Broken Hill Mines’ silver growth story is one to watch. Pic: Getty Images

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Blue Ocean Equities senior resources analyst Carlos Crowley Vazquez about a junior polymetallic producer that’s increasingly becoming a silver growth story.

Sydney-based Blue Ocean is a small boutique, high conviction broker that pursues a “very conscious strategy” of focusing on either emerging projects on Australia’s East Coast or tier one projects.

That gives Carlos Crowley Vazquez and his small team of analysts unique insight into the currently booming precious metals sector in New South Wales.

“We focus on emerging companies with good management teams and good assets,” he said.

It is this focus that drew Blue Ocean to Broken Hill Mines (ASX:BHM) .

Broken Hill – named after the famed mining town that was the cradle for mining giant BHP – listed on the ASX in July 2025 following the reverse takeover of Coolabah Metals.

However, its history dates a little further back to when Japanese zinc products manufacturer Toho Zinc decided to exit global mining in 2023.

Toho sold the (then) mothballed Endeavor silver-zinc-lead mine to Polymetals Resources (ASX:POL) while the producing Rasp mine and its associated plant were sold to Patrick Walta’s Broken Hill Mines.

Though Broken Hill Mines originally sought to raise $4m before carrying out its backdoor listing, Vazquez said that Blue Ocean helped the company set its sights higher.

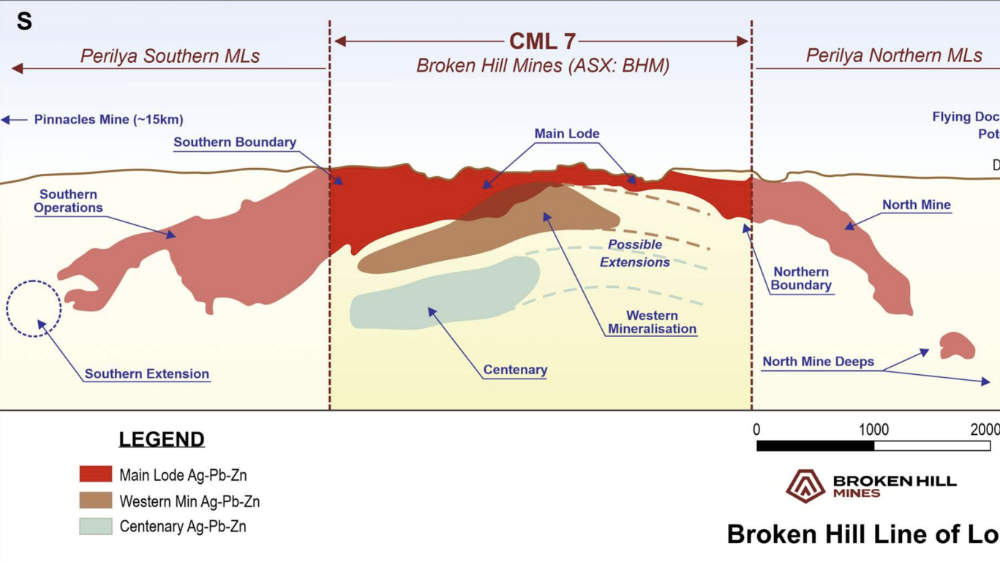

Mineralised lodes at the Rasp mine. Pic: Broken Hill Mines

Mineralised lodes at the Rasp mine. Pic: Broken Hill Mines

“We were arguing that (Patrick) should be raising $20m because he was going to need to spend $15m developing the access to a silver-rich deposit called Main Lode,” Vazquez noted.

“When he acquired the mine from Toho Zinc, they were mostly mining from Western Mineralisation, which is a high-grade zinc deposit that is a bit deeper.

“At the end he was able to secure a prepayment from a group called Hartree Metals for around $40m but he also agreed to raise $20m ahead of the relisting so we helped him a bit with that.”

While Blue Ocean had enough interest from its clients, the involvement of another broker and the heavy involvement of the chairman’s list meant their applications for the offering at 35c per share were scaled back.

The strength of the company’s story and the continued interest triggered another $40m capital raising in the middle of October 2025, just as silver started to run.

“There was a lot of interest in companies with growing silver production and Broken Hill Mines is one of them,” Vazquez added.

A compelling tale

So just what is it about Broken Hill Mines that makes it such a compelling tale?

It’s pretty simple. Unlike many emerging silver plays, the company – by virtue of having acquired an operating asset – is already producing at the Rasp mine.

During the quarter ending September 30, 2025, the company mined 118,500t of ore and carried out 1157m of development.

Mine grades also improved with 117,000t of ore processed at 4.4% zinc equivalent.

This resulted in the production of 5988t of zinc concentrate grading 48%, 2290t of lead concentrate at 62% and 41,500oz of silver.

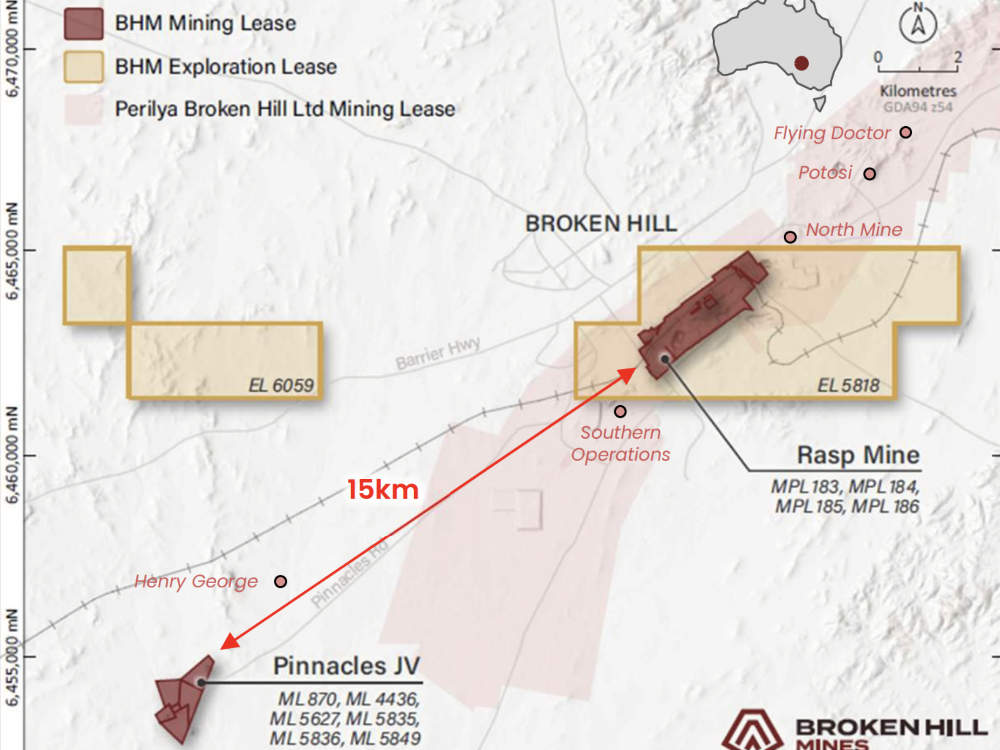

The Rasp mine and Pinnacles JV. Pic: Broken Hill Mines

The Rasp mine and Pinnacles JV. Pic: Broken Hill Mines

The growth story

While this would be enough on its own to differentiate Broken Hill Mines from its peers, the real draw is the growth story.

“It’s an operating mine but the plant is not operating at capacity,” Vazquez said.

“The plant is operating at around 400,000-450,000 tonnes per annum while the capacity is 750,000tpa.

“Toho was interested in the zinc deposit so they were not running the plant as hard as they could.”

He points out that some capital needs to be spend on the plant to bring it up to capacity.

“On top of having or recovering that capacity, accessing the high grade Main Lode silver deposit really transforms the economics once that ore goes to the plant,” Vazquez added.

“In the meantime, the company is doing a lot of exploration drilling both in Rasp and the 70% Pinnacles joint venture, which provides a bit of additional upside.

“That deposit is potentially going to be an open pit with an underground mine.

“They’re doing the mining studies at the moment, but it’s also very high grade and very rich in terms of silver. There’s a bit gold as well.”

This is also expected to boost the percentage of silver in terms of revenues from current levels of about 15-20% to over 40% over the next two years, enabling Broken Hill Mines to benefit from silver prices which have surged past US$84/oz ($125.14/oz).

“At the moment, I have a $1.65 price target for the company. That was based on a note that I published on the 15th of October,” Vazquez said.

“But I’ve been updating the model. So after the capital raising that was done in October, I think it’s probably a $2 to $2.50 stock in the near term.”

At Stockhead, we tell it like it is. While Broken Hill Mines is a Stockhead advertisers, it did not sponsor this article.