President Javier Milei is a unique figure in Argentine economic history — not necessarily due to his libertarian roots, which are more declarative than substantive in his financial decisions, but because he has enacted a policy of fiscal austerity and still remained popular enough to win the midterm elections by a landslide.

However, in Argentina, today’s political capital could become tomorrow’s liability if the president fails to acknowledge that macroeconomic consolidation is a political endeavor as well as an economic one.

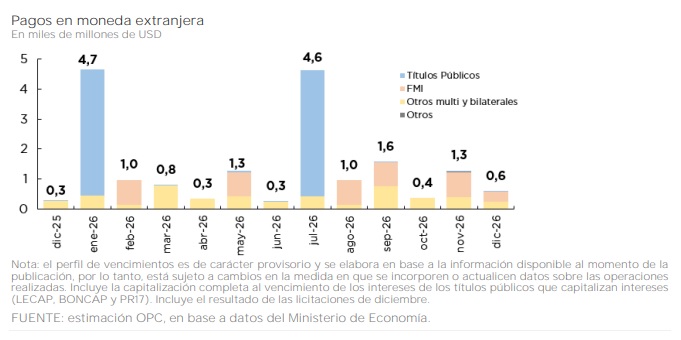

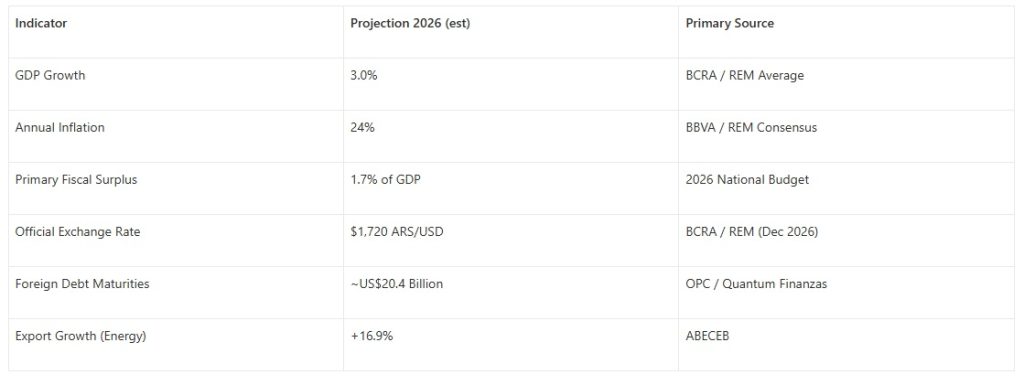

Persistently high inflation, maturities totaling around US$20 billion during 2026, and uneven growth across sectors with minimal job creation are the three main economic challenges pressuring the government’s political standing.

The financial front: the never-ending storm

Perhaps the best metaphor for Argentina’s relationship with its financial situation is karma. No matter the government, managing public finances remains one of the nation’s primary challenges.

2025 was no different: the government reached an agreement with the IMF for US$20 billion in April. That was immediately followed by the announcement that it was modifying the country’s exchange restrictions, removing the so-called cepo on individuals and partially lifting the restrictions for companies.

However, this wasn’t enough to alleviate uncertainty over the midterm elections, which put pressure on the exchange rate. It was during this tumultuous period that the government received unprecedented support from the United States Treasury Department.

Calm was only restored after the political risk subsided, aided by a victory that strengthened Milei’s government in both houses of Congress.

The financial outlook for 2026 remains demanding, with Argentina facing maturities exceeding US$19 billion.

A critical factor to monitor is whether the government can issue debt in international markets to refinance these maturities with private entities and international organizations. This would require lowering the country risk.

On the brighter side, global conditions are favorable for emerging markets, fueled by the Fed’s interest rate cuts.

U.S. dollar-denominated debt maturities in 2026 / Source: Congress Budget Office

U.S. dollar-denominated debt maturities in 2026 / Source: Congress Budget Office

Inflation: an untamable beast

Inflation for 2025 will have come to around 35%, a significant drop from 117.8% the previous year, although there was a slight acceleration during the last quarter.

For 2026, the market expects yearly inflation to drop further, to around 20%, but this target hinges on the Central Bank’s ability to accumulate reserves. Lower reserves lead to greater uncertainty about the exchange rate, directly affecting inflation.

It will be crucial to monitor the evolution of regulated prices (especially tariffs) and the pace of peso devaluation under the crawling peg system.

Economic activity: less heterogeneity and more employment

Following a recovery in 2025, with analysts estimating growth of 4.4%, the IMF expects 4% growth in 2026.

Energy — particularly driven by the contributions of Vaca Muerta — and agriculture will continue to drive growth. Mining could also gain significance, although many investments depend on regulatory changes, particularly regarding amendments to the Glaciers Law.

On the downside, industrial and domestic consumption have proven to be more vulnerable. This is particularly concerning, as these sectors are labor-intensive, and job losses in 2025 were primarily attributed to a decline in purchasing power for a significant portion of workers and pensioners.

For the coming year, monitoring the evolution of private investment will be crucial. According to a report by consultancy PxQ, based on Central Bank information, foreign direct investment (FDI) totaled -US$1.52 billion between January and November 2025 — the first year with a deficit since 2003.

The 2026 model must transition from being merely a “rebound” to fostering genuine investment that creates formal employment.

The political factor: time waits for no one

The Milei government still enjoys high levels of popularity. Following a landslide victory in October’s midterm elections, the administration has achieved confidence levels not seen since 2011, according to a survey by Torcuato Di Tella University.

However, this political capital could quickly become a liability if macroeconomic stability is not fully established. Persistently high inflation, declining purchasing power for most workers and pensioners, and a challenging financial landscape present a complex situation to navigate after three years in office.

Beyond the macroeconomic challenges, the government must engage in careful political management. When the 2026 budget was debated in the Chamber of Deputies, relations with allies were strained to the point of public dispute with Mauricio Macri’s PRO party. If that approach is any indication, the road ahead may be difficult.

The government aims to pass economic reforms in Congress early in 2026, particularly labor reform. This will require negotiations with governors and unions. The Milei administration cannot take anything for granted — the outcome lies firmly in its hands.