After nearly two years of relative calm, the hard disk drive (HDD) market is showing signs of stress again. According to a report from Digitimes Asia (quoting Nikkei), HDD contract prices jumped roughly 4% quarter over quarter in Q4 2025. That’s the sharpest increase seen in eight quarters, and suppliers expect this upward pressure to persist. That might sound like a niche storage story, but in reality, it’s a symptom of much larger forces reshaping the entire computing supply chain, from Chinese PC procurement policies to the rapid AI-driven expansion of U.S. data centers.

The report identifies two primary demand drivers. The first is a sudden resurgence of HDD demand in China’s PC market, driven by government procurement policies that favor domestically produced CPUs and operating systems. That policy shift has accelerated local PC production, and in an unexpected twist, has also boosted HDD adoption. A big part of the reason is trust, or rather, the lack of it. Sources cited in the report point to concerns around long-term data retention in SSDs, whose critical components rely on NAND flash memory that is vulnerable to “bit rot” over time spent in storage. The result has been a renewed push toward HDDs for certain use cases, reversing what had long looked like an inexorable transition toward solid-state storage.

You may like

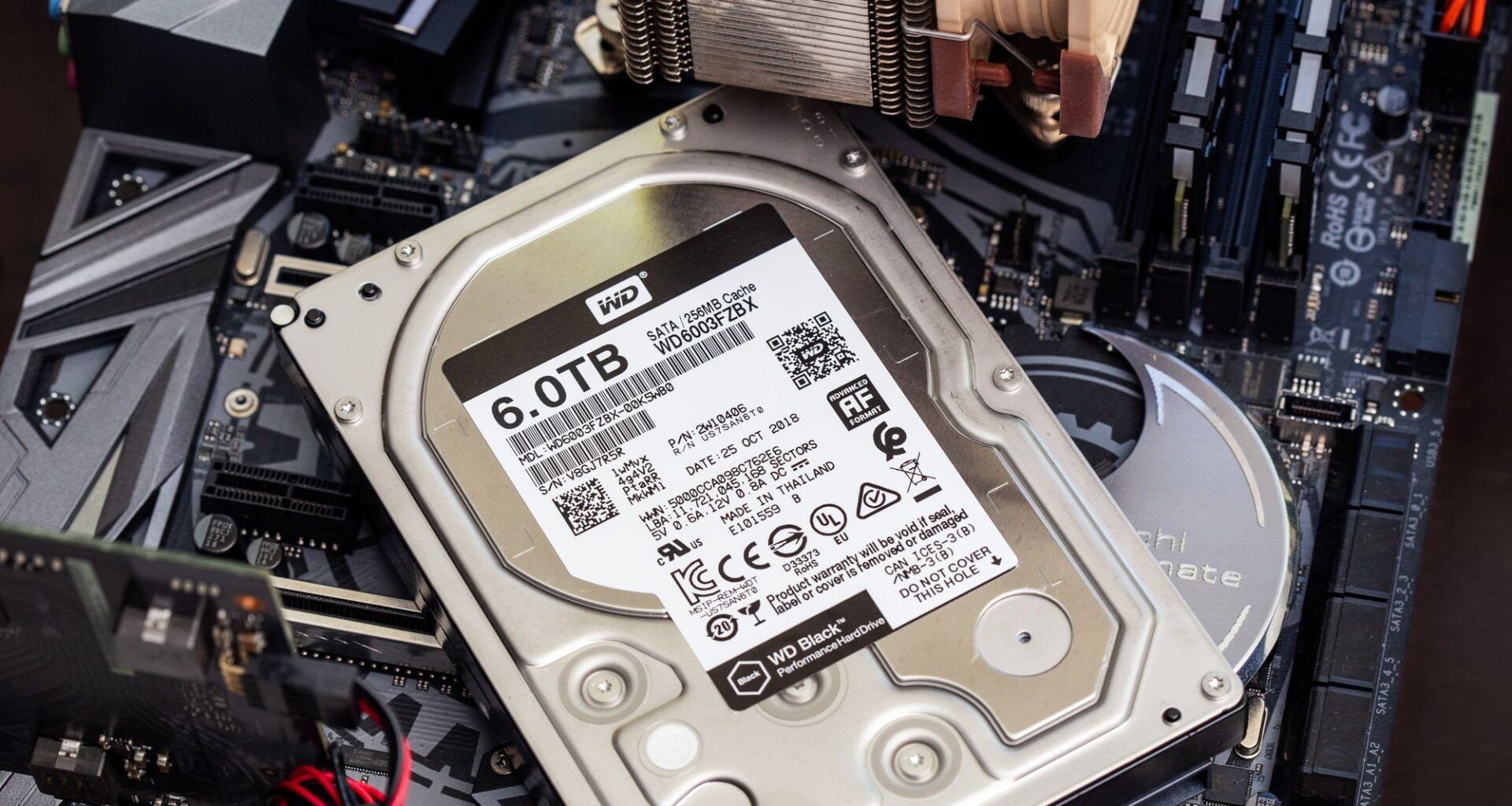

While SSDs offer many advantages over HDDs, spinning rust still wins in price-per-gigabyte, even considering flash memory’s density advantage. (Image credit: Shutterstock)

What makes this moment especially interesting is how it intersects with the wider AI infrastructure boom. AI data centers aren’t just consuming GPUs and accelerators; they’re devouring memory, storage, power equipment, and even physical construction capacity at a historic pace. High-bandwidth memory and enterprise DRAM are already in short supply, and elevated DRAM pricing has made it harder for HDD makers to control manufacturing costs, even as demand surges. After all, hard drives use lots of DRAM for cache memory.

In that sense, HDD pricing pressure isn’t an anomaly so much as it is collateral damage. Capital expenditure on AI infrastructure has ballooned so rapidly that it’s begun showing up in macroeconomic data. Analysts have pointed out that a disproportionate share of recent U.S. GDP growth has come from investment spending tied to data centers, servers, and related infrastructure rather than consumer demand. HDDs, humble as they may seem, are part of that same CapEx wave.

Unlike flash memory, which can ramp with new fabs and process shrinks, HDD production is constrained by specialized components such as read/write heads and precision media. Scaling output isn’t fast or cheap, and manufacturers have been cautious about expanding capacity after years of pricing pressure and consolidation. The result is a market that can tighten quickly when demand rebounds from multiple directions at once.

The bigger takeaway is that hard drives, often treated as a legacy technology, are once again being pulled into the center of the industry’s growth story. Between China’s shifting procurement priorities and the AI sector’s insatiable appetite for data storage, spinning disks are experiencing demand dynamics few would have predicted just a couple of years ago. Whether this turns into a sustained pricing cycle or a temporary squeeze will depend on how quickly capacity expands, and whether AI infrastructure spending continues at its current breakneck pace.

Follow Tom’s Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.