Report Overview

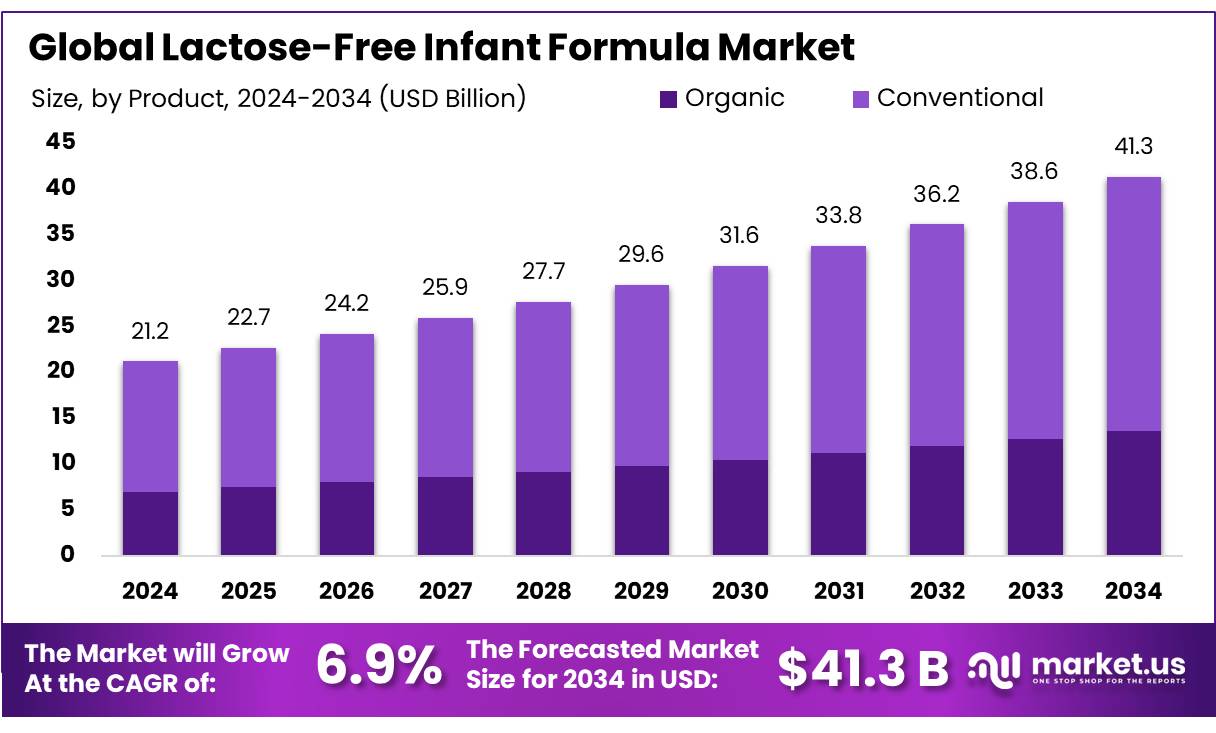

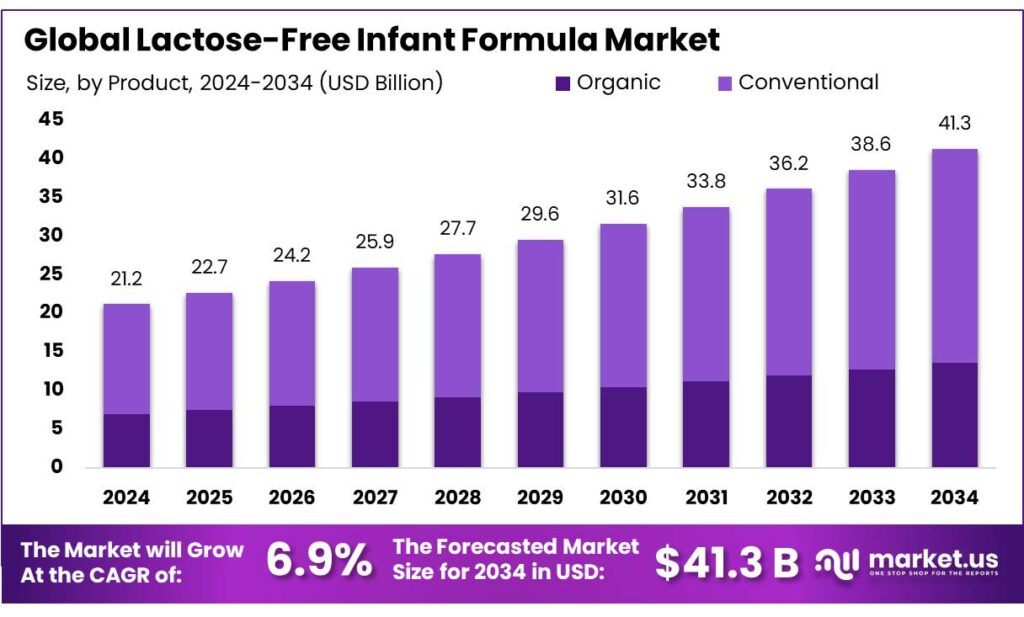

The Global Lactose-Free Infant Formula Market size is expected to be worth around USD 41.3 Billion by 2034, from USD 21.2 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 Middle East & Africa held a dominant market position, capturing more than a 58.9% share, holding USD 8.4 Billion in revenue.

Infant formula, including lactose‑free formulations, serves as a critical nutritional substitute for infants up to 12 months old when breastfeeding is not possible or sufficient. Lactose‑free infant formula is formulated to provide nutrition without lactose sugar; often used in infants with lactose intolerance, cow’s milk protein allergy, or other digestive issues. Globally, lactose intolerance affects large populations: approximately 70% of the world’s population are estimated to have lactase non‑persistence in later childhood or adulthood. However, clinical lactose intolerance in infants is much lower, but the perception of intolerance / demand for non‑lactose products is rising.

Prevalence of lactose intolerance or lactase non‑persistence helps define the potential addressable population. For instance, studies show that globally a large proportion of adults have some level of lactase deficiency; by genotyping ~74%, by lactose tolerance testing ~55–57% of adult populations in some regions show non‑persistence. However, in infants congenital lactase deficiency is rare. Also, less severe digestive or transient lactose intolerance occur in young children, increasing demand for specialised formula.

In 2023, FSSAI proposed amendments to nutrient requirement tables when it comes to infant formula, follow‑up formula and particularly for lactose free follow‑up formula. For example, manganese requirement for lactose free follow up formula is proposed as 5‑400 mg per 100 g or 1‑85.1 mg per 100 kcal.

Government initiatives and regulations also shape the supply, labeling, and safety of lactose‑free infant formulas. In the EU regulation above (2016/127), there are requirements on nutrient compositions, labelling, claims, and limits for pesticide residues (e.g. not exceeding 0.01 mg/kg for many active substances) in formula products.

Key Takeaways

Lactose-Free Infant Formula Market size is expected to be worth around USD 41.3 Billion by 2034, from USD 21.2 Billion in 2024, growing at a CAGR of 6.9%.

Conventional held a dominant market position, capturing more than a 67.3% share in the Lactose-Free Infant Formula Market.

Powdered Lactose-Free Formula held a dominant market position, capturing more than a 69.1% share in the Lactose-Free Infant Formula Market.

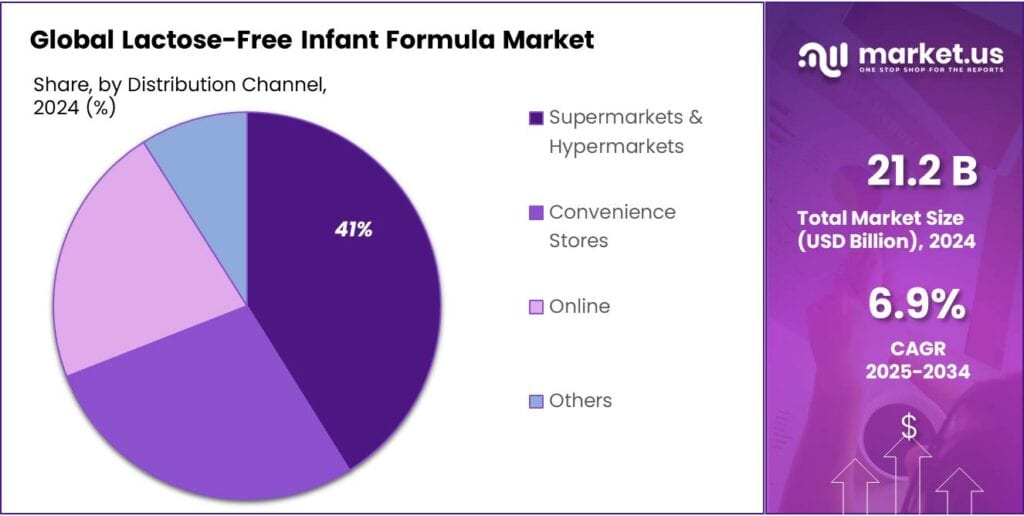

Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.2% share in the Lactose-Free Infant Formula Market.

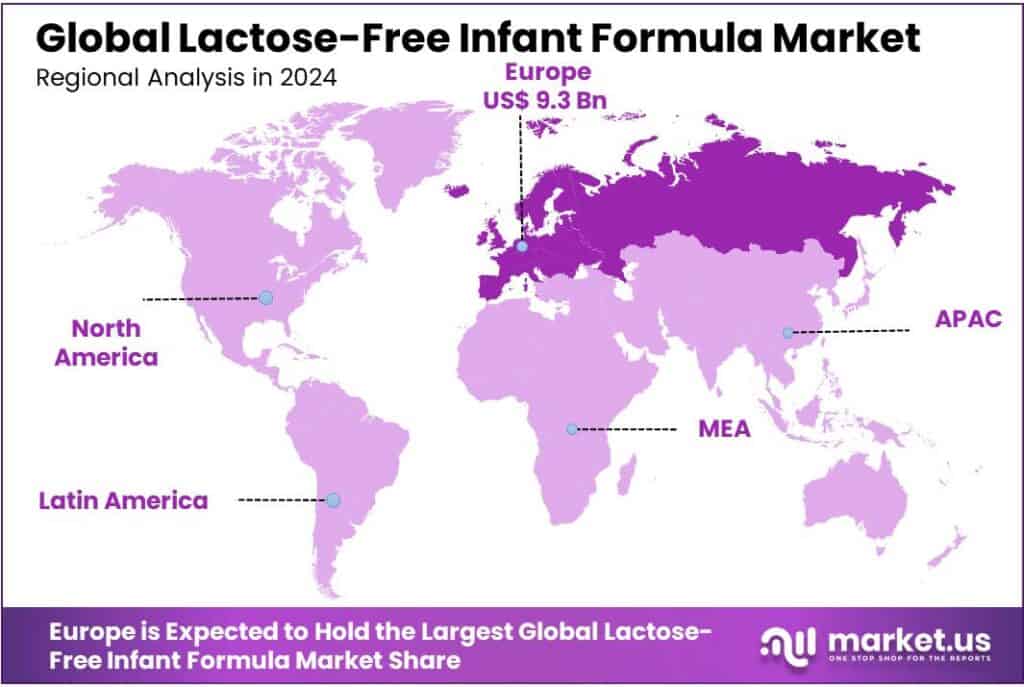

Europe dominated the lactose‑free infant formula market, accounting for approximately 43.9% of global share, amounting to an estimated USD 9.3 billion in revenue.

By Product Analysis

Conventional Formula Leads with 67.3% Share Thanks to Affordability and Wide Availability

In 2024, Conventional held a dominant market position, capturing more than a 67.3% share in the Lactose-Free Infant Formula Market. This strong foothold is mainly because conventional lactose-free formulas are widely accessible, cost-effective, and cater to most infants with basic lactose intolerance symptoms. These formulas are typically made with standard milk proteins but without lactose, making them suitable for temporary or mild intolerance without needing specialized medical supervision.

Parents often prefer them due to their familiar ingredients, balanced nutrition profile, and presence in both retail and hospital settings. By 2025, the demand for conventional variants is expected to grow steadily, supported by increasing awareness, better diagnosis of lactose intolerance in early infancy, and expanding availability across supermarkets and pharmacy chains in both urban and semi-urban regions.

By Product Type Analysis

Powdered Lactose-Free Formula dominates with 69.1% due to easy storage and longer shelf life

In 2024, Powdered Lactose-Free Formula held a dominant market position, capturing more than a 69.1% share in the Lactose-Free Infant Formula Market. Its popularity comes from practical benefits like ease of storage, long shelf life, and affordability. Parents often prefer powdered formulas because they can be prepared as needed, helping reduce waste and allowing better portion control. Healthcare professionals also recommend powdered formats in non-critical cases due to their convenience and consistency in nutrient delivery.

By 2025, the segment is expected to maintain its lead, especially in regions where refrigeration is limited or cost sensitivity is high. The product’s strong availability in retail outlets and its compatibility with government-supported nutrition programs further reinforce its leading position in the market.

By Distribution Channel Analysis

Supermarkets & Hypermarkets lead with 41.2% thanks to consumer trust and product variety

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.2% share in the Lactose-Free Infant Formula Market. This dominance is mainly due to the trust consumers place in large retail chains, where they can physically examine product options, compare brands, and read labels before purchasing. These stores also offer frequent promotions and bundle deals, which make specialty products like lactose-free formulas more affordable for families.

The wide availability of both international and local brands under one roof helps meet the diverse preferences of consumers. By 2025, this channel is likely to retain its strong market presence as more modern retail formats expand into suburban and tier-2 cities, offering convenience and reliability in infant nutrition purchases.

Key Market Segments

By Product

By Product Type

Powdered Lactose-Free Formula

Ready-to-Feed Lactose-Free Formula

By Distribution Channel

Supermarkets & Hypermarkets

Convenience Stores

Online

Others

Emerging Trends

Increasing Scrutiny on Added Sugars and Carbohydrate Sources in Lactose‑Reduced/Free Formulas

Lately there is growing attention among scientists, health agencies, and parents on what actually replaces lactose in infant formulas, especially how much added sugar and the type of alternative carbohydrates are used. It turns out, many lactose‑reduced or lactose‐free formulas substitute lactose with other sugars or glucose‐based carbohydrates, and that is inviting concern because of possible longer‑term health effects.

Research published in 2025 found that infant formulas produced in the U.S. contain on average 7‑8 grams of added sugars per serving. These sugars are often from sources like corn syrup solids or other glucose‑based sweeteners. The study raises questions about whether such replacement mimics the natural carbohydrate profile of human breast‑milk, and whether it affects infant metabolism, risk of obesity, or insulin response.

Another large U.S. study (WIC data, Southern California, 2012‑2020) looked at numerous infants who were given lactose‐reduced formula with corn syrup solids. It found that these infants were more likely to be obese in toddlerhood compared to infants who were not given such formulas. The data suggests that the carbohydrate composition of formula matters, not just the removal of lactose.

The public health implications are significant. If a formula has high levels of simple carbohydrates, that may influence early childhood growth rates, insulin sensitivity, appetite regulation, and ultimately risk of obesity or metabolic issues. Because of studies like those above, health authorities may consider guidelines or even limits for added sugar content in infant formula, similar to how many countries limit sugar in adult or toddler foods.

Drivers

The Role of Rising Consumer/Parental Awareness around Digestive Health and Dietary Sensitivities

Over recent years, more parents, caregivers, and health‑professionals have become aware that infants can suffer from digestive discomforts related to lactose, or that they might have special dietary needs—whether due to intolerance, sensitivity, or temporary under‑development of the enzyme lactase (for example, in premature babies). This awareness has become a powerful driver pushing demand for lactose‑free or lactose‑reduced infant formula.

In the United States, data from a study using NHANES (National Health and Nutrition Examination Survey) spanning 1999 to 2020 shows that more than half of all feeding sessions for infants involved a formula that included at least one non‑lactose carbohydrate. That same research found that 59.0% of formula products purchased were lactose‑reduced, and 28.5% were fully lactose‑free. These are large numbers, tied to consumer behaviour—not to projections by commercial market research firms—and they reflect a shift in what parents are choosing for their babies.

Government and regulatory bodies also reinforce this trend via safety, labeling, and educational initiatives. For instance, the U.S. Food and Drug Administration (FDA) clearly defines “lactose‑free formula” as a formula that contains no lactose, intended for infants who have difficulty digesting lactose. The FDA mandates that manufacturers must notify the agency before marketing new formulas, and every infant formula product must meet the regulatory standards for safety and nutritional adequacy. These requirements give consumers confidence in using lactose‑free options when needed, supporting demand.

Another government‑level driver is the assistance programs like WIC (Women, Infants, and Children) in the U.S., which help low‑income families secure infant formula. During times of supply‑strain or recalls, regulators allowed flexibility so that WIC benefits could cover alternative formulas. For example, during the 2022 U.S. infant formula shortage, federal agencies temporarily waived some restrictions around types of formula allowed under WIC to make sure families had access.

Restraints

Potential Health Risks & Nutritional Trade‑Offs

Many parents choose lactose‑free infant formula hoping to avoid digestive issues, but what’s less often discussed is that replacing lactose may bring its own set of health and nutritional trade‑offs. Lactose is not just a sugar; it supports calcium absorption, influences gut microbiota, and contributes to healthy growth in infants. When you remove or severely reduce lactose, alternative carbohydrates or sugar sources often fill in, and that can change digestion, weight gain, risk profiles, or even insulin response.

A study published in 2022 by researchers at the University of Rochester found that infants fed lactose‑reduced formula (without a medical need) had about a 10% higher risk of obesity by age two, compared with infants who had lactose‑based formula. This suggests that substituting lactose changes metabolic or feeding patterns in subtle ways.

Another piece of evidence comes from “Effect of Low Lactose Formula on the Short‑Term Outcomes” (2021). This study observed that among infants with Neonatal Abstinence Syndrome (NAS) given low‑lactose formulas, there was no significant benefit in terms of length of hospital stay, need for pharmacologic therapy, or other short‑term outcomes versus standard formula. In other words, in certain situations, removing lactose did not automatically improve health outcomes.

From a regulatory and medical authority standpoint, the American Academy of Pediatrics notes that true congenital lactase deficiency is very rare. Most infants who seem to have lactose intolerance (for example during or after gastrointestinal illness) are temporarily intolerant, not permanently so. Using lactose‑free formula when it’s not strictly needed can therefore be overkill and might deprive infants of the benefits of lactose while possibly imposing risks from alternative carbohydrates.

Opportunity

Rising Prevalence of Lactose Intolerance & Genetic Lactase Non‑Persistence

One of the biggest chances for lactose‑free infant formula lies in the growing acknowledgment among medical science of how common lactose intolerance and lactase non‑persistence (i.e. the genetically determined decline in lactase enzyme activity after early childhood) are across many ethnic groups. This offers fertile ground for producers and health systems to better support infants who either show symptoms or are more likely to develop issues with lactose digestion.

Globally, about 65% to 70% of people have reduced ability to digest lactose (primary lactose intolerance or lactase non‑persistence). While many of those are adults, this genetic trait often has implications from infancy—especially in populations where lactose intolerance or secondary lactase deficiency (for example, following gastrointestinal infection or illness) is not rare. Knowing this, doctors and caregivers become more sensitive to lactose‑related discomfort, and more willing to consider formula options that avoid or reduce lactose.

Clinical research supports that lactose‑free milk protein‑based infant formulas can support normal growth in term infants. For example, in a randomized, blinded trial comparing infants fed a lactose‑free formula (NoLAC) versus a standard lactose formula, weight gain in the lactose‑free group was about 31.1 ± 0.9 g/day, versus 29.4 ± 0.9 g/day in the lactose formula group, over 112 days. That shows the option is not just safe, but competitive in supporting infant growth.

Another dimension is that medical guidelines in many countries are increasingly encouraging early diagnosis and treatment of gastrointestinal conditions or intolerance symptoms. As these clinical practices spread, so does the recommendation for lactose‑free formulas when indicated. Although I did not find a government in Asia with large‑scale data specific to lactose‑free formula use, regulatory bodies in places like the U.S. define lactose‑free formulas explicitly, and expect safety, nutrition adequacy, and clear labeling.

Regional Insights

In 2024, Europe dominated the lactose‑free infant formula market, accounting for approximately 43.9% of global share, amounting to an estimated USD 9.3 billion in revenue. This commanding position reflects both strong consumer awareness in Europe around infant digestive health and well‑established supply / retail channels that support specialty formulas.

Several factors underpin Europe’s leadership. Regulations in the European Union and member states set clear nutritional and safety standards for infant formulas, including restrictions on permissible formulations, labeling, and medical use of formulas for infants with intolerance. These regulatory frameworks give consumers confidence, which in turn boosts adoption of lactose‑free alternatives. Public health campaigns and pediatric guidance in many European countries also promote early diagnosis of issues like temporary lactose intolerance or milk sugar sensitivities, increasing demand for these formulas.

Retail infrastructure contributes heavily to Europe’s strong performance. Supermarkets and hypermarkets, alongside pharmacy chains, provide extensive geographical coverage, especially in Western Europe. Online retail is also growing fast, enabling niche specialty products to reach more remote or underserved populations in Central and Eastern Europe. These channels help Europe maintain a broad consumer base for lactose‑free infant formula, ranging from premium to more affordable conventional variants.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Nestlé holds a strong position in the lactose-free infant formula space through its NAN range, particularly NAN Lactose-Free and Althera formulas. The company leverages global R&D and its deep clinical nutrition expertise to address infant digestive disorders. With robust distribution in Europe, Asia, and Latin America, Nestlé continues expanding its hypoallergenic and specialty formula lines. Its commitment to regulatory compliance, product safety, and infant well-being supports its leadership in the specialty infant formula sector.

Nutricia, a part of Danone Group, plays a critical role in the lactose-free infant formula segment through its medical nutrition solutions. Products like Neocate LCP and Pepti-Junior are designed for infants with CMPA and secondary lactose intolerance. The company has strong penetration in European clinical and pharmacy-based channels. With scientific backing and collaborations with pediatric specialists, Nutricia emphasizes gut health, allergy management, and tailored nutrition, making it a preferred brand in hospitals and among health professionals.

Abbott is a key global player in infant formula, offering Similac Sensitive and Similac Total Comfort, formulated for lactose sensitivity. With FDA-compliant facilities and a large U.S. market share, Abbott emphasizes digestibility and reduced fussiness in infants. The company’s research-backed approach and healthcare partnerships help it maintain dominance in pediatric nutrition. Abbott is also active in innovation, including formulas with HMO (Human Milk Oligosaccharides) that support gut and immune health in sensitive infants.

Top Key Players Outlook

Nestlé

Nutricia

Valio Oy

Abbott

Gimme the Good Stuff

Apta Advice

Danone

Reckitt Benckiser Group PLC

Good Start

Dana Dairy Group

Abbott Laboratories Co.

Recent Industry Developments

In 2024, Valio Oy’s total net sales rose to EUR 2,278.5 million, slightly up from EUR 2,277.6 million in 2023.

In 2024, Danone’s overall net sales reached €27,376 million, growing +4.3% on a like-for-like basis versus the prior year.

Report Scope