The finance expert spoke about the benefits of marriage to inheritance

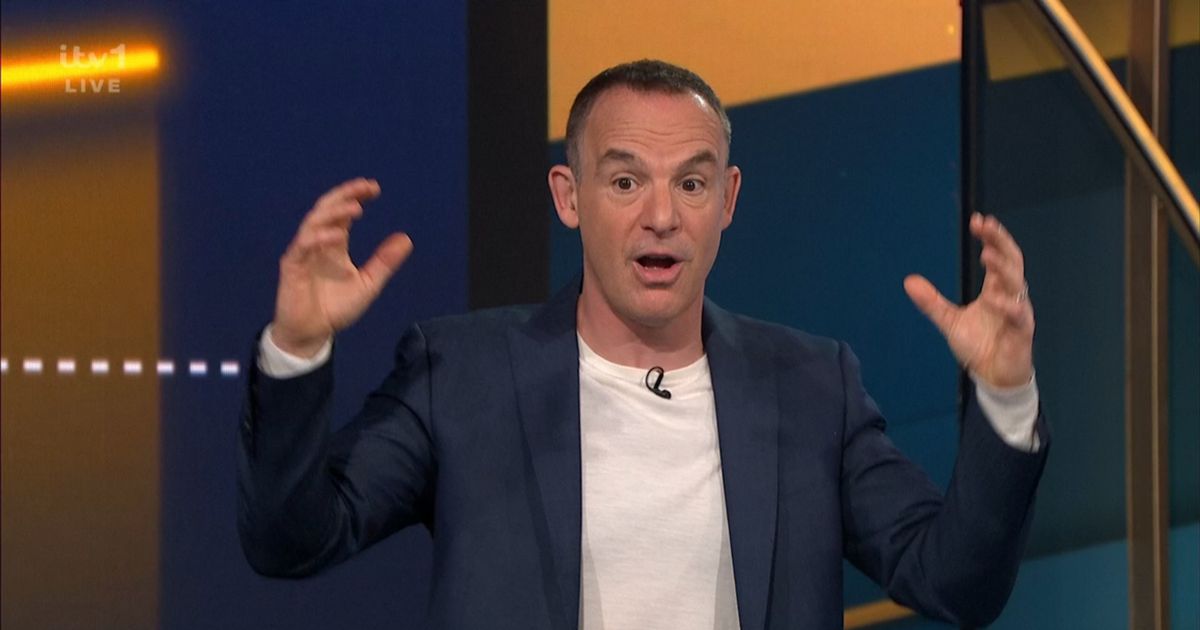

Martin Lewis issues warning to all couples who live together unmarried(Image: ITV)

Martin Lewis has issued a warning to British couples that are living together but are not married.

During an episode of his eponymously titled ITV show, the MoneySavingExpert.com founder was asked about getting finances in order for the new year ahead.

He was asked: “Martin, if you had to prioritise, which would you sort first: Will/ Power of Attorney, or pensions/tax/inheritance? And why?”

READ MORE: 1 in 4 UK households have less than £250 saved for emergencies

Martin replied: “That is a tough one. So first of all, let’s say we’ll take inheritance for a second, only about 6% to 8% of the population their estates pay inheritance tax.

“It’s something far more people worry about than actually affects them.

“If you’re married and you’re leaving your property to one of your descendants, then if you do it right, you can leave up to £1 million with no inheritance tax.

“If you’re not married, it’s £500,000, so that might not even be an issue for you in the first place. It isn’t for many people. Do some more reading on that.”

Speaking previously on his podcast, the finance guru explained: “When we talk about marriage it applies to anyone who is married or who has a legal civil partnership.

“But this does not apply to you if you are just cohabiting.

“A legal recognition of your relationship and civil partnership is also a legal recognition of your relationship without some of the, some might say, paternalistic religious overhang that a marriage has.

“So the two big inheritance tax benefits. First of all your spouse won’t pay inheritance tax on anything you leave to them. When you die any money, any property, any assets left to your spouse is automatically exempt from inheritance tax.

“An even more important inheritance tax boon of marriage is you can pass on your unused inheritance tax balance to your spouse. So in plainspeak you don’t pay inheritance tax on the first £325,000 you leave when you die.

“Above that if you’re leaving your main residence to your direct descendents, so your children or grandchildren or step children, you usually get another £175,000 on top. So that’s £500,000 that you can leave without paying tax on it.

“So if you leave everything to your spouse when you die, then you haven’t used any of those allowances and as they’re unused they get passed on to your spouse.

“That means when your spouse passes away their allowance and yours, which means if you’re leaving the main property, they can then leave a million pounds they can pass on without paying any inheritance tax. That’s a huge benefit.

“And that’s why it’s often worth looking at getting married or a civil partnership which counts in exactly the same way.”