SINGAPORE – About a year ago, Ms Teo Yi Ki bought an investment-linked insurance policy (ILP) with her very first pay cheque, having been convinced of the prudence of such an action by a financial adviser.

“I thought, oh my gosh, I’m being the most financially savvy person,” said the 25-year-old product manager.

But a few months later, she read the fine print and realised she was locked in to the plan for 25 years, and any bonus earned would be forfeited if she made a withdrawal within the first five years.

“For a lot of us, we don’t know what we don’t know,” said Ms Teo, referring to the challenges young people – especially first-timers – often face when buying financial products.

“We don’t know what questions to ask, and what to be concerned about.”

This prompted her and five others to create a web-based digital tool which helps to highlight key information and simplify jargon found in financial product documents.

They aptly named it Redflags.

The team of six began working on it after meeting at the inaugural Sparks x Build for Good Community Hackathon in June.

The event, co-organised by the People’s Association and Open Government Products, brought together young people keen on developing tech-driven solutions to tackle community challenges.

“In a person’s whole lifetime, there are many firsts for big financial decisions they might be uncertain about,” said Ms Teo, adding that this could come in the form of a student loan, work contract, investment, house, car or medical bill.

“We aim for Redflags to be the go-to guide for every first-timer dealing with financial documents.”

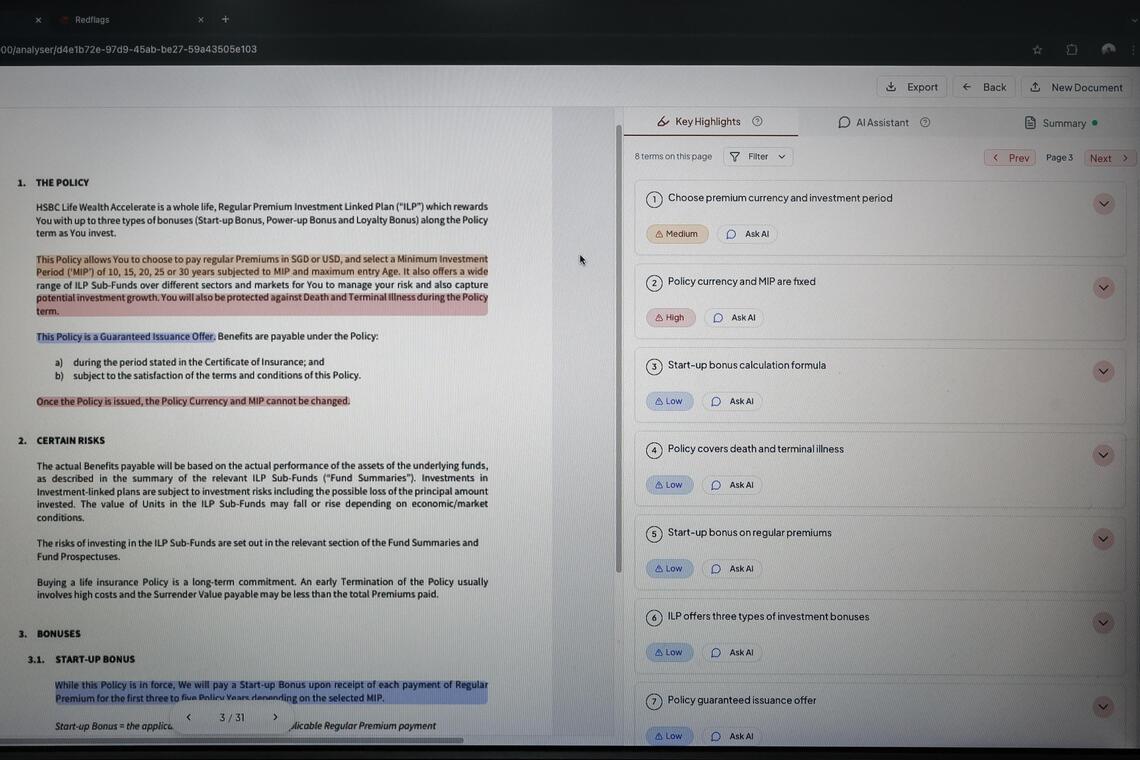

Built using Google’s Gemini large-language model and fortified with guardrails to prevent hallucinations – false, inaccurate or nonsensical information generated by an AI system – Redflags can analyse a document and provide a summary, a list of pros and risks, and a ranking of key points based on importance.

Information that is linked to cost, coverage, risk and returns is highlighted as of high importance. This includes a product’s premium structure, fees and charges, investment allocations and policy benefits, said Ms Teo.

Points of medium importance include fund performance illustrations, bonuses, non-guaranteed benefit illustration and policyholder rights. Standard disclaimers and minor operational details such as administrative notes are of the lowest importance.

“These categorisations are based on the advice of senior financial experts that we consulted,” said Ms Teo, adding that Redflags does not make judgment calls on whether a product is good or bad.

“We want to be as objective as possible. We highlight the key points so that people will be aware of it, rather than advising people to go or not go for it.”

In trying out the tool, The Straits Times uploaded a 31-page product summary of an ILP. Redflags stated that the product is a way to benefit from potential long-term investment growth, while securing life insurance coverage for death and terminal illness.

One of the pros is that it offers three types of bonuses, something that adds to the policy value of time, but a risk highlighted is that customers might potentially lose their invested capital as benefits are linked to fund performance, which can fall or rise.

There are 18 points categorised as of high importance, which are highlighted in red and explained in layman terms. For instance, a line in the document states that “early termination of the policy usually involves high costs, and the surrender value may be less than the total premiums paid”.

A demonstration of Redflags’ web app that helps to highlight key information and break down jargon in financial documents.

ST PHOTO: GAVIN FOO

In explaining this line, Redflags stated that customers who need their money back within the minimum investment period (for instance, 15 years), might receive an amount significantly lower than what they paid for.

Earlier in September, ST reported that

consumer complaints against ILPs hit a high

of 211 cases in 2024. This was up from 55 claims in 2023, according to the Financial Industry Disputes Resolution Centre (Fidrec).

Many of the complaints pertain to market misconduct, which refers to practices like mis-selling or misrepresentation, inadequate disclosure of information about the ILP product, or giving inappropriate advice, said Fidrec chief executive Eunice Chua.

The Redflags team told ST they were unsurprised by this statistic, but said that it adds to the urgency to refine their product.

Their own survey, which involved 80 respondents between the ages of 18 and 30, found that the most common difficulties faced when presented with a financial document are understanding the jargon and identifying hidden fees.

Nearly half of these respondents said they only occasionally read through contracts fully before signing, as opposed to 32.5 per cent of people who said they do every time, and 7.5 per cent who never do.

“We are concerned about the lack of financial literacy when it comes to such products,” said Ms Teo. “This burden drives our vision further.”

Looking ahead, the team is working to partner financial advisory associations to build credibility and further refine the accuracy of information given to users.

In the long run, such partnerships might also pave the way to building Redflags as a platform to link customers with trusted financial advisers, said Ms Teo.

She added: “We want to make the financial scene feel less gated, and have fewer cases of people feeling like they have been scammed.”

Those who are interested in trying out Redflags can visit

https://www.redflags.sg

/