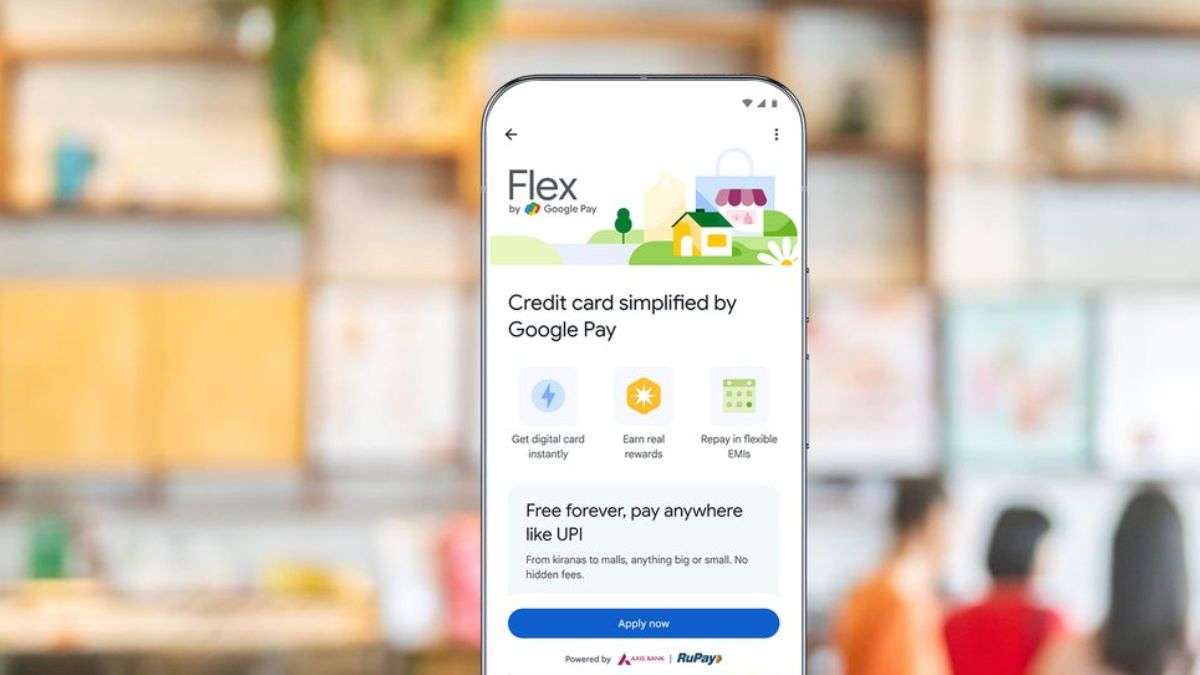

Google has launched Flex by Google Pay, a new UPI-powered digital credit card in partnership with Axis Bank. Built on the RuPay network, the card lives entirely inside the Google Pay app and allows users to make UPI-style payments using credit.

New Delhi:

Google has launched Flex by Google Pay, a completely new digital credit product specifically for users in India. This starts with the Google Pay Flex Axis Bank Credit Card. This brand-new digital product will be a co-branded credit card and will completely integrate with the Google Pay app.

Unlike normal credit cards, Flex integrates both the simplicity of a UPI payment and the flexibility of a credit line so that people are able to pay later while scanning a QR code or making an online payment easily.

How the Flex Credit Card works

Flex is powered by the RuPay network and thus can be used for payments by the millions of merchants online and offline who accept payments made by RuPay and UPI.

Once approved, users can:

Payments through credits, like in UPI

Payment in brick-and-mortar shops, websites, and apps

Employ a credit card without holding a credit card

All transactions are conducted from the Google Pay app itself and eliminate the use of physical cards and paperwork.

Fully digital application and instant access

Google states that taking out a Flex credit card requires only a few minutes of the applicant’s time. It also states that the whole procedure, right from application to getting approved for the credit card, is done online and does not require any documentation.

After approval, it is possible to immediately utilise the credit limit. This is quite beneficial when it is required instantly.

Rewards, EMI options and controls

Google Pay Flex provides the following features, which can be considered standard in the case of traditional credit cards, besides the convenience of UPI:

Reward Program: Users earn “stars” with each transaction

Star Values:

Every star is equivalent to 1 rupee and can be redeemed immediately.

Repayment Options: Entire Bill Payment or Purchase Option for EMI

In-App Controls: Spend limits, block/unblock the card, change PIN, and monitor transactions

All functionalities can be accessed from the Google Pay app itself.

Reasons why Google launched Flex in India

According to Google, it appears that today India has just 50 million credit card holders, although it has hundreds of millions of UPI users. Flex aims to address this gap by ensuring that credit card services can be easily accessed, particularly by individuals who are UPI-savvy but don’t have a traditional credit card. With RuPay, UPI, and digital onboarding, Google and Axis Bank are reaching many more people.

Availability and rollout timeline

Flex by Google Pay is starting its launch process as of today. Initially, users who are concerned about getting this app can sign up through the Google Pay app by joining a waitlist. Google has confirmed a wider launch in India in a few months.