59m agoFri 12 Sep 2025 at 12:23amMarket snapshotASX 200: +0.7% at 8,865 points (live values below)

Australian dollar: +0.1% to 66.62 US centsNikkei 225: +0.9% to 44,783 pointsS&P 500: +0.8% to 6,587 pointsNasdaq: +0.6% to 7,747 points

FTSE: +0.8% to 9,297 pointsEuroStoxx: +0.6% to 555 pointsSpot gold: -0.1% to $US3,631/ounce

Brent crude: -0.4% to $US66.10/barrel Iron ore: -0.1% to $US105.35/tonne Bitcoin: +1.1% to $US115,732

Prices current around 10:20am AEST

Live updates on the major ASX indices:

16m agoFri 12 Sep 2025 at 1:05amEx-Virgin boss sees $50 million payday

Virgin Australia has revealed its total pay day for former boss Jayne Hrdlicka was $50 million, with the details contained in its annual report lodged to the ASX this morning.

On top of her base salary of $1.2 million, Ms Hrdlicka received a more than $500,000 bonus and $18.4 million in “other cash payments”.

She was also granted 10.2 million shares, valued at just shy of $30 million based on Virgin’s initial public offering price of $2.90 — or even more at this morning’s price of $3.30.

Ms Hrdlicka helmed the airline from November 2020 to March this year, leading it through the private equity takeover by Bain Capital, who sold out when the stock re-listed on the ASX this year.

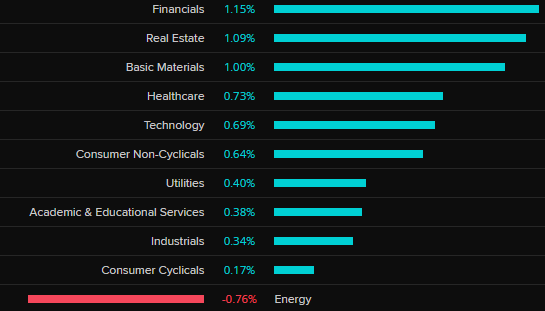

43m agoFri 12 Sep 2025 at 12:39amAll sectors rise except energy

It’s been a strong start to the Friday session, and it could just be enough to turn the ASX 200 positive for the week.

The major banks and miners are rising strongly, with energy the only sector lagging behind at the moment, after oil price falls.

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

Here are the best performing stocks:

HMC Capital +4.2%Clarity Pharmaceuticals +4.2%Regis Resources +3.6%Alcoa +3.6%Nuix +3.4%

And the worst:

Austal -3.4%Karoon Energy -2.1%Deep Yellow -2.1%Aristocrat Leisure -2%Paladin Energy -1.8%

If the benchmark index hangs onto its current gains, it could end the week a few points above where it closed last Friday, clawing back some the losses accumulated over the last four days.

1h agoFri 12 Sep 2025 at 12:15amASX on the rise in early trade

The ASX 200 has opened higher, gaining 0.6% so far.

Meanwhile, in Japan the Nikkei 225 has risen 1% to a record high.

1h agoThu 11 Sep 2025 at 11:48pmEuropean Central Bank leaves rates on hold

The European Central Bank left interest rates unchanged overnight as expected and maintained an upbeat view on growth and inflation, dampening expectations for any further cut in borrowing costs.

The ECB halved its key rate in the year to June but has been on hold at 2% since, arguing that the economy of the 20-country euro zone is in a “good place” even if all policy options, including additional easing, could not be ruled out.

“We continue to be in a good place,” ECB President Christine Lagarde told a press conference, adding that inflation was where the ECB wanted it to be and the domestic economy solid.

Uncertainty about global trade had eased after a number of US tariff deals, she said, including the European Union’s own agreement which set a 15% duty on most US imports of EU goods.

Sources with direct knowledge of the discussion said rate cut talk was not over but that it would still take months for the ECB to gain clarity, meaning the next proper debate on whether more support is needed is likely to be in December.

Money markets are now pricing in just a 40% chance of one last rate cut by next spring, less than before the overnight decision, even while they expect the Fed to ease US borrowing costs six times by the end of 2026.

Reporting with Reuters

2h agoThu 11 Sep 2025 at 11:13pm

🎥 AI optimism drives stocks

Before local trade gets underway in just under an hour, catch up on what you missed with finance reporter David Chau:

Loading…

2h agoThu 11 Sep 2025 at 10:48pm

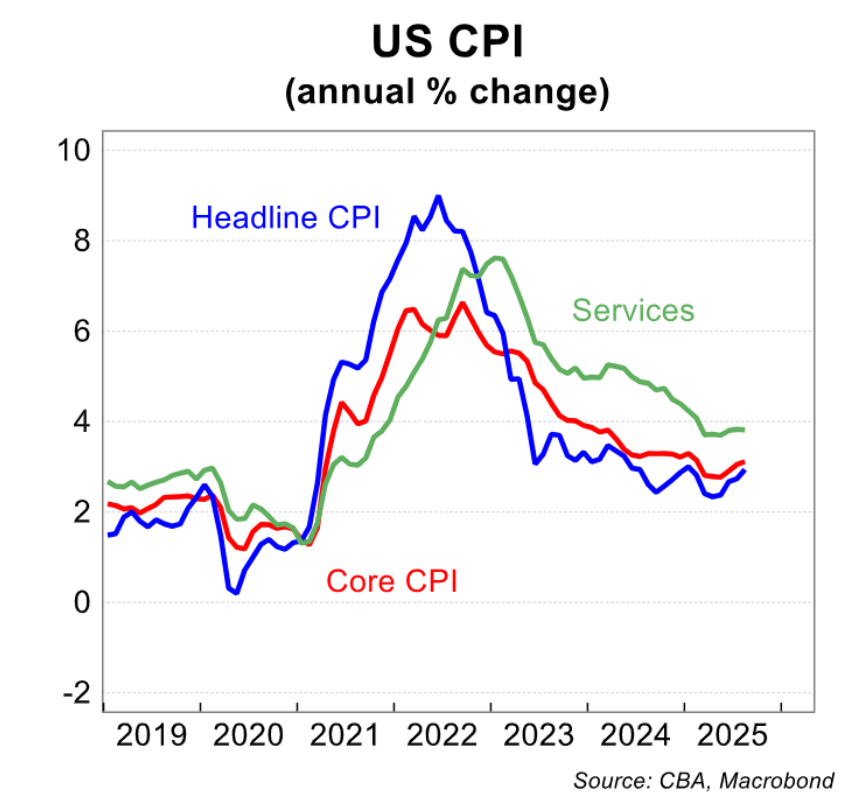

US inflation running at 2.9% and not just because of tariffs

The US CPI rose by 0.4% in the month but what is the current annual rate?

– Moomy

Hi there, thanks for joining us — the headline inflation rate in the US is running at 2.9% annually.

That’s the largest 12 month increase since January, up from 2.7% in July.

Commonwealth Bank senior economist and currency strategist Kristina Clifton had some interesting observations in her morning note today.

While companies passing on tariff costs to American consumers is having a gradual pass through to prices, it’s not all about tariffs.

“Services inflation remains sticky, just below 4.% [annually],” Ms Clifton notes.

Here’s a chart:

US CPI annual change (CommBank)

US CPI annual change (CommBank)

“However, this week’s readings on the producer prices and consumer prices are not strong enough to change market pricing for [a Federal Reserve] cut next week,” Ms Clifton writes.

“Given the weakness in the US labour market, we judge there is a risk of 50bp cut by year end.

“Our base case is for four 25bps cuts in September, October, December and March 2026.”

2h agoThu 11 Sep 2025 at 10:34pm

‘Clone’ websites catch out Australian customers

Experts say online shopping scams are alarmingly common in Australia and have become one of the most frequently reported scam types.

The National Anti-Scam Centre warns “clone” websites impersonate legitimate brands, while some have appeared in search engine results and ads.

One shopper told the ABC of her experience buying a dryer from what she thought was Aldi, after a Google search.

As recently as last week, a Google search showed half of the sponsored tumble dryers on the top of the page were from fraudulent websites.

The advertisements had been removed after the ABC approached Google for comment.

An Aldi spokesperson said the company was aware of “some websites impersonating ALDI” and it had been “actively pursuing their removal to protect our customers”.

“We have been in contact with the ACCC and its National Anti-Scam Centre, and we are working with organisations like Google to remove potential avenues that scammers are exploiting,” the spokesperson told the ABC.

“DoorDash is the only platform that sells ALDI supermarket products online in Australia.”

Australians have reported financial losses of nearly $40 million from shopping scams since 2020.

Read more from reporter Yiying Li

2h agoThu 11 Sep 2025 at 10:23pm

US inflation picks up while jobless claims near four-year high

US consumer prices increased by the most in seven months in August amid higher costs for housing and food, but a surge in first-time applications for jobless benefits last week kept the US Federal Reserve on track to cut interest rates next week

The larger-than-expected rise in the Consumer Price Index reported by the Labor Department resulted in the biggest year-on-year increase in inflation since January.

Higher inflation and softening labor market conditions fanned fears of stagflation, and pose a dilemma for the US central bank, beyond next week’s anticipated rate decision.

The broad increase in inflation partly reflected businesses passing on higher costs from US President Donald Trump’s sweeping tariffs to consumers and a rebound in demand for travel.

Tourist traffic to the US tanked during the spring and early summer amid boycotts and the White House’s immigration crackdown.

“Even though a September cut is a fait a compli, the future trend looks less certain,” said Sung Won Sohn, a finance and economics professor at Loyola Marymount University, told Reuters.

“The interaction of rising inflation and softening employment creates a difficult policy dilemma for the Fed.

“Cutting rates too quickly risks embedding tariff-driven inflation, while delaying cuts risks amplifying unemployment.”

The CPI rose 0.4% last month, the biggest gain since January, after increasing 0.2% in July, the Labor Department’s Bureau of Labor Statistics said. The CPI was driven by a 0.4% jump in the cost of shelter. Food prices increased 0.5%, with prices at the supermarket soaring 0.6%.

Financial markets have fully priced in a quarter-percentage-point reduction in rates next Wednesday (US time), with the Fed expected to deliver two similar-sized additional cuts this year.

The US central bank, which has a 2% inflation target, paused its easing cycle in January because of uncertainty over the inflationary impact of import duties.

The pass-through from import duties has been gradual, but businesses have now depleted their pre-tariff inventories.

Business surveys have for some time been signaling imminent price increases. Economists were divided on whether the pass-through from tariffs would be a one-off event or prolonged.

Reporting with Reuters

3h agoThu 11 Sep 2025 at 9:56pmMixed data leaves Fed rate cut on table

Good morning and what a privilege to be able to tell you my favourite news of the week — it’s Friday.

In other news, the economic data out of the US overnight was mixed and should leave the Federal Reserve cutting interest rates next week, according to economists’ commentary and the market reaction.

The consumer price index rose by 0.4 per cent, the most in seven months, while jobless claims rose to their highest level since late 2021.

So while inflation accelerated, the weaker-than-expected jobs picture should leave a rate cut on the table when the US central bank meets next week.

“Inflation is not getting closer to the Fed’s target, but with risks as labour market concerns grow more pressing, fears price pressures will be persistent fade,” NAB senior economist Taylor Nugent wrote.

“There is nothing to stand in the way of Fed cuts this year even as further weakness in activity and the labour market are needed to justify the extent of easing priced through 2026.”

As a result, we saw the US dollar down and stocks on the rise, and that’s expected to continue when local trade gets underway.

Stick with us!

Loading

3h agoThu 11 Sep 2025 at 9:23pm

Market snapshotASX 200 futures: +0.5% at 8,850 points

Australian dollar: flat at 66.59 US cents S&P 500: +0.8% to 6,587 pointsNasdaq: +0.6% to 7,747 points

FTSE: +0.8% to 9,297 pointsEuroStoxx: +0.6% to 555 pointsSpot gold: -0.2% to $US3,633/ounce

Brent crude: -1.8% to $US66.29/barrel Iron ore: -0.1% to $US105.35/tonne Bitcoin: flat at $US114,453

Prices current around 7:20am AEST

Live updates on the major ASX indices:

ASX 200: +0.7% at 8,865 points (live values below)

ASX 200: +0.7% at 8,865 points (live values below)