SUBANG JAYA, Nov 26 — PMCare Sdn Bhd vociferously opposes the “middleman” label that some medical practitioners attach to third-party administrators (TPAs) or managed care organisations (MCOs) in Malaysia.

In an exclusive interview with CodeBlue that shed rare light on the behind-the-scenes workings of a TPA in health care management, PMCare’s leadership team explained that they actually seek to endorse clinicians’ treatment plans to their “paymasters”: insurance and corporate clients.

“We have evolved to more than just a ‘middleman’,” said PMCare chief medical officer Dr Muhammad Ainuddin Mohamad Rusli during the interview last Thursday with his colleagues, including representatives from the company’s owner, Sumitomo Corporation, at PMCare’s office here.

“We have become advocates of hospitals and consultants, so we never reject technical advancements and all the decisions by the consultants.”

PMCare chief medical officer Dr Muhammad Ainuddin Mohamad Rusli. Photo by Saw Siow Feng for CodeBlue.

PMCare chief medical officer Dr Muhammad Ainuddin Mohamad Rusli. Photo by Saw Siow Feng for CodeBlue.

Dr Ainuddin explained that, for example, PMCare’s insurance clients consider laparoscopic surgery to be robotic surgery, which is only covered for prostate, fibroids, and ovarian cysts even though robotic surgery isn’t new.

But PMCare advised its clients that laparoscopic surgery should be defined as minimally invasive surgery that would then merit coverage, rather than robotic surgery.

“We explain to them the advantages of robotic surgery or all the technological advancements in medicine because it’s not only cost that should be the concern, but productivity. We know that usually, less complications are reported and you have faster recovery,” said Dr Ainuddin.

“This is where we come in as a TPA to our clients. From this point of view, we should be seen as associates of our providers by trying to explain to clients why these treatments should be considered.”

PMCare chief executive officer Kamal Aryf Baharuddin said his company has urged hospitals to charge robotic surgery at the same price as conventional surgery; health care providers usually charge up to 30 per cent higher for robotic surgery.

CodeBlue previously reported that robotic surgery technology costs about US$2 million (RM8.9 million) to US$3 million (RM13.2 million) internationally.

“Hospitals have already invested in this expensive device, but you’re not getting patients because the paymaster is not going to pay,” said Kamal.

Private hospitals demur, he noted, as they cite high capex. “Without them working towards this, it will be difficult to convince the insurance company and paymaster because they’re saying, ‘this is part of our cost-containment’,” Kamal lamented.

Standing is PMCare chief executive officer Kamal Aryf Baharuddin, followed by (clockwise) Takuma Wada (representative from Sumitomo Corporation), PMCare chief medical officer Dr Muhammad Ainuddin Mohamad Rusli, PMCare operations head Syahrul Nizam Baharuddin, PMCare claims director Dr Armijn Mahpha Fansuri, Ayaka Onoe (representative from Sumitomo Corporation), and CodeBlue editor-in-chief Boo Su-Lyn. Photo by Saw Siow Feng for CodeBlue.

Standing is PMCare chief executive officer Kamal Aryf Baharuddin, followed by (clockwise) Takuma Wada (representative from Sumitomo Corporation), PMCare chief medical officer Dr Muhammad Ainuddin Mohamad Rusli, PMCare operations head Syahrul Nizam Baharuddin, PMCare claims director Dr Armijn Mahpha Fansuri, Ayaka Onoe (representative from Sumitomo Corporation), and CodeBlue editor-in-chief Boo Su-Lyn. Photo by Saw Siow Feng for CodeBlue.

Another common exclusion, according to PMCare, is hyaluronic acid (HA) injections for knee osteoarthritis. Insurers also don’t cover congenital diseases.

PMCare – a 30-year-old company that pioneered the concept of managed care in Malaysia – is 100 per cent owned by Japan’s Sumitomo Corporation, a Fortune Global 500 company, after Ekuiti Nasional Berhad (Ekuinas) divested its entire 60 per cent stake from the TPA in 2019.

For its insurance clients, PMCare manages their group policies for companies, whereas its corporate clients self-pay for employee benefit schemes. PMCare, the oldest TPA in Malaysia, has serviced more than 2,000 clients since its inception in 1995.

Its insurance clients include insurers and takaful operators, whereas its corporate clients comprise government-linked companies, multinational corporations, banks, and even private hospitals.

‘We Never Question Treatment Decisions’

PMCare claims director Dr Armijn Mahpha Fansuri. Photo by Saw Siow Feng for CodeBlue.

PMCare claims director Dr Armijn Mahpha Fansuri. Photo by Saw Siow Feng for CodeBlue.

According to Kamal, claims or guarantee letters (GLs) issued by PMCare are usually handled by non-doctor staff, guided by parameters in its system based on the client’s policy or schedule of benefits. If cases need to be escalated, they are brought up to medical doctors in the company. PMCare employees dealing with hospitals are doctors.

PMCare has 15 medical doctors, which Kamal noted is far more than insurance companies that usually only have two to three doctors. None of PMCare’s doctors are specialists.

“At PMCare, we pride ourselves with good questions when we query doctors for every claim,” said PMCare claims director Dr Armijn Mahpha Fansuri.

He said PMCare doesn’t ask clinicians broad questions like, “why are you doing this procedure?”

“We actually query in a way that the doctors understand what we actually want to know and find out, rather than a basic old-school open question.”

Dr Ainuddin acknowledged that certain consultants may perceive PMCare as questioning their treatment decisions, but he insisted that the TPA doesn’t do so, nor tell doctors, “you shouldn’t do this” or “you must do this”.

“Once they decide on certain treatments, then we say ‘fine, that’s the medical expertise decision’,” he said. “But what we’re trying to educate or bring the message to the consultant is that they have to understand that according to our client’s policy, the treatment modality that they decided to go for is non-reimbursable.”

Dr Armijn said the doctor or hospital, not PMCare, is responsible for telling an insured patient that a particular drug or procedure isn’t covered.

“‘Not covered’ doesn’t mean ‘no, I cannot treat you’,” he said. “‘I can still treat you’.”

CodeBlue disputed this, pointing out that denials effectively result in patients being unable to access treatment, since Malaysians in general can’t afford to pay out of pocket for care in private hospitals; hence why they take up insurance in the first place.

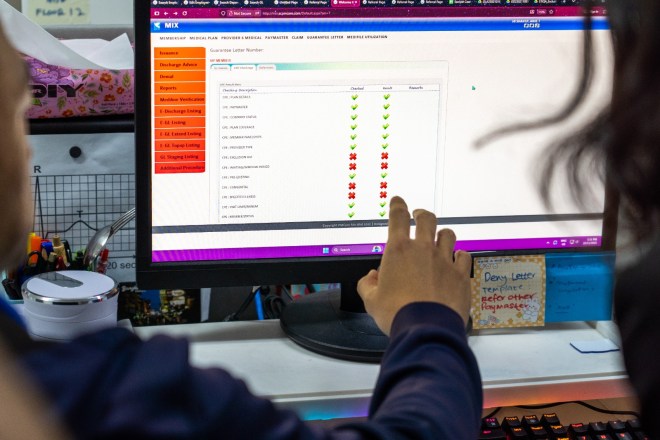

Prior to issuing a guarantee letter, a PMCare call centre agent utilises the company’s rule-based engine to verify the request against parameter sets derived from the client’s policy or schedule of benefits. Photo by Saw Siow Feng for CodeBlue.

Prior to issuing a guarantee letter, a PMCare call centre agent utilises the company’s rule-based engine to verify the request against parameter sets derived from the client’s policy or schedule of benefits. Photo by Saw Siow Feng for CodeBlue.

Kamal then intervened and said when clients are onboarded, PMCare explains to their clients’ employees about what’s covered or not in benefit schemes, citing maternity as an exclusion. He said patients sometimes don’t know that they’re pregnant when they go to a hospital after suffering symptoms.

“It turns out to be an ectopic pregnancy, for example,” he said. “As far as the company is concerned, they don’t cover it, but the hospital has to give treatment.”

Such medical emergencies, Kamal said, put the TPA in a predicament.

“This is where we actually try to argue on behalf of the patient first and then explain later to their employer,” said the PMCare CEO. “The employer says, ‘the employee should know’, but how to prove that the employee should know when they probably didn’t know they were pregnant?”

60-Day Payment Term For Providers, RM104 Million In Past Due Claim Receivables

A PMCare call centre agent responds to member queries. Photo by Saw Siow Feng for CodeBlue.

A PMCare call centre agent responds to member queries. Photo by Saw Siow Feng for CodeBlue.

PMCare has 352 staff, with the company taking up three floors of Menara Insignia in Subang Jaya.

Kamal explained that before the formation of TPAs or MCOs in Malaysia, after an insured patient sees a panel general practitioner (GP) or gets admitted to a private hospital, the health care provider sends the bill to the human resource (HR) department of the patient’s employer. Finance will then pay the bill.

The problem arises when admission occurs at night, as HR doesn’t work after hours. Hence, MCOs came in to fill that gap to enable cashless treatment 24/7, which then allowed companies to focus on their core business instead of allocating a lot of human resources for redundant and repetitive work.

“TPAs are an extension of HR; we’re also an extension of an insurance company’s role,” said Kamal.

These dashboards at PMCare’s call centre provide real-time monitoring of final guarantee letter issuance, tracking claims submitted via both Medibase portals and API e-billing. Photo by Saw Siow Feng for CodeBlue.

These dashboards at PMCare’s call centre provide real-time monitoring of final guarantee letter issuance, tracking claims submitted via both Medibase portals and API e-billing. Photo by Saw Siow Feng for CodeBlue.

TPAs offer payers cost containment, governance, reduced leakage, fraud control, and reporting. Providers, on the other hand, benefit from patient volume and marketing, administrative efficiency, financial guarantee, and not needing to chase multiple corporations for payment.

PMCare boasts the largest panel network of medical providers nationwide with cashless access in Malaysia, at nearly 7,300 panel providers comprising 5,280 GP clinics, 1,163 dental clinics, 492 specialists or hospitals, and 337 optical clinics.

“For providers, they’re interested to be part of the panel because they will get access straight away to the headcount and patients,” said Kamal. “Otherwise, if you just start a business without going to PMCare, you need to knock on every single door of corporations – ‘Can I be on your panel?’”

PMCare call centre staff meticulously check and confirm all information and documents received from members and hospitals as a crucial step preceding the issuance of a guarantee letter. Photo by Saw Siow Feng for CodeBlue.

PMCare call centre staff meticulously check and confirm all information and documents received from members and hospitals as a crucial step preceding the issuance of a guarantee letter. Photo by Saw Siow Feng for CodeBlue.

PMCare’s revenue comes from two sources: a service subscription fee for payers (self-insured enterprise or insurance company) and a platform fee for providers (hospital or clinic).

In three decades, PMCare’s subscription fee for payers dropped by 40 per cent from RM60 per insured person per year in 1995 to a maximum of RM36 currently, due to a “price war” among TPAs to get corporate clients. “When your fees go down, you have to be efficient,” said Kamal.

Unlike other TPAs that charge providers a percentage of the latter’s fees, like 10 to 15 per cent, PMCare’s platform fee for providers is a fixed rate of RM8 per patient per approved transaction. “If it’s not approved, we won’t charge the doctor.”

These dashboards at PMCare’s call centre display key metrics for call centre performance (calls in/out) and the progress of guarantee letter issuance for both outpatient specialist clinics and hospital admissions. Photo by Saw Siow Feng for CodeBlue.

These dashboards at PMCare’s call centre display key metrics for call centre performance (calls in/out) and the progress of guarantee letter issuance for both outpatient specialist clinics and hospital admissions. Photo by Saw Siow Feng for CodeBlue.

PMCare’s commitment to panel providers, including GP clinics, is a payment term of not more than 60 days. Sumitomo initially wanted a 30-day payment term, like what is practised in Japan, but PMCare is unable to do so because not all of its clients pay on time.

PMCare reported claim receivables of a whopping RM233 million last year, comprising RM129.5 million not past due, RM62.5 million past due one to 30 days, and RM41 million past due 31 to 120 days, requiring the TPA to manage its cashflow.

“People do not see this,” lamented Kamal. “People just say, ‘middleman middleman middleman’.”

When CodeBlue suggested that PMCare complain about clients not paying on time, Kamal laughed and said, “If we complain, then they will go to another TPA.”

In response to some doctors criticising TPAs for “double-dipping” by charging both corporations and clinics, the PMCare CEO said, “They do not know in reality how much a TPA is suffering.”

PMCare pays GPs a consultation fee of RM34 on average across the country; in Selangor and Kuala Lumpur, the fee ranges from RM35 to RM36. “We know that some TPAs actually fix RM18,” Kamal noted. “I think Starbucks coffee is more expensive than that.”

IT Programming, Data Analytics, Tour Of Call Centre

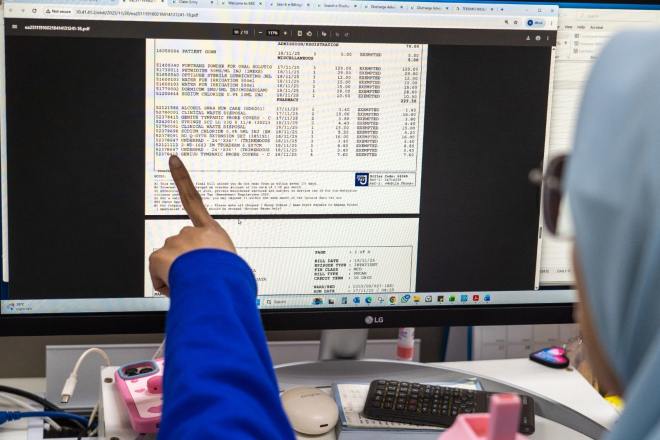

Final GL team members at PMCare assess and adjudicate invoices received from hospitals before issuing the final GLs. Photo by Saw Siow Feng for CodeBlue.

Final GL team members at PMCare assess and adjudicate invoices received from hospitals before issuing the final GLs. Photo by Saw Siow Feng for CodeBlue.

Kamal dislikes the term “middleman” as he thinks it implies as if TPAs just process transactions without doing anything further, like “I just look, okay, bye.”

“We’re doing more than that,” he said.

Managed care services at PMCare comprise medical management (medical audit, utilisation review, and wellness initiatives); administrative services (hassle-free claims adjudication, 24/7 careline, and a mobile app for members or insured people); and provider network management (cashless treatment, nationwide provider access, and medical cost containment).

PMCare employs 40 IT programmers and eight or nine data analytics staff. Its data analytics team does predictive modeling on health outcomes linked to behaviour, enabling the company to provide health care or disease management solutions for an overall cost containment strategy.

Kamal said PMCare also provides anonymised data to the Ministry of Health (MOH), like GP charges as requested last week by regulators.

Besides tracking the status of GLs or claims, PMCare’s mobile app for members has other features like teleconsultations, home delivery of long-term medications, personal health records, and assessments for health risk and mental health.

PMCare’s senior IT manager providing an explanation of the system’s performance metrics shown on a monitoring room dashboard, including transaction parameters and processing speed. Photo by Saw Siow Feng for CodeBlue.

PMCare’s senior IT manager providing an explanation of the system’s performance metrics shown on a monitoring room dashboard, including transaction parameters and processing speed. Photo by Saw Siow Feng for CodeBlue.

When CodeBlue asked if TPAs add on to the cost of health care due to their role as so-called “middlemen”, Kamal disagreed, saying that PMCare looks at overall cost containment based on data, rather than cherry-picking certain items.

“Even if it’s two ringgit, if it’s not justifiable, we will not approve it,” he said. “But if it’s 100 ringgit and it’s justifiable, even though people may say this is expensive, we will approve it if it’s necessary.”

Kamal took the CodeBlue team on a tour around PMCare’s call centre and departments across three floors: provider network management (Level 11); health care solutions, client solutions, client servicing, enrolment, and call centre (Level 12); and claims, data analytics, and IT department (Level 13).

PMCare’s call centre has 83 employees, comprising 45 to attend calls and issue GLs, plus another 38 managing discharge advice or final GLs.

A Final GL team member at PMCare performs claims verification using claims data received via API, preceding the claims adjudication based on the schedule of benefits or policy. Photo by Saw Siow Feng for CodeBlue.

A Final GL team member at PMCare performs claims verification using claims data received via API, preceding the claims adjudication based on the schedule of benefits or policy. Photo by Saw Siow Feng for CodeBlue.

Staff showed CodeBlue how initial GLs for admission and final GLs for discharge are issued from PMCare’s proprietary system, which reduces dependency on personnel, as the rule-based processing engine evaluates claims based on diagnosis, hospital tier, and patient age.

Exclusions automatically flagged by the system prompt PMCare staff to further query GL requests from a hospital, following a digital preadmission form filled up by the attending doctor. PMCare’s commitment is to issue GLs for admission within 30 minutes. Delays, said Kamal, are very rare.

PMCare has various live dashboards on the wall in their call centre, showing the status of claims processing for admission and discharge. Staff also showed CodeBlue the features of its IT system, like the speed of transactions.

PMCare processes more than 13,000 claims on average per day.

“We are part of bringing value to the health care ecosystem,” said Kamal.