By Ka Sing Chan

China’s last standing property giant isn’t really standing at all. China Vanke 000002,

000002 is on the brink of default despite a rescue led by a Shenzhen government entity just two years ago. Once “unreserved” in its support for the company, its home-state backer is wavering. That threatens a company with 360 billion yuan ($51 billion) in interest‑bearing debt and, in the process, exposes how little progress Beijing has made in reinvigorating home buyer confidence.

For decades Vanke has been the poster boy of China’s booming property market as well as the economic miracle of its hometown, China’s Silicon Valley. Now it encapsulates everything that’s wrong with the country’s real estate downturn since 2020, when President Xi Jinping drew “three red lines” around developers’ indebtedness.

Vanke has so far, technically, avoided default, but it has made little progress to stay solvent. Not only has interest-bearing debt climbed by one-fifth since 2020, Vanke’s revenue has also tanked. Contract sales shrunk to about 100 billion yuan in the first 10 months this year, down from 700 billion yuan five years ago, against a nationwide halving of annual home sales over a similar period.

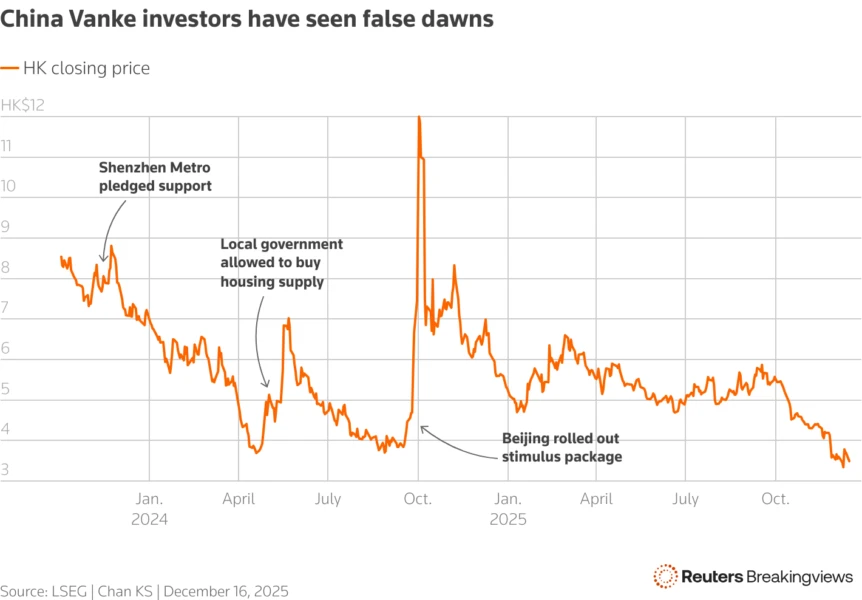

Thomson ReutersChina Vanke investors have seen false dawns

Thomson ReutersChina Vanke investors have seen false dawns

Shenzhen Metro, Vanke’s largest shareholder with a 27% stake, has also fallen short of its earlier rhetoric. That’s why holders of a 2-billion‑yuan bond are playing hardball over Vanke’s request to extend its repayment deadline. Although Shenzhen Metro guaranteed the developer’s latest proposal for a delayed payment, it last month compelled Vanke to pledge its entire controlling stake in Onewo 2602, the group’s crown‑jewel property‑management arm.

Such hesitation is understandable but unhelpful. The bill for any fresh state backing by Shenzhen Metro could balloon quickly, given 43% of Vanke’s interest-bearing debt will mature within a year. The developer will be badly squeezed if the property market doesn’t stabilise or realise expectations of a recovery led by price rises in major Chinese cities within that period.

Yet the failure to win over bondholders reflects the enduring disconnect between hopes and reality in China’s property market. China Real Estate News, a newspaper under the housing ministry, even published an editorial this month calling for local governments to deal with distressed property firms in a “market-oriented” approach. That sounds like a plea for Shenzhen Metro to fully stand aside.

CONTEXT NEWS

China Vanke will seek on December 18 to extend the grace period for a 2 billion yuan ($283.6 million) bond payment from five days up to 30 business days, Reuters reported on December 15, citing sources.

Creditors rejected the state-backed developer’s first attempt to seek approval to delay payment via a voting process on December 12. One proposal, which included credit enhancement measures, won 83.4% approval, falling short of the 90% acceptance threshold.