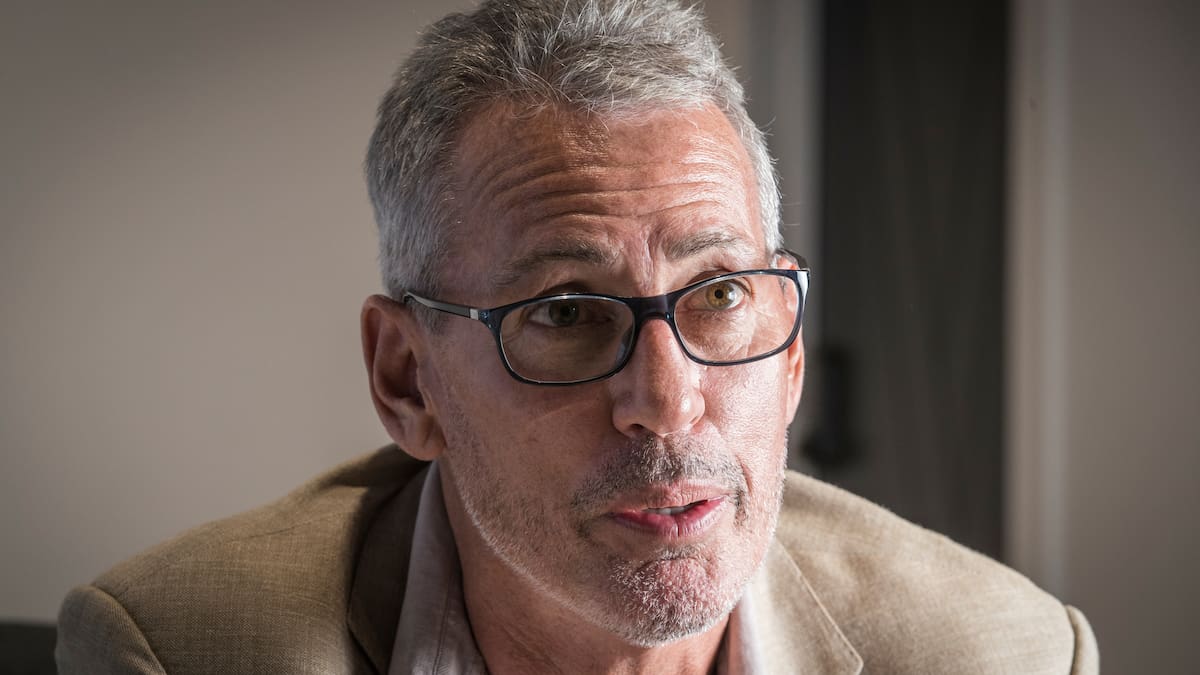

Sir Owen Glenn (left) and Eric Watson in 2012 in happier times when they were co-owner of the Warriors NRL team. Photo / Paul Estcourt

These recent years have been a sharp decline for Watson, who during the 1990s was assessed as New Zealand’s sixth-richest man and whose extravagant lifestyle and relationships made him common fodder for gossip pages.

But from his residence on the Spanish island of Mallorca, he told the Herald he believed his horizon was full of sunlit uplands powered by artificial intelligence.

Watson claims he has been offered a settlement by the SEC with no requirement to pay a fine.

“They’ve offered to settle, for nothing. ‘Bye bye, see you later. You can just never be on a company board in America’,” he said.

“They’ll settle for no money, no admission of guilt. They just want it to go away, but I refuse to settle on principle.”

Watson has in recent years been representing himself in court actions – “I’m poor, very poor” he says from Mallorca, while also acknowledging he kept a residence in Ibiza – and said he has found the experience as a self-taught litigator invigorating.

“I’m happy to just keep going. I find it intellectually stimulating to be honest, the back and forth. I’m learning a lot about the US legal system, and it gives me a little bit of a hobby.

“That’s the nature, ultimately, with civil cases, and you get to the court and it’s a toss-up at the end of the day. No matter what anybody says, who’s got the best lawyers wins. But in this case, I think I’ve got the best lawyer: Myself.”

Watson insisted he had many avenues of appeal, and many superior courts to appeal to, and could drag proceedings on for years.

He also believed the main problem with Long Blockchain was being too early in pivoting to crypto. He said the company would have been a success under President Donald Trump.

“The whole mood in the SEC in Washington was anti-crypto, anti-blockchain, the opposite of what it is now. So their real motivation was to stamp out anybody that did anything about blockchain,” Watson claimed.

He asserted Long Blockchain would be a “billion dollar company” if it had been allowed to continue trading, but acknowledges it could have been better-run.

“I would be the first to say that the management didn’t do a very good job of communicating it or executing. The share price shot up 1000% or whatever,” he said of Long Blockchain.

Watson may now be an old dog – he recently qualified for New Zealand Super should he choose to return to the country of his birth – but he has enjoyed learning new tricks.

He is enthusiastic about artificial intelligence which he said helped him draft legal submissions.

Eric Watson is a booster for generative AI and says the tools have been helping him self-represent in US and UK courts.

“I use a combination of ChatGPT, Claude and Gemini and one other – four different AI systems – and it’s pretty good, actually,” he said of his generation of legal letters and briefs.

He jokes about running for Parliament in New Zealand, “I’ll do an AI Prime Minister’s campaign. What do you think?” he asked.

“Trump’s got a much worse legal record than me: 37 criminal convictions. I haven’t got any of those, but maybe I’d have a chance. I’ve got the brand, but…” he said, trailing off.

He said he had wasted “decades, and tens of millions of dollars” on lawyers over the course of his life.

“My recommendation is, if you’re going to go to court, don’t. And if you are going to go to court, ideally, don’t use lawyers.”

Watson said, aside from using AI on Spanish islands to duel with US regulators, he still had business ambitions and was working with a gold-mining company in the United States.

“The company has an active gold mining resource in the United States.

“They’ve got exploration permits, and they’ve got alluvial gold mining income and the gold price is very high. They wanted some help to raise some more capital and ultimately go public so that’s what I’ve been working on.”

He declined to name the company, but offered this reporter an opportunity to buy into the venture: “If you’ve got some spare cash, you can buy some shares in a pre-IPO round. That’s completely legal, by the way.”

Watson is also two of 14 defendants named in a labyrinthine set of proceedings filed in United Kingdom courts by one of Egypt’s richest families.

One lawyer acting for the plaintiffs described the case as a “US$100m fraud claim alleging fraudulent misrepresentations, breaches of fiduciary duty and good faith and conspiracy in respect of investments in an FX business”.

Watson described the case as “outlandish” and said he was, again, representing himself.

“There’s about 15 defendants, that’s a very big trial. So, you know, in the world of litigation, people will try anything: People just filing suits all over the f**king place, and I guess throwing my name in sort of seems to be popular.”

Matt Nippert is an Auckland-based investigations reporter covering white-collar and transnational crimes and the intersection of politics and business. He has won more than a dozen awards for his journalism – including twice being named Reporter of the Year – and joined the Herald in 2014 after having spent the decade prior reporting from business newspapers and national magazines.

Stay ahead with the latest market moves, corporate updates, and economic insights by subscribing to our Business newsletter – your essential weekly round-up of all the business news you need.