Bloomberg

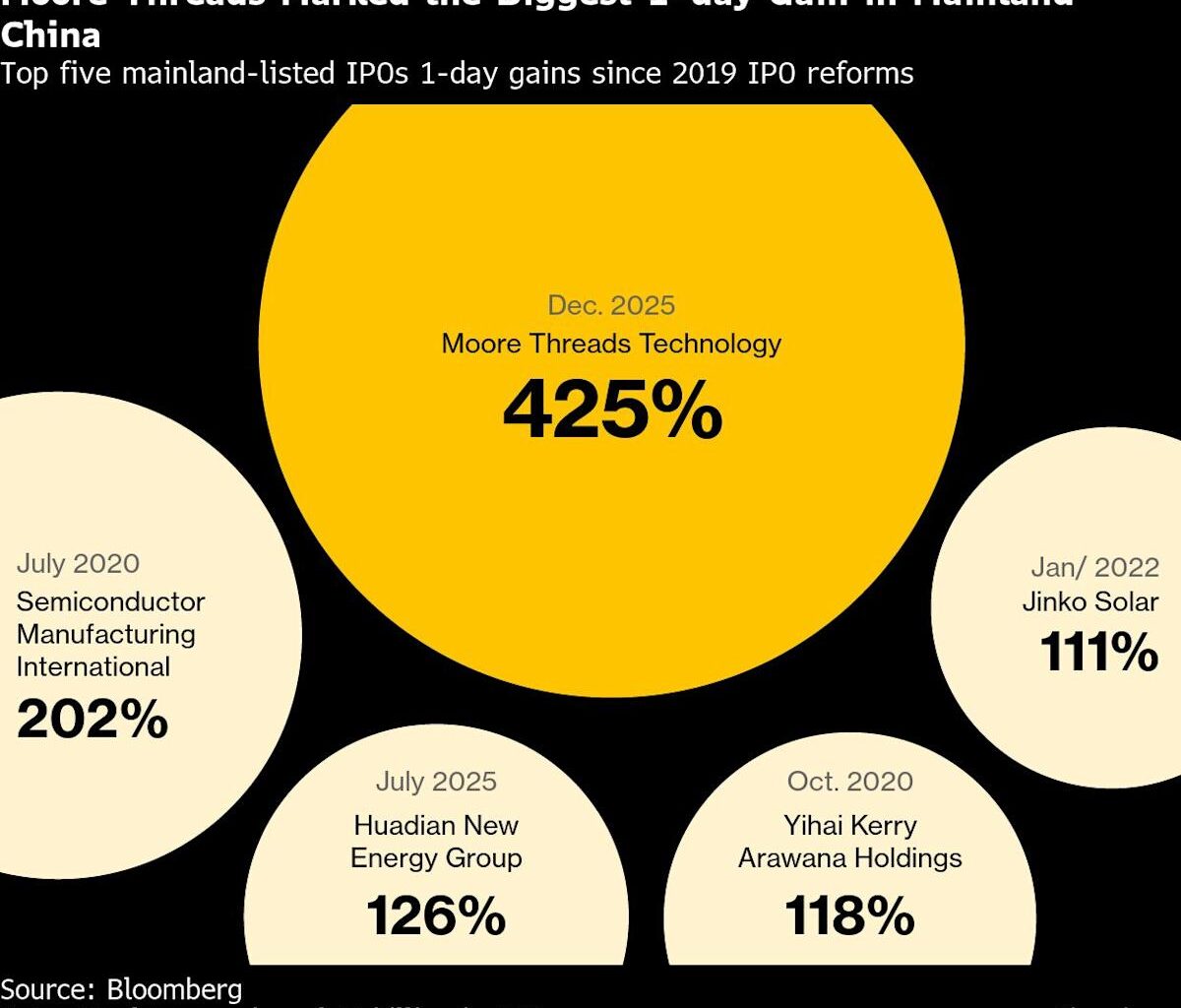

(Bloomberg) — Moore Threads Technology Co.’s phenomenal debut this month — China’s most successful coming-out party since 2019 — capped a year in which investors have grown increasingly excited about the prospects for the country’s AI chip advancement. That euphoria may be misplaced.

From Moore Threads to Cambricon Technologies Corp. and MetaX, the market is celebrating a coterie of once-unknown names that now harbor bold ambitions to take on Nvidia Corp. — at least at home. Major players like Alibaba Group Holding Ltd. and Baidu Inc. are making headway into the semiconductors that underpin AI development — one of Beijing’s top priorities. Recently, Canadian research firm TechInsights took apart a Huawei Technologies Co. smartphone and revealed a processor made using more advanced technologies than Chinese chipmakers were thought capable of. China is even now preparing a package of as much as $70 billion to bankroll and support the sector, people familiar with the matter said.

Most Read from Bloomberg

The reality is grimmer. To advance to the cutting edge, many like Huawei are relying on Semiconductor Manufacturing International Corp. — a US-blacklisted firm that can’t procure the requisite equipment to efficiently crank out advanced chips. Cambricon is making its best processors there at about a 20% yield — meaning four out of five silicon dies that roll off the assembly line are discarded as unusable. In its report, TechInsights warned that SMIC’s achievements came with “tradeoffs” in cost.

Even Moore Threads warned that investors may be getting over-exuberant. Its shares tanked as much as 19% Friday.

“The key challenge remains access to advanced-node wafer capacity,” said Karl Li, investment manager of China equities at Aberdeen Investments. “There remains a considerable supply deficit. We expect China to emphasize the expansion of advanced-node capacity to resolve this constraint, but we still anticipate a technological gap to the US to be maintained over the next couple of years.”

Still, a casual observer wouldn’t know that just from looking at the markets.

In just a week, Moore Threads — a loss-making firm with a fraction of Huawei’s output — more than quintupled to become one of China’s most valuable pure hardware companies. AI accelerator designer MetaX Integrated Circuits Shanghai Co. drew thousands of times more bids for shares than it was offering in its IPO.

Story Continues

The mania reflects a vague bet that Beijing will pull out all the stops to prop up homegrown chipmakers in the age of AI, seeking to blunt American dominance in a field that could determine the destinies of nations. That necessarily involves developing Nvidia substitutes at home. US President Donald Trump’s offer earlier this month to allow Nvidia to sell the relatively powerful H200 to China has so far met with silence on Beijing’s part — for good reason.

“Access to H200s could temporarily ease performance constraints, reducing urgency for some firms,” Forrester Research analyst Charlie Dai said. “However, China’s strategic commitment to semiconductor independence remains unwavering. The effect will be substantial in the near term, but limited over time as policy, funding, and talent continue driving domestic innovation.”

In the longer run, Beijing’s obsession with self-reliance will eventually prevail to a certain degree. The emergence of DeepSeek — which just this month released a highly capable model despite its lack of unfettered access to advanced Nvidia accelerators — underscores how Huawei and its rivals are indeed climbing the technology ladder with semiconductors optimized for training smaller, open-sourced platforms.

Hardware constraints may actually help drive innovation on the AI applications front.

“China has the best open-source models in the world, despite not having the best silicon,” said Felix Wang, tech sector head at Hedgeye Risk Management. “China chipmakers and AI players may have an advantage over the US since they’re more adept at finding optimizations in those models.”

But the industry may have more immediate concerns. National resolve or no, the chokepoints facing China’s chip companies remain firmly in place.

Chinese AI chip designers can’t utilize the most cutting-edge fabrication processes at Taiwan Semiconductor Manufacturing Co. due to US curbs, putting them at an disadvantage against Nvidia and Advanced Micro Devices Inc.

Read: How World Powers Are Vying for Chip Supremacy: QuickTake

Memory is another major issue. Chinese companies have to rely on smuggled and previously stockpiled foreign parts, particularly high-end memory chips, for making AI accelerators. That’s because China hasn’t established a comprehensive ecosystem to provide all the critical parts it needs for emerging technologies. National champion Huawei’s latest AI chip was found to contain an older generation of high-bandwidth memory chips from South Korean powerhouses SK Hynix Inc. and Samsung Electronics Co., while using dies from TSMC.

Washington and its allies including Japan and the Netherlands are not supplying the country with the gear required to make the most sophisticated AI chips. Dutch firm ASML Holding NV so far has not sold a single extreme ultraviolet lithography system to China. That large, multimillion-dollar machine is seen as essential for manufacturing the fastest and most capable AI accelerators.

Huawei is planning to make about 600,000 of its marquee 910C Ascend chips next year, while Cambricon is preparing to deliver about 500,000 AI accelerators in 2026. Both are regarded as major achievements within China.

But for context, Nvidia alone was estimated to have sold a million H20 chips, a product it customized for China to meet export control requirements, in 2024.

“Replicating the chip-plus-software ecosystem takes more than 10 years as one has to deal with user inertia, lack of cutting-edge chip fabrication technologies and equipment import restrictions, among other issues,” said Phelix Lee, an analyst at Morningstar.

–With assistance from Jessica Sui and Maggie Eastland.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.